Life Insurance Quotes For Whole Life Policy

In today's world, where financial security is a top priority, understanding the various life insurance options is crucial. One such option is the whole life policy, a type of permanent insurance that offers lifelong coverage and a range of benefits. This article aims to provide an in-depth analysis of whole life insurance quotes, helping you navigate the process of obtaining the best coverage for your needs.

Understanding Whole Life Insurance

Whole life insurance, often referred to as permanent life insurance, is a long-term financial protection plan. Unlike term life insurance, which provides coverage for a specific period, whole life insurance remains active throughout the insured’s life, provided the premiums are paid as agreed.

The policy builds cash value over time, which can be accessed through various means, such as loans, withdrawals, or even surrendering the policy. This makes whole life insurance a popular choice for those seeking both financial protection and a means of saving for the future.

Factors Influencing Whole Life Insurance Quotes

Obtaining a whole life insurance quote involves a comprehensive assessment of several factors. Here are some key considerations:

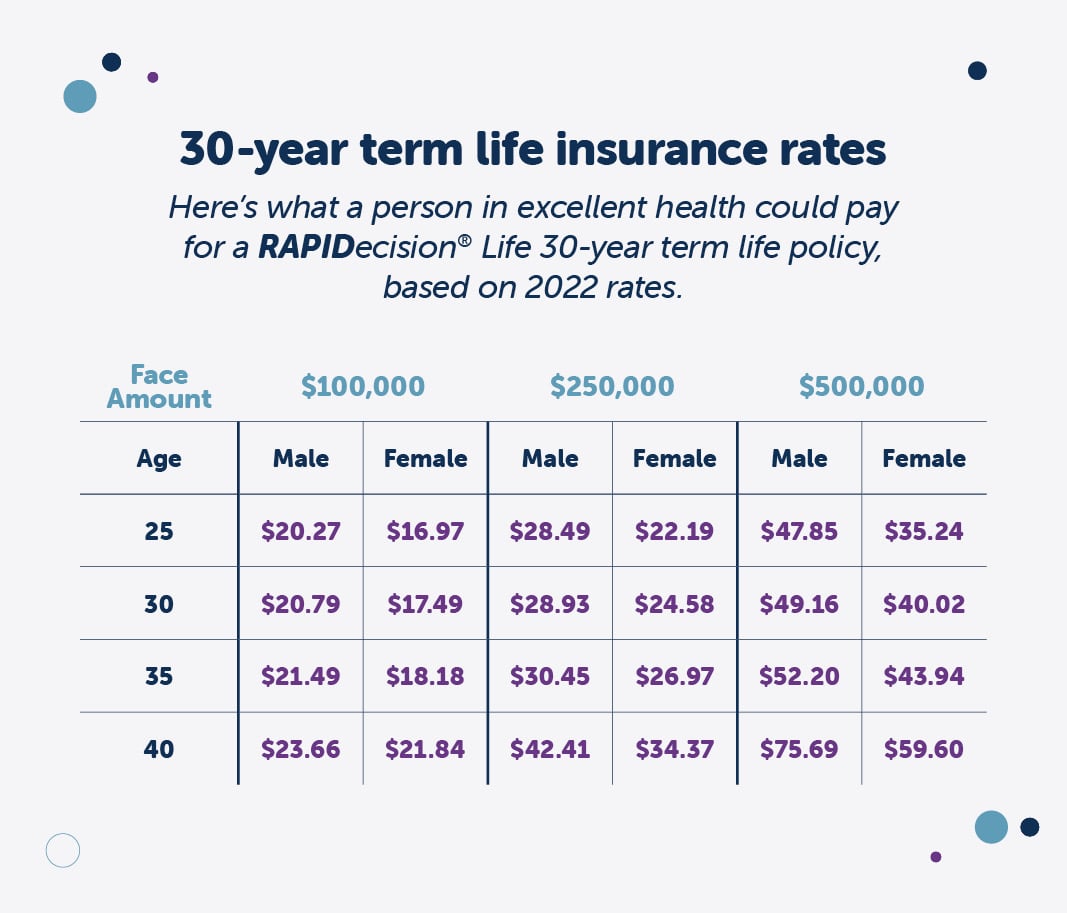

Age and Health

The insured’s age and health status play a significant role in determining the premium rates. Generally, younger individuals are offered lower premiums due to their lower risk profile. Additionally, good health and a healthy lifestyle can lead to more favorable rates.

| Age | Average Premium Rate |

|---|---|

| 25 years | $40 - $60 per month |

| 35 years | $50 - $75 per month |

| 45 years | $70 - $120 per month |

| 55 years | $100 - $200 per month |

It's important to note that these rates are indicative and can vary based on individual circumstances and the insurance provider.

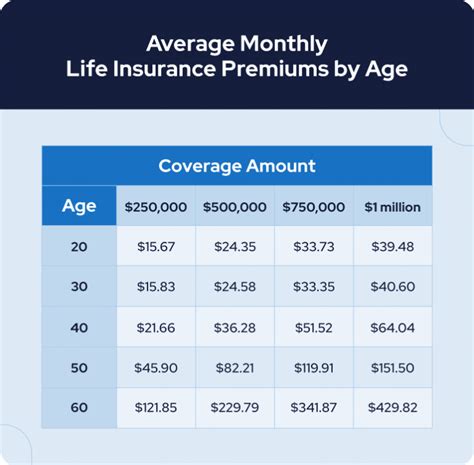

Coverage Amount

The desired coverage amount is another crucial factor. Higher coverage typically results in higher premiums. It’s advisable to calculate your financial needs accurately to determine the appropriate coverage amount.

| Coverage Amount | Average Premium |

|---|---|

| $100,000 | $40 - $60 per month |

| $250,000 | $70 - $100 per month |

| $500,000 | $120 - $180 per month |

| $1,000,000 | $250 - $350 per month |

Policy Features and Riders

Whole life insurance policies often offer a range of optional features and riders, such as accelerated death benefits, waiver of premium, or spousal coverage. These additions can increase the overall cost of the policy.

Insurance Company and Policy Type

Different insurance companies offer varying whole life insurance policies with unique features and pricing structures. It’s essential to compare multiple providers to find the best fit for your needs.

The Process of Obtaining a Quote

Obtaining a whole life insurance quote involves a straightforward process. Here’s a step-by-step guide:

- Research and Compare: Begin by researching reputable insurance providers and their whole life insurance offerings. Compare their rates, policy features, and customer reviews to narrow down your options.

- Fill Out an Application: Once you've identified potential providers, fill out an application form. This typically involves providing personal information, health details, and financial data.

- Medical Examination (if required): Some insurance companies may require a medical examination to assess your health status. This process helps them determine your risk profile and set appropriate premium rates.

- Receive the Quote: After submitting your application and any necessary medical exams, you'll receive a quote from the insurance company. This quote will detail the premium amount, coverage limits, and any applicable policy riders.

- Review and Decide: Carefully review the quote, considering your financial goals and needs. If you're satisfied with the terms, you can proceed with purchasing the policy. Remember, you're not obligated to accept the quote, and you can always seek alternative options.

Benefits of Whole Life Insurance

Whole life insurance offers several advantages that make it an appealing choice for many individuals:

- Lifetime Coverage: As the name suggests, whole life insurance provides coverage for your entire life, offering peace of mind and financial protection.

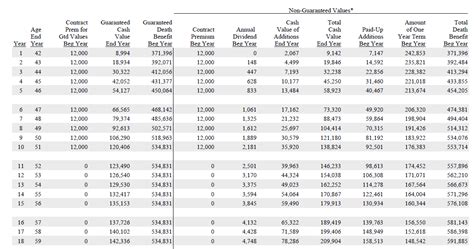

- Cash Value Accumulation: Over time, your policy builds cash value, which can be used for various purposes, such as loans, withdrawals, or even supplementing retirement income.

- Guaranteed Death Benefit: The policy ensures that your beneficiaries receive a predetermined amount upon your death, regardless of when it occurs.

- Flexible Payment Options: Many whole life insurance policies offer flexible payment plans, allowing you to adjust your premium payments to suit your financial situation.

- Tax Benefits: The cash value accumulation within the policy may offer certain tax advantages, making it a tax-efficient way to save and invest.

Potential Drawbacks

While whole life insurance has its benefits, it’s essential to consider the potential drawbacks as well:

- Higher Costs: Whole life insurance policies often have higher premiums compared to term life insurance, which can make them less affordable for some individuals.

- Complex Policies: The structure and features of whole life insurance can be complex, making it essential to thoroughly understand the policy before committing.

- Limited Flexibility: While whole life insurance offers some flexibility, it may not be as adaptable as other types of insurance, especially in terms of coverage amounts and premium payments.

Real-World Examples

Let’s look at a couple of real-world scenarios to better understand the impact of whole life insurance:

Case Study 1: Financial Security for Young Families

Consider a young couple, Sarah and John, who recently started a family. They understand the importance of financial security and decide to explore whole life insurance options. After researching and comparing various providers, they settle on a policy with a reputable company. The policy offers a coverage amount of 500,000, with a monthly premium of 120. This policy provides them with peace of mind, knowing that their family’s financial future is secure, even in unforeseen circumstances.

Case Study 2: Retirement Planning with Cash Value

Meet Robert, a successful businessman nearing retirement. He wants to ensure a comfortable retirement and explore ways to maximize his savings. He opts for a whole life insurance policy with a higher coverage amount of 1,000,000, paying a monthly premium of 300. Over the years, the policy’s cash value accumulates, providing him with a substantial sum to supplement his retirement income. This strategy not only secures his financial future but also offers a tax-efficient way to save and invest.

Conclusion

Whole life insurance quotes provide a gateway to financial security and long-term planning. By understanding the factors that influence these quotes and exploring various policy options, individuals can make informed decisions to secure their future and that of their loved ones. Whether it’s protecting your family, saving for retirement, or both, whole life insurance offers a versatile solution.

Frequently Asked Questions

How does whole life insurance differ from term life insurance?

+

Whole life insurance offers permanent coverage and builds cash value, while term life insurance provides coverage for a specific period, typically 10-30 years, without any cash value accumulation.

Can I access the cash value of my whole life insurance policy?

+

Yes, you can access the cash value through various means, including policy loans, withdrawals, or surrendering the policy. However, it’s important to consider the potential tax implications and the impact on your coverage.

What happens if I miss a premium payment for my whole life insurance policy?

+

Missing a premium payment can lead to a lapse in coverage. However, many policies have a grace period, allowing you to make the payment within a certain timeframe to avoid losing coverage. It’s essential to understand the terms of your policy and stay current with premium payments.

Can I increase the coverage amount of my whole life insurance policy later in life?

+

Yes, in some cases, you can increase the coverage amount by converting your whole life insurance policy or adding additional riders. However, this may require a new application and potentially higher premiums.

Are there any tax benefits associated with whole life insurance policies?

+

Yes, the cash value accumulation within whole life insurance policies often offers tax advantages. The growth of cash value is typically tax-deferred, and policy loans or withdrawals may be tax-free if the policy is properly structured.