State Farm Mutual Automobile Insurance Company

The insurance industry is a vast and complex landscape, with numerous companies offering a wide range of services to protect individuals and businesses. Among the myriad of options, State Farm Mutual Automobile Insurance Company stands out as a prominent player, with a rich history and a comprehensive suite of insurance products. This article aims to delve into the world of State Farm, exploring its origins, key offerings, and the impact it has had on the insurance market.

A Legacy of Trust: The State Farm Story

State Farm’s journey began in 1922, founded by a visionary named George J. Mecherle. Mecherle, a former farmer and insurance agent, recognized a gap in the market for affordable automobile insurance tailored to the needs of individual policyholders. His innovative idea laid the foundation for what would become one of the largest and most trusted insurance providers in the United States.

Headquartered in Bloomington, Illinois, State Farm has grown exponentially over the decades. Today, it boasts a network of nearly 19,000 agents and over 65,000 employees, serving millions of customers across the nation. The company's success can be attributed to its commitment to providing personalized service, competitive pricing, and a comprehensive range of insurance products.

State Farm’s Comprehensive Insurance Portfolio

State Farm’s reputation as a trusted insurer stems from its ability to offer a diverse array of insurance products to meet the diverse needs of its customers. Here’s an overview of some of their key offerings:

Automobile Insurance

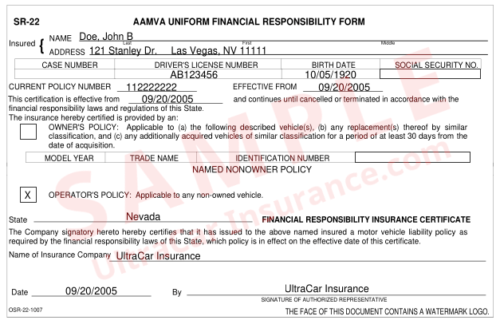

As the company’s flagship product, State Farm’s automobile insurance provides comprehensive coverage for car owners. Their policies include liability protection, collision coverage, comprehensive coverage, and additional benefits such as rental car reimbursement and roadside assistance. State Farm’s extensive agent network allows for personalized service, ensuring customers receive tailored advice and support.

| Policy Type | Coverage Highlights |

|---|---|

| Liability Insurance | Covers bodily injury and property damage claims made against the policyholder. |

| Collision Coverage | Pays for repairs or replacement of the insured vehicle after an accident, regardless of fault. |

| Comprehensive Coverage | Protects against damages caused by non-collision events like theft, vandalism, or natural disasters. |

Homeowners Insurance

State Farm offers a range of homeowners insurance policies, providing protection for dwellings, personal property, and liability. Their coverage options include standard, broad, and special form policies, catering to different levels of protection and risk exposure. Additionally, State Farm provides optional endorsements to customize coverage further, such as water backup coverage or identity restoration services.

Life Insurance

Recognizing the importance of financial security, State Farm offers life insurance products to protect families and individuals. Their life insurance portfolio includes term life, whole life, and universal life insurance policies. Term life insurance provides coverage for a specified period, while whole life and universal life policies offer permanent coverage with cash value accumulation.

Health Insurance

State Farm also plays a significant role in the health insurance market, offering a variety of health plans. Their portfolio includes individual and family plans, as well as Medicare Supplement Insurance and Medicare Advantage plans. State Farm’s health insurance products aim to provide comprehensive medical coverage, prescription drug benefits, and access to a network of healthcare providers.

State Farm’s Digital Innovation and Customer Experience

In an era where digital transformation is reshaping industries, State Farm has embraced technology to enhance its customer experience. The company has invested heavily in developing user-friendly digital platforms and mobile apps, allowing policyholders to manage their insurance needs conveniently. From policy management and claims reporting to payment options, State Farm’s digital offerings provide a seamless and efficient experience.

Additionally, State Farm has implemented innovative tools like the Drive Safe & Save program, which utilizes telematics technology to monitor driving behavior and offer discounts based on safe driving practices. This program not only encourages safer driving habits but also provides customers with personalized rate adjustments.

Community Engagement and Social Responsibility

Beyond its insurance offerings, State Farm has a strong commitment to community engagement and social responsibility. The company actively supports various causes and initiatives, including education, disaster relief, and youth leadership programs. State Farm’s sponsorship of the Good Neighbor Scholarship program, for instance, provides financial assistance to deserving students, empowering them to pursue their educational goals.

Furthermore, State Farm's involvement in community development projects and its support for local businesses demonstrate its dedication to making a positive impact beyond the insurance realm.

Industry Recognition and Awards

State Farm’s exceptional service and commitment to its customers have not gone unnoticed. The company has consistently received high rankings and accolades from industry experts and consumer organizations. J.D. Power, a renowned research and consulting firm, has recognized State Farm for its excellent customer satisfaction in multiple categories, including auto insurance claims and homeowners insurance.

Additionally, State Farm has been honored with awards for its corporate social responsibility initiatives, such as the Community Champion Award and the Corporate Philanthropy Award, showcasing its dedication to making a difference in the communities it serves.

The Future of State Farm: Embracing Change

As the insurance industry continues to evolve, State Farm remains dedicated to adapting and innovating. The company recognizes the importance of staying ahead of emerging trends and technological advancements. State Farm’s focus on digital transformation and its commitment to providing personalized service positions it well for the future.

With a rich history, a comprehensive suite of insurance products, and a strong focus on customer satisfaction, State Farm Mutual Automobile Insurance Company continues to be a leading force in the insurance market. Its ability to embrace change, combined with its unwavering commitment to its customers, ensures that State Farm will remain a trusted partner for individuals and businesses seeking comprehensive insurance solutions.

What sets State Farm apart from other insurance companies?

+State Farm’s unique selling proposition lies in its commitment to personalized service and its extensive network of agents. Their focus on providing tailored advice and support sets them apart, ensuring customers receive the right coverage for their specific needs.

How does State Farm’s digital platform enhance the customer experience?

+State Farm’s digital platform offers a convenient and efficient way for policyholders to manage their insurance needs. From policy management and claims reporting to payment options, the platform provides a seamless experience, allowing customers to access their insurance information anytime, anywhere.

What are some of State Farm’s initiatives for community engagement and social responsibility?

+State Farm actively supports various causes, including education, disaster relief, and youth leadership programs. The company sponsors initiatives like the Good Neighbor Scholarship program, which provides financial assistance to deserving students, and engages in community development projects to make a positive impact.