American Insurance Auto

The insurance industry is a vital sector in the United States, offering financial protection and security to millions of Americans. Among the various types of insurance, auto insurance plays a pivotal role, ensuring the safety and peace of mind of drivers and vehicle owners across the nation. In this comprehensive article, we delve into the world of American Insurance Auto, exploring its significance, key features, and the impact it has on the lives of individuals and the broader community.

Understanding American Insurance Auto

American Insurance Auto is a term that encompasses a wide range of insurance policies designed specifically for automobiles and their owners. It serves as a safeguard against financial losses and liabilities that can arise from unexpected events such as accidents, theft, natural disasters, and other mishaps related to vehicle ownership and operation.

The primary objective of auto insurance is to provide coverage for damages to vehicles, injuries sustained by individuals involved in accidents, and potential legal liabilities. By offering a comprehensive range of coverage options, American Insurance Auto empowers drivers to tailor their policies to their specific needs and budget, ensuring adequate protection in various scenarios.

Key Components of American Insurance Auto

American Insurance Auto policies typically consist of several core components, each serving a distinct purpose:

- Liability Coverage: This aspect of auto insurance covers damages and injuries caused to others in an accident for which the insured driver is at fault. It provides financial protection against claims made by third parties, ensuring that the insured individual's assets are not at risk.

- Collision Coverage: Collision coverage is designed to cover the cost of repairs or replacements for the insured vehicle in the event of an accident, regardless of fault. It offers peace of mind, knowing that the policyholder's vehicle will be financially supported in case of a collision.

- Comprehensive Coverage: Comprehensive coverage goes beyond accidents, providing protection against theft, vandalism, natural disasters, and other non-collision-related incidents. This type of coverage is essential for safeguarding the vehicle against a wide range of unforeseen events.

- Medical Payments or Personal Injury Protection (PIP): These coverages focus on the medical expenses of the insured and their passengers, regardless of fault. They ensure that medical bills are covered promptly, allowing individuals to focus on their recovery without the added stress of financial burden.

- Uninsured/Underinsured Motorist Coverage: This coverage steps in when the at-fault driver in an accident does not have adequate insurance to cover the damages and injuries caused. It provides protection against financial losses resulting from such incidents.

The Importance of American Insurance Auto

American Insurance Auto holds immense significance for both individuals and society as a whole. Here are some key reasons why it is a crucial aspect of modern life:

Financial Protection and Peace of Mind

One of the primary benefits of auto insurance is the financial security it provides. In the event of an accident or unforeseen incident, the costs associated with vehicle repairs, medical expenses, and legal liabilities can be substantial. American Insurance Auto policies ensure that individuals are not burdened with these financial obligations, allowing them to focus on recovery and moving forward.

Compliance with Legal Requirements

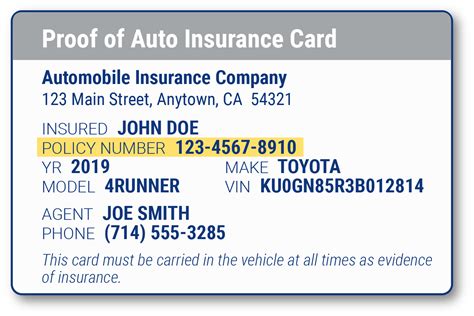

In the United States, auto insurance is often a legal requirement for vehicle ownership and operation. Most states have mandatory minimum insurance coverage limits that drivers must adhere to. By obtaining adequate auto insurance, individuals ensure they are compliant with local laws and regulations, avoiding potential legal consequences and penalties.

| State | Minimum Liability Coverage |

|---|---|

| California | $15,000 Bodily Injury per Person / $30,000 Bodily Injury per Accident / $5,000 Property Damage |

| Texas | $30,000 Bodily Injury per Person / $60,000 Bodily Injury per Accident / $25,000 Property Damage |

| New York | $25,000 Bodily Injury per Person / $50,000 Bodily Injury per Accident / $10,000 Property Damage |

Safety and Roadway Responsibility

Auto insurance plays a vital role in promoting safety on the roads. By requiring drivers to carry insurance, it encourages responsible driving behaviors and discourages reckless actions. Insured drivers are more likely to adhere to traffic laws and take necessary precautions, as they understand the potential financial implications of accidents.

Support for Victims of Accidents

In the unfortunate event of an accident, auto insurance provides crucial support to victims. It ensures that those injured receive prompt medical attention and that their financial needs are met. This assistance can be life-changing, especially for individuals facing significant medical bills and lost wages due to their injuries.

Choosing the Right American Insurance Auto Policy

When it comes to selecting an American Insurance Auto policy, individuals have a wide range of options to consider. The complexity of the insurance landscape can be daunting, but understanding a few key factors can simplify the decision-making process.

Assessing Individual Needs

The first step in choosing an auto insurance policy is to assess one’s specific needs. Factors such as the type of vehicle owned, driving habits, location, and personal financial situation all play a role in determining the appropriate level of coverage. For instance, individuals with newer, more expensive vehicles may opt for comprehensive coverage to protect their investment.

Comparing Providers and Policies

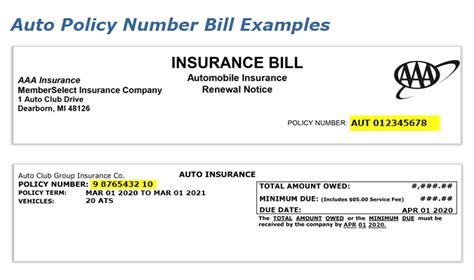

With numerous insurance providers in the market, it is essential to compare different policies and companies. Factors to consider include coverage options, policy limits, deductibles, and additional perks or discounts offered. Online resources and comparison tools can be invaluable in this process, allowing individuals to quickly evaluate multiple options.

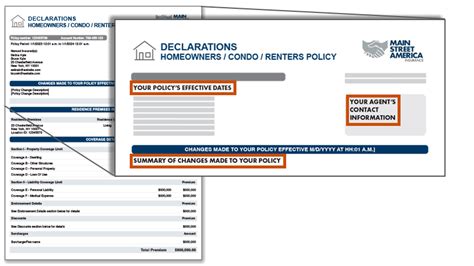

Understanding Policy Terms and Conditions

Before finalizing an auto insurance policy, it is crucial to thoroughly understand the terms and conditions. This includes reading the fine print to identify any exclusions, limitations, or restrictions that may apply. Being aware of these details ensures that individuals are fully informed about their coverage and can make decisions aligned with their expectations.

Seeking Professional Advice

For those who prefer a more personalized approach, seeking advice from insurance professionals can be beneficial. Insurance agents and brokers can provide expert guidance, helping individuals navigate the complex world of auto insurance and find the policy that best suits their needs and budget.

The Future of American Insurance Auto

The insurance industry is continuously evolving, and auto insurance is no exception. As technology advances and societal needs change, the landscape of American Insurance Auto is expected to transform as well. Here are some insights into the potential future developments:

Advancements in Telematics and Usage-Based Insurance

Telematics technology, which uses data from vehicle sensors and GPS systems, is gaining traction in the insurance industry. Usage-based insurance policies leverage telematics data to offer customized premiums based on an individual’s driving behavior and habits. This innovative approach could revolutionize auto insurance, providing more accurate pricing and incentivizing safe driving practices.

Integration of Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are poised to play a significant role in the future of auto insurance. These technologies can analyze vast amounts of data, identify patterns, and predict potential risks more accurately. Insurers may leverage AI and ML to enhance risk assessment, improve fraud detection, and personalize coverage recommendations.

Embracing Electric and Autonomous Vehicles

The rise of electric vehicles (EVs) and the impending arrival of autonomous vehicles present new challenges and opportunities for the insurance industry. As these technologies become more prevalent, insurers will need to adapt their policies to accommodate the unique risks and benefits associated with EV and autonomous vehicle ownership and operation.

Focus on Sustainability and Environmental Impact

With growing concerns about climate change and environmental sustainability, the insurance industry is likely to shift its focus towards greener practices. This could include offering incentives for eco-friendly driving behaviors, promoting electric and hybrid vehicle ownership, and developing insurance products that support sustainable transportation initiatives.

Conclusion

American Insurance Auto is a cornerstone of financial security and peace of mind for millions of Americans. Its role in providing protection, compliance, and support cannot be overstated. As the insurance landscape evolves, individuals can expect more innovative and tailored solutions, ensuring that auto insurance remains a vital component of their financial planning and risk management strategies.

What are the average costs of American Insurance Auto policies?

+The cost of auto insurance policies varies widely based on factors such as location, driving history, and the chosen coverage options. On average, Americans can expect to pay between 500 and 1,500 annually for basic liability coverage. However, comprehensive policies with higher coverage limits can exceed $2,000 per year.

How do I know if I have adequate auto insurance coverage?

+Assessing your auto insurance coverage involves considering your specific needs and financial situation. It’s recommended to review your policy regularly and consult with an insurance professional to ensure you have sufficient liability, collision, and comprehensive coverage to protect your assets and provide peace of mind.

Are there discounts available for American Insurance Auto policies?

+Yes, many insurance providers offer a range of discounts to attract customers and reward safe driving practices. Common discounts include multi-policy discounts (bundling auto insurance with other types of insurance), safe driver discounts, good student discounts, and loyalty discounts for long-term customers.