Homeowners Insurance Rankings

Homeowners insurance is an essential financial protection for property owners, providing coverage for a wide range of potential risks and liabilities. With the diverse range of insurance providers and policy options available, choosing the right coverage can be a complex decision. This article aims to demystify the process by offering a comprehensive guide to homeowners insurance rankings, helping you make an informed choice that suits your specific needs.

Understanding Homeowners Insurance: A Comprehensive Overview

Homeowners insurance is a form of property insurance that offers financial protection against damages to an individual’s home and its contents. It covers a variety of risks, including fire, theft, vandalism, and natural disasters. Additionally, it provides liability coverage, protecting homeowners from lawsuits arising from injuries that occur on their property.

The world of homeowners insurance is diverse, with numerous providers offering a wide array of policy options. Understanding the basics is crucial before delving into rankings. This includes grasping the different types of policies, such as HO-1, HO-2, HO-3, and HO-5, each tailored to specific needs and risks. Additionally, knowing the components of a policy, including coverage limits, deductibles, and endorsements, is vital for making an informed choice.

Types of Homeowners Insurance Policies

The most common type of homeowners insurance policy is the HO-3 policy, also known as the Special Form policy. It provides coverage for the structure of the home and its contents, as well as personal liability. However, it’s important to note that HO-3 policies typically exclude certain types of risks, such as flood and earthquake, which require separate coverage.

For those seeking broader coverage, HO-5 policies, or the Comprehensive Form, offer more extensive protection for the dwelling and its contents. HO-5 policies generally cover more perils than HO-3 policies, providing added peace of mind for homeowners.

On the other hand, HO-1 and HO-2 policies, or the Basic Form and Broad Form respectively, offer more limited coverage. HO-1 policies provide the least amount of coverage, typically covering only specific perils listed in the policy, while HO-2 policies offer a slightly broader range of coverage.

| Policy Type | Coverage | Description |

|---|---|---|

| HO-1 | Basic | Covers only named perils |

| HO-2 | Broad Form | Provides broader coverage than HO-1 |

| HO-3 | Special Form | Most common policy, covers structure, contents, and liability |

| HO-5 | Comprehensive Form | Offers the most extensive coverage |

Components of a Homeowners Insurance Policy

A homeowners insurance policy consists of several key components that affect the level of coverage and the cost of the policy. These include:

- Coverage Limits: The maximum amount the insurance company will pay for a covered loss.

- Deductibles: The amount the homeowner must pay out-of-pocket before the insurance coverage kicks in.

- Endorsements: Add-ons to the policy that provide additional coverage for specific risks or valuable items.

- Liability Coverage: Protection against lawsuits arising from injuries on the insured property.

The Top-Ranked Homeowners Insurance Providers

When it comes to homeowners insurance, the market is saturated with numerous providers, each offering unique policy features and pricing structures. Ranking these providers can help homeowners narrow down their choices and select the best fit for their needs.

Criteria for Ranking Homeowners Insurance Providers

Ranking homeowners insurance providers involves a thorough evaluation of several key factors. These include financial stability, customer satisfaction, policy options, coverage limits, deductibles, and the overall cost of the policy.

Financial stability is a crucial factor, as it ensures the insurance company can meet its obligations in the event of a large-scale disaster or a high volume of claims. Customer satisfaction ratings provide insight into the overall experience of policyholders, including claims handling, customer service, and the ease of policy management.

Policy options and coverage limits are also essential considerations. Some providers offer more flexible policies with higher coverage limits, while others may specialize in specific types of coverage. Deductibles and the overall cost of the policy also play a significant role in the ranking process, as homeowners seek affordable coverage that suits their budget.

The Top 5 Homeowners Insurance Providers

Based on the aforementioned criteria, the following are the top-ranked homeowners insurance providers in the market today:

- State Farm: With a strong focus on customer satisfaction and a wide range of policy options, State Farm ranks highly for its comprehensive coverage and competitive pricing.

- Allstate: Allstate offers a suite of innovative tools and resources for policy management, along with a robust selection of policy options and competitive rates.

- USAA: Known for its exceptional customer service and financial strength, USAA provides exclusive coverage for military members and their families.

- Liberty Mutual: Liberty Mutual offers a comprehensive suite of insurance products and services, including homeowners insurance with flexible policy options and competitive rates.

- Farmers Insurance: Farmers Insurance is known for its local agent network, providing personalized service and tailored coverage options for homeowners.

| Provider | Rank | Financial Strength | Customer Satisfaction |

|---|---|---|---|

| State Farm | 1 | A++ (Superior) | 4.5/5 |

| Allstate | 2 | A+ (Superior) | 4.2/5 |

| USAA | 3 | A++ (Superior) | 4.7/5 |

| Liberty Mutual | 4 | A (Excellent) | 4.1/5 |

| Farmers Insurance | 5 | A (Excellent) | 4.0/5 |

Factors to Consider When Choosing Homeowners Insurance

Selecting the right homeowners insurance policy involves a careful evaluation of several factors to ensure you get the coverage you need at a price you can afford. These factors include the type of home you own, the location of your property, and the specific risks and hazards it faces.

Assessing Your Home’s Risks and Hazards

Every home is unique, and understanding the specific risks and hazards it faces is crucial for selecting the right homeowners insurance policy. These risks can include natural disasters like hurricanes, tornadoes, and earthquakes, as well as human-induced risks such as theft, vandalism, and liability claims.

It's important to conduct a thorough risk assessment of your home and its surroundings. Consider the historical weather patterns and natural disaster risks in your area, as well as the potential for human-induced risks based on your home's location and its proximity to potential hazards.

Comparing Coverage Options and Costs

Once you have a clear understanding of the risks your home faces, the next step is to compare coverage options and costs from different insurance providers. This involves evaluating the types of policies offered, the coverage limits, deductibles, and any additional endorsements or riders that may be necessary.

It's crucial to strike a balance between the level of coverage and the cost of the policy. While it's tempting to opt for the most comprehensive coverage, it's important to ensure that the policy is affordable and fits within your budget. Additionally, consider the financial stability and reputation of the insurance provider to ensure they will be able to meet their obligations in the event of a claim.

Understanding Policy Exclusions and Limitations

No homeowners insurance policy provides coverage for every possible risk. It’s essential to carefully review the policy’s exclusions and limitations to understand what is not covered. Common exclusions include flood, earthquake, and water damage from plumbing or appliance failures.

If your home is located in an area prone to specific risks, such as floods or earthquakes, it's crucial to obtain separate coverage for these perils. Additionally, consider any valuable items in your home, such as jewelry, artwork, or electronics, and determine if additional coverage or endorsements are necessary to adequately protect these items.

Tips for Getting the Best Homeowners Insurance Coverage

Securing the best homeowners insurance coverage involves more than just choosing a top-ranked provider. It requires a strategic approach that takes into account your specific needs, the unique characteristics of your home, and your budget.

Shop Around and Compare Quotes

Don’t settle for the first homeowners insurance quote you receive. Take the time to shop around and compare quotes from multiple providers. This will give you a better understanding of the market rates and help you identify the most competitive prices.

Online comparison tools and insurance brokerages can be valuable resources for comparing quotes. These platforms allow you to input your information once and receive multiple quotes from different providers, saving you time and effort.

Bundle Your Policies for Discounts

If you have multiple insurance needs, such as homeowners insurance, auto insurance, and life insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts when you purchase multiple policies from them, potentially saving you a significant amount of money.

Bundling your policies can also streamline your insurance management, as you'll only have one provider to deal with for all your insurance needs. This can simplify billing, policy updates, and claims processes, making your insurance experience more efficient and hassle-free.

Utilize Home Safety Features for Discounts

Many insurance providers offer discounts for homes equipped with safety features such as fire alarms, sprinkler systems, and burglar alarms. These features not only enhance the safety of your home but can also lead to significant savings on your homeowners insurance policy.

When installing safety features, be sure to consult with your insurance provider to understand which features qualify for discounts and how much you can expect to save. Additionally, regularly maintain and update these safety features to ensure they continue to meet the requirements for insurance discounts.

Common Misconceptions About Homeowners Insurance

There are several common misconceptions about homeowners insurance that can lead to confusion and potentially costly mistakes. Understanding these misconceptions is crucial for making informed decisions about your coverage.

Homeowners Insurance Covers All Risks

One of the most prevalent misconceptions is that homeowners insurance covers all risks. In reality, most standard policies have exclusions and limitations, particularly for natural disasters like floods and earthquakes.

To ensure you have adequate coverage for all potential risks, carefully review your policy's exclusions and limitations. If you live in an area prone to specific natural disasters, consider purchasing separate coverage or endorsements to protect your home and its contents.

Homeowners Insurance is Expensive

Another common misconception is that homeowners insurance is prohibitively expensive. While it’s true that the cost of homeowners insurance can vary widely depending on several factors, including the location and value of your home, there are ways to keep costs down.

By shopping around, comparing quotes, and taking advantage of discounts, you can find affordable homeowners insurance that provides the coverage you need. Additionally, maintaining a good credit score and a clean claims history can also lead to lower insurance premiums.

All Homeowners Insurance Policies are the Same

Many homeowners assume that all homeowners insurance policies are essentially the same. However, this is far from the truth. Different providers offer a wide range of policy options with varying coverage limits, deductibles, and endorsements.

When selecting a homeowners insurance policy, carefully evaluate the options offered by different providers. Consider your specific needs and budget, and choose a policy that provides the right balance of coverage and cost. Don't hesitate to ask questions and seek clarification to ensure you fully understand the policy's terms and conditions.

The Future of Homeowners Insurance: Trends and Innovations

The homeowners insurance industry is constantly evolving, driven by technological advancements, changing consumer expectations, and emerging risks. Understanding these trends and innovations can help homeowners stay ahead of the curve and make informed decisions about their coverage.

The Rise of Digital Insurance

The digital transformation of the insurance industry is well underway, with many providers now offering digital platforms for policy management, claims filing, and customer service. These platforms provide greater convenience and efficiency for homeowners, allowing them to manage their policies and file claims from the comfort of their own homes.

Digital insurance also offers enhanced transparency and real-time updates, providing homeowners with immediate access to their policy information and claim status. This shift towards digital insurance is expected to continue, with more providers investing in digital technologies to enhance the customer experience and streamline their operations.

Personalized Insurance Policies

The one-size-fits-all approach to homeowners insurance is becoming less prevalent as providers recognize the need for more personalized coverage. With the advancement of data analytics and risk modeling, insurance providers are now able to offer policies tailored to the specific needs and risks of individual homeowners.

Personalized insurance policies take into account a homeowner's unique circumstances, including the location and value of their home, their personal belongings, and their specific risk profile. This level of customization ensures that homeowners receive the coverage they need without paying for unnecessary add-ons.

Emerging Risks and Coverage

The insurance industry is constantly evolving to address emerging risks, such as cyber threats and climate change-related disasters. As these risks become more prevalent, insurance providers are developing new coverage options to protect homeowners.

For instance, cyber insurance is becoming increasingly popular as homeowners recognize the potential risks associated with digital technology. Similarly, insurance providers are offering new coverage options to address the rising threat of climate change-related disasters, such as severe storms and wildfires.

What is the average cost of homeowners insurance in the United States?

+

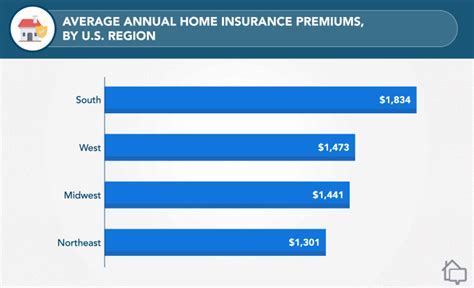

The average cost of homeowners insurance in the U.S. varies widely based on factors such as location, the value of the home, and the level of coverage. On average, homeowners can expect to pay between 1,000 and 2,000 annually for a standard policy.

What are some common discounts available for homeowners insurance policies?

+

Common discounts for homeowners insurance include multi-policy discounts (when you bundle homeowners insurance with other policies like auto insurance), safety feature discounts (for homes equipped with security systems or fire alarms), and loyalty discounts for long-term customers.

How often should I review and update my homeowners insurance policy?

+

It’s recommended to review your homeowners insurance policy annually, especially after significant life changes like marriage, divorce, the birth of a child, or a home renovation. These events can impact your insurance needs, so it’s important to ensure your policy is up-to-date and provides the coverage you require.