Auto Insurance What Does Comprehensive Cover

Auto insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers across the globe. Among the various coverage options available, comprehensive insurance stands out as a crucial component, offering a broad range of benefits to policyholders. In this comprehensive guide, we will delve into the intricacies of comprehensive auto insurance, exploring its definition, coverage scope, benefits, exclusions, and real-world examples to help you understand its importance and how it can protect you on the road.

Understanding Comprehensive Auto Insurance

Comprehensive auto insurance, often referred to as comp insurance, is a type of coverage that goes beyond the basic liability and collision policies. It is designed to protect your vehicle from a wide array of risks and damages that are not typically covered by other types of auto insurance. This comprehensive coverage provides financial assistance for repairs or replacements in situations where your vehicle sustains damage from events other than collisions with other vehicles or objects.

Definition and Scope of Comprehensive Coverage

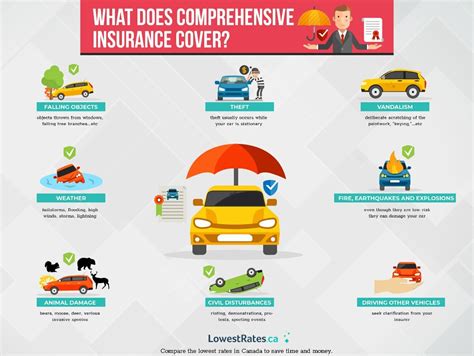

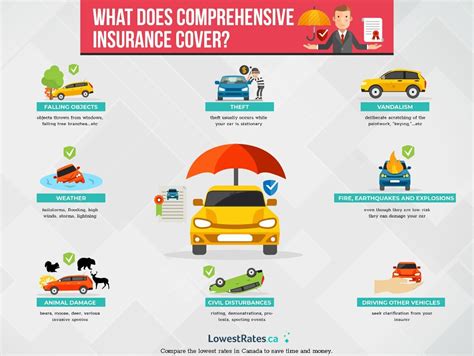

Comprehensive insurance covers a broad spectrum of incidents and perils that can affect your vehicle. These include, but are not limited to, the following:

- Theft and Vandalism: If your vehicle is stolen or damaged by vandals, comprehensive coverage will help cover the costs of repairs or replacement.

- Natural Disasters: Events such as hurricanes, tornadoes, floods, wildfires, and earthquakes are covered under comprehensive insurance.

- Animal Collisions: Hitting an animal on the road, such as a deer or a wild boar, is a common risk for drivers. Comprehensive insurance can provide coverage for repairs in such scenarios.

- Falling Objects: If your vehicle is damaged by falling debris, branches, or even space debris, comprehensive insurance has got you covered.

- Glass Damage: Comprehensive coverage typically includes protection for damaged windshields, windows, and sunroofs.

- Fire and Explosion: In the unfortunate event of a fire or explosion, comprehensive insurance will assist with the costs of repairs or replacement.

- Riots and Civil Unrest: Damage to your vehicle during riots or civil disturbances is covered under comprehensive insurance.

- Collisions with Unknown Objects: If you hit an unknown object on the road, such as a pothole or a piece of debris, comprehensive insurance can provide coverage.

Benefits and Advantages of Comprehensive Coverage

Comprehensive auto insurance offers a multitude of benefits that make it an invaluable addition to your insurance portfolio. Here are some key advantages:

- Financial Protection: Comprehensive coverage provides financial security, ensuring that you won’t have to bear the full brunt of unexpected expenses resulting from covered incidents.

- Peace of Mind: Knowing that your vehicle is protected against a wide range of risks allows you to drive with confidence and peace of mind.

- Coverage for Non-Collision Incidents: Unlike collision insurance, comprehensive coverage extends to damages caused by non-collision events, such as theft, natural disasters, and animal collisions.

- Personalized Coverage Options: You can tailor your comprehensive insurance policy to suit your specific needs and the risks prevalent in your region.

- Potential Discounts: Some insurance providers offer discounts for combining comprehensive insurance with other types of coverage, such as liability or collision insurance.

| Coverage Type | Comprehensive Insurance |

|---|---|

| Theft and Vandalism | Covered |

| Natural Disasters | Covered |

| Animal Collisions | Covered |

| Falling Objects | Covered |

| Glass Damage | Covered |

| Fire and Explosion | Covered |

| Riots and Civil Unrest | Covered |

| Collisions with Unknown Objects | Covered |

Exclusions and Limitations

While comprehensive insurance provides extensive coverage, it is essential to understand what it does not cover. Here are some common exclusions and limitations:

- Normal Wear and Tear: Damage caused by regular wear and tear, such as aging parts or gradual deterioration, is typically not covered.

- Mechanical or Electrical Failures: Issues arising from mechanical or electrical malfunctions are usually excluded from comprehensive coverage.

- Intentional Damage: If you intentionally cause damage to your vehicle, comprehensive insurance will not provide coverage.

- Pre-Existing Conditions: Damage resulting from pre-existing conditions or known issues with your vehicle is often excluded.

- Customizations and Upgrades: Modifications or customizations made to your vehicle may not be covered by comprehensive insurance.

- War and Terrorism: Damage caused by acts of war or terrorism is typically excluded from auto insurance policies.

Real-World Examples of Comprehensive Coverage

Let’s explore a few real-life scenarios where comprehensive auto insurance can prove invaluable:

- Theft Recovery: Imagine your vehicle is stolen from your driveway. With comprehensive insurance, you can file a claim to receive compensation for the theft and potentially get your vehicle back if it’s recovered.

- Hurricane Damage: If a hurricane strikes your area, causing extensive damage to your vehicle, comprehensive insurance will cover the costs of repairs or even provide a replacement if the damage is extensive.

- Deer Collision: While driving through a rural area, you unfortunately collide with a deer. Comprehensive insurance can help cover the costs of repairs to your vehicle, ensuring you’re not left with a hefty bill.

- Glass Replacement: Your windshield cracks due to a falling branch. Comprehensive insurance typically includes glass coverage, so you can get it replaced without worrying about the cost.

Conclusion

Comprehensive auto insurance is an essential component of a well-rounded insurance portfolio for vehicle owners. By providing protection against a wide range of non-collision incidents, it offers financial security and peace of mind. Understanding the scope of comprehensive coverage and its benefits is crucial for making informed decisions about your auto insurance needs. Remember to carefully review your policy and consult with your insurance provider to ensure you have the right level of coverage for your specific circumstances.

Does comprehensive insurance cover all types of vehicle damage?

+No, comprehensive insurance covers a wide range of non-collision incidents, but it has certain exclusions. It typically does not cover normal wear and tear, mechanical or electrical failures, intentional damage, pre-existing conditions, and modifications.

Can I choose my own repair shop if I file a comprehensive claim?

+Yes, you generally have the freedom to choose your preferred repair shop when filing a comprehensive claim. However, it’s always advisable to check with your insurance provider to ensure that the chosen shop is within your policy’s network or meets their requirements.

What is the difference between comprehensive and collision insurance?

+Comprehensive insurance covers non-collision incidents such as theft, natural disasters, and animal collisions. Collision insurance, on the other hand, covers damage to your vehicle resulting from collisions with other vehicles, objects, or as a result of flipping over.