Cheap Local Car Insurance

When it comes to finding affordable car insurance, many drivers seek out local options that offer competitive rates without compromising on coverage. In today's market, there are numerous insurance providers that cater specifically to local communities, providing tailored policies and excellent customer service. This comprehensive guide will explore the world of cheap local car insurance, shedding light on the factors that influence rates, the benefits of choosing a local provider, and strategies to secure the best coverage at an affordable price.

Understanding the Local Car Insurance Landscape

Local car insurance providers are often small-scale or regional companies that have a deep understanding of the specific needs and risks associated with their local communities. They offer a more personalized approach to insurance, taking into account local factors such as traffic patterns, crime rates, and even weather conditions that can influence insurance rates.

One of the key advantages of choosing a local car insurance provider is the ability to establish a direct relationship with your insurer. Unlike national or multinational insurance companies, local providers often have a physical office in the community they serve, making it easier for policyholders to connect with representatives face-to-face. This level of accessibility can be invaluable when it comes to resolving claims, addressing concerns, or simply seeking advice on the best coverage options.

Furthermore, local insurance providers often have a vested interest in the community's well-being. They may offer community-focused initiatives, discounts for local organizations or charities, and even provide educational resources to help drivers understand their coverage and rights. This sense of community involvement can foster a stronger relationship between the insurer and the policyholder, leading to better overall satisfaction.

Factors Influencing Local Car Insurance Rates

The cost of local car insurance can vary significantly based on a multitude of factors. Here are some of the key elements that play a role in determining insurance rates:

- Driving History: Your driving record is a critical factor in determining insurance rates. Local providers will assess your history of accidents, traffic violations, and claims to gauge the level of risk they associate with insuring you.

- Vehicle Type: The make, model, and year of your vehicle can impact insurance costs. Certain vehicles may be more expensive to repair or are statistically involved in more accidents, leading to higher insurance premiums.

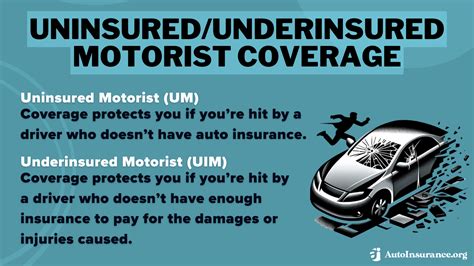

- Coverage Type and Limits: The type of coverage you choose and the limits you set for each coverage type will directly affect your insurance premium. Comprehensive coverage and higher liability limits typically result in higher premiums.

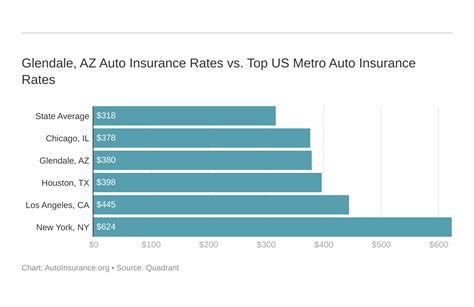

- Location: Your physical address plays a significant role in determining insurance rates. Local providers may consider factors like the crime rate, traffic congestion, and accident statistics in your neighborhood when setting premiums.

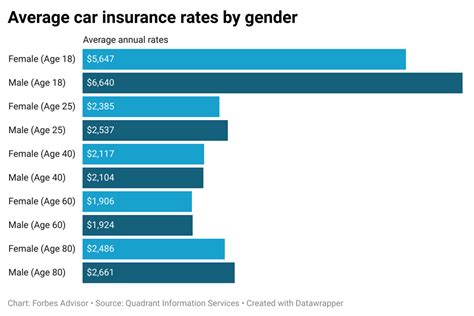

- Age and Gender: In many cases, insurance rates can be influenced by age and gender. Younger drivers and male drivers are often considered higher risk and may face higher premiums.

- Claims History: A history of frequent claims can lead to higher insurance rates. Local providers may view a high number of claims as an indication of increased risk.

It's important to note that while these factors are common considerations, local insurance providers may have their own unique rating systems and criteria. This means that two drivers with similar profiles may receive different insurance quotes from different local providers.

Benefits of Choosing a Local Car Insurance Provider

Selecting a local car insurance provider can offer a range of benefits that go beyond just affordable rates. Here are some key advantages to consider:

Personalized Service

Local insurance providers often pride themselves on offering a high level of personalized service. They understand that every driver and every situation is unique, and they tailor their policies and coverage recommendations accordingly. This level of customization can result in more comprehensive and cost-effective insurance plans.

Community Engagement

As previously mentioned, local insurance providers often have a strong sense of community involvement. They may partner with local businesses, sponsor community events, or offer discounts to members of local organizations. This community focus can foster a sense of trust and loyalty between the insurer and policyholders.

Accessibility and Response Time

Having a local insurance provider means you can easily access their services and support. Whether it’s visiting their physical office, calling their local phone number, or even stopping by their booth at a community event, local providers make it convenient for policyholders to connect. This accessibility can be especially valuable in emergency situations or when resolving complex claims.

Understanding Local Risks

Local insurance providers have an in-depth understanding of the specific risks and challenges faced by drivers in their community. They can offer tailored advice and coverage options to address these risks, ensuring policyholders are adequately protected. For example, if your area is prone to natural disasters like hurricanes or floods, a local provider can help you navigate the best coverage options to mitigate potential losses.

Strategies for Securing Cheap Local Car Insurance

Finding cheap local car insurance requires a strategic approach. Here are some effective strategies to consider when shopping for affordable coverage:

Compare Multiple Quotes

Don’t settle for the first insurance quote you receive. Take the time to request quotes from multiple local providers. This allows you to compare coverage options, premiums, and the overall value each provider offers. Online quote comparison tools can be a convenient way to gather multiple quotes quickly and easily.

Bundle Your Policies

Many local insurance providers offer discounts when you bundle multiple policies together. For example, you may be able to save money by combining your car insurance with homeowners or renters insurance. Bundling can lead to significant savings and streamline your insurance management process.

Review Your Coverage Annually

Insurance needs can change over time, so it’s important to review your coverage annually. This allows you to assess whether your current policy still meets your needs and whether you’re getting the best value. Regular reviews can also help you identify opportunities to adjust your coverage or switch providers to save money.

Take Advantage of Discounts

Local insurance providers often offer a variety of discounts to policyholders. These can include safe driver discounts, loyalty discounts, good student discounts, and more. Make sure to inquire about all available discounts and see if you qualify for any that can reduce your insurance premiums.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is a unique approach that calculates your insurance premium based on your actual driving behavior. Local providers may offer this option, which can be beneficial for drivers who don’t use their vehicles frequently or for long distances. By installing a tracking device or using a smartphone app, the insurer can monitor your driving habits and offer personalized rates based on your usage.

| Discount Type | Description |

|---|---|

| Safe Driver Discount | Reward for maintaining a clean driving record. |

| Loyalty Discount | Offered to long-term policyholders. |

| Good Student Discount | Discount for students with good academic standing. |

| Multi-Policy Discount | Saving when you bundle multiple policies. |

The Future of Local Car Insurance

The car insurance industry is evolving, and local providers are adapting to stay competitive. Here are some trends and developments to watch for in the future of local car insurance:

Digital Transformation

Many local insurance providers are embracing digital technologies to enhance their services. This includes online quote tools, mobile apps for policy management, and even digital claims processing. These digital innovations can make it easier and more convenient for policyholders to access their insurance information and file claims.

Telematics and Data Analytics

Usage-based insurance and telematics are expected to play a larger role in the future of local car insurance. With advancements in technology, insurers will have more accurate data on driving behavior, which can lead to more personalized and fair insurance rates. This data-driven approach can benefit safe drivers and encourage safer driving practices overall.

Community-Focused Initiatives

Local insurance providers are likely to continue their focus on community engagement. This may involve sponsoring local events, partnering with community organizations, and offering educational resources to help drivers better understand their insurance options. By fostering stronger community ties, local providers can build trust and loyalty among policyholders.

Innovative Coverage Options

As the automotive industry evolves, so too will the coverage options offered by local insurance providers. This may include coverage for electric and hybrid vehicles, ride-sharing services, and autonomous vehicles. Local providers will need to stay abreast of these changes to ensure they can offer comprehensive coverage for the vehicles of the future.

Conclusion

Cheap local car insurance is within reach for many drivers, and understanding the factors that influence rates, the benefits of choosing a local provider, and effective strategies for securing affordable coverage can make the process smoother and more rewarding. By taking a proactive approach to insurance shopping and staying informed about the latest trends, drivers can find the right balance between cost and coverage.

Frequently Asked Questions

What are the average rates for local car insurance?

+Average rates for local car insurance can vary significantly depending on the provider, location, and coverage type. It’s best to request quotes from multiple providers to get an accurate idea of the rates in your area.

How can I improve my chances of getting cheap local car insurance?

+To improve your chances of getting cheap local car insurance, focus on maintaining a clean driving record, shopping around for multiple quotes, and taking advantage of available discounts. Additionally, consider bundling your policies and regularly reviewing your coverage to ensure you’re getting the best value.

Are local insurance providers more expensive than national providers?

+Local insurance providers may have different pricing structures compared to national providers. While some local providers may offer competitive rates, it’s essential to compare quotes from both local and national insurers to find the best value for your needs.

What is usage-based insurance, and is it a good option for me?

+Usage-based insurance, or pay-as-you-drive insurance, calculates your premium based on your actual driving behavior. It can be a good option if you drive infrequently or for short distances. However, it may not be suitable for those who drive regularly or for long distances.

How can I find reputable local car insurance providers in my area?

+To find reputable local car insurance providers, start by asking for recommendations from friends, family, or local business owners. You can also check online review platforms and compare quotes from multiple providers to assess their reputation and customer satisfaction.