Best Medical Insurance Coverage

Medical insurance, also known as health insurance, is an essential aspect of healthcare that provides financial protection and access to necessary medical services. With the rising costs of healthcare, choosing the best medical insurance coverage is crucial to ensure peace of mind and comprehensive care. This comprehensive guide aims to help individuals and families navigate the complex world of medical insurance, offering expert insights and practical advice to make informed decisions.

Understanding Medical Insurance Coverage

Medical insurance coverage encompasses a range of benefits and services designed to cover various healthcare needs. It typically includes hospitalization, outpatient care, prescription medications, preventive services, and sometimes even specialty treatments. Understanding the scope and limitations of your insurance plan is vital to maximize its benefits.

The coverage offered by medical insurance plans can vary significantly, from basic plans with limited benefits to comprehensive plans covering a wide range of services. Factors such as premium costs, deductibles, copayments, and out-of-pocket maximums play a crucial role in determining the overall value and suitability of a plan.

Key Components of Medical Insurance

- Premium: The premium is the regular payment made to maintain your insurance coverage. It is usually paid monthly or annually and can vary based on factors like age, location, and the level of coverage chosen.

- Deductible: A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Higher deductibles often result in lower premiums, but it means you’ll pay more before your insurance benefits start.

- Copayment: Copayments, or copays, are fixed amounts you pay for covered services, such as doctor visits or prescription medications. These copays are typically specified in your insurance plan and can vary based on the service.

- Out-of-Pocket Maximum: This is the maximum amount you’ll pay out of pocket in a year for covered services. Once you reach this limit, your insurance plan covers 100% of eligible expenses for the remainder of the year.

- Network Providers: Most insurance plans have a network of preferred providers, including hospitals, doctors, and specialists. Using in-network providers often results in lower costs and smoother claims processes.

Assessing Your Medical Insurance Needs

Before selecting a medical insurance plan, it’s essential to assess your specific healthcare needs and preferences. Consider factors such as your current health status, the health of your family members, any pre-existing conditions, and your expected healthcare utilization.

If you have a chronic condition or require regular medical attention, you'll want a plan with robust coverage for your specific needs. On the other hand, if you're generally healthy and rarely require medical care, a plan with lower premiums and higher deductibles might be a better fit.

Factors to Consider:

- Age and Health Status: Younger individuals may opt for plans with lower premiums and higher deductibles, while older adults or those with health issues might prioritize plans with more comprehensive coverage.

- Family Size: If you have a large family, consider plans that offer family coverage with a single premium and comprehensive benefits for all family members.

- Prescription Needs: If you rely on prescription medications, choose a plan with generous prescription coverage, including preferred brands and generic options.

- Specialty Care: Assess whether you or your family members require specialty care, such as mental health services, physical therapy, or dental/vision care. Ensure your chosen plan covers these services adequately.

Comparing Medical Insurance Plans

When comparing medical insurance plans, it’s crucial to evaluate their benefits, costs, and provider networks. Review the plan’s summary of benefits and coverage to understand what’s included and what’s not. Look for plans that align with your healthcare needs and offer the best value for your money.

Consider the following aspects when comparing plans:

- Network of Providers: Ensure the plan’s network includes your preferred doctors, specialists, and hospitals. Check if the plan offers out-of-network coverage and what the associated costs would be.

- Covered Services: Review the plan’s coverage for hospitalization, outpatient care, prescription medications, preventive services, and any specific treatments you might require.

- Cost-Sharing: Understand the plan’s cost-sharing structure, including deductibles, copayments, and coinsurance. Compare these costs across plans to determine which one aligns best with your budget and expected healthcare utilization.

- Wellness and Preventive Care: Look for plans that cover preventive services, such as annual check-ups, vaccinations, and screening tests, as these can help catch health issues early and reduce long-term costs.

- Additional Benefits: Some plans offer extra benefits like telemedicine services, fitness programs, or discounts on certain health-related products. These can enhance your overall healthcare experience.

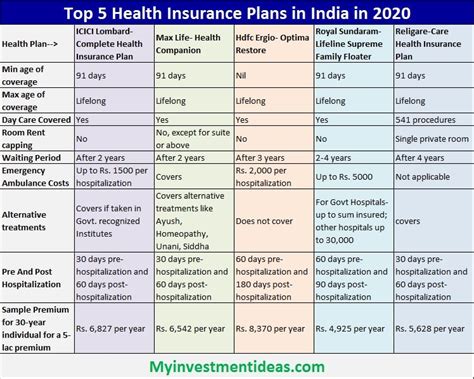

Table: Sample Comparison of Medical Insurance Plans

| Plan Name | Premium | Deductible | Copayment | Out-of-Pocket Max | Network Size |

|---|---|---|---|---|---|

| Plan A | 350/month</td> <td>2,000 | 30</td> <td>5,000 | 1,500 providers | ||

| Plan B | 400/month</td> <td>1,500 | 40</td> <td>6,000 | 2,000 providers | ||

| Plan C | 450/month</td> <td>1,000 | 20</td> <td>7,500 | 3,000 providers |

Maximizing Your Medical Insurance Benefits

Once you’ve selected your medical insurance plan, it’s important to understand how to maximize its benefits. Here are some strategies to ensure you get the most out of your coverage:

- Familiarize Yourself with Your Plan: Review your policy documents thoroughly to understand your benefits, coverage limits, and any exclusions. Know your deductibles, copays, and the process for submitting claims.

- Use In-Network Providers: Utilizing in-network providers can significantly reduce your out-of-pocket costs. Check your plan’s provider directory regularly to ensure your preferred doctors and facilities are still in-network.

- Understand Your Prescription Coverage: Learn about your plan’s prescription drug formulary, which lists covered medications and their tiers. Understand the costs associated with different tiers and consider generic alternatives to save money.

- Take Advantage of Preventive Services: Many insurance plans cover preventive services at no cost to you. Schedule regular check-ups, screenings, and vaccinations to stay on top of your health and catch potential issues early.

- Consider Wellness Programs: Some insurance companies offer wellness programs or incentives to encourage healthy behaviors. Participate in these programs to improve your health and potentially reduce future healthcare costs.

Future of Medical Insurance

The landscape of medical insurance is continually evolving, driven by advancements in healthcare technology, changing consumer needs, and policy reforms. Here’s a glimpse into the future of medical insurance and its potential implications:

- Digital Health Innovations: The integration of digital health technologies, such as telemedicine and health monitoring apps, is expected to play a significant role in the future of medical insurance. These innovations can enhance access to care, improve patient engagement, and potentially reduce costs.

- Value-Based Care Models: The shift towards value-based care, where providers are incentivized to deliver high-quality, cost-effective care, is gaining momentum. This approach aims to improve patient outcomes while reducing overall healthcare costs, benefiting both patients and insurers.

- Personalized Medicine: Advancements in genomics and personalized medicine are likely to influence medical insurance coverage. Insurers may offer tailored coverage options based on an individual’s genetic makeup, enabling more precise and effective healthcare.

- Enhanced Consumer Engagement: Insurance companies are increasingly focusing on engaging consumers in their healthcare decisions. This includes providing educational resources, offering personalized health plans, and incentivizing healthy behaviors to empower individuals to take control of their health.

FAQ

What is the difference between PPO and HMO plans?

+

PPO (Preferred Provider Organization) plans offer more flexibility, allowing you to choose any healthcare provider, including out-of-network options. HMO (Health Maintenance Organization) plans typically require you to choose a primary care physician and use in-network providers, offering more cost-effective care but less flexibility.

How do I choose the right medical insurance plan for my family?

+

Consider your family’s healthcare needs, including any chronic conditions or specialized care requirements. Evaluate plans based on their coverage for these needs, as well as their network of providers and overall cost structure.

What is a health savings account (HSA)?

+

An HSA is a tax-advantaged savings account that allows you to set aside pre-tax dollars for qualified medical expenses. HSAs are often paired with high-deductible health plans and can provide significant tax benefits and flexibility in managing healthcare costs.

How can I reduce my medical insurance costs?

+

Consider plans with higher deductibles and lower premiums if you’re generally healthy. Utilize preventive services and wellness programs offered by your insurance company. Compare quotes from different insurers to find the most competitive rates.

What happens if I need medical care while traveling?

+

Some insurance plans offer emergency travel coverage, but it’s important to review your policy’s details. Consider purchasing travel insurance with medical coverage if your primary plan doesn’t offer adequate travel protection.