Monthly Insurance

In today's dynamic world, financial protection and security are paramount. Monthly insurance plans have emerged as a popular and flexible solution, offering individuals and businesses a way to safeguard their future and manage risks effectively. This comprehensive guide aims to delve into the intricacies of monthly insurance, exploring its advantages, coverage options, and the peace of mind it provides. Join us as we navigate the landscape of this innovative insurance approach, uncovering the key factors that make it a valuable asset for modern risk management.

Unlocking Flexibility and Peace of Mind

Monthly insurance represents a paradigm shift in the traditional insurance model, offering unparalleled flexibility and tailored coverage. Unlike annual or long-term policies, monthly plans allow individuals to adapt their insurance needs to their current life circumstances. This adaptability is particularly advantageous for those experiencing significant life changes, such as career transitions, family growth, or retirement planning.

With monthly insurance, policyholders gain the freedom to adjust their coverage limits, deductibles, and additional benefits on a monthly basis. This flexibility ensures that insurance remains an affordable and practical solution, aligning with one’s evolving financial goals and priorities. Whether it’s increasing coverage during a high-risk activity or scaling back during more stable periods, monthly insurance provides the agility to make informed decisions without long-term commitments.

Comprehensive Coverage, Tailored to You

The beauty of monthly insurance lies in its ability to offer comprehensive coverage options, tailored to the unique needs of each policyholder. Whether it’s health, life, property, or liability insurance, monthly plans provide an extensive array of coverage choices. For instance, health insurance plans can be customized to include specific medical procedures, prescription drug coverage, or mental health support, ensuring that policyholders receive the care they need without unnecessary expenses.

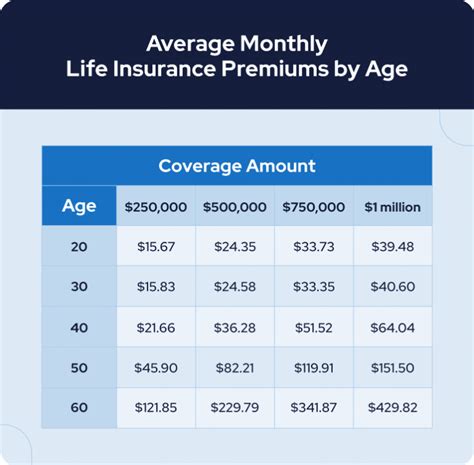

Life insurance, too, benefits from the flexibility of monthly plans. Policyholders can choose between term life insurance, offering coverage for a specific period, and permanent life insurance, which provides lifelong protection. Furthermore, riders and additional benefits, such as accelerated death benefits or waiver of premium, can be added or removed on a monthly basis, allowing individuals to customize their coverage according to their changing needs and financial capacity.

The Benefits of Monthly Premiums

One of the most appealing aspects of monthly insurance is the payment structure. Instead of paying large sums annually or semi-annually, policyholders can opt for more manageable monthly premiums. This approach makes insurance more accessible and affordable, especially for those with limited financial resources or irregular income streams. Monthly payments also align with most individuals’ budgeting strategies, making it easier to plan and allocate funds accordingly.

Moreover, the monthly premium structure encourages policyholders to stay engaged with their insurance policies. Regular payments and the ability to make changes on a monthly basis foster a sense of ownership and responsibility. Policyholders are more likely to review their coverage regularly, ensuring that their insurance remains relevant and effective in the face of life’s unpredictable twists and turns.

Real-World Scenarios: Where Monthly Insurance Shines

Monthly insurance has proven its worth in various real-life scenarios, offering tailored protection and peace of mind in critical situations. Consider the case of a small business owner who needs liability insurance for their premises. With monthly insurance, they can secure the necessary coverage and adjust it as their business grows or changes, without being locked into a long-term commitment.

For individuals, monthly insurance provides a safety net during life’s transitions. A young professional starting their career might opt for basic health and life insurance, gradually increasing their coverage as they establish financial stability. Conversely, a retiree might reduce their insurance needs, focusing on essential coverage while maintaining a comfortable budget.

Navigating the Landscape: Choosing the Right Monthly Insurance Plan

Selecting the right monthly insurance plan requires careful consideration and expert guidance. Policyholders should evaluate their current and future needs, assessing potential risks and the level of coverage required. It’s crucial to choose an insurance provider that offers a wide range of coverage options and the flexibility to customize policies.

Additionally, policyholders should review the fine print, understanding the terms and conditions, exclusions, and any potential limitations. Seeking advice from financial advisors or insurance brokers can provide valuable insights and ensure that the chosen plan aligns with individual goals and circumstances.

The Future of Insurance: Embracing Innovation

Monthly insurance represents a forward-thinking approach to risk management, reflecting the evolving needs of modern individuals and businesses. As technology advances and lifestyles become more dynamic, insurance solutions must adapt to provide flexible, accessible, and tailored protection. The monthly insurance model embodies this innovation, offering a fresh perspective on financial security and peace of mind.

In the years to come, we can expect further advancements in monthly insurance, with the integration of cutting-edge technologies and data-driven insights. Insurtech startups and established insurance providers will continue to collaborate, leveraging digital tools to enhance the customer experience, streamline processes, and offer even more personalized coverage options.

Conclusion: A New Era of Insurance Flexibility

Monthly insurance has ushered in a new era of flexibility and customization in the insurance industry. With its adaptable coverage, manageable premiums, and tailored solutions, it has become a powerful tool for individuals and businesses to navigate life’s uncertainties. As we move forward, the principles of monthly insurance will continue to shape the future of risk management, offering a bright and secure horizon for all.

FAQ

Can I change my coverage mid-month if my circumstances change suddenly?

+Yes, most monthly insurance plans offer the flexibility to make changes to your coverage at any time. However, it’s important to check with your insurance provider to understand their specific policies and any potential fees or adjustments that may apply.

Are there any disadvantages to monthly insurance plans compared to annual plans?

+While monthly insurance offers flexibility, it may have slightly higher administrative costs due to the frequent policy changes. Additionally, some providers may have specific requirements or restrictions for monthly plans, so it’s essential to research and compare different options.

How does monthly insurance impact my credit score or financial history?

+Monthly insurance payments, like any other regular financial commitment, can positively impact your credit score if you make timely payments. However, missed or late payments may have a negative effect, so it’s crucial to manage your finances responsibly.