Car Insurance Nsw Compare

Car insurance is an essential aspect of vehicle ownership, and in New South Wales (NSW), Australia, it is a legal requirement for all motorists to have at least the minimum level of cover. With a wide range of car insurance providers and policies available, comparing options to find the best fit for your needs and budget is crucial. This comprehensive guide will delve into the world of car insurance in NSW, offering an in-depth analysis to help you make an informed decision.

Understanding Car Insurance in NSW

Car insurance in NSW provides financial protection for vehicle owners in various situations, such as accidents, theft, and damage. It is designed to cover repair or replacement costs, as well as any third-party liabilities that may arise. The state’s Compulsory Third Party (CTP) insurance is a fundamental component, ensuring that all motorists have a basic level of cover for personal injury claims.

Beyond CTP, there are several other types of car insurance policies available in NSW, each offering different levels of coverage and benefits. These include:

- Comprehensive Insurance: This is the highest level of cover, providing protection against theft, fire, vandalism, and accidental damage, as well as third-party liability. It offers the most comprehensive protection but is typically the most expensive option.

- Third Party Property Insurance: Also known as Third Party Fire and Theft, this policy covers damage to other people's property and vehicles, as well as theft or fire damage to your own vehicle. It is a middle-ground option between comprehensive and CTP cover.

- CTP Green Slip: This is the basic, legally required insurance in NSW. It covers personal injury claims made against you by other motorists, pedestrians, or passengers involved in an accident caused by your driving. CTP insurance is purchased separately from your car insurance policy.

The Importance of Comparison

With numerous insurance providers and policy types available, it’s essential to compare options to find the best value for your money and the coverage that suits your specific needs. Factors to consider when comparing car insurance policies include:

- Coverage and Exclusions: Ensure you understand what is and isn't covered by the policy. Different policies have varying exclusions, so it's crucial to read the fine print.

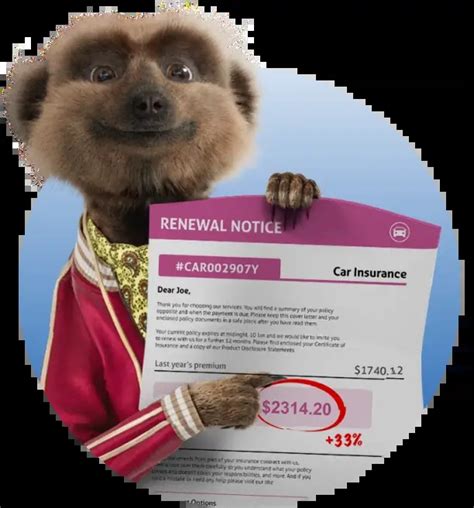

- Premiums and Excess: Compare the cost of premiums and the excess amounts you'll need to pay in the event of a claim. Remember that the cheapest premium may not always be the best value if the excess is high.

- Inclusions and Benefits: Look for additional features like roadside assistance, rental car coverage, or injury cover that can add value to your policy.

- Reputation and Financial Stability: Choose a reputable insurer with a solid financial standing to ensure they'll be able to pay out claims when needed.

- Customer Service and Claims Process: Research the insurer's customer service reputation and the ease of their claims process. You want an insurer that will support you when you need it most.

Key Factors to Consider When Comparing Car Insurance in NSW

When comparing car insurance policies in NSW, there are several key factors that can significantly impact the cost and coverage of your policy. These include:

Vehicle Details

The type of vehicle you drive and its value play a significant role in determining your insurance premium. Insurers consider factors such as the make, model, age, and safety features of your car. For instance, a newer, high-performance vehicle with advanced safety systems may be cheaper to insure than an older, less safe car.

Additionally, the value of your vehicle influences the level of cover you may require. If your car is worth a substantial amount, comprehensive insurance may be a wise choice to ensure full protection.

| Vehicle Factor | Impact on Insurance |

|---|---|

| Make and Model | Some vehicles are more expensive to insure due to higher repair costs or theft risks. |

| Age of Vehicle | Older vehicles may be cheaper to insure, but they may also have fewer safety features and higher repair costs. |

| Safety Ratings | Vehicles with higher safety ratings may qualify for insurance discounts. |

Driver Profile

Your personal details and driving history are crucial considerations for insurance providers. Factors such as age, gender, and driving experience can affect your premium. Younger drivers, especially males, often face higher premiums due to their perceived higher risk of accidents.

Your driving history is also a significant factor. Insurers look at your claims history, any traffic violations, and the number of years you've been driving. A clean driving record can lead to lower premiums, while multiple claims or violations may increase your costs.

Coverage and Additional Features

The level of coverage you choose is a critical factor in determining your insurance premium. Comprehensive insurance, as mentioned earlier, provides the highest level of protection but also carries the highest cost. Third-party property insurance and CTP cover are more affordable options but offer less comprehensive protection.

Additionally, consider any extra features or add-ons you may want with your policy. These can include roadside assistance, rental car coverage, windscreen repair, or coverage for personal belongings. While these add-ons can increase your premium, they may provide essential peace of mind.

Excess and Deductibles

Excess, also known as the deductible, is the amount you agree to pay out of pocket in the event of a claim. The higher your excess, the lower your premium will generally be. It’s important to choose an excess that you’re comfortable paying if the need arises.

Some insurers offer flexible excess options, allowing you to choose a higher excess for a lower premium or vice versa. This can be a strategic way to save on your insurance costs while still maintaining a manageable excess.

Tips for Finding the Best Car Insurance in NSW

To ensure you’re getting the best car insurance deal in NSW, here are some valuable tips to consider:

- Shop Around: Don't settle for the first quote you receive. Compare prices and coverage from multiple insurers to find the best value.

- Bundle Policies: If you have multiple insurance needs, such as home and contents insurance, consider bundling them with your car insurance. Many insurers offer discounts for multi-policy customers.

- Review Your Policy Regularly: Insurance needs can change over time. Review your policy annually to ensure it still meets your requirements and to take advantage of any new discounts or offers.

- Consider Excess Options: As mentioned, choosing a higher excess can lower your premium. However, make sure you choose an amount you can afford to pay if needed.

- Understand Your Needs: Assess your personal risk tolerance and financial situation to determine the level of cover you need. Don't pay for coverage you won't use.

- Read the Fine Print: Always review the Product Disclosure Statement (PDS) and any policy documents thoroughly to understand what's covered and what isn't.

The Future of Car Insurance in NSW

The car insurance landscape in NSW is continually evolving, with new technologies and trends shaping the industry. Here’s a glimpse into the future of car insurance in the state:

Telematics and Usage-Based Insurance

Telematics technology, which uses data from vehicle sensors and GPS to track driving behavior, is gaining traction in the insurance industry. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, uses telematics to offer policies that are priced based on how, when, and where a car is driven.

This technology has the potential to benefit safe drivers by offering lower premiums based on their actual driving behavior, rather than generalizations about their demographics or driving history.

Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles is expected to bring significant changes to the car insurance market. Electric vehicles, with their advanced safety features and lower risk of certain types of accidents, may qualify for lower insurance premiums in the future.

Autonomous vehicles, while still in their early stages, have the potential to dramatically reduce the number of accidents caused by human error. This could lead to a significant shift in the way insurance is priced and structured.

Increased Focus on Prevention

Insurers are increasingly focusing on prevention rather than just paying out claims. This shift is driven by advancements in technology and a growing understanding of the benefits of proactive risk management.

Insurers are now offering incentives and discounts for customers who take steps to reduce their risk of accidents, such as installing advanced safety features in their vehicles or completing defensive driving courses. This trend is likely to continue and expand in the future.

Conclusion

Comparing car insurance options in NSW is crucial to finding the right coverage at the best price. By understanding the different types of policies available, considering key factors that impact premiums, and staying informed about industry trends, you can make an informed decision that suits your needs and budget.

Remember, car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind. With the right policy, you can drive with confidence, knowing you're covered for the unexpected.

What is the average cost of car insurance in NSW?

+The average cost of car insurance in NSW can vary significantly based on a range of factors, including the type of policy, the insurer, and the driver’s profile. On average, comprehensive car insurance in NSW can range from 800 to 2,500 per year, while third-party property insurance may cost around 400 to 1,000 annually. CTP insurance, which is purchased separately, typically ranges from 400 to 600 per year.

How often should I review my car insurance policy?

+It’s a good practice to review your car insurance policy annually, or whenever your circumstances change significantly. This ensures that your coverage remains adequate and that you’re not paying for coverage you no longer need. Additionally, reviewing your policy annually allows you to take advantage of any new discounts or offers that may be available.

Can I switch car insurance providers at any time?

+Yes, you can switch car insurance providers at any time. However, be aware of any cancellation fees or penalties that may apply, especially if you’re still within the initial policy term. It’s generally a good idea to compare prices and coverage from multiple insurers before making a switch to ensure you’re getting the best value.