Dental Insurance Plans For Medicare

Dental insurance is an essential component of comprehensive healthcare, especially for individuals enrolled in Medicare. While Medicare covers a wide range of medical services, it traditionally lacks extensive dental coverage. This has led to the emergence of specialized dental insurance plans tailored to meet the needs of Medicare beneficiaries. In this expert analysis, we delve into the world of dental insurance plans for Medicare, exploring their features, benefits, and implications for senior healthcare.

Understanding Dental Insurance for Medicare

Dental insurance plans designed for Medicare beneficiaries aim to bridge the gap in dental care coverage. These plans offer a range of benefits, including preventive care, restorative procedures, and sometimes even cosmetic dentistry. They provide an opportunity for seniors to maintain optimal oral health, which is crucial for overall well-being.

The Importance of Dental Health in Older Adults

As individuals age, the risk of dental issues such as gum disease, tooth decay, and tooth loss increases. These conditions can not only cause pain and discomfort but also impact an individual’s ability to eat, speak, and maintain a healthy diet. Additionally, poor oral health has been linked to systemic health problems, including cardiovascular disease and diabetes.

By offering dental insurance, Medicare beneficiaries can access the necessary care to prevent and manage these oral health issues, improving their quality of life and overall health outcomes.

Types of Dental Insurance Plans for Medicare

There are several types of dental insurance plans available for Medicare beneficiaries, each with its own set of features and coverage limits. Understanding these options is crucial for seniors to make informed decisions about their oral health.

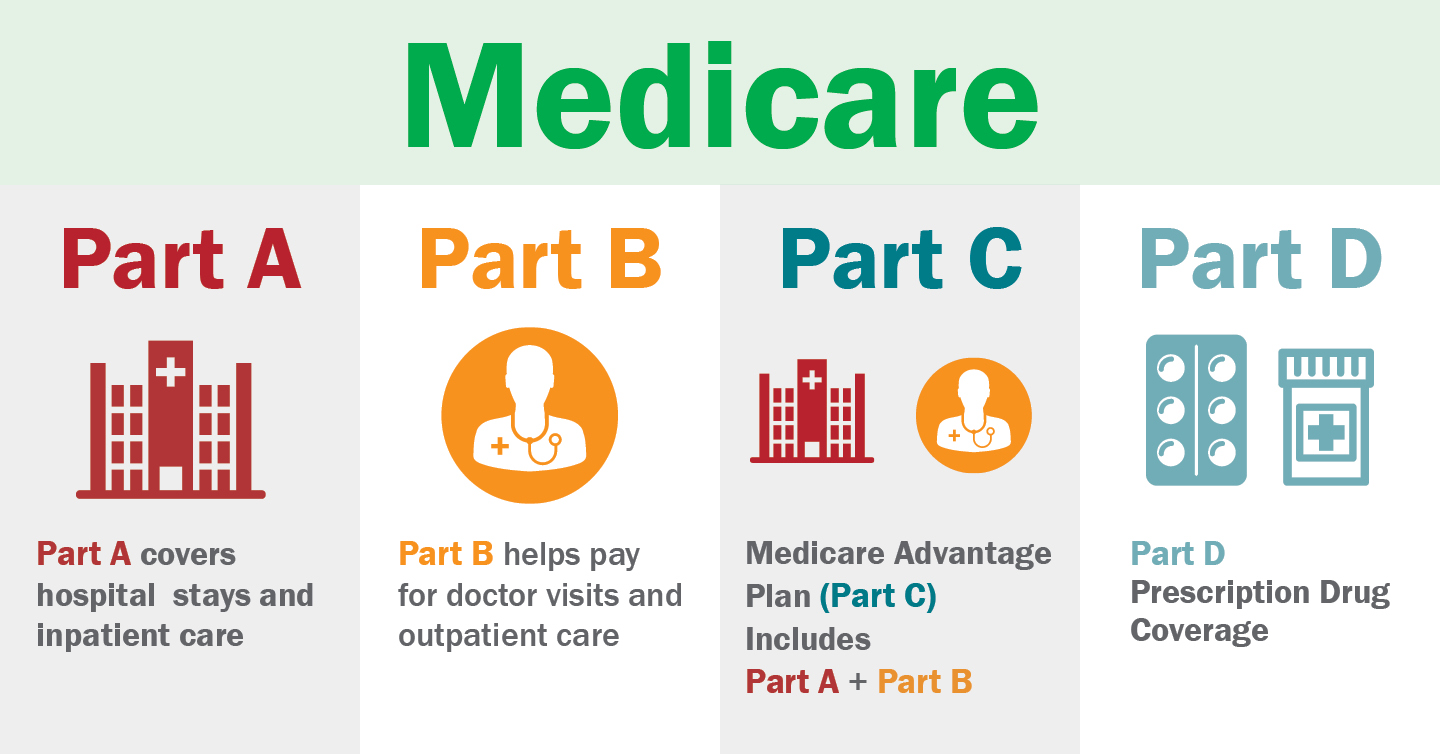

- Medicare Advantage Plans with Dental Coverage: Some Medicare Advantage plans, also known as Part C plans, include dental benefits as part of their comprehensive coverage. These plans often provide a fixed annual allowance for dental services, covering a range of procedures. However, the specific coverage and limits can vary greatly between different plans.

- Standalone Dental Insurance Plans: For individuals who prefer more flexibility, standalone dental insurance plans are an option. These plans are purchased separately from Medicare coverage and offer a variety of options, including preventive care plans, major dental plans, and even plans that cover cosmetic procedures. Standalone plans often provide more extensive coverage but may have higher premiums.

- Discount Dental Plans: These plans are not traditional insurance but rather offer discounted rates on dental services. Members pay an annual fee and receive access to a network of dentists who provide services at reduced rates. While these plans may not cover the full cost of procedures, they can significantly lower out-of-pocket expenses for seniors.

Comparative Analysis of Dental Insurance Plans

When considering dental insurance options for Medicare beneficiaries, it’s essential to compare plans based on various factors, including coverage limits, annual maximums, deductibles, and co-insurance rates. Additionally, the network of participating dentists and the range of covered procedures should be taken into account.

For instance, a Medicare Advantage plan with dental coverage might offer a more straightforward and cost-effective solution for individuals who prioritize convenience and simplicity. On the other hand, standalone dental insurance plans may provide more comprehensive coverage, allowing seniors to choose their preferred dentist and access a wider range of procedures.

Here's a table comparing the key features of different dental insurance plans for Medicare beneficiaries:

| Plan Type | Coverage Limits | Network Flexibility | Premium Costs |

|---|---|---|---|

| Medicare Advantage with Dental | Varies by plan, often includes preventive and basic restorative care | May be limited to in-network providers | Included in the overall Medicare Advantage premium |

| Standalone Dental Insurance | Can offer extensive coverage for various procedures | Often allows choice of dentist | Varies based on plan and provider |

| Discount Dental Plans | Provides discounted rates, not full coverage | Members can choose from a network of dentists | Lower annual fees compared to traditional insurance |

Performance Analysis and Real-World Examples

Let’s explore some real-world scenarios to understand the impact of dental insurance plans on Medicare beneficiaries’ oral health and financial well-being.

Case Study: Ms. Johnson’s Experience

Ms. Johnson, a 68-year-old retiree, had been struggling with tooth pain and sensitivity for several months. Without dental insurance, she was hesitant to seek treatment due to the potential costs. However, after enrolling in a Medicare Advantage plan with dental coverage, she was able to visit a dentist and receive the necessary treatment, including a root canal and crown placement.

The dental insurance plan covered a significant portion of the procedure, reducing Ms. Johnson’s out-of-pocket expenses. This experience not only relieved her pain but also highlighted the importance of dental insurance in maintaining oral health and overall well-being.

Impact on Overall Healthcare Costs

Dental insurance plans for Medicare beneficiaries can play a crucial role in reducing overall healthcare costs. By providing coverage for preventive care and early intervention, these plans help prevent more costly and complex dental issues from developing. Regular dental check-ups and cleanings, for instance, can catch potential problems early on, leading to simpler and more affordable treatments.

Additionally, dental health is closely linked to systemic health. By addressing dental issues promptly, Medicare beneficiaries can reduce the risk of developing related health conditions, such as gum disease-associated cardiovascular problems. This holistic approach to healthcare can lead to improved health outcomes and potentially lower long-term medical expenses.

Future Implications and Industry Insights

The demand for dental insurance plans among Medicare beneficiaries is expected to grow in the coming years. As the population ages, the need for comprehensive oral healthcare becomes increasingly important. This trend has already prompted some insurance providers to expand their offerings, introducing more specialized dental plans tailored to the unique needs of seniors.

Furthermore, advancements in dental technology and procedures are making dental care more accessible and efficient. From digital dentistry to laser treatments, these innovations are not only improving patient experiences but also reducing treatment times and costs. As these technologies become more widespread, dental insurance plans may evolve to incorporate coverage for these advanced procedures, further enhancing the benefits for Medicare beneficiaries.

Industry Collaboration and Initiatives

To address the growing demand for dental care among seniors, industry collaborations and initiatives are taking shape. For instance, some dental insurance providers are partnering with dental schools and community clinics to offer reduced-cost or pro bono services to Medicare beneficiaries. These partnerships aim to improve access to dental care for seniors, especially those with limited financial means.

Additionally, advocacy groups and senior organizations are actively promoting the importance of dental health and pushing for expanded dental coverage under Medicare. These efforts are instrumental in raising awareness and potentially influencing policy changes to better support the oral health needs of the aging population.

Conclusion: The Importance of Dental Insurance for Medicare

Dental insurance plans for Medicare beneficiaries play a vital role in ensuring access to essential oral healthcare. By providing coverage for preventive care, restorative procedures, and sometimes even cosmetic dentistry, these plans contribute to improved oral health and overall well-being among seniors.

As the industry continues to evolve, dental insurance options for Medicare beneficiaries are likely to expand, offering more comprehensive and innovative solutions. This trend, coupled with industry collaborations and initiatives, promises a brighter future for senior oral healthcare. Ultimately, the availability of dental insurance plans for Medicare beneficiaries empowers seniors to take control of their oral health and maintain a high quality of life as they age.

Can I enroll in a dental insurance plan at any time, or are there specific enrollment periods for Medicare beneficiaries?

+Enrollment periods for dental insurance plans can vary. Some plans may offer open enrollment periods throughout the year, while others may align with the annual Medicare Open Enrollment period, typically from October 15 to December 7. It’s important to check with the specific plan or insurance provider to understand the enrollment timelines and any potential restrictions.

What happens if I need a procedure that’s not covered by my dental insurance plan?

+If a procedure is not covered by your dental insurance plan, you will likely be responsible for paying for it out of pocket. It’s important to carefully review the plan’s coverage limits and exclusions before choosing a plan. Some plans may offer the option to purchase additional coverage for specific procedures, so it’s worth exploring these possibilities during the enrollment process.

Are there any income-based assistance programs for dental insurance for Medicare beneficiaries?

+Yes, there are income-based assistance programs available to help Medicare beneficiaries with their dental insurance costs. The Low-Income Subsidy (LIS) program, for example, provides financial assistance to eligible individuals for their Medicare Part D prescription drug coverage. While this program primarily focuses on prescription drugs, some states may offer additional subsidies or programs to assist with dental insurance costs. It’s advisable to research and inquire about these programs in your specific state or region.