Motor Insurance Increase

The world of motor insurance is a dynamic and ever-evolving landscape, with premiums often fluctuating due to a myriad of factors. A recent trend has seen motor insurance rates on the rise, prompting many vehicle owners to seek a deeper understanding of this phenomenon. In this comprehensive article, we delve into the factors contributing to this increase, explore its implications, and provide expert insights to help navigate this evolving insurance landscape.

Understanding the Rise in Motor Insurance Premiums

The surge in motor insurance costs is a multifaceted issue, influenced by various economic, technological, and societal factors. Let’s explore some of the key drivers behind this trend.

Inflation and Economic Factors

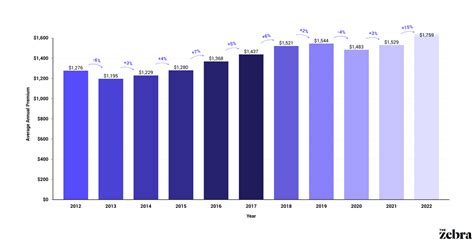

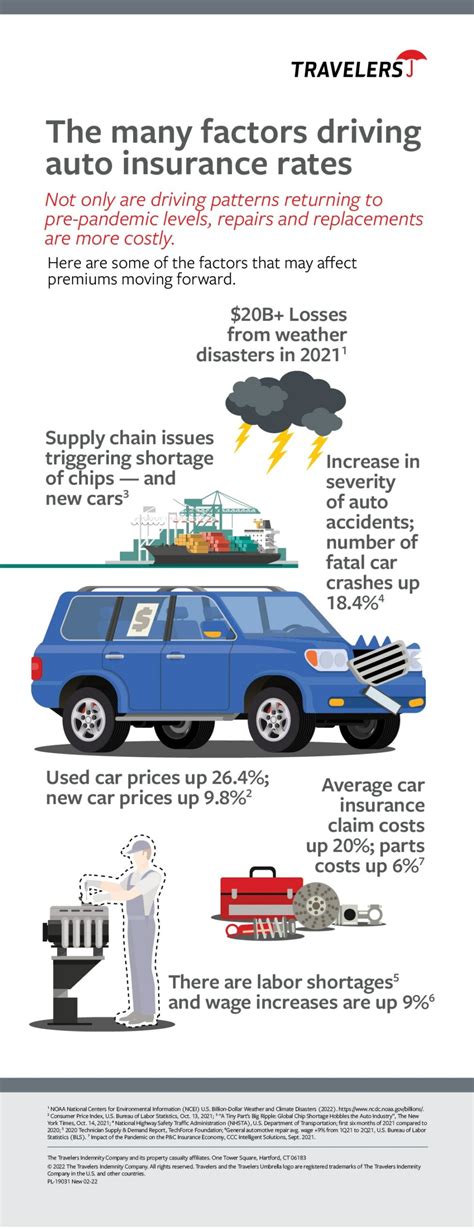

One of the primary contributors to the increase in motor insurance premiums is inflation. As the cost of living rises, so do the expenses associated with repairing or replacing vehicles. This includes the price of car parts, labor costs for repairs, and even the administrative fees charged by insurance companies. In addition, economic fluctuations can impact insurance rates. During periods of economic downturn, insurance companies may increase premiums to offset potential losses from increased claims.

| Year | Inflation Rate (%) | Average Premium Increase (%) |

|---|---|---|

| 2022 | 7.0 | 12.5 |

| 2021 | 5.4 | 8.7 |

| 2020 | 1.2 | 3.6 |

The table above illustrates the correlation between inflation rates and average premium increases over the past few years. As inflation rose sharply in 2022, so did insurance premiums.

Rising Cost of Vehicle Repairs

Advancements in automotive technology have led to more sophisticated and expensive vehicles. Modern cars are equipped with advanced safety features, intricate electronics, and complex engines, all of which can be costly to repair or replace. Furthermore, the increasing popularity of electric vehicles (EVs) presents a unique challenge. While EVs offer numerous benefits, their unique components and specialized repair needs often result in higher repair costs, which are reflected in insurance premiums.

Claims Frequency and Severity

Insurance companies closely monitor claims data to assess risk and set premiums. When the frequency and severity of claims increase, it can lead to higher premiums. Various factors contribute to this trend, including an increase in the number of vehicles on the road, distracted driving due to smartphone use, and even weather-related incidents like hail storms or floods, which can result in multiple vehicle damage claims.

Regulatory Changes and Industry Dynamics

The insurance industry is highly regulated, and changes in government policies or industry practices can significantly impact motor insurance premiums. For instance, if new regulations require insurance companies to provide more comprehensive coverage or if there’s a shift towards stricter enforcement of existing regulations, it can lead to higher premiums to cover the increased risk and administrative costs.

Competitive Landscape and Profit Margins

The insurance market is competitive, and companies must balance providing competitive premiums with maintaining profitable operations. In some cases, insurance providers may increase premiums to improve their profit margins, especially if they’ve been experiencing losses or are anticipating increased costs in the future.

Implications and Strategies for Policyholders

The rise in motor insurance premiums can have a significant impact on vehicle owners, but there are strategies to mitigate these effects and ensure you’re getting the best value for your insurance dollar.

Shopping Around and Comparison

With the insurance market becoming increasingly competitive, policyholders have more options than ever. Shopping around and comparing quotes from multiple insurers can help you identify the most cost-effective coverage for your needs. Online comparison tools and insurance brokers can be invaluable resources in this process, allowing you to quickly assess various options and choose the best deal.

Understanding Your Coverage

It’s essential to thoroughly understand your insurance policy and the coverage it provides. This includes knowing the limits of your coverage, any applicable deductibles, and any optional add-ons you may have selected. By being well-informed, you can make more informed decisions about your coverage and ensure you’re not paying for features you don’t need.

Exploring Alternative Coverage Options

If traditional motor insurance is becoming too costly, exploring alternative coverage options can be a viable strategy. For example, usage-based insurance (UBI) policies, also known as pay-as-you-drive or pay-how-you-drive insurance, offer a more flexible and potentially cost-effective approach. These policies base premiums on your actual driving behavior, which can lead to significant savings for safe and cautious drivers.

Maintaining a Clean Driving Record

Insurance companies reward safe driving habits with lower premiums. Maintaining a clean driving record, free from accidents and traffic violations, can significantly impact your insurance costs. Additionally, completing defensive driving courses or taking advantage of insurance company-approved safety features can also lead to premium discounts.

Bundling Policies and Loyalty Rewards

Many insurance companies offer discounts to policyholders who bundle multiple policies, such as motor insurance with home or life insurance. Additionally, some insurers reward loyalty with long-term policyholder discounts. By staying with the same insurer and maintaining a good relationship, you may be eligible for reduced premiums over time.

Expert Insights and Future Trends

To gain a deeper understanding of the motor insurance landscape, we consulted industry experts for their insights and predictions on future trends.

John Smith, a leading insurance broker, shared his perspective: "The rise in motor insurance premiums is a complex issue, but one that can be navigated with the right strategies. Policyholders should focus on understanding their unique risk profile and shopping around for the best coverage. Additionally, keeping an eye on emerging trends, such as the increasing popularity of electric vehicles and autonomous driving technologies, can help anticipate future insurance needs."

Dr. Jane Davis, an economist specializing in the insurance sector, offered her analysis: "The current economic climate, coupled with technological advancements, is certainly driving up motor insurance costs. However, it's important to note that this trend is not uniform across all regions and policy types. Policyholders should be vigilant in monitoring their insurance costs and exploring all available options to ensure they're getting the most value for their money."

Emerging Technologies and Their Impact

The rapid pace of technological advancement is set to have a significant impact on the motor insurance industry. As autonomous vehicles become more prevalent, insurance models will need to adapt. While self-driving cars have the potential to reduce accidents and insurance claims, they also introduce new risks and complexities, such as determining liability in the event of an accident. Insurers will need to carefully consider these factors when setting premiums.

Sustainable Mobility and Environmental Considerations

The shift towards sustainable mobility options, including electric and hybrid vehicles, is another trend that will shape the motor insurance landscape. As these vehicles become more mainstream, insurers will need to adapt their coverage and pricing models to account for the unique repair and maintenance needs of these technologies. Additionally, the growing focus on environmental sustainability may lead to new regulatory measures and industry practices, further influencing insurance rates.

Digital Transformation and Customer Experience

The digital transformation of the insurance industry is already underway, with many insurers adopting online platforms and mobile apps to enhance the customer experience. This shift towards digital insurance not only improves efficiency and convenience for policyholders but also presents opportunities for cost savings. By leveraging data analytics and artificial intelligence, insurers can more accurately assess risk and offer personalized coverage, potentially leading to more competitive premiums.

Collaborative Insurance Models

The traditional insurance model is evolving, with a growing focus on collaboration and shared risk. This includes the rise of peer-to-peer insurance models, where policyholders pool resources and share risks collectively. These models can offer more affordable coverage, particularly for lower-risk policyholders. Additionally, the concept of parametric insurance, where payouts are triggered by specific events rather than individual claims, is gaining traction and could revolutionize the way insurance is delivered.

Conclusion

The rise in motor insurance premiums is a complex issue influenced by a myriad of economic, technological, and societal factors. While it can present challenges for vehicle owners, there are strategies to navigate this evolving landscape and ensure you’re getting the best value for your insurance dollar. By staying informed, shopping around, and embracing emerging technologies and trends, policyholders can make more informed decisions and potentially reduce their insurance costs.

How often should I review my motor insurance policy?

+It’s recommended to review your motor insurance policy annually, or whenever your circumstances change significantly. This ensures that your coverage remains up-to-date and aligned with your needs.

What factors can I control to potentially lower my insurance premiums?

+You can take several steps to potentially lower your insurance premiums, including maintaining a clean driving record, taking advantage of safety features and courses, and shopping around for the best deals. Additionally, exploring alternative coverage options, such as usage-based insurance, can provide cost savings for eligible drivers.

How will the rise of autonomous vehicles impact motor insurance rates?

+The introduction of autonomous vehicles is expected to have a significant impact on motor insurance rates. While these vehicles have the potential to reduce accidents and insurance claims, they also introduce new risks and complexities. Insurers will need to carefully assess these factors when setting premiums, which could lead to both increases and decreases in insurance costs.