Best Health Insurance Plans For Families

Choosing the right health insurance plan for your family is a crucial decision that can significantly impact your financial well-being and access to healthcare services. With numerous options available in the market, it's essential to understand the key factors that differentiate these plans and make an informed choice. This article aims to provide a comprehensive guide to the best health insurance plans for families, considering various factors such as coverage, cost, and provider networks.

Understanding Family Health Insurance Plans

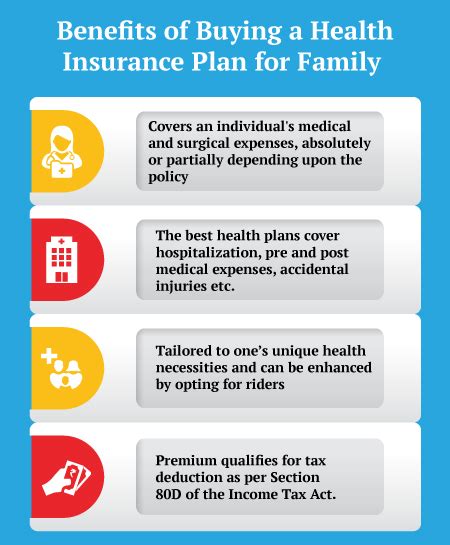

Family health insurance plans are designed to cover multiple family members, including spouses, children, and, in some cases, extended family. These plans offer comprehensive coverage for a wide range of medical expenses, ensuring that your loved ones receive the necessary care when they need it. The primary goal of these plans is to provide financial protection and peace of mind, knowing that medical emergencies or ongoing healthcare needs are well-managed.

Key Considerations for Choosing a Family Plan

When evaluating health insurance plans for your family, several factors come into play. Here are some critical considerations to keep in mind:

- Coverage: Ensure that the plan covers essential healthcare services such as doctor visits, hospital stays, prescription medications, and specialist care. Look for plans that offer coverage for preventive care, mental health services, and dental and vision care, if required.

- Cost: Health insurance plans vary significantly in terms of premiums, deductibles, copayments, and out-of-pocket maximums. Evaluate the overall cost of the plan, considering not just the monthly premium but also the potential out-of-pocket expenses. Plans with lower premiums often have higher deductibles, so strike a balance based on your family's healthcare needs and budget.

- Provider Network: A robust provider network is crucial to ensure that your preferred doctors and hospitals are included in the plan. Check the network size and verify if your family's healthcare providers are in-network. Out-of-network care can lead to higher costs, so choose a plan that offers a comprehensive network of healthcare providers.

- Plan Type: Health insurance plans come in various types, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). Each type has its own network and coverage rules. Research and understand the differences to find the plan type that aligns with your family's healthcare preferences and needs.

- Benefits and Add-ons: Look for plans that offer additional benefits such as wellness programs, disease management support, or telemedicine services. These add-ons can enhance your family's overall healthcare experience and provide valuable support in managing chronic conditions or maintaining a healthy lifestyle.

Top-Rated Family Health Insurance Plans

Now, let's explore some of the best health insurance plans available for families, based on coverage, cost, and provider network:

1. UnitedHealthcare Family Plan

UnitedHealthcare offers a range of family plans that provide comprehensive coverage and a vast provider network. Their plans typically include coverage for primary care, specialist visits, hospital stays, prescription drugs, and preventive care services. With a focus on consumer-directed health plans, UnitedHealthcare allows families to customize their coverage based on their specific needs.

| Plan Highlights | UnitedHealthcare Family Plan |

|---|---|

| Coverage | Comprehensive coverage for primary care, specialists, hospital stays, and prescription drugs |

| Cost | Competitive premiums with options for high-deductible plans and Health Savings Accounts (HSAs) |

| Provider Network | Extensive network with a focus on quality and accessibility |

| Additional Benefits | Telemedicine services, wellness programs, and disease management support |

2. Blue Cross Blue Shield Family Plans

Blue Cross Blue Shield (BCBS) is a well-known and trusted name in the health insurance industry. Their family plans offer a wide range of options, including PPO and HMO plans, providing flexibility and comprehensive coverage. BCBS plans typically cover a broad spectrum of healthcare services and have an extensive provider network, ensuring that families have access to quality care.

| Plan Highlights | Blue Cross Blue Shield Family Plans |

|---|---|

| Coverage | Comprehensive coverage for medical, surgical, and prescription drug needs |

| Cost | Affordable premiums with options for different plan types and deductibles |

| Provider Network | Large network of healthcare providers across the country |

| Additional Benefits | Wellness incentives, telemedicine access, and chronic condition management programs |

3. Aetna Family Health Plans

Aetna is known for its innovative and consumer-friendly health insurance plans. Their family plans offer a unique blend of affordability and comprehensive coverage. Aetna provides a wide range of plan options, including HMO, PPO, and EPO plans, catering to different family needs. Their plans often include additional benefits such as telemedicine services and health management tools.

| Plan Highlights | Aetna Family Health Plans |

|---|---|

| Coverage | Comprehensive coverage for primary care, specialists, and prescription drugs |

| Cost | Competitive premiums with cost-saving options for families |

| Provider Network | Extensive network with a focus on quality and value-based care |

| Additional Benefits | Telemedicine, health coaching, and wellness programs |

4. Cigna Family Health Insurance

Cigna's family health insurance plans are designed to provide peace of mind and financial protection. Their plans offer a balanced approach to coverage and cost, ensuring that families have access to essential healthcare services without breaking the bank. Cigna's provider network is robust, ensuring that families can find quality care close to home.

| Plan Highlights | Cigna Family Health Insurance |

|---|---|

| Coverage | Comprehensive coverage for medical, surgical, and prescription drug needs |

| Cost | Affordable premiums with a range of plan options to suit different budgets |

| Provider Network | Extensive network of healthcare providers, including specialists and hospitals |

| Additional Benefits | Telehealth services, health and wellness programs, and chronic condition management support |

5. Humana Family Health Plans

Humana's family health plans are known for their focus on value and consumer satisfaction. Their plans offer a combination of comprehensive coverage and cost-effective solutions. Humana provides a wide range of plan options, including HMO, PPO, and Medicare Advantage plans, catering to the diverse needs of families. Their plans often include additional benefits such as dental and vision coverage.

| Plan Highlights | Humana Family Health Plans |

|---|---|

| Coverage | Comprehensive coverage for primary care, specialists, and prescription drugs |

| Cost | Affordable premiums with cost-saving options and potential tax benefits |

| Provider Network | Large network of healthcare providers, including hospitals and specialists |

| Additional Benefits | Dental and vision coverage, wellness incentives, and telemedicine services |

Frequently Asked Questions

What is the average cost of a family health insurance plan?

+

The average cost of a family health insurance plan varies based on factors such as location, plan type, and coverage. Premiums can range from a few hundred dollars to over a thousand dollars per month. It’s essential to compare plans and consider your family’s healthcare needs to find the best value.

Do family health insurance plans cover pre-existing conditions?

+

Yes, under the Affordable Care Act (ACA), health insurance plans must cover pre-existing conditions. This means that your family’s health insurance plan should provide coverage for any pre-existing medical conditions without discrimination or additional costs.

Can I customize my family’s health insurance plan to include specific benefits?

+

Yes, many health insurance providers offer customizable plans. You can often choose between different plan types, coverage levels, and add-on benefits to create a plan that suits your family’s unique needs. It’s a good idea to discuss your options with an insurance broker or agent.

Are there any tax benefits associated with family health insurance plans?

+

Yes, there are potential tax benefits associated with family health insurance plans. Depending on your income and plan type, you may be eligible for tax credits or deductions. It’s advisable to consult a tax professional to understand the specific benefits available to you.

How can I compare health insurance plans for my family effectively?

+

Comparing health insurance plans can be done through online tools provided by insurance companies or independent websites. These tools allow you to input your family’s details and preferences, and they generate a list of suitable plans with their respective costs and coverage details. Additionally, seeking advice from insurance professionals can provide valuable insights.