Dental Insurance Virginia

Dental insurance is an essential aspect of healthcare coverage, ensuring that individuals have access to necessary dental treatments and services without incurring excessive financial burdens. In Virginia, like many other states, dental insurance plans are widely available to cater to the diverse needs of its residents. This article delves into the intricacies of dental insurance in Virginia, providing a comprehensive guide to help you navigate the options and make informed decisions regarding your oral health and financial well-being.

Understanding Dental Insurance Plans in Virginia

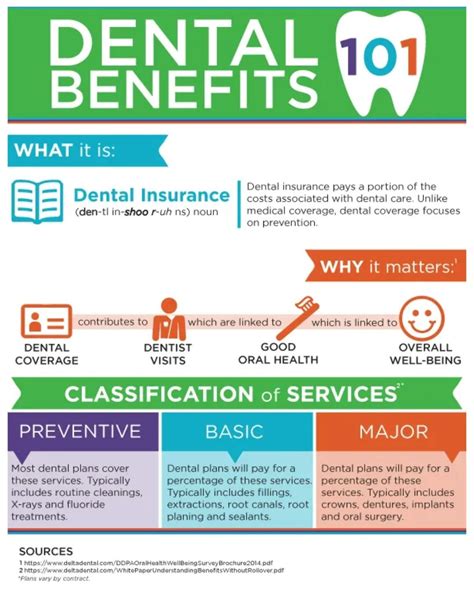

Dental insurance plans in Virginia typically fall into two main categories: indemnity plans and managed care plans. Indemnity plans, also known as fee-for-service or traditional plans, offer more flexibility in choosing dental providers but may have higher out-of-pocket costs. On the other hand, managed care plans, such as Dental Health Maintenance Organizations (DHMOs) and Preferred Provider Organizations (PPOs), often have lower costs but may limit your choice of dentists.

In Virginia, the most common types of dental insurance plans include:

- DHMOs: These plans usually require you to select a primary care dentist within their network and may have lower monthly premiums.

- PPOs: Offering a wider range of dentist choices, PPOs typically have higher premiums but provide more flexibility in treatment options.

- Indemnity Plans: While less common, these plans provide the most freedom in choosing dental providers and may be suitable for those with specific dental needs.

Key Considerations for Dental Insurance in Virginia

When evaluating dental insurance options in Virginia, several factors should be taken into account to ensure you choose a plan that aligns with your oral health needs and financial situation.

Coverage and Benefits

Dental insurance plans in Virginia vary in the scope of services they cover. Basic coverage typically includes diagnostic and preventive services such as cleanings, check-ups, and X-rays. However, more comprehensive plans may also cover major procedures like root canals, crowns, and dentures. It’s essential to review the coverage limits and waiting periods associated with these procedures to understand the full extent of your benefits.

| Dental Procedure | Average Coverage (%) |

|---|---|

| Cleanings and Check-ups | 100% |

| Fillings | 80% |

| Root Canals | 50% |

| Crowns | 50% |

Network of Dentists

The network of participating dentists is a crucial aspect of dental insurance plans. In-network dentists have agreed to provide services at discounted rates, which can significantly reduce your out-of-pocket expenses. It’s advisable to check if your preferred dental providers are included in the insurance plan’s network to ensure uninterrupted care.

Premiums and Out-of-Pocket Costs

Dental insurance plans come with monthly premiums, which vary based on the type of plan, the level of coverage, and the insurance provider. Additionally, you may incur deductibles, co-payments, and co-insurance costs when receiving dental treatment. Understanding these financial aspects is vital for managing your dental care expenses effectively.

Specialist Referrals and Pre-Authorization

Some dental insurance plans in Virginia may require pre-authorization or referrals for certain specialized treatments or procedures. This process ensures that the insurance company approves the treatment before it is carried out, preventing any unexpected costs or denials of coverage. Being aware of these requirements can help you navigate the claims process more smoothly.

Evaluating Dental Insurance Providers in Virginia

Virginia is home to several reputable dental insurance providers, each offering a range of plans to suit different needs and budgets. When evaluating these providers, consider the following aspects to make an informed decision:

Reputation and Customer Satisfaction

Research the reputation and customer satisfaction ratings of the insurance providers. Online reviews and testimonials can provide valuable insights into the quality of service and the overall experience of policyholders. A provider with a solid track record of customer satisfaction is often a reliable choice.

Financial Stability

The financial stability of the insurance company is crucial for ensuring the longevity and reliability of your dental insurance coverage. Look for providers with a strong financial rating from reputable agencies like A.M. Best or Standard & Poor’s. This indicates their ability to honor policy commitments and pay claims promptly.

Plan Customization and Flexibility

Different individuals have varying dental needs. Evaluate the extent to which the insurance provider allows for plan customization and flexibility. Some providers offer add-on benefits or the ability to tailor coverage limits to suit specific requirements, providing a more personalized insurance experience.

Claims Processing and Customer Support

Efficient claims processing and responsive customer support are essential aspects of a good dental insurance provider. Inquire about their claims turnaround time and assess the accessibility and effectiveness of their customer service channels. A provider with a dedicated customer support team can provide valuable assistance when navigating the complexities of dental insurance.

Tips for Maximizing Your Dental Insurance Benefits in Virginia

Once you’ve selected a dental insurance plan, it’s important to make the most of your coverage to optimize your oral health and minimize costs. Here are some tips to help you maximize your benefits:

Regular Preventive Care

Take advantage of preventive care services covered by your insurance plan, such as cleanings, fluoride treatments, and oral cancer screenings. These services are typically fully covered and can help identify and address potential issues early on, preventing more complex and costly treatments down the line.

Understanding Your Plan’s Benefits

Familiarize yourself with the specifics of your dental insurance plan, including coverage limits, waiting periods, and any exclusions or limitations. This knowledge will help you make informed decisions about treatments and ensure you receive the full benefits of your plan.

Choosing In-Network Dentists

Whenever possible, select in-network dentists to take advantage of the discounted rates they offer. This can significantly reduce your out-of-pocket expenses and ensure a smoother claims process. Most insurance providers offer online tools or directories to help you find in-network providers in your area.

Communicating with Your Dentist

Maintain open communication with your dentist about your dental insurance coverage. Discuss any concerns or questions you may have about treatments, costs, and coverage to ensure you receive the necessary care within the parameters of your plan.

The Future of Dental Insurance in Virginia

The landscape of dental insurance in Virginia, like many other states, is continually evolving to meet the changing needs of its residents. As oral health awareness grows and technology advances, we can expect to see improvements in coverage, accessibility, and patient experience.

Expanding Coverage Options

In response to the increasing demand for comprehensive dental care, insurance providers in Virginia are likely to expand their coverage options. This may include more inclusive plans that cover a wider range of procedures, as well as specialized plans tailored to specific demographics or dental needs.

Embracing Digital Innovations

The digital revolution has already made significant inroads into the dental insurance industry. Going forward, we can anticipate further digitization of claims processing, online enrollment and management platforms, and teledentistry services. These innovations will enhance convenience, efficiency, and accessibility for policyholders.

Focus on Preventive Care

With growing emphasis on preventive care, dental insurance providers in Virginia are likely to promote and incentivize regular dental check-ups and preventive treatments. This shift towards proactive oral health management can lead to improved overall health outcomes and reduced long-term healthcare costs.

Collaborative Partnerships

In an effort to enhance patient experience and improve access to dental care, we may see increased collaboration between dental insurance providers and dental practices in Virginia. These partnerships could result in streamlined processes, enhanced patient education, and better coordination of care for policyholders.

Frequently Asked Questions

Can I use my dental insurance plan outside of Virginia?

+Dental insurance plans in Virginia may have varying levels of portability. Some plans offer nationwide coverage, while others may have limitations on out-of-state services. It’s essential to review your policy’s terms to understand your coverage options outside of Virginia.

What is the average cost of dental insurance in Virginia?

+The average cost of dental insurance in Virginia can vary depending on the type of plan, the level of coverage, and the insurance provider. As a rough estimate, monthly premiums for individual plans can range from 30 to 50, while family plans may cost between 100 and 200. However, it’s best to obtain specific quotes based on your needs.

How often should I visit the dentist with dental insurance coverage?

+With dental insurance, it’s recommended to visit your dentist for a check-up and cleaning at least twice a year. This frequency is often covered by basic dental insurance plans and can help detect and prevent potential dental issues before they become more serious.

Can I switch dental insurance plans during the year in Virginia?

+In Virginia, switching dental insurance plans outside of the annual open enrollment period is generally possible if you experience a qualifying life event, such as marriage, divorce, birth of a child, or loss of other dental coverage. Check with your insurance provider or state regulations for specific guidelines.