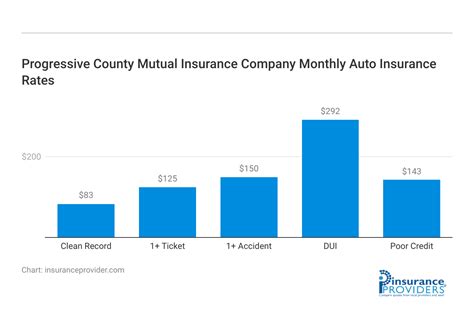

Progressive County Mutual Insurance Company

In the dynamic landscape of the insurance industry, few entities have achieved the level of recognition and success that Progressive County Mutual Insurance Company has. With a rich history spanning decades and a reputation for innovation, this company has become a household name, synonymous with reliable insurance solutions. As we delve into the intricacies of their operations, strategies, and impact, it becomes evident that Progressive County Mutual Insurance Company is more than just an insurer; it is a force shaping the industry's future.

A Legacy of Innovation: Progressive County Mutual’s Journey

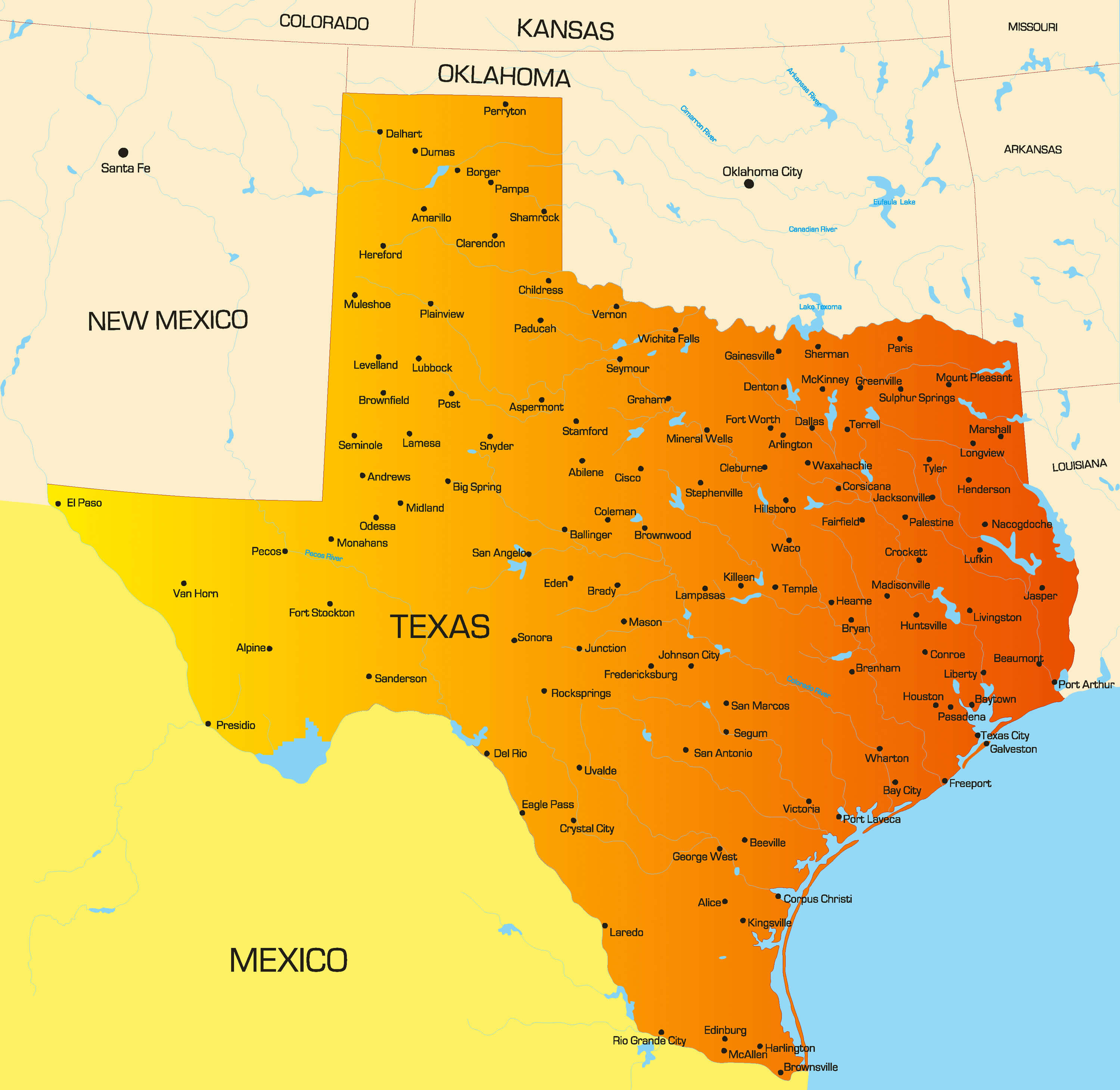

The story of Progressive County Mutual Insurance Company began in 1957 when a group of visionary entrepreneurs recognized the need for a more flexible and customer-centric approach to insurance. Founded in Texas, the company’s initial focus was on providing affordable and comprehensive auto insurance to drivers in the state. However, their ambition and innovative spirit quickly propelled them beyond these humble beginnings.

One of the key differentiators of Progressive County Mutual has been its relentless pursuit of technological advancement. In an industry often associated with traditional, paper-based processes, the company embraced digital transformation early on. By investing in cutting-edge technology, they streamlined their operations, enhanced customer service, and offered innovative products that resonated with modern consumers.

Key Milestones and Industry Contributions

Over the years, Progressive County Mutual has achieved numerous milestones that have solidified its position as an industry leader. Here are some notable achievements:

- 1989: Progressive County Mutual introduced the concept of pay-as-you-drive insurance, allowing customers to pay premiums based on their actual driving habits. This revolutionary idea disrupted the industry and paved the way for more personalized insurance plans.

- 2003: The company launched its online platform, offering customers the convenience of purchasing insurance policies and managing their accounts digitally. This move not only improved customer experience but also reduced administrative costs.

- 2012: Progressive County Mutual expanded its reach by partnering with leading ride-sharing platforms, providing insurance coverage for drivers engaged in this emerging sector. This strategic move positioned the company as a forward-thinking insurer in the digital age.

- 2019: The introduction of AI-powered claims processing significantly reduced the time and resources required for settling claims. This innovation not only benefited customers but also enhanced the company's operational efficiency.

| Year | Milestone |

|---|---|

| 1995 | Introduced multi-policy discounts, encouraging customers to bundle their insurance needs. |

| 2008 | Launched a comprehensive road assistance program, providing 24/7 support to policyholders. |

| 2016 | Became the first insurance company to offer insurance for autonomous vehicles, demonstrating its foresight into the future of transportation. |

Product Diversity and Customer Satisfaction

Progressive County Mutual Insurance Company understands that insurance needs are as diverse as the customers they serve. To cater to this wide range of requirements, the company offers a comprehensive suite of insurance products, including:

- Auto Insurance: Their flagship product, offering coverage for a variety of vehicles and driving profiles. From comprehensive plans to basic liability coverage, they ensure every driver can find an appropriate policy.

- Homeowners Insurance: Providing protection for homeowners against a wide range of risks, including natural disasters, theft, and liability claims. Their policies can be tailored to suit different home types and locations.

- Renters Insurance: Recognizing the needs of renters, Progressive County Mutual offers affordable policies that cover personal belongings, liability, and additional living expenses in case of a covered loss.

- Life Insurance: With a range of term and permanent life insurance options, the company helps individuals and families secure their financial future and protect their loved ones.

- Business Insurance: From small startups to established enterprises, Progressive County Mutual provides customized insurance solutions to protect businesses against various risks, including property damage, liability, and business interruption.

A Focus on Customer Experience

At the heart of Progressive County Mutual’s success is its unwavering commitment to delivering an exceptional customer experience. The company understands that insurance is not a one-size-fits-all proposition, and their approach reflects this understanding.

One of the key aspects of their customer-centric strategy is personalized service. By leveraging advanced analytics and customer data, they tailor their offerings to individual needs. Whether it's providing customized policy recommendations or offering tailored advice during the claims process, Progressive County Mutual ensures every customer feels valued and understood.

Furthermore, their 24/7 customer support, accessible through multiple channels, ensures that help is always within reach. This round-the-clock availability has been particularly crucial in emergency situations, where prompt assistance can make a significant difference.

| Customer Service Channel | Description |

|---|---|

| Phone Support | Trained customer service representatives are available to assist with inquiries, policy changes, and claims. |

| Online Chat | Real-time chat support for quick answers and guidance. |

| Mobile App | Customers can manage their policies, make payments, and report claims directly from their smartphones. |

| Email Support | For more detailed inquiries, customers can correspond with dedicated support teams. |

Financial Stability and Industry Recognition

Progressive County Mutual’s success isn’t just measured by its customer base or product offerings; it’s also reflected in its financial performance and industry recognition.

The company has consistently maintained a strong financial position, as evidenced by its A+ rating from leading credit rating agencies. This rating signifies the company's ability to meet its financial obligations and its commitment to sound financial management. Additionally, Progressive County Mutual's reserves and capital adequacy ratios are among the highest in the industry, providing a buffer against unforeseen risks and ensuring long-term sustainability.

In terms of industry recognition, Progressive County Mutual has been the recipient of numerous awards and accolades. These honors, bestowed by respected industry bodies and consumer organizations, testify to the company's excellence in various aspects, including customer satisfaction, financial strength, and innovation.

Awards and Achievements

- 2020: Ranked as one of the top 10 most trusted insurance brands by Forbes, a testament to its commitment to integrity and customer satisfaction.

- 2021: Recognized as the Most Innovative Insurance Company by Insurance Business America, highlighting its leadership in embracing new technologies and business models.

- 2022: Awarded the Best Customer Experience Award by the Insurance Industry Awards, acknowledging its outstanding service and dedication to customer needs.

Community Engagement and Corporate Social Responsibility

Beyond its core insurance business, Progressive County Mutual actively engages with the communities it serves, embodying the spirit of corporate social responsibility.

The company has established several initiatives focused on giving back to society. These efforts range from supporting local charities and educational institutions to participating in environmental conservation projects. By aligning its values with community needs, Progressive County Mutual demonstrates its commitment to making a positive impact beyond its business operations.

Key Community Initiatives

- Education Sponsorship: Progressive County Mutual has partnered with local schools and universities, providing scholarships and funding for educational programs. This initiative aims to empower the next generation and promote access to quality education.

- Environmental Sustainability: Recognizing the importance of environmental conservation, the company has implemented several green initiatives. From reducing paper usage in its offices to supporting reforestation projects, Progressive County Mutual is dedicated to minimizing its environmental footprint.

- Disaster Relief: In times of natural disasters, Progressive County Mutual steps up to provide support. This includes offering temporary housing solutions, waiving certain insurance requirements, and contributing to relief funds.

The Future of Progressive County Mutual

As the insurance industry continues to evolve, driven by technological advancements and changing consumer preferences, Progressive County Mutual is well-positioned to navigate these shifts. The company’s history of innovation and customer-centric approach will remain its guiding principles as it charts its path forward.

Looking ahead, Progressive County Mutual is likely to focus on several key areas to maintain its competitive edge:

- Digital Transformation: The company will continue to invest in digital technologies, enhancing its online platform and leveraging data analytics to provide even more personalized insurance solutions.

- Expanded Product Offerings: With an eye on emerging risks and changing customer needs, Progressive County Mutual will likely expand its product portfolio to include new insurance options, such as cyber insurance and insurance for emerging technologies.

- Enhanced Claims Management: The company is expected to further streamline its claims process, leveraging AI and automation to provide faster and more efficient claim settlements.

- Global Expansion: While currently focused primarily on the North American market, Progressive County Mutual may explore opportunities for international expansion, leveraging its expertise and innovative products to enter new markets.

Conclusion

In conclusion, Progressive County Mutual Insurance Company has solidified its position as a leading force in the insurance industry through a combination of innovation, customer-centricity, and financial stability. Its journey from a small Texas-based insurer to a nationally recognized brand is a testament to its ability to adapt and thrive in a highly competitive market.

As it continues to shape the future of insurance, Progressive County Mutual remains committed to its core values, ensuring that its customers receive not only the best insurance products but also an exceptional customer experience. With its eyes firmly on the horizon, the company is poised to continue its legacy of success and leadership in the insurance industry.

What makes Progressive County Mutual unique in the insurance industry?

+

Progressive County Mutual stands out for its innovative approach to insurance. From introducing pay-as-you-drive insurance to leveraging AI for claims processing, the company has consistently pushed the boundaries of what’s possible in the industry. Additionally, its commitment to customer satisfaction and community engagement sets it apart from competitors.

How does Progressive County Mutual ensure financial stability for its customers?

+

The company maintains a strong financial position, as evidenced by its A+ credit rating and robust capital reserves. This financial stability provides customers with confidence that their insurance policies are backed by a reliable and solvent insurer.

What community initiatives does Progressive County Mutual support?

+

Progressive County Mutual actively engages in various community initiatives, including education sponsorship, environmental sustainability projects, and disaster relief efforts. These initiatives reflect the company’s commitment to making a positive impact beyond its business operations.