Insurance Pricing

Insurance pricing is a complex and multifaceted topic that plays a crucial role in the world of finance and risk management. The process of determining insurance premiums involves a delicate balance between assessing risk factors, understanding market dynamics, and ensuring the sustainability of insurance providers. In this in-depth exploration, we delve into the intricacies of insurance pricing, shedding light on the strategies, factors, and considerations that shape this critical aspect of the insurance industry.

Understanding the Fundamentals of Insurance Pricing

At its core, insurance pricing revolves around the concept of risk assessment. Insurance companies meticulously evaluate a multitude of factors to determine the likelihood of an insured event occurring. This risk assessment forms the basis for establishing insurance premiums. The objective is to strike a delicate equilibrium, ensuring that premiums are adequate to cover potential losses while remaining competitive in the market.

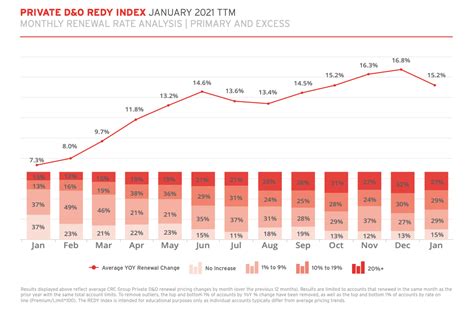

One of the primary drivers of insurance pricing is the loss ratio, which represents the proportion of premiums used to pay out claims. A well-managed loss ratio is crucial for the financial stability of insurance providers. Additionally, insurance pricing is influenced by regulatory requirements, which vary across jurisdictions and impact the pricing strategies employed by insurance companies.

Key Factors Influencing Insurance Premiums

Insurance premiums are determined by a myriad of factors, each playing a unique role in shaping the final cost. Here’s a closer look at some of the critical elements:

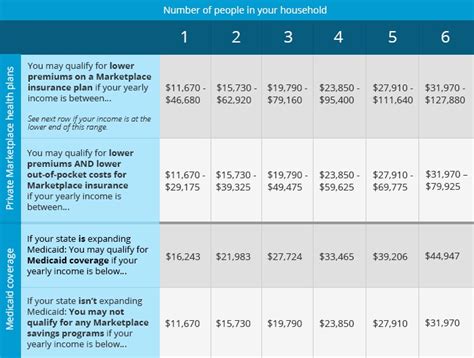

- Risk Profile: The risk profile of the insured individual or entity is a fundamental consideration. Factors such as age, gender, health status, occupation, and lifestyle choices can significantly impact insurance premiums. For instance, younger individuals are often considered lower-risk candidates, resulting in more favorable premiums.

- Coverage Type and Limits: The type of insurance coverage and the selected policy limits have a direct bearing on premiums. Comprehensive policies with higher coverage limits generally attract higher premiums, while more basic coverage options may be more affordable.

- Claims History: A clean claims history can be a significant advantage when it comes to insurance pricing. Insurance companies often offer discounts or more competitive rates to individuals or businesses with a track record of responsible claim management.

- Location and Geographical Factors: Geographical considerations play a pivotal role in insurance pricing. Factors such as crime rates, natural disaster risks, and local regulations can influence premiums. For example, areas prone to hurricanes or earthquakes may face higher insurance costs.

- Credit Score: Surprisingly, credit scores can also impact insurance premiums. Insurance companies often use credit-based insurance scores to assess an individual's financial responsibility, which can influence the final premium.

These factors, among others, contribute to the intricate process of insurance pricing. It's important to note that insurance providers employ sophisticated actuarial models and statistical analyses to determine premiums, ensuring a balanced approach to risk management.

The Role of Data and Technology in Modern Insurance Pricing

In the digital age, data and technology have revolutionized the insurance industry, including the way premiums are calculated. Advanced analytics and machine learning algorithms enable insurance companies to process vast amounts of data, enhancing the accuracy and efficiency of insurance pricing.

Data-Driven Approaches

Insurance companies now leverage extensive data sets to identify patterns, trends, and correlations that influence risk. By analyzing historical claim data, demographic information, and even social media behavior, insurers can make more informed decisions about premium rates.

For instance, telematics in auto insurance allows insurers to monitor driving behavior in real-time, providing insights into risk factors such as aggressive driving or frequent late-night trips. This data-driven approach enables more precise risk assessment and personalized pricing.

Technological Innovations

Technology has not only improved data analysis but has also introduced new insurance products and services. Insurtech startups are disrupting the traditional insurance landscape with innovative solutions, often leveraging technology to offer more flexible and tailored insurance options.

For example, parametric insurance, which pays out based on predefined parameters rather than individual claims, is gaining traction. This approach, enabled by technology, offers faster claim settlements and reduced administrative costs, potentially leading to more competitive premiums.

| Insurtech Innovation | Impact on Insurance Pricing |

|---|---|

| Usage-Based Insurance | Offers personalized premiums based on actual usage, promoting safer behavior and potentially reducing costs. |

| Blockchain Technology | Enhances data security and transparency, reducing fraud and administrative costs, which can lead to more efficient pricing. |

| Artificial Intelligence | Enables advanced risk assessment and claim management, improving accuracy and potentially lowering premiums. |

The Challenge of Fair and Affordable Insurance Pricing

While data and technology have undoubtedly improved insurance pricing, ensuring fair and affordable premiums remains a complex challenge. Here’s a closer look at some of the considerations and potential solutions:

Addressing Underwriting Bias

Underwriting bias, where certain groups or individuals are unfairly penalized in insurance pricing, is a critical concern. To mitigate this, insurance companies are implementing diversity and inclusion initiatives, as well as adopting more objective risk assessment methods.

Promoting Transparency and Consumer Education

Enhancing transparency in insurance pricing is essential for empowering consumers. Insurance companies are increasingly providing clear explanations of premium calculations, ensuring consumers understand the factors influencing their rates.

Exploring Regulatory Reforms

Regulatory bodies play a vital role in ensuring fair insurance pricing. Some proposed reforms include standardized pricing models and increased oversight to prevent discriminatory practices. Collaboration between regulators and the insurance industry is crucial for striking the right balance.

The Future of Insurance Pricing: Emerging Trends and Predictions

The insurance industry is evolving rapidly, and several emerging trends are set to shape the future of insurance pricing:

Personalized Insurance

With the advent of data-driven technologies, personalized insurance is becoming increasingly feasible. Insurers are exploring ways to offer tailored premiums based on individual risk profiles, behavior, and preferences. This trend is expected to gain momentum, offering consumers more control over their insurance costs.

Insurtech Disruption

Insurtech startups will continue to disrupt the traditional insurance landscape, challenging established players with innovative business models. These startups often leverage technology to offer more efficient, flexible, and affordable insurance options, potentially driving down premiums across the industry.

Artificial Intelligence and Machine Learning

AI and machine learning will play an even more significant role in insurance pricing. These technologies will enhance risk assessment, claim management, and fraud detection, leading to more accurate and efficient pricing models. Additionally, AI-powered chatbots and virtual assistants will improve customer interactions, further streamlining the insurance process.

Conclusion

Insurance pricing is a dynamic and ever-evolving field, influenced by a multitude of factors and technological advancements. As the industry continues to innovate, the focus on fair, transparent, and affordable premiums will remain paramount. By leveraging data, technology, and regulatory oversight, the insurance industry can navigate the complexities of pricing, ultimately benefiting consumers and fostering a sustainable insurance ecosystem.

How do insurance companies determine premiums for individual policies?

+

Insurance companies use a combination of factors, including risk assessment, coverage type, claims history, and location, to determine individual premiums. Advanced analytics and data-driven approaches further enhance the accuracy of premium calculations.

What impact does technology have on insurance pricing?

+

Technology, especially data analytics and machine learning, has revolutionized insurance pricing. It enables more accurate risk assessment, personalized premiums, and improved operational efficiency, ultimately benefiting consumers with potentially lower costs.

How can consumers ensure they are getting fair insurance premiums?

+

Consumers can educate themselves about insurance pricing factors and shop around for multiple quotes. Additionally, they can advocate for transparency and ethical practices within the insurance industry to ensure fair and affordable premiums.