Cheapest Auto Insurance For Full Coverage

Finding the cheapest auto insurance for full coverage requires a careful assessment of various factors, including your location, driving history, and the specific coverage options you need. While the term "cheapest" may be enticing, it's essential to strike a balance between affordability and comprehensive protection to ensure you're adequately covered in the event of an accident or other vehicle-related incidents.

Understanding Full Coverage Auto Insurance

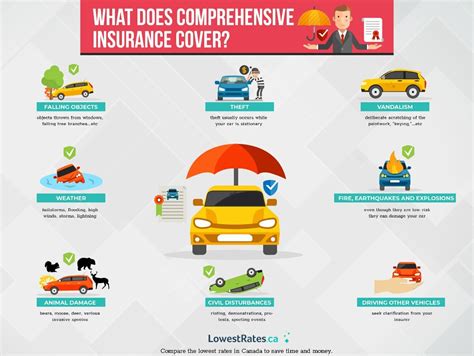

Full coverage auto insurance is a comprehensive policy that offers more than just the basic liability coverage. It typically includes collision coverage, which pays for repairs or replacements if your vehicle is damaged in an accident, regardless of fault. Comprehensive coverage is also a part of full coverage, protecting against non-collision incidents like theft, vandalism, natural disasters, or damage caused by animals.

Additionally, full coverage often includes personal injury protection (PIP) or medical payments coverage, which helps cover medical expenses for you and your passengers in the event of an accident. Uninsured/underinsured motorist coverage is another crucial component, providing protection if you're involved in an accident with a driver who doesn't have enough insurance to cover the damages.

Factors Influencing the Cost of Full Coverage

Location

The state and city you reside in play a significant role in determining the cost of your auto insurance. Insurance rates can vary greatly between states due to differences in traffic density, accident rates, and local laws. For instance, states with higher population densities and more frequent accidents, like California or New York, often have higher insurance premiums.

Driving History

Your driving record is a critical factor in determining your insurance rates. Insurers typically consider the number of accidents and violations on your record. A clean driving history with no recent accidents or traffic violations can lead to lower premiums, while a history of accidents or moving violations may result in higher costs.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can impact your insurance rates. Sports cars or luxury vehicles tend to have higher insurance costs due to their higher repair or replacement costs. Additionally, if you use your vehicle for business purposes or drive long distances, your insurance rates may be higher.

Credit Score

Believe it or not, your credit score can influence your insurance rates. Many insurers use credit-based insurance scores to assess the risk of insuring a driver. A higher credit score may lead to lower insurance premiums, as it indicates a lower risk of filing claims.

Strategies to Find the Cheapest Full Coverage Auto Insurance

Shop Around

Don’t settle for the first insurance quote you receive. Shopping around and comparing rates from multiple insurers is crucial to finding the best deal. Online insurance marketplaces can be a great starting point, as they allow you to compare quotes from various providers in one place.

Bundle Policies

If you have multiple insurance needs, such as auto, home, or renters’ insurance, consider bundling your policies with one insurer. Many insurers offer discounts when you combine multiple policies, which can significantly reduce your overall insurance costs.

Raise Your Deductible

Increasing your deductible (the amount you pay out-of-pocket before your insurance coverage kicks in) can lower your insurance premiums. However, it’s important to ensure that you can afford the increased deductible in the event of an accident.

Take Advantage of Discounts

Insurers offer various discounts that can reduce your insurance costs. These may include safe driver discounts, good student discounts, loyalty discounts, or discounts for completing defensive driving courses. Ask your insurer about the discounts they offer and see if you qualify for any.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach where your insurance premium is based on how much and how safely you drive. This type of insurance may be a good option if you’re a safe and cautious driver, as it can lead to significant savings.

Review Your Coverage Annually

Insurance rates and coverage options can change over time. It’s essential to review your insurance policy annually to ensure you’re still getting the best deal. This review can help you identify any changes in your circumstances or insurance needs that may impact your coverage and costs.

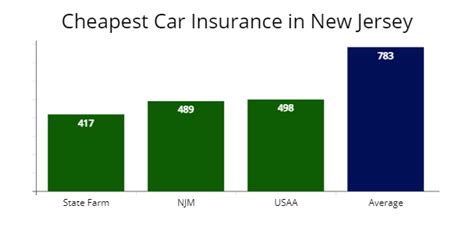

Analyzing Real-World Examples

To provide a more tangible understanding, let’s explore some real-world examples of auto insurance costs for full coverage policies.

| Driver Profile | Estimated Annual Premium |

|---|---|

| Young Adult (25 years old) with a clean driving record, driving a 2018 Toyota Corolla in California | $1,200 - $1,500 |

| Middle-Aged Adult (45 years old) with a few minor violations, driving a 2020 Honda Civic in Texas | $800 - $1,100 |

| Senior Citizen (65 years old) with a perfect driving record, driving a 2015 Ford Fusion in Florida | $700 - $900 |

These examples highlight the significant variations in insurance costs based on individual circumstances. It's essential to note that these estimates are for illustration purposes only and may not reflect the exact rates you'll receive. Your specific situation and insurance needs will determine your actual insurance costs.

The Future of Auto Insurance: A Glimpse

The auto insurance industry is evolving rapidly, with technological advancements and changing consumer behaviors shaping its future. One notable trend is the rise of telematics and usage-based insurance, which allows insurers to gather real-time data on driving behavior and offer more personalized and potentially cheaper insurance options.

Additionally, the increasing adoption of autonomous vehicle technology is likely to impact auto insurance in the coming years. As self-driving cars become more prevalent, insurance providers may need to adjust their coverage models to account for the reduced risk of human error in accidents. This could potentially lead to more affordable insurance rates for consumers.

In conclusion, finding the cheapest auto insurance for full coverage requires a thoughtful approach that considers your individual circumstances and the various factors influencing insurance rates. By shopping around, leveraging discounts, and staying informed about industry trends, you can make informed decisions to ensure you're getting the best value for your insurance needs.

What is the difference between full coverage and liability-only auto insurance?

+Full coverage auto insurance provides comprehensive protection, including collision and comprehensive coverage, as well as personal injury protection and uninsured/underinsured motorist coverage. Liability-only insurance, on the other hand, covers only the damages you cause to others, excluding coverage for your own vehicle or medical expenses.

Can I get full coverage auto insurance if I have a poor driving record?

+Yes, it is possible to obtain full coverage auto insurance even with a poor driving record. However, insurers may charge higher premiums or impose additional restrictions on your policy. It’s essential to shop around and compare quotes from multiple insurers to find the best option.

How can I reduce my auto insurance premiums without compromising coverage?

+To reduce your premiums without sacrificing coverage, consider increasing your deductible, taking advantage of available discounts, and reviewing your coverage annually to ensure you’re not paying for unnecessary add-ons. Additionally, maintaining a clean driving record and improving your credit score can lead to lower insurance costs over time.