Best Ppo Health Insurance

Health insurance is an essential aspect of financial planning and healthcare management, providing individuals and families with peace of mind and access to necessary medical services. Among the various health insurance plans available, Preferred Provider Organization (PPO) plans have gained popularity for their flexibility and comprehensive coverage options. This article aims to delve into the world of PPO health insurance, exploring its features, benefits, and how it can be the best choice for individuals seeking quality healthcare coverage.

Understanding PPO Health Insurance

A Preferred Provider Organization (PPO) is a type of health insurance plan that offers policyholders the freedom to choose healthcare providers within a network of preferred doctors, hospitals, and specialists. PPO plans aim to provide a balance between cost-effectiveness and flexibility, allowing individuals to access a wide range of medical services while benefiting from negotiated rates and potential cost savings.

Key Features of PPO Plans

PPO health insurance plans are known for their unique set of features that cater to the diverse needs of policyholders. Here are some key aspects that make PPO plans attractive:

- Provider Network: PPO plans have an extensive network of healthcare providers, including doctors, hospitals, and specialists. Policyholders can choose from this network, ensuring access to a wide range of medical professionals.

- Freedom of Choice: One of the primary advantages of PPO plans is the flexibility they offer. Unlike some other insurance plans, PPO policyholders are not restricted to a specific set of providers. They can choose their preferred doctors and hospitals, providing a sense of control over their healthcare decisions.

- Negotiated Rates: PPO plans negotiate rates with healthcare providers within their network. This means that policyholders often benefit from lower costs for medical services compared to out-of-network options. These negotiated rates can lead to significant savings on healthcare expenses.

- Out-of-Network Coverage: While PPO plans encourage the use of in-network providers, they also offer coverage for out-of-network services. This flexibility allows policyholders to access specialized medical care or emergency services when needed, even if the provider is not within the PPO network.

- No Referrals Required: In most PPO plans, policyholders do not need referrals from primary care physicians to see specialists. This feature streamlines the healthcare process, allowing individuals to seek specialized care directly, saving time and effort.

- Coverage for Pre-Existing Conditions: PPO plans typically cover pre-existing conditions, ensuring that individuals with existing health issues can access the necessary medical care without worrying about coverage limitations.

Benefits of Choosing PPO Health Insurance

PPO health insurance plans offer a range of benefits that make them an attractive choice for individuals and families. Here are some key advantages to consider:

- Flexibility and Choice: The ability to choose from a vast network of healthcare providers gives policyholders the freedom to select doctors and specialists they trust. This flexibility is particularly beneficial for individuals with specific healthcare needs or those who prefer certain medical practices.

- Cost Savings: Negotiated rates with in-network providers can result in significant cost savings for policyholders. PPO plans often have lower out-of-pocket expenses compared to other insurance types, making healthcare more affordable.

- Access to Specialists: PPO plans provide direct access to specialists without the need for referrals. This feature is advantageous for individuals with complex medical conditions or those who require ongoing specialized care.

- Emergency Coverage: In case of emergencies, PPO plans offer coverage for out-of-network services. This ensures that individuals can receive immediate medical attention without worrying about insurance limitations during critical situations.

- Comprehensive Coverage: PPO plans typically cover a wide range of medical services, including preventive care, hospital stays, prescription medications, and more. This comprehensive coverage ensures that policyholders have access to the necessary healthcare services without financial strain.

- Peace of Mind: With PPO health insurance, individuals can have peace of mind knowing that they are protected against unexpected medical expenses. The plan’s coverage and flexibility provide a sense of security, allowing individuals to focus on their health and well-being.

Performance Analysis and Real-World Examples

To understand the effectiveness of PPO health insurance plans, let’s examine some real-world scenarios and performance data. Here’s an overview:

| Scenario | PPO Plan Benefits |

|---|---|

| John, a young professional with no major health concerns, seeks an affordable insurance plan with flexibility. | John chooses a PPO plan, benefiting from cost savings through negotiated rates and the freedom to choose his preferred doctors. He can access preventive care services without financial strain and has the option to explore different specialists as needed. |

| Sarah, a mother with a young family, requires regular medical check-ups and access to pediatric specialists. | Sarah opts for a PPO plan, ensuring that her family has access to a wide range of pediatricians and specialists. The plan’s coverage for well-child visits and immunizations provides peace of mind, and the direct access to specialists without referrals simplifies the healthcare process for her growing family. |

| Michael, an older adult with a history of heart disease, requires ongoing medical care and access to cardiologists. | Michael’s PPO plan offers comprehensive coverage for his heart-related conditions. He can choose cardiologists within the network, benefiting from negotiated rates. The plan’s flexibility allows him to schedule regular check-ups and access specialized care without the hassle of referrals. |

Comparative Analysis: PPO vs. Other Insurance Types

When considering health insurance options, it’s essential to understand how PPO plans compare to other types of insurance. Here’s a brief comparison:

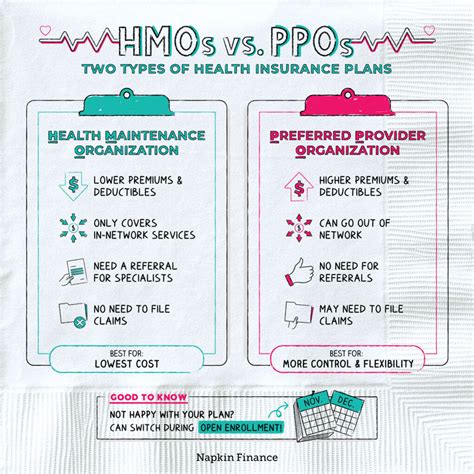

- PPO vs. HMO (Health Maintenance Organization): PPO plans offer more flexibility compared to HMOs, as they do not require referrals for specialists and provide coverage for out-of-network services. PPO plans may have higher premiums but offer greater choice and convenience.

- PPO vs. EPO (Exclusive Provider Organization): Similar to PPO plans, EPO plans have a network of preferred providers. However, EPO plans do not cover out-of-network services, limiting policyholders’ choices. PPO plans provide more flexibility and coverage options.

- PPO vs. POS (Point of Service): POS plans combine elements of HMOs and PPOs. While PPO plans offer more flexibility, POS plans require referrals for out-of-network services. PPO plans provide a simpler and more straightforward approach to healthcare coverage.

Future Implications and Industry Insights

As the healthcare industry evolves, PPO health insurance plans are likely to continue playing a significant role in providing quality coverage. Here are some future implications and industry insights:

- Digital Health Integration: With the rise of digital health technologies, PPO plans are expected to integrate digital solutions, such as telemedicine and mobile health apps, to enhance the patient experience and improve access to care.

- Value-Based Care: The healthcare industry is shifting towards value-based care models, focusing on outcomes and patient satisfaction. PPO plans may adapt to incorporate value-based initiatives, offering incentives for policyholders to choose high-quality, cost-effective healthcare providers.

- Focus on Preventive Care: PPO plans are likely to continue emphasizing preventive care services, encouraging policyholders to take proactive steps towards maintaining their health. This approach not only improves overall well-being but also reduces long-term healthcare costs.

- Expanded Network Options: PPO plans may expand their provider networks to include a more diverse range of healthcare professionals, ensuring that policyholders have access to a comprehensive range of medical services and specialties.

- Personalized Health Plans: In the future, PPO plans may offer more personalized coverage options, allowing individuals to customize their insurance plans based on their unique healthcare needs and preferences.

Expert Insights

💡 According to industry experts, PPO health insurance plans offer a compelling balance between cost-effectiveness and flexibility. The ability to choose from a vast network of providers and access specialized care directly sets PPO plans apart. As the healthcare landscape continues to evolve, PPO plans are well-positioned to meet the diverse needs of individuals and families, providing comprehensive coverage and a seamless healthcare experience.

Frequently Asked Questions

How do PPO plans differ from HMO plans in terms of provider choice and coverage flexibility?

+PPO plans offer more flexibility compared to HMO plans. PPO policyholders can choose from a network of preferred providers without requiring referrals for specialists. HMO plans, on the other hand, typically require members to choose a primary care physician and obtain referrals for specialist visits. PPO plans provide greater freedom and choice in selecting healthcare providers.

What are the potential cost savings associated with PPO health insurance plans?

+PPO plans negotiate rates with healthcare providers within their network, resulting in lower costs for policyholders. In-network services are typically more affordable than out-of-network options. Additionally, PPO plans often have lower out-of-pocket expenses, such as deductibles and copayments, making healthcare more financially manageable.

Can I choose any doctor or specialist with a PPO plan, even if they are not in the network?

+While PPO plans encourage the use of in-network providers, they also offer coverage for out-of-network services. Policyholders can choose to see out-of-network doctors or specialists, but they may incur higher costs. However, PPO plans provide some level of coverage for these services, ensuring that individuals have access to the necessary medical care.

Are there any limitations or exclusions in PPO health insurance plans?

+Like any insurance plan, PPO plans may have certain limitations and exclusions. These can vary depending on the specific policy and insurance provider. It’s essential to review the plan’s details, including any exclusions, to understand the coverage comprehensively. However, PPO plans generally offer comprehensive coverage for a wide range of medical services.

How can I find the best PPO health insurance plan for my needs and budget?

+To find the best PPO health insurance plan, consider your healthcare needs, budget, and preferred level of flexibility. Compare different PPO plans offered by various insurance providers, evaluating factors such as provider networks, coverage limits, and out-of-pocket expenses. Seek advice from insurance brokers or financial advisors who can guide you in choosing a plan that aligns with your specific requirements.