Car Insurance For Military Families

Military service is a noble and often challenging path, and one of the key considerations for service members and their families is financial planning, especially when it comes to essential aspects like car insurance.

In this comprehensive guide, we'll delve into the world of car insurance for military families, exploring the unique benefits, challenges, and strategies to ensure you and your loved ones are protected on the road. Whether you're active duty, a veteran, or a military spouse, understanding your insurance options is crucial for your financial well-being and peace of mind.

Understanding Military Car Insurance

Car insurance for military families operates within a specialized niche, offering tailored coverage and benefits to cater to the unique needs of those serving in the armed forces. Here’s an overview of the key aspects:

Discounts and Military-Friendly Policies

Many insurance providers recognize the sacrifices made by military personnel and their families. As a result, they offer dedicated military discounts and specialized policies designed to provide cost-effective coverage. These discounts can significantly reduce your insurance premiums, making it more affordable to maintain comprehensive coverage.

Some providers extend these benefits to veterans and retired service members, ensuring that the support continues long after active duty ends.

Deployment and Temporary Coverage

One of the unique challenges military families face is deployment. When a service member is deployed, their vehicle may be left unattended for extended periods. Traditional insurance policies often require continuous coverage, but military-friendly insurers understand this challenge.

These insurers offer temporary coverage options or deployment discounts to accommodate such situations. This flexibility ensures that your vehicle remains insured during deployment, providing peace of mind without unnecessary expenses.

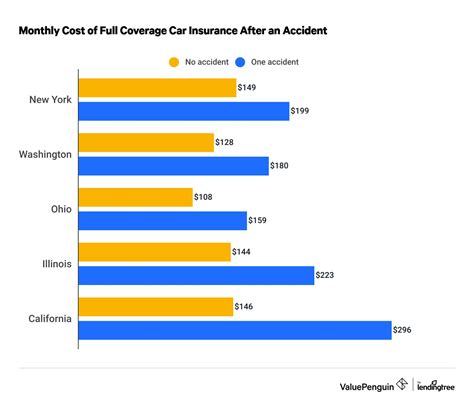

Accident Forgiveness and Special Benefits

The nature of military service can sometimes lead to unique circumstances, and insurers recognize this. Some policies include accident forgiveness, waiving rate increases after a first at-fault accident. This benefit is particularly valuable for young service members or those transitioning to civilian life, as it can prevent rate hikes due to minor accidents.

Additionally, certain providers offer special benefits like rental car discounts, emergency travel assistance, or even discounts for taking defensive driving courses. These perks are designed to support military families in various aspects of their lives.

Coverage for Multiple Vehicles and Locations

Military families often have unique vehicle needs. Whether it’s a primary car for the service member, a secondary vehicle for the spouse, or even multiple vehicles for a growing family, insurers understand the demand.

Many policies cater to multiple vehicles under a single policy, offering discounts for bundling coverage. This is especially beneficial when relocating to a new duty station, as it simplifies the insurance process and saves costs.

Choosing the Right Car Insurance Provider

With a deep understanding of the military insurance landscape, it’s time to explore how to select the best provider for your specific needs.

Researching Military-Friendly Insurers

Start by researching insurance companies that actively cater to military families. Look for providers with a proven track record of offering dedicated military discounts and specialized policies. These insurers often have a deep understanding of the unique challenges faced by service members and their families.

Consider seeking recommendations from fellow military personnel or veterans. Word-of-mouth reviews can provide valuable insights into the quality of service and the level of support you can expect.

Evaluating Coverage Options

Once you’ve identified potential insurers, delve into the specifics of their coverage options. Compare the types of coverage they offer, including liability, collision, comprehensive, and any additional perks like rental car reimbursement or roadside assistance.

Assess the flexibility of their policies. Do they allow for temporary coverage during deployments? Do they provide accident forgiveness or other benefits tailored to military families? These features can significantly impact your overall insurance experience and cost.

Understanding Discounts and Savings

Military discounts are a significant advantage when choosing an insurer. Compare the discount structures offered by different providers. Some may offer flat discounts based on your military status, while others may provide savings based on specific criteria like the type of vehicle or your driving record.

Additionally, explore other potential savings opportunities. Do they offer discounts for multiple vehicles, safe driving records, or defensive driving courses? These additional savings can further reduce your insurance costs.

Assessing Customer Service and Claims Handling

The quality of customer service and claims handling is crucial, especially in times of need. Research the insurer’s reputation for customer satisfaction and prompt claims processing. Look for reviews and testimonials that highlight their responsiveness and support during challenging situations.

Consider whether the insurer has a dedicated military support team or specialists who understand the unique needs of service members. This level of expertise can make a significant difference in ensuring a smooth insurance experience.

Maximizing Your Military Car Insurance Benefits

Once you’ve selected an insurance provider, there are several strategies you can employ to maximize the benefits and savings offered by military car insurance.

Bundling Policies for Savings

Many insurance providers offer discounts when you bundle multiple policies, such as auto and home insurance. If you own a home or rent a property, consider bundling your car insurance with your homeowner’s or renter’s insurance policy. This can result in significant savings and streamline your insurance management.

Maintaining a Clean Driving Record

A clean driving record is not only essential for your safety but also for keeping your insurance costs down. Avoid traffic violations and at-fault accidents to maintain a positive driving history. This can lead to lower insurance premiums and even qualify you for additional discounts offered by some insurers.

Utilizing Deployment Discounts

If you’re facing a deployment, take advantage of deployment discounts or temporary coverage options offered by your insurer. This can help you save on insurance costs during periods when your vehicle is not in use. Be sure to understand the terms and conditions of these discounts to ensure you’re maximizing your savings.

Exploring Additional Discounts

Beyond military discounts, many insurers offer a range of additional savings opportunities. These may include discounts for safe driving, defensive driving courses, vehicle safety features, or even your choice of payment method. Explore these options and see if you qualify for any further reductions in your insurance premiums.

Understanding Your Coverage Limits

It’s crucial to understand the coverage limits of your policy. Review your policy regularly to ensure you have adequate coverage for your needs. Consider factors such as the value of your vehicle, the cost of repairs or replacements, and any potential liabilities you may face. Adjust your coverage limits as necessary to ensure you’re properly protected.

Addressing Common Challenges

While military car insurance offers numerous benefits, there are some common challenges that military families may encounter. Here’s how to address them effectively.

Relocation and Insurance Continuity

Frequent relocations are a part of military life, and ensuring insurance continuity during these transitions is crucial. When moving to a new duty station, notify your insurer in advance. They can guide you through the process of updating your policy to reflect your new location and any necessary changes in coverage.

Vehicle Storage and Insurance

If you’re storing a vehicle while deployed or during a temporary absence, it’s essential to understand your insurance options. Some insurers offer coverage specifically for stored vehicles, ensuring they remain protected even when not in use. Explore these options to maintain comprehensive coverage during storage periods.

Addressing Gap in Coverage

Occasionally, there may be a gap in coverage when transitioning between policies or during a move. This can leave you vulnerable to financial risks. To avoid this, ensure you have continuous coverage by maintaining your existing policy until your new policy takes effect. Bridge any gaps by securing short-term coverage if necessary.

The Future of Military Car Insurance

The landscape of military car insurance is continually evolving to meet the changing needs of service members and their families. Here’s a glimpse into the future and some trends to watch.

Digitalization and Convenience

The insurance industry is increasingly moving towards digitalization, and military car insurance is no exception. Expect to see more insurers offering convenient online platforms for policy management, claims filing, and communication. This shift towards digital convenience can streamline your insurance experience and make it more accessible.

Enhanced Personalization

As data analytics and artificial intelligence advance, insurers will increasingly tailor policies to individual needs. This level of personalization can result in more precise coverage and pricing, ensuring you only pay for what you truly need. Keep an eye out for insurers who lead the way in offering personalized military car insurance plans.

Integration of Telematics

Telematics, the use of technology to track driving behavior, is gaining traction in the insurance industry. While it may seem invasive, it can lead to significant savings for safe drivers. Expect to see more insurers offering telematics-based policies, where your driving behavior directly influences your insurance rates. This trend can incentivize safer driving habits and result in lower premiums for responsible drivers.

Expanded Benefits and Support

Insurers are likely to continue expanding their support for military families, offering an even wider range of benefits and discounts. Keep an eye out for insurers who go beyond traditional coverage, providing additional perks like identity theft protection, travel assistance, or even financial planning resources tailored to military life.

Conclusion

Car insurance for military families is a specialized field, offering tailored benefits and support to those who serve. By understanding the unique advantages, choosing the right insurer, and maximizing your benefits, you can ensure comprehensive protection for your vehicles and your finances.

As the insurance landscape evolves, stay informed about the latest trends and opportunities. With the right insurance coverage, you can focus on your service and family life with the peace of mind that comes from being properly protected.

How can I find the best military car insurance provider for my needs?

+Start by researching providers known for their military discounts and specialized policies. Look for recommendations from fellow service members or veterans. Compare coverage options, discounts, and customer service reputation to find the best fit for your specific needs.

What are some common military car insurance discounts I should look for?

+Common discounts include military status discounts, deployment discounts, accident forgiveness, multiple vehicle discounts, and safe driving discounts. These can significantly reduce your insurance premiums.

How can I ensure continuous insurance coverage during frequent relocations or deployments?

+Notify your insurer in advance of any moves or deployments. They can guide you through the process of updating your policy and ensuring continuous coverage. Take advantage of deployment discounts or temporary coverage options to maintain protection during periods of inactivity.

Are there any challenges I should be aware of when it comes to military car insurance?

+Some common challenges include managing insurance during relocations, understanding coverage options for stored vehicles, and addressing gaps in coverage during transitions. Stay informed and plan ahead to mitigate these challenges effectively.