Apply Insurance

Applying for insurance is a crucial step in securing financial protection and peace of mind for individuals and businesses alike. Whether it's health, life, property, or liability insurance, the process involves understanding one's needs, evaluating options, and completing the necessary paperwork. This article aims to provide a comprehensive guide to navigating the insurance application journey, covering everything from initial research to successful policy acquisition.

Understanding Insurance Types and Your Needs

Before diving into the application process, it's essential to grasp the different types of insurance available and assess your specific requirements. Each type of insurance serves a unique purpose, and the coverage options can vary significantly. Here's a breakdown of common insurance categories:

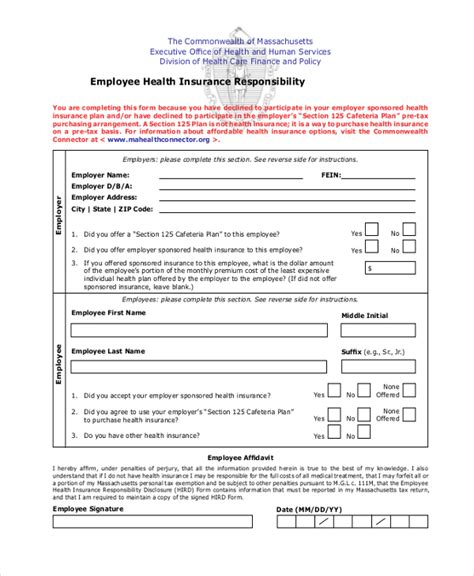

Health Insurance

Health insurance provides coverage for medical expenses, including doctor visits, hospital stays, prescription drugs, and sometimes even dental and vision care. It is particularly crucial in countries where healthcare costs are high and can ensure you receive the necessary medical attention without incurring massive financial burdens.

When applying for health insurance, consider factors such as your age, pre-existing conditions, the number of dependents, and the level of coverage you desire. Some policies offer comprehensive coverage, while others may be more basic, focusing on essential services.

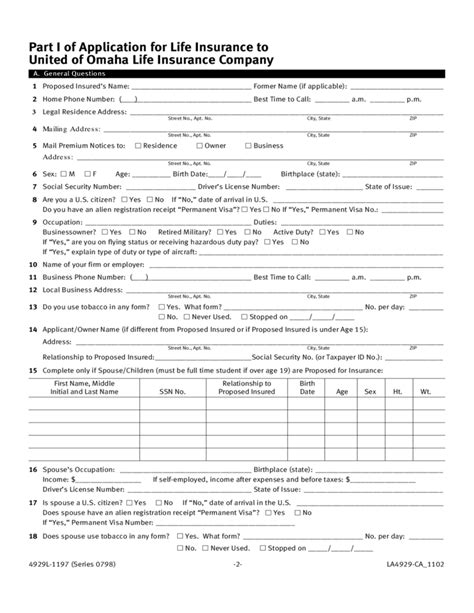

Life Insurance

Life insurance policies provide financial protection to your loved ones in the event of your death. The payout can help cover funeral expenses, outstanding debts, and ongoing living costs for your family. There are two main types of life insurance:

- Term Life Insurance: This type of policy provides coverage for a specific period, often 10, 20, or 30 years. It is generally more affordable than permanent life insurance but offers coverage only during the selected term.

- Permanent Life Insurance: Policies like whole life, universal life, and variable life insurance offer coverage for your entire life and typically include a cash value component that can grow over time.

Property Insurance

Property insurance protects your assets, such as your home, its contents, and any other valuable possessions. This category includes homeowners' insurance, renters' insurance, and specialized policies for items like jewelry, art, or collector's items.

When applying for property insurance, factors like the location, age, and value of your property, as well as any specific risks (e.g., flood or earthquake zones), will influence the coverage and premium you'll need.

Liability Insurance

Liability insurance provides protection against legal claims and lawsuits resulting from accidents or injuries caused by you or your property. This type of insurance is particularly important for businesses but can also benefit individuals who rent out their properties or engage in high-risk activities.

Researching Insurance Providers and Plans

With a clear understanding of your insurance needs, the next step is to research and compare different providers and their plans. This stage is crucial to ensuring you find a policy that offers the right coverage at a competitive price.

Online Comparison Tools

Utilize online insurance comparison platforms that allow you to input your details and preferences to receive quotes from multiple providers. These tools can provide a quick overview of different plans, making it easier to narrow down your options.

Provider Reputation and Financial Stability

Research the reputation and financial stability of insurance companies you're considering. Look for reviews and ratings from reputable sources, and check if the provider has a history of prompt claim settlements. A financially stable insurer is more likely to be able to pay out claims when needed.

Policy Details and Fine Print

Thoroughly read the policy documents provided by each insurer. Pay attention to the coverage limits, deductibles, exclusions, and any additional benefits or riders offered. Understanding the fine print ensures you know exactly what you're signing up for and can make an informed decision.

Gathering Required Documentation

Once you've selected an insurance provider and plan, the next step is to gather the necessary documentation to complete your application. The specific documents required can vary depending on the type of insurance and your personal circumstances.

Common Documents

- Personal Information: This includes your full name, date of birth, contact details, and often your Social Security number.

- Financial Information: For certain types of insurance, especially life insurance, providers may require financial statements or tax returns to assess your financial situation.

- Health Records: Health insurance applications may require medical history details or even a health assessment, especially if you have pre-existing conditions.

- Property Details: For property insurance, you'll need to provide accurate descriptions and values of your assets, including homes, vehicles, or other valuable possessions.

Completing the Application

With your research complete and all the necessary documents in hand, you're ready to begin the application process. Most insurance providers now offer online applications, which can be more convenient and faster than traditional paper forms.

Online Application Process

When applying online, you'll typically be guided through a series of questions or forms. Ensure you have all the required information and documents readily available to streamline the process. Double-check your answers and ensure all details are accurate before submission.

Paper Applications

If you prefer a paper application or are required to submit one, carefully follow the instructions provided by the insurer. Make sure to fill out all sections and provide legible handwriting or clear printing. Incomplete applications can lead to delays or even rejection.

Review and Confirmation

After submitting your application, you'll typically receive a confirmation, either via email or post. This confirmation will include important details such as your application number, the policy you've applied for, and any outstanding requirements.

Policy Review

Take the time to review the policy document carefully. Ensure that the coverage, limits, and terms match your expectations and needs. If you have any questions or concerns, reach out to the insurer's customer support for clarification.

Payment and Activation

Most insurance policies require an initial payment, often referred to as a down payment or deposit, to activate the coverage. Make sure you understand the payment schedule and any associated fees. Timely payments are crucial to maintaining your coverage.

Frequently Asked Questions (FAQ)

What happens if I have pre-existing medical conditions when applying for health insurance?

+If you have pre-existing conditions, some health insurance providers may require a medical assessment or additional information about your health history. They may also impose waiting periods or exclude certain conditions from coverage. It's important to disclose all relevant information accurately during the application process.

How can I determine the right amount of life insurance coverage for my needs?

+Determining the appropriate life insurance coverage amount involves considering factors like your income, debts, financial goals, and the financial needs of your dependents. Online calculators and financial advisors can help you estimate the right coverage, ensuring your loved ones are adequately protected.

Are there any tax benefits associated with insurance policies?

+Yes, certain types of insurance policies offer tax benefits. For example, premiums paid for health insurance may be tax-deductible, and life insurance proceeds are generally tax-free. It's advisable to consult a tax professional to understand the specific tax implications of your insurance choices.

Applying for insurance is a responsible step towards protecting yourself, your loved ones, and your assets. By understanding your needs, researching options, and completing the application process diligently, you can secure the coverage you require. Remember, insurance is an investment in your financial security and peace of mind, so take the time to make informed decisions.