What Is Coinsurance In Health Insurance

Coinsurance is a fundamental concept in health insurance that directly impacts the financial responsibilities of policyholders when they access healthcare services. It plays a crucial role in determining the cost-sharing arrangement between the insured individuals and their insurance providers. Understanding coinsurance is essential for individuals to effectively manage their healthcare expenses and make informed decisions about their insurance coverage.

Understanding Coinsurance in Health Insurance

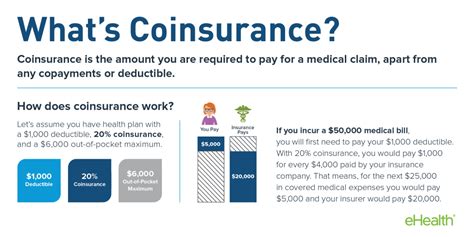

Coinsurance represents the percentage of healthcare costs that an insured individual is responsible for paying after their deductible has been met. This cost-sharing mechanism ensures that policyholders have a financial stake in their healthcare decisions, encouraging them to be mindful of unnecessary expenses while still having access to necessary medical treatments.

For instance, if an individual has a health insurance policy with a 20% coinsurance rate, they will be required to pay 20% of the approved cost for covered healthcare services once their deductible has been satisfied. The insurance company, in this case, will cover the remaining 80% of the approved cost.

How Coinsurance Works

Coinsurance is typically applied after the deductible has been met, which is the amount an individual must pay out of pocket before their insurance coverage kicks in. Once the deductible is satisfied, the coinsurance rate comes into play for each covered service. It’s important to note that coinsurance does not apply to the entire healthcare bill but rather to the approved amount by the insurance company.

Let's consider an example. Suppose an individual has a $1,500 deductible and a 20% coinsurance rate. If they receive a medical service with an approved cost of $2,000, they will first pay the $1,500 deductible. After that, they will be responsible for 20% of the remaining $500, which is $100. The insurance company will cover the remaining $400.

Variations in Coinsurance Rates

Coinsurance rates can vary significantly depending on the health insurance plan and the type of healthcare service. Some plans may have different coinsurance rates for inpatient and outpatient services, while others may have separate rates for different specialties, such as radiology or laboratory tests.

| Service Type | Coinsurance Rate |

|---|---|

| Inpatient Hospitalization | 20% |

| Outpatient Surgery | 30% |

| Specialist Consultation | 25% |

In the above table, we can see that the coinsurance rates differ for various service types, reflecting the complexity and cost of each procedure.

Benefits and Considerations

Coinsurance offers several advantages. It encourages individuals to be more involved in their healthcare decisions, potentially leading to more cost-effective choices. Additionally, it can provide a financial buffer for insurance companies, helping to manage their overall expenses and keep premiums more stable for policyholders.

However, it's essential for individuals to carefully consider their coinsurance rates when choosing a health insurance plan. Higher coinsurance rates can result in substantial out-of-pocket expenses, especially for individuals who require frequent or extensive medical care. On the other hand, lower coinsurance rates may come with higher premiums, which can also impact overall affordability.

Real-World Examples of Coinsurance

To illustrate the impact of coinsurance, let’s look at a few practical scenarios.

Example 1: Routine Check-up

An individual with a health insurance plan has a 1,000 deductible and a 20% coinsurance rate. They go for a routine check-up, which costs 500 and is fully covered by their insurance. However, since they haven’t met their deductible yet, they will pay the full $500 out of pocket.

Example 2: Emergency Surgery

In a different scenario, the same individual is involved in an accident and requires emergency surgery, with an approved cost of 25,000. They have already met their 1,000 deductible for the year. With a 20% coinsurance rate, they will be responsible for 20% of the remaining 24,000, which is 4,800. The insurance company will cover the rest.

Example 3: Chronic Condition Management

Consider an individual with a chronic condition who requires regular specialist visits and medications. Their insurance plan has a 2,000 deductible and a 30% coinsurance rate for specialist services. Throughout the year, they incur 8,000 in specialist costs. After meeting their deductible, they will pay 30% of the remaining 6,000, which is 1,800. The insurance company will cover the remaining $4,200.

Coinsurance and Out-of-Pocket Maximums

To provide a safety net for policyholders, many health insurance plans include an out-of-pocket maximum. This is the maximum amount an individual is expected to pay in a year for covered services, including deductibles, coinsurance, and copayments. Once an individual reaches their out-of-pocket maximum, the insurance company covers 100% of the approved costs for the rest of the year.

Out-of-Pocket Maximum Example

Imagine an individual has a health insurance plan with a 6,000 out-of-pocket maximum. During the year, they meet their 2,000 deductible and incur various medical expenses, including specialist visits and prescription medications. Their total out-of-pocket expenses, including deductibles and coinsurance, amount to $5,500. At this point, they have reached their out-of-pocket maximum, and the insurance company will cover any additional approved costs for the remainder of the year.

Coinsurance vs. Copayments

Coinsurance is often compared to copayments, another cost-sharing mechanism in health insurance. Copayments are flat fees that individuals pay for covered services, typically at the time of service. For example, an individual may have a $20 copay for a doctor’s office visit.

Coinsurance, on the other hand, is a percentage-based cost-sharing method that applies after the deductible is met. It is more flexible than copayments, as it adjusts based on the cost of the service. However, it can also result in higher out-of-pocket expenses for more costly procedures.

Future Trends and Considerations

As healthcare costs continue to rise, coinsurance rates and deductibles are likely to play an increasingly significant role in health insurance plans. Policyholders will need to be more vigilant about understanding their insurance coverage and the potential financial implications of their healthcare decisions.

Furthermore, the trend towards high-deductible health plans (HDHPs) is expected to continue, as these plans often offer lower premiums. While HDHPs can be advantageous for individuals who rarely need medical care, they can result in substantial out-of-pocket expenses for those with more frequent healthcare needs.

It is essential for individuals to carefully review their insurance policies, understand their coinsurance rates and deductibles, and make informed choices about their healthcare to ensure they are adequately protected financially.

What is the difference between coinsurance and copayments in health insurance?

+Coinsurance is a percentage-based cost-sharing mechanism that applies after the deductible is met. It varies based on the cost of the service. Copayments, on the other hand, are flat fees that individuals pay for covered services, typically at the time of service. Copayments are more predictable but may not cover the full cost of expensive procedures.

How can I minimize my out-of-pocket expenses under coinsurance?

+To minimize out-of-pocket expenses, it’s essential to understand your insurance plan’s details, including deductibles, coinsurance rates, and out-of-pocket maximums. Choose in-network providers to ensure cost-effectiveness, and consider preventive care and wellness programs, which are often fully covered.

Are there any situations where coinsurance doesn’t apply?

+Yes, some health insurance plans offer certain services or benefits with no coinsurance. These can include preventive care services, such as annual check-ups, certain screenings, and immunizations. Additionally, some plans may waive coinsurance for specific procedures or services, so it’s important to review your policy carefully.