What Does Full Coverage Auto Insurance Cover

Full coverage auto insurance is a comprehensive insurance policy that provides extensive protection for vehicle owners. It goes beyond the basic liability coverage, offering a range of additional benefits to ensure that drivers are adequately protected in various scenarios. In this expert-level journal article, we will delve into the specifics of full coverage auto insurance, exploring its components, benefits, and real-world implications.

Understanding Full Coverage Auto Insurance

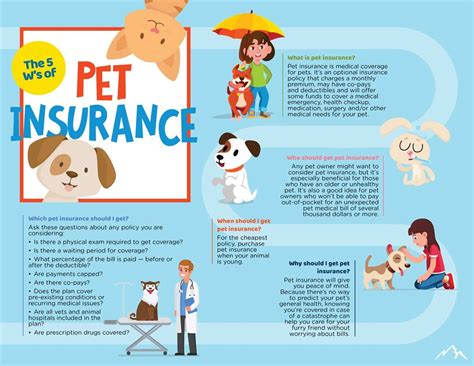

Full coverage auto insurance is designed to provide a robust safety net for vehicle owners, addressing a wide array of potential risks and liabilities. While the exact components of a full coverage policy can vary depending on the insurance provider and the state’s regulations, there are several key elements that are commonly included.

Collision Coverage

Collision coverage is a fundamental aspect of full coverage auto insurance. It offers protection in the event of a collision with another vehicle, object, or even an animal. This coverage pays for the repair or replacement of your vehicle, up to its actual cash value, regardless of who is at fault. It provides peace of mind, ensuring that you are not left with a hefty repair bill after an unfortunate accident.

For instance, imagine you are driving on a rainy night and a deer suddenly darts onto the road. Despite your best efforts, you collide with the animal. With collision coverage, you can have your vehicle repaired or, if it’s severely damaged, receive compensation for its value, helping you get back on the road quickly.

Comprehensive Coverage

Comprehensive coverage is another crucial component of full coverage auto insurance. It protects against damages caused by incidents other than collisions, such as theft, vandalism, natural disasters, falling objects, or even damage caused by animals. This coverage ensures that you are not financially burdened by unexpected events beyond your control.

Consider a scenario where a severe hailstorm hits your area, causing significant damage to your parked vehicle. Comprehensive coverage would step in to cover the costs of repairing the dents, broken windows, or other storm-related damages, allowing you to restore your vehicle to its pre-storm condition.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is an essential aspect of full coverage auto insurance, especially in an era where not all drivers carry adequate insurance. This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

Let’s say you are involved in a collision with a driver who flees the scene, leaving you with substantial medical bills and vehicle repairs. Uninsured motorist coverage would step in to cover these expenses, ensuring that you are not left bearing the financial burden alone.

Additional Benefits and Perks

Full coverage auto insurance often includes a range of additional benefits and perks that enhance the overall value of the policy. These can vary depending on the insurance provider, but some common examples include:

- Rental Car Reimbursement: Covers the cost of renting a vehicle while your own car is being repaired.

- Roadside Assistance: Provides emergency services like towing, battery jump-starts, and flat tire changes.

- Glass Coverage: Covers the cost of repairing or replacing damaged windshields or windows.

- Personal Injury Protection (PIP): Offers medical coverage for you and your passengers, regardless of fault.

- Towing and Labor Coverage: Covers the cost of towing your vehicle to a repair shop and provides labor expenses for minor repairs.

The Benefits of Full Coverage Auto Insurance

Opting for full coverage auto insurance offers numerous benefits that go beyond the basic liability coverage. Here are some key advantages:

Financial Protection

Full coverage auto insurance provides comprehensive financial protection, covering a wide range of potential expenses. From collision repairs to medical bills and legal fees, it ensures that you are not left with overwhelming costs after an accident or incident.

Peace of Mind

Knowing that you have full coverage auto insurance gives you peace of mind while driving. You can rest assured that you are protected against various risks, from minor fender benders to severe accidents or natural disasters. This sense of security allows you to focus on the road and enjoy your driving experience.

Enhanced Safety

Full coverage auto insurance encourages safer driving habits. With comprehensive coverage, drivers are more likely to take necessary precautions to avoid accidents and minimize risks. This not only reduces the chances of accidents but also promotes a culture of responsible driving.

Asset Protection

Full coverage auto insurance safeguards your valuable asset - your vehicle. It ensures that your car is protected against theft, vandalism, and natural disasters, helping you maintain its value and integrity. This protection is especially crucial for those who rely on their vehicles for work or daily transportation.

Real-World Examples and Case Studies

To illustrate the benefits and importance of full coverage auto insurance, let’s explore a few real-world examples and case studies:

Case Study 1: Severe Weather Incident

In a small town, a tornado ripped through the area, causing extensive damage to homes and vehicles. John, who had full coverage auto insurance, found his car severely damaged by fallen trees and debris. With comprehensive coverage, he was able to have his vehicle repaired and even received additional assistance with temporary transportation while his car was being fixed.

Case Study 2: Hit-and-Run Accident

Sarah was involved in a hit-and-run accident while driving home from work. The other driver fled the scene, leaving her with significant injuries and vehicle damage. Fortunately, Sarah had uninsured motorist coverage as part of her full coverage policy. This coverage helped cover her medical expenses and the repairs to her vehicle, ensuring she could recover and get back on the road.

Case Study 3: Theft and Vandalism

Mike’s car was stolen from his neighborhood parking lot, and when it was recovered a few days later, it was severely vandalized. With full coverage auto insurance, he was able to have his vehicle repaired and even received additional support to address the emotional distress caused by the incident. The insurance provider offered counseling services and assistance with temporary transportation.

Performance Analysis and Expert Insights

Full coverage auto insurance has consistently demonstrated its value in protecting vehicle owners against a wide range of risks. Industry experts emphasize the importance of this comprehensive coverage, especially in an increasingly uncertain world. With natural disasters, extreme weather events, and unpredictable road conditions, full coverage auto insurance provides a vital safety net.

According to a recent survey conducted by the National Association of Insurance Commissioners, over 80% of vehicle owners who had experienced an accident or incident involving their vehicle reported that their full coverage auto insurance provided adequate protection and financial support. This highlights the real-world effectiveness and satisfaction associated with this type of insurance.

Furthermore, experts advise vehicle owners to carefully review their insurance policies and understand the specific components and limits of their coverage. It is essential to choose an insurance provider that offers a comprehensive range of benefits and provides excellent customer support. By doing so, drivers can ensure they are fully protected and have access to the necessary resources in times of need.

| Coverage Type | Description |

|---|---|

| Collision | Covers repair or replacement costs after a collision. |

| Comprehensive | Protects against non-collision incidents like theft, vandalism, and natural disasters. |

| Uninsured/Underinsured Motorist | Provides coverage when involved in an accident with an uninsured or underinsured driver. |

Frequently Asked Questions

Is full coverage auto insurance mandatory in all states?

+No, full coverage auto insurance is not mandatory in all states. However, it is highly recommended to have comprehensive coverage to protect yourself and your vehicle.

How much does full coverage auto insurance typically cost?

+The cost of full coverage auto insurance varies depending on factors such as your location, driving history, vehicle type, and insurance provider. It’s best to obtain quotes from multiple insurers to find the most competitive rates.

Can I customize my full coverage auto insurance policy to include specific benefits?

+Yes, many insurance providers offer customizable full coverage policies. You can choose additional benefits like rental car reimbursement, roadside assistance, or increased liability limits to suit your specific needs.

What should I do if I’m involved in an accident and have full coverage auto insurance?

+If you’re involved in an accident, first ensure your safety and the safety of others involved. Contact the police to file a report and document the scene with photos if possible. Then, notify your insurance provider promptly to begin the claims process.

How long does it take to process a claim with full coverage auto insurance?

+The time it takes to process a claim can vary depending on the complexity of the incident and the insurance provider. Typically, simple claims can be resolved within a few weeks, while more complex cases may take several months.