Assurance Home Owner Insurance

In the complex world of homeownership, having adequate insurance is paramount. Assurance Home Owner Insurance has emerged as a trusted partner, offering comprehensive coverage and peace of mind to homeowners across the country. With a reputation for reliability and a customer-centric approach, Assurance Home Owner Insurance has become a go-to choice for many. In this article, we will delve into the intricacies of this insurance provider, exploring its coverage, benefits, and unique features, to help you make an informed decision about your home insurance needs.

Understanding Assurance Home Owner Insurance

Assurance Home Owner Insurance is a leading provider of residential insurance, specializing in tailoring coverage to the unique needs of homeowners. Founded on the principles of integrity and customer satisfaction, the company has grown to become a trusted name in the industry. With a focus on providing personalized service and competitive rates, Assurance has built a strong reputation, attracting homeowners seeking reliable protection for their biggest investment.

One of the key strengths of Assurance Home Owner Insurance lies in its comprehensive coverage options. The company understands that every home is different, and so are the risks associated with it. Therefore, they offer a wide range of policies to cater to various homeowner needs. From standard coverage for common risks like fire, theft, and natural disasters to more specialized plans that cover unique circumstances, Assurance ensures that every policyholder can find the right fit for their home.

Key Features of Assurance Home Owner Insurance

Assurance Home Owner Insurance boasts several distinctive features that set it apart from its competitors. These features not only enhance the overall customer experience but also provide added value and protection to policyholders.

- Personalized Coverage: Assurance recognizes that no two homes are alike, which is why they offer highly customizable policies. Policyholders can choose from a wide range of coverage options, including various levels of liability, dwelling protection, and additional endorsements to cover specific risks like water backup, identity theft, or valuable items.

- Discounts and Rewards: The company encourages responsible homeownership by offering a variety of discounts. These include multi-policy discounts for those who bundle their home and auto insurance, loyalty discounts for long-term customers, and even discounts for homes equipped with certain safety features like fire alarms and security systems. Assurance also rewards policyholders for claim-free years, providing additional incentives to maintain a safe and secure home.

- 24/7 Customer Support: Assurance understands that home emergencies can occur at any time. That's why they provide round-the-clock customer support, ensuring that policyholders can reach a live agent whenever they need assistance. Whether it's a late-night emergency or a simple coverage question, Assurance's dedicated team is always ready to help.

- Digital Tools and Resources: In today's digital age, Assurance Home Owner Insurance recognizes the importance of online convenience. They offer a user-friendly online platform where policyholders can manage their accounts, make payments, and even file claims. Additionally, the company provides educational resources and tools to help homeowners better understand their coverage and make informed decisions about their insurance needs.

| Policy Type | Coverage Highlights |

|---|---|

| Standard Homeowner's Policy | Covers dwelling, personal property, liability, and additional living expenses. |

| Condominium Policy | Covers the interior of the unit, personal property, and personal liability. |

| Mobile Home Policy | Tailored coverage for manufactured homes, including structure, contents, and liability. |

| Landlord Policy | Provides coverage for rental properties, including building structure and landlord liability. |

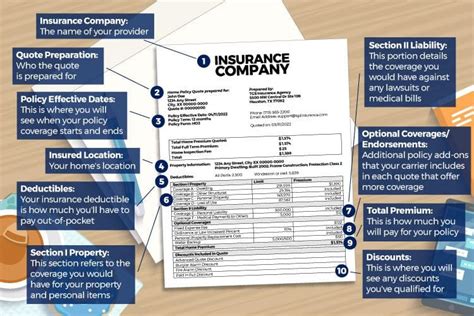

Coverage Options and Add-Ons

Assurance Home Owner Insurance offers a robust selection of coverage options to address the diverse needs of homeowners. Here’s an overview of some of the key coverage types and add-ons available:

Dwelling Coverage

The foundation of any homeowner’s insurance policy, dwelling coverage protects the physical structure of your home. This includes the main house, any attached structures like garages or carports, and even detached buildings like sheds or workshops. Assurance offers customizable dwelling coverage limits to ensure that your home is adequately protected, taking into account factors like the size of your home, its construction materials, and any unique features or upgrades.

Personal Property Coverage

Personal property coverage is designed to protect your belongings against theft, damage, or loss. This includes furniture, appliances, clothing, electronics, and other personal items. Assurance allows policyholders to choose the level of coverage they desire, with options ranging from actual cash value (ACV) to replacement cost coverage. ACV coverage provides reimbursement for the current value of your items, while replacement cost coverage ensures you receive the full amount needed to replace them.

Liability Coverage

Liability coverage is an essential component of homeowner’s insurance, as it protects you from financial loss in the event that someone is injured on your property or you are found legally responsible for an accident or injury off your property. Assurance offers liability limits that can be tailored to your specific needs, providing peace of mind and financial protection in case of unforeseen circumstances.

Additional Living Expenses (ALE) Coverage

In the event that your home becomes uninhabitable due to a covered loss, such as a fire or severe storm damage, Additional Living Expenses coverage steps in to help cover the costs of temporary housing and other necessary expenses. This coverage ensures that you can maintain your normal standard of living while your home is being repaired or rebuilt.

Add-Ons and Endorsements

To further customize your insurance policy and address specific risks, Assurance Home Owner Insurance offers a range of add-ons and endorsements. These include coverage for high-value items like jewelry or fine art, water backup and sump pump failure, identity theft protection, and even coverage for service animals. By adding these endorsements, policyholders can ensure that their unique assets and circumstances are adequately protected.

The Claims Process and Customer Satisfaction

When it comes to insurance, the true test of a provider’s worth is often revealed during the claims process. Assurance Home Owner Insurance prides itself on its commitment to customer satisfaction and streamlined claims handling. The company understands that filing a claim can be a stressful and uncertain time for policyholders, which is why they have implemented a comprehensive and efficient claims process.

Upon filing a claim, Assurance assigns a dedicated claims adjuster who will guide you through the process and ensure a timely resolution. The adjuster will thoroughly assess the damage, investigate the circumstances, and work closely with you to determine the extent of coverage and the appropriate course of action. Assurance strives to provide prompt and fair settlements, aiming to minimize the financial impact and inconvenience caused by the loss.

To further enhance the claims experience, Assurance offers a variety of resources and support options. Policyholders can access online claim portals, where they can track the progress of their claim, upload necessary documentation, and communicate directly with their adjuster. The company also provides a 24/7 claims hotline, ensuring that help is always within reach, regardless of the time or day.

Customer Satisfaction and Reviews

Assurance Home Owner Insurance consistently receives high marks for customer satisfaction. Numerous online reviews and ratings highlight the company’s commitment to excellent service and timely claims handling. Policyholders praise Assurance for their professional and empathetic approach, as well as their willingness to go the extra mile to ensure a positive outcome.

Here are a few testimonials from satisfied Assurance customers:

"I had a wonderful experience with Assurance during a recent claim. The adjuster was incredibly knowledgeable and helped me understand the entire process. They were quick to respond and provided regular updates. I felt well taken care of and highly recommend Assurance."

"Assurance has been my trusted insurance provider for years, and I'm glad I chose them. When I had a water damage issue, they were prompt in sending an adjuster and covered all the necessary repairs. Their customer service is top-notch, and I appreciate their personalized approach."

Future Outlook and Industry Insights

As the insurance industry continues to evolve, Assurance Home Owner Insurance remains committed to staying ahead of the curve. The company actively invests in research and development, leveraging advanced technologies to enhance its services and improve the overall customer experience. By adopting innovative solutions, such as AI-powered claims processing and digital damage assessment tools, Assurance aims to further streamline its operations and provide even faster and more efficient service.

Looking ahead, Assurance is poised to expand its reach and cater to an increasingly diverse range of homeowners. With a focus on inclusivity and accessibility, the company is dedicated to ensuring that every homeowner, regardless of their background or circumstances, can access comprehensive and affordable insurance coverage. By offering flexible payment plans, educational resources, and tailored policies, Assurance aims to bridge the insurance gap and provide peace of mind to all.

In an ever-changing insurance landscape, Assurance Home Owner Insurance remains a trusted and reliable partner for homeowners. With its commitment to innovation, customer satisfaction, and inclusive practices, the company is well-positioned to continue its growth and maintain its position as a leading provider of home insurance solutions.

What factors determine the cost of my home insurance policy with Assurance?

+The cost of your home insurance policy with Assurance is influenced by several factors, including the location and value of your home, the level of coverage you choose, and any additional endorsements or add-ons you select. Other factors, such as your claims history and the security features of your home, may also impact your premium. It’s best to consult with an Assurance representative to get an accurate quote based on your specific circumstances.

How does Assurance handle claims for high-value items like jewelry or fine art?

+Assurance offers specialized coverage for high-value items through endorsements or add-ons to your homeowner’s policy. When filing a claim for such items, Assurance will require detailed documentation, including appraisals, photographs, and receipts, to verify the value and ownership of the item. Their team of experts will work closely with you to ensure a fair and timely settlement for your valuable possessions.

Can I bundle my home and auto insurance policies with Assurance to save money?

+Yes, Assurance encourages policyholders to bundle their home and auto insurance policies to take advantage of multi-policy discounts. By bundling your policies, you can often save a significant amount on your overall insurance premiums. Speak with an Assurance representative to learn more about their bundling options and potential savings.

What steps does Assurance take to prevent and detect insurance fraud?

+Assurance has a dedicated team of fraud investigators who work tirelessly to prevent and detect insurance fraud. They employ advanced analytics and data-driven techniques to identify suspicious claims and patterns. Assurance also collaborates with law enforcement agencies and industry partners to share information and take swift action against fraudulent activities. Their commitment to fraud prevention helps ensure that policyholders receive fair and honest treatment.

How can I contact Assurance Home Owner Insurance for further inquiries or assistance?

+You can reach Assurance Home Owner Insurance through their website, by calling their customer service hotline, or by visiting one of their local branches. Their contact information, including phone numbers and email addresses, can be found on their official website. Assurance’s dedicated team is always ready to assist you with any questions or concerns you may have.