Minimum Vehicle Insurance

Understanding the concept of minimum vehicle insurance is crucial for every vehicle owner, as it ensures compliance with legal requirements and provides a basic level of financial protection in the event of accidents. This article aims to delve into the specifics of minimum vehicle insurance, offering a comprehensive guide to help drivers navigate this essential aspect of vehicle ownership.

What is Minimum Vehicle Insurance and Why is it Important?

Minimum vehicle insurance, also known as compulsory or mandatory insurance, is the legal minimum coverage that drivers are required to carry to operate a vehicle on public roads. It serves as a fundamental safeguard, protecting drivers and passengers from financial ruin in the event of an accident. While it provides a basic level of coverage, it is essential to understand the limits and scope of this insurance to ensure adequate protection.

In many regions, minimum vehicle insurance is a legal requirement, and driving without it can result in severe penalties, including fines, license suspension, or even vehicle impoundment. Moreover, it is a vital component of road safety, as it ensures that drivers can cover the costs of repairs, medical expenses, and legal liabilities in the event of an accident. This not only protects the insured driver but also provides a safety net for other road users, pedestrians, and property owners.

State-by-State Minimum Insurance Requirements

The minimum insurance requirements for vehicles can vary significantly depending on the state or region. These variations are often influenced by local laws, traffic conditions, and the overall cost of living. It is crucial for drivers to be aware of the specific requirements in their area to ensure compliance and avoid legal consequences.

Liability Insurance

Liability insurance is a fundamental component of minimum vehicle insurance. It covers the costs of damages and injuries caused to other parties in an accident for which the insured driver is deemed at fault. The liability coverage typically includes two main components:

- Bodily Injury Liability: This coverage pays for the medical expenses and rehabilitation costs of individuals injured in an accident caused by the insured driver. It also covers lost wages and pain and suffering damages.

- Property Damage Liability: This aspect of liability insurance covers the cost of repairing or replacing property damaged in an accident, including other vehicles, fences, buildings, and personal property.

The minimum liability limits required by law vary from state to state. For instance, in California, the minimum liability limits are set at $15,000 for bodily injury per person, $30,000 for bodily injury per accident, and $5,000 for property damage. However, in New York, the limits are higher, with a minimum of $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $10,000 for property damage.

| State | Bodily Injury Liability (per person) | Bodily Injury Liability (per accident) | Property Damage Liability |

|---|---|---|---|

| California | $15,000 | $30,000 | $5,000 |

| New York | $25,000 | $50,000 | $10,000 |

| Texas | $30,000 | $60,000 | $25,000 |

| Florida | $10,000 | $20,000 | $10,000 |

| Illinois | $25,000 | $50,000 | $20,000 |

Additional Coverages

While liability insurance is the primary component of minimum vehicle insurance, some states also require additional coverages to be included in the policy. These may include:

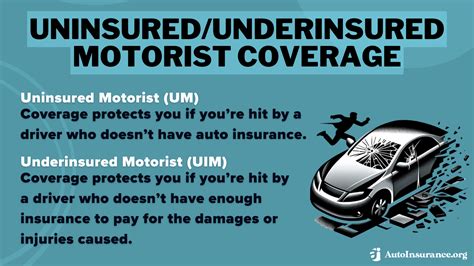

- Uninsured/Underinsured Motorist Coverage: This coverage protects the insured driver if they are involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

- Personal Injury Protection (PIP): PIP coverage, also known as no-fault insurance, covers medical expenses, lost wages, and other related costs for the insured driver and their passengers, regardless of who is at fault in the accident.

- Medical Payments Coverage: This coverage provides additional medical expense coverage for the insured driver and their passengers, often with higher limits than PIP.

The inclusion of these additional coverages in the minimum insurance requirements varies by state. For example, while New York requires both PIP and uninsured motorist coverage, California only mandates uninsured motorist coverage as part of its minimum insurance package.

Understanding the Limitations of Minimum Insurance

While minimum vehicle insurance is a legal requirement and provides a basic level of protection, it is essential to understand its limitations. The coverage limits specified in the policy may not be sufficient to cover the costs of a severe accident, especially if there are multiple injured parties or extensive property damage.

Additionally, minimum insurance policies often have restrictions and exclusions that can impact the level of protection provided. For instance, some policies may exclude coverage for certain types of vehicles, such as rental cars or vehicles used for commercial purposes. There may also be limitations on coverage for certain types of damages, such as emotional distress or punitive damages.

Choosing the Right Insurance Coverage

To ensure adequate protection, drivers should carefully review their insurance options and consider their specific needs. While minimum insurance is a legal requirement, it may not provide sufficient coverage for all situations. Drivers should assess their risk tolerance, the value of their vehicle, and their financial situation to determine the appropriate level of coverage.

Some factors to consider when choosing insurance coverage include:

- Vehicle Value: The value of the vehicle can influence the level of coverage needed. Higher-value vehicles may require more comprehensive coverage to protect against total loss or significant damage.

- Financial Responsibility: Drivers should consider their ability to financially recover from an accident. Higher liability limits can provide greater peace of mind and protection against potential lawsuits.

- Personal Circumstances: Individual circumstances, such as driving record, age, and marital status, can impact insurance rates and coverage needs. For instance, young drivers or those with a history of accidents may benefit from additional coverage to mitigate potential risks.

The Future of Minimum Vehicle Insurance

As the automotive industry evolves, so too does the concept of minimum vehicle insurance. With the rise of autonomous vehicles and ride-sharing services, traditional insurance models may need to adapt to accommodate these new forms of transportation. Additionally, advancements in technology, such as telematics and usage-based insurance, may play a significant role in shaping the future of minimum insurance requirements.

Telematics devices, which track driving behavior and transmit data to insurance companies, can provide a more accurate assessment of an individual's risk profile. This technology has the potential to revolutionize insurance pricing, offering discounts to safe drivers and incentivizing responsible driving behaviors. Usage-based insurance, which tailors premiums based on actual miles driven, may also become more prevalent, offering a more personalized and cost-effective insurance option.

Furthermore, the increasing popularity of electric vehicles and the shift towards sustainable transportation may influence insurance policies. As electric vehicles become more common, insurance providers may need to adjust their policies to account for the unique characteristics and potential risks associated with these vehicles.

Conclusion

Understanding the nuances of minimum vehicle insurance is essential for responsible vehicle ownership. By familiarizing themselves with the specific requirements in their state and assessing their individual needs, drivers can make informed decisions about their insurance coverage. While minimum insurance provides a legal safeguard, it is important to consider the limitations and tailor coverage to ensure adequate protection.

As the automotive landscape continues to evolve, so too will the concept of minimum insurance. With advancements in technology and changes in transportation trends, the future of vehicle insurance is likely to bring new opportunities and challenges. Stay informed, compare insurance options, and make sure you have the coverage you need to stay safe and compliant on the road.

What happens if I drive without minimum insurance coverage?

+Driving without minimum insurance coverage is illegal and can result in severe penalties. These may include fines, license suspension, vehicle impoundment, and even criminal charges. It is crucial to maintain the required insurance coverage to avoid these consequences and ensure compliance with the law.

Can I customize my insurance policy beyond the minimum requirements?

+Absolutely! While minimum insurance is a legal requirement, drivers have the option to customize their policies to meet their specific needs. This can include increasing liability limits, adding optional coverages, or selecting additional perks such as rental car reimbursement or roadside assistance.

Are there any discounts available for minimum insurance policies?

+Yes, many insurance providers offer discounts on minimum insurance policies. These discounts can be based on various factors, such as good driving records, vehicle safety features, multi-policy discounts (bundling auto insurance with other policies), or loyalty discounts for long-term customers.