Insurances For A Small Business

For small business owners, navigating the complex world of insurance can be a daunting task. From general liability to workers' compensation, the options can seem overwhelming. However, having the right insurance coverage is crucial to protect your business, its assets, and its future. This article aims to guide you through the essential insurances for small businesses, providing insights into the key policies you should consider and why they matter.

The Foundation: General Liability Insurance

General liability insurance is the bedrock of small business insurance. It safeguards your business against a wide range of risks and potential liabilities that could arise from daily operations. Here’s a closer look at what it covers and why it’s vital.

Protection Against Third-Party Claims

General liability insurance is your shield against claims made by third parties, including customers, vendors, or even passersby. These claims can arise from various incidents, such as property damage, bodily injury, or even advertising-related issues.

For instance, imagine a customer slips and falls on a wet floor in your retail store. General liability insurance would cover the medical costs and any legal fees associated with such an incident, protecting your business from potentially devastating financial losses.

Defense Against Product and Service Claims

Your business might face claims related to the products or services you offer. General liability insurance provides coverage for such situations, whether it’s a defective product that causes harm or a service that leads to a client’s financial loss.

Consider a scenario where a client sues your software development company for losses incurred due to a bug in your latest software release. General liability insurance would step in to defend your business and potentially cover the associated costs.

Peace of Mind for Renting or Leasing

If you rent or lease a commercial space, your landlord will likely require you to have general liability insurance. This is a standard precaution to protect their property and ensure that, in case of an incident, the burden doesn’t fall solely on them.

| Key Coverage Areas | Protection Details |

|---|---|

| Property Damage | Covers costs for damage to others' property caused by your business operations. |

| Bodily Injury | Provides coverage for medical expenses and legal fees related to injuries sustained on your business premises. |

| Advertising and Personal Injury | Protects against claims related to copyright infringement, libel, slander, or other advertising-related issues. |

Securing Your Workforce: Workers’ Compensation Insurance

Workers’ compensation insurance is a legal requirement in many jurisdictions, and for good reason. It provides essential protection for your employees and your business in the event of work-related injuries or illnesses.

Comprehensive Coverage for Employee Injuries

Workers’ compensation insurance covers a broad spectrum of workplace incidents, from minor injuries like cuts and sprains to more serious conditions like occupational diseases or even fatal accidents.

For example, if an employee suffers a back injury while lifting heavy equipment on the job, workers’ comp would cover the medical treatment and a portion of their wages while they recover.

Legal Compliance and Peace of Mind

Having workers’ compensation insurance is not just a recommendation; it’s often mandated by law. This insurance provides a safety net for your employees and ensures that, should the worst happen, they receive the care and compensation they deserve.

Furthermore, it protects your business from potential lawsuits and ensures you remain in good standing with regulatory bodies.

Managing Costs Effectively

Workers’ compensation insurance is designed to manage costs efficiently. It provides benefits directly to injured workers without the need for lengthy and costly legal processes, which can be a significant advantage for both the employee and the employer.

| Coverage Highlights | Benefits |

|---|---|

| Medical Benefits | Covers the cost of medical treatment for work-related injuries or illnesses. |

| Income Benefits | Provides a portion of the employee's wages while they are unable to work due to a work-related injury. |

| Death Benefits | Offers financial support to the dependents of a worker who dies as a result of a work-related accident or illness. |

Protecting Your Investment: Property Insurance

Your business premises and the assets within them are likely one of your most significant investments. Property insurance is designed to protect these assets from a variety of perils, ensuring your business can recover from unexpected events.

Safeguarding Your Physical Assets

Property insurance covers a range of physical assets, including your building, its contents, and any equipment or inventory you have on site. It provides financial protection against damage or loss due to various causes.

Consider a scenario where a fire breaks out in your warehouse, destroying your stock and damaging the building. Property insurance would step in to cover the costs of repairing or replacing these assets, helping your business get back on its feet.

Protection Against Natural Disasters

Depending on your location, your business may be vulnerable to natural disasters like hurricanes, floods, or earthquakes. Property insurance can provide coverage for damage caused by these events, which are often excluded from standard policies.

Business Interruption Coverage

Property insurance often includes business interruption coverage, which can be a lifesaver in the event of a disaster. This coverage provides compensation for lost income and additional expenses incurred while your business is unable to operate due to a covered loss.

For instance, if a severe storm forces you to temporarily close your restaurant, business interruption coverage would help cover your ongoing expenses and lost revenue until you can reopen.

| Property Insurance Coverage Types | Protection Details |

|---|---|

| Building Coverage | Covers the structure of your building, including repairs or rebuilding after a covered loss. |

| Business Personal Property Coverage | Protects your business's furniture, fixtures, machinery, inventory, and other contents. |

| Business Income Coverage | Replaces lost income and pays ongoing expenses if your business is forced to shut down due to a covered loss. |

Mitigating Financial Risks: Business Owner’s Policy (BOP)

A Business Owner’s Policy (BOP) is a cost-effective way to bundle essential insurance coverages into one comprehensive policy. It’s designed specifically for small to medium-sized businesses and offers tailored protection to meet the unique needs of your enterprise.

Customized Protection for Your Business

A BOP typically includes a combination of general liability, property, and business interruption insurance, along with additional coverages tailored to your industry. This ensures that your policy is tailored to the specific risks your business faces.

For instance, if you own a small bakery, your BOP might include product liability coverage to protect against claims arising from your baked goods.

Cost-Effective Solution for Small Businesses

By combining multiple coverages into one policy, a BOP can offer significant cost savings. It streamlines your insurance needs and provides a more affordable option compared to purchasing individual policies.

Flexible Coverage Options

BOPs are highly customizable. You can choose the coverage limits and deductibles that align with your business’s unique needs and budget. This flexibility ensures you’re not paying for coverage you don’t need, while still maintaining essential protections.

| BOP Coverage Highlights | Benefits |

|---|---|

| General Liability | Covers a wide range of third-party claims, including property damage and bodily injury. |

| Property Insurance | Protects your business's physical assets, including buildings, contents, and inventory. |

| Business Interruption | Provides compensation for lost income and covers ongoing expenses during a covered loss. |

| Additional Coverages | Tailored to your industry, this could include product liability, equipment breakdown, or identity recovery coverage. |

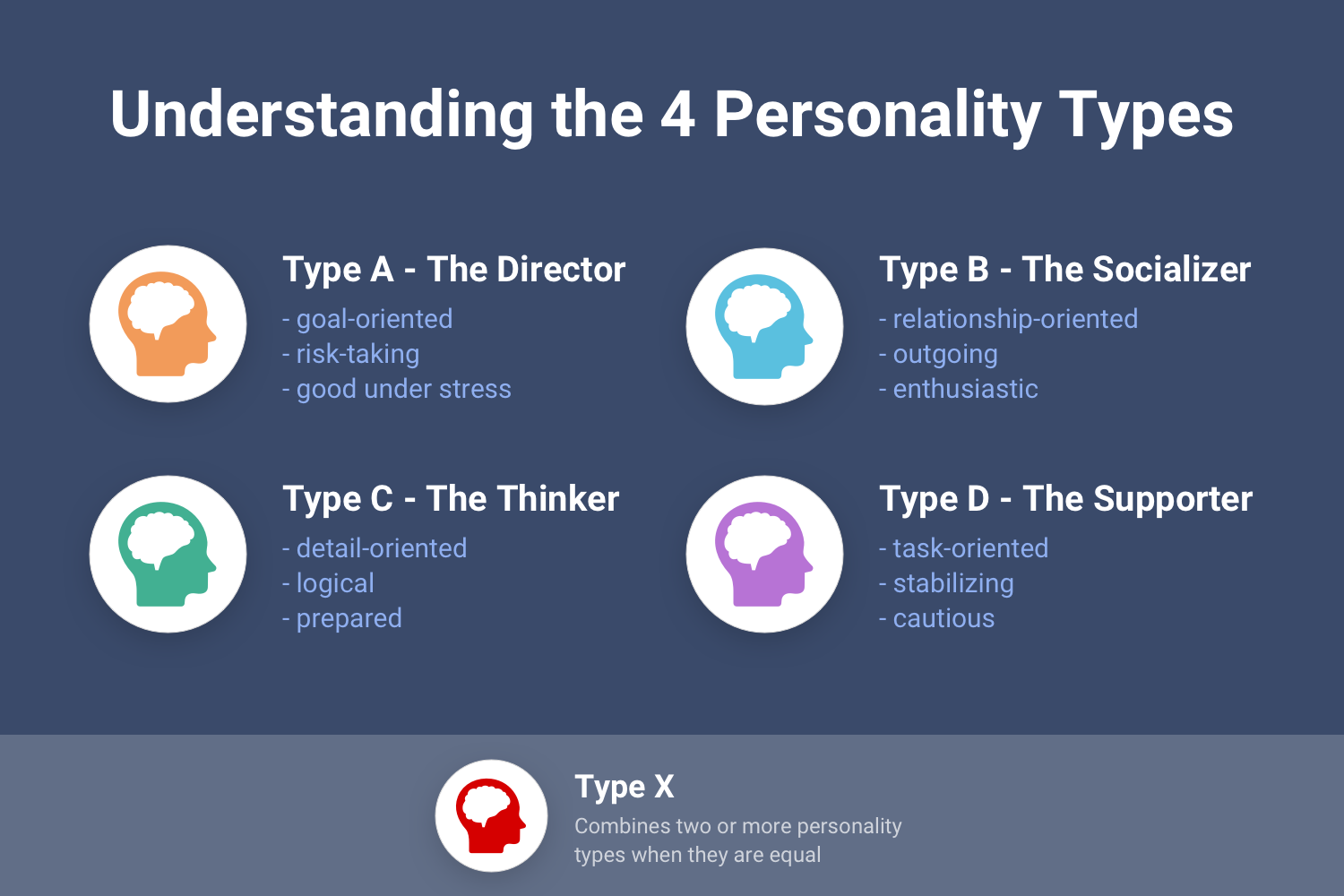

Navigating the Complex World of Business Insurance

The world of business insurance is intricate, and choosing the right coverage can be a challenging task. It’s essential to understand the unique risks your business faces and how insurance can help mitigate those risks. Here are some additional considerations to guide you further.

Professional Liability Insurance (E&O)

Professional liability insurance, also known as Errors and Omissions (E&O) insurance, is crucial for businesses that provide professional services. It covers legal costs and damages if your business is sued for negligence, errors, or omissions in the services you provide.

For instance, if a client sues your consulting firm for advice that leads to financial losses, E&O insurance would provide coverage for the legal defense and any resulting damages.

Cyber Liability Insurance

In today’s digital age, cyber liability insurance is becoming increasingly important. It protects your business from the financial consequences of cyberattacks, data breaches, and other online security threats.

Imagine your e-commerce business falls victim to a ransomware attack. Cyber liability insurance would help cover the costs of restoring your systems, investigating the breach, and notifying affected customers.

Business Auto Insurance

If your business owns or leases vehicles, business auto insurance is a must-have. It provides coverage for vehicles used for business purposes, including liability, physical damage, and medical payments.

For a delivery service business, business auto insurance would cover the vehicles used for deliveries, protecting the business and its drivers in the event of an accident.

| Additional Insurance Considerations | Coverage Details |

|---|---|

| Professional Liability (E&O) | Covers legal costs and damages arising from professional services provided by your business. |

| Cyber Liability | Protects against financial losses from cyberattacks, data breaches, and other online security threats. |

| Business Auto | Provides coverage for vehicles used for business purposes, including liability, physical damage, and medical payments. |

Conclusion: A Secure Future for Your Business

Insuring your small business is a proactive step towards securing its future. By understanding the key insurance policies and how they protect your business, you can make informed decisions to safeguard your assets, your employees, and your livelihood. Remember, insurance is not just a legal requirement; it’s a strategic investment in the long-term success and resilience of your enterprise.

FAQ

What is the average cost of general liability insurance for a small business?

+The cost of general liability insurance can vary significantly based on factors like your industry, business size, and location. On average, small businesses can expect to pay between 300 and 1,000 annually for general liability coverage. However, it’s essential to tailor your coverage to your specific needs, as the cost can be influenced by the chosen limits and deductibles.

Is workers’ compensation insurance mandatory for all businesses?

+In most states, workers’ compensation insurance is mandatory for businesses with employees. However, the specific requirements can vary. Some states may have exemptions for very small businesses or those in certain industries. It’s crucial to check your state’s regulations to ensure you’re in compliance.

What does property insurance typically exclude from coverage?

+Property insurance often excludes coverage for certain types of natural disasters, such as floods or earthquakes, unless additional endorsements or separate policies are purchased. It may also exclude coverage for acts of war, nuclear incidents, and intentional damage caused by the policyholder. Always review your policy carefully to understand what’s covered and what’s excluded.

Can I customize my Business Owner’s Policy (BOP) to meet my specific needs?

+Absolutely! One of the significant advantages of a BOP is its customizability. You can work with your insurance provider to tailor the policy to your business’s unique needs. This includes adjusting coverage limits, adding or removing specific coverages, and choosing the right deductibles to align with your budget and risk tolerance.