Progressive Advanced Insurance Company

Introduction

In today’s rapidly evolving digital landscape, the insurance industry is undergoing a transformative shift, and at the forefront of this revolution is Progressive Advanced Insurance Company. With a commitment to innovation and a forward-thinking approach, this leading insurer is reshaping the way we perceive and interact with insurance services. This article delves into the remarkable journey and groundbreaking initiatives of Progressive Advanced, exploring how they are setting new standards in the industry.

Progressive Advanced Insurance Company has emerged as a pioneer, leveraging advanced technologies to enhance every aspect of the insurance experience. From streamlining processes to offering personalized coverage, their innovative strategies have positioned them as a trusted partner for individuals and businesses alike. In this article, we will uncover the key strategies, technological advancements, and real-world impact that have solidified Progressive Advanced’s position as a leader in the digital age of insurance.

Technological Advancements: Driving Innovation

AI-Powered Underwriting and Risk Assessment

At the core of Progressive Advanced’s success lies their revolutionary use of artificial intelligence (AI) in underwriting and risk assessment. Traditional methods of insurance underwriting often rely on manual processes and historical data, which can be time-consuming and may not always reflect the dynamic nature of modern risks. Progressive Advanced, however, has developed sophisticated AI algorithms that analyze vast amounts of data in real time, enabling precise and efficient risk assessment.

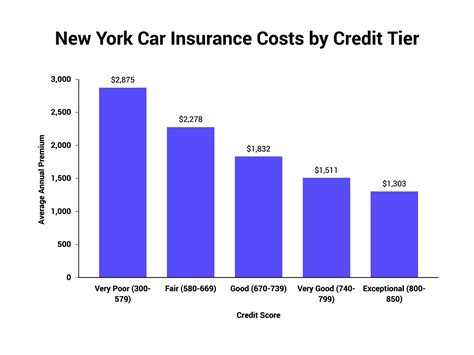

By leveraging AI, Progressive Advanced can accurately assess and price risks, ensuring that customers receive fair and competitive insurance rates. This technology also allows for continuous learning and adaptation, as the AI system can identify emerging trends and patterns, helping the company stay ahead of potential challenges and provide more accurate coverage.

Blockchain for Secure and Transparent Transactions

Recognizing the importance of security and transparency in the insurance industry, Progressive Advanced has embraced blockchain technology. Blockchain, known for its decentralized and immutable nature, provides a robust solution for secure transactions and record-keeping. By implementing blockchain, Progressive Advanced has revolutionized the way insurance policies are issued, managed, and claimed.

The use of blockchain ensures that all insurance-related transactions are secure, transparent, and tamper-proof. Policyholders can have peace of mind knowing that their data and claims are protected, while also benefiting from the efficiency and speed that blockchain technology brings. This innovative approach has not only enhanced customer trust but has also streamlined internal processes, making Progressive Advanced a trailblazer in the digital insurance space.

Smart Devices and Internet of Things (IoT) Integration

Progressive Advanced is at the forefront of utilizing smart devices and the Internet of Things (IoT) to enhance the insurance experience. By integrating IoT devices into various aspects of insurance, the company has created a more personalized and responsive ecosystem. For instance, smart home devices can provide real-time data on energy consumption, security breaches, or even potential hazards, allowing Progressive Advanced to offer customized coverage and provide proactive risk management advice to policyholders.

In the automotive industry, Progressive Advanced has implemented IoT technology in vehicles, enabling usage-based insurance programs. These programs use telematics data to assess driving behavior and offer personalized insurance rates, incentivizing safer driving practices. By harnessing the power of IoT, Progressive Advanced has not only improved customer satisfaction but has also paved the way for a more sustainable and data-driven insurance model.

Real-World Impact and Customer Experience

Streamlined Claims Process

One of the most significant benefits of Progressive Advanced’s technological advancements is the streamlined claims process. In the past, filing and processing insurance claims could be a lengthy and cumbersome process, often requiring extensive paperwork and multiple interactions with insurance providers. However, Progressive Advanced has revolutionized this experience by digitizing and automating various steps.

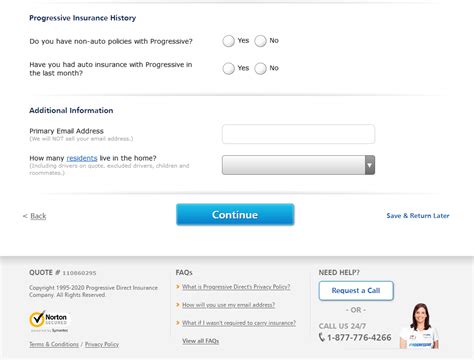

Through their innovative mobile app and online portal, policyholders can quickly and easily report claims, upload necessary documentation, and track the progress of their claim in real time. The integration of AI and machine learning algorithms enables Progressive Advanced to assess and validate claims more efficiently, reducing the time it takes to receive compensation. This not only enhances customer satisfaction but also reduces the administrative burden on both the insurer and the policyholder.

Personalized Coverage and Customized Plans

Progressive Advanced understands that every customer has unique needs and risks. Their commitment to personalized coverage has led to the development of innovative tools and platforms that allow policyholders to tailor their insurance plans to their specific requirements. Whether it’s customizing auto insurance coverage based on driving behavior or creating tailored home insurance plans that reflect the unique features of each property, Progressive Advanced ensures that customers receive the right coverage at the right price.

By leveraging advanced analytics and customer data, Progressive Advanced can offer dynamic pricing models that adapt to changing circumstances. This level of personalization not only enhances customer satisfaction but also fosters a deeper understanding of individual needs, allowing Progressive Advanced to provide more comprehensive and relevant insurance solutions.

Industry Recognition and Future Outlook

The remarkable achievements of Progressive Advanced Insurance Company have not gone unnoticed by industry experts and analysts. Progressive Advanced has consistently been recognized for its innovative practices and has received numerous accolades, including awards for technological excellence, customer service, and industry leadership. These honors reflect the company’s commitment to pushing the boundaries of what insurance can be.

Looking ahead, Progressive Advanced is poised to continue its journey of innovation and growth. With a focus on research and development, the company is constantly exploring new technologies and trends that can further enhance the insurance experience. From exploring the potential of quantum computing for complex risk modeling to leveraging augmented reality for interactive policyholder engagement, Progressive Advanced is dedicated to staying at the forefront of the digital insurance revolution.

Conclusion

Progressive Advanced Insurance Company stands as a shining example of how technology can transform and elevate the insurance industry. Through their innovative use of AI, blockchain, and IoT, they have not only streamlined processes and enhanced customer experiences but have also set new standards for personalized coverage and risk management. As the insurance landscape continues to evolve, Progressive Advanced’s unwavering commitment to technological advancement and customer-centric approaches will undoubtedly continue to shape the future of the industry.

FAQ

How does Progressive Advanced’s AI-powered underwriting process work?

+Progressive Advanced’s AI-powered underwriting process utilizes advanced algorithms to analyze vast amounts of data in real time. These algorithms assess various factors such as historical claims data, demographic information, and even social media activity to accurately determine the risk associated with a potential policyholder. This process allows for a more precise and efficient risk assessment, resulting in fair and competitive insurance rates.

What benefits does Progressive Advanced’s blockchain integration offer to policyholders?

+Progressive Advanced’s integration of blockchain technology provides policyholders with enhanced security and transparency. All insurance-related transactions are securely stored on a decentralized ledger, ensuring that policy information and claims data are tamper-proof. This not only protects policyholders’ privacy but also streamlines the claims process, as it eliminates the need for extensive paperwork and manual verification.

How does Progressive Advanced utilize IoT devices to enhance insurance coverage?

+Progressive Advanced leverages IoT devices to gather real-time data on various aspects of policyholders’ lives. For example, in the case of home insurance, smart devices can monitor energy consumption, detect security breaches, or identify potential hazards. This data allows Progressive Advanced to offer more accurate and personalized coverage, providing policyholders with tailored risk management advice. In the automotive sector, IoT integration enables usage-based insurance programs, where driving behavior is assessed to offer dynamic pricing and incentives for safe driving.