Insurance Comprehensive Meaning

In the realm of risk management and financial protection, insurance plays a pivotal role, offering individuals and businesses a crucial safety net against unforeseen events and losses. The term "insurance" encompasses a broad range of policies designed to mitigate risks and provide financial stability. Among these, comprehensive insurance stands out as a comprehensive and versatile option, offering extensive coverage and peace of mind.

Understanding Comprehensive Insurance

Comprehensive insurance is a type of policy that offers broad coverage, protecting policyholders from a wide range of potential risks and liabilities. Unlike more basic or limited insurance policies that cover specific events or perils, comprehensive insurance aims to provide a more all-encompassing level of protection.

This type of insurance is particularly valuable for those seeking to safeguard their assets and financial well-being against a variety of unforeseen circumstances. It is designed to offer a robust safety net, providing coverage for multiple risks under a single policy.

Key Features of Comprehensive Insurance

Comprehensive insurance policies are known for their breadth of coverage. They typically include protection against a wide array of perils, including but not limited to:

- Property Damage: Covers damage to physical assets like homes, vehicles, or business premises.

- Liability: Provides protection against legal claims and financial liabilities arising from accidents or injuries caused by the policyholder.

- Theft and Burglary: Offers compensation for losses due to theft or burglary, including stolen items and potential damage to the property.

- Natural Disasters: Provides coverage for damages caused by natural events like floods, hurricanes, earthquakes, or wildfires.

- Accidents and Injuries: Offers medical and rehabilitation benefits for policyholders and their covered dependents who suffer accidents or injuries.

- Legal Expenses: Covers the costs of legal representation and related expenses in certain situations.

- Business Interruption: Provides financial support to businesses that suffer losses due to disruptions in operations, such as after a covered event.

The exact coverage and terms of a comprehensive insurance policy can vary depending on the provider, the type of policy, and the specific needs and circumstances of the policyholder.

Benefits and Advantages

The primary benefit of comprehensive insurance is its all-encompassing nature. By bundling multiple types of coverage into a single policy, policyholders can enjoy the convenience and cost-effectiveness of managing their risks through a single provider. This simplifies the insurance process and often results in more affordable premiums compared to purchasing separate policies for each risk.

Additionally, comprehensive insurance policies are often highly customizable. Policyholders can tailor their coverage to their specific needs and circumstances, ensuring they have the right level of protection without paying for unnecessary coverage. This flexibility allows individuals and businesses to create a personalized safety net that aligns with their unique risks and financial situations.

Furthermore, comprehensive insurance policies often come with additional benefits and perks. These can include 24/7 emergency assistance, access to a network of preferred providers, and specialized services like road assistance for vehicle policies or disaster response teams for property policies. These added services enhance the overall value and peace of mind offered by comprehensive insurance.

Common Examples of Comprehensive Insurance

Comprehensive insurance is a versatile concept, applicable to a wide range of situations and needs. Here are some common examples of comprehensive insurance policies:

1. Homeowner’s Insurance

Homeowner’s insurance is a popular form of comprehensive insurance, providing coverage for a wide range of risks associated with homeownership. It typically includes protection against property damage, liability, theft, and natural disasters. Many policies also offer additional coverage options, such as personal property protection, guest medical liability, and identity theft protection.

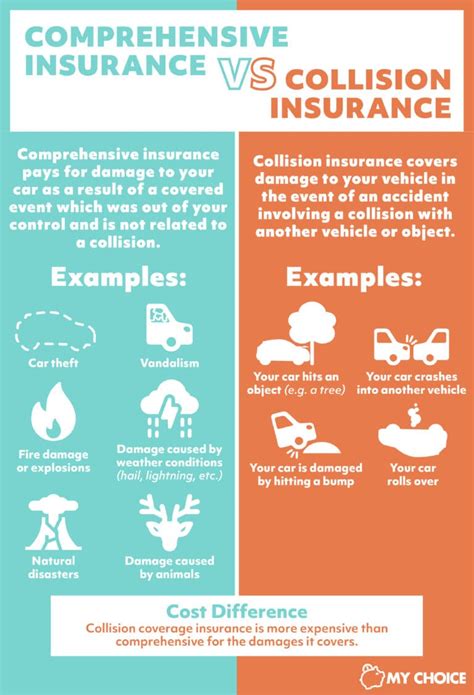

2. Auto Insurance

Auto insurance is another prevalent example of comprehensive coverage. While basic auto insurance policies may only cover liability and collision, comprehensive auto insurance policies provide additional protection against a wide range of perils, including theft, vandalism, and natural disasters. This type of policy ensures that policyholders are financially protected even in situations beyond their control.

3. Business Insurance

Business insurance is crucial for protecting commercial enterprises against various risks. Comprehensive business insurance policies can cover a wide range of perils, including property damage, liability, business interruption, and cyber risks. These policies are tailored to the specific needs of the business, ensuring that the coverage aligns with the nature of the business and its potential risks.

4. Health Insurance

Health insurance is a vital form of comprehensive coverage, providing financial protection against the high costs of medical care. Comprehensive health insurance policies typically include coverage for hospital stays, doctor visits, prescription medications, and preventive care. Many policies also offer additional benefits like dental and vision coverage, mental health services, and alternative medicine treatments.

Real-World Scenarios and Case Studies

To better understand the value and impact of comprehensive insurance, let’s explore some real-world scenarios and case studies:

Case Study 1: Natural Disaster Protection

Imagine a homeowner living in an area prone to hurricanes. Despite the potential risk, the homeowner opts for a comprehensive homeowner’s insurance policy that includes coverage for hurricane damage. When a category 3 hurricane hits the region, causing extensive damage to homes and infrastructure, the homeowner’s policy kicks in, providing financial support for repairs and temporary housing. Without comprehensive insurance, the homeowner would have faced significant financial burdens and potential hardship.

Case Study 2: Auto Accident Coverage

A driver with comprehensive auto insurance is involved in a severe accident that totals their vehicle. Fortunately, their policy includes coverage for property damage, liability, and medical expenses. The insurance provider covers the cost of repairing the other driver’s vehicle, compensates for any medical bills incurred, and provides a rental car while the insured vehicle is being repaired. The driver’s comprehensive insurance policy ensures they are not left financially burdened by the accident.

Case Study 3: Business Interruption Protection

A small business owner invests in comprehensive business insurance, including coverage for business interruption. Unfortunately, a fire breaks out in their premises, causing significant damage and forcing them to temporarily cease operations. The business interruption coverage in their policy provides financial support to cover lost income and the costs of temporary relocation, ensuring the business can weather the disruption and continue operating.

Performance Analysis and Metrics

Assessing the performance and effectiveness of comprehensive insurance policies can be complex due to the wide range of coverage and potential scenarios involved. However, several key metrics and indicators can provide insights into the value and impact of these policies.

Claims Satisfaction

One of the most critical indicators of the performance of comprehensive insurance policies is the level of satisfaction among policyholders during the claims process. Insurance providers often conduct surveys and collect feedback to gauge how well they have met the needs of policyholders during times of loss or damage. High satisfaction rates indicate that the policies are effectively providing the promised coverage and support.

Loss Ratio

The loss ratio is a key metric in the insurance industry that measures the relationship between the amount of money an insurance company pays out in claims and the amount of money it collects in premiums. A high loss ratio, where the amount paid out in claims is relatively close to the amount collected in premiums, can indicate that the insurance company is experiencing a high volume of claims or that its underwriting practices may need adjustment. On the other hand, a low loss ratio may suggest that the insurance company is effectively managing its risks and has a healthy balance between premiums and claims.

Policyholder Retention

The retention rate of policyholders is another crucial metric for comprehensive insurance providers. High retention rates indicate that policyholders are satisfied with their coverage and the services provided by the insurance company. Conversely, low retention rates may suggest that policyholders are switching to other providers due to dissatisfaction with the coverage, pricing, or customer service.

Financial Stability

The financial stability of insurance companies offering comprehensive policies is also a critical factor. Insurance companies must maintain adequate reserves to pay out claims and ensure they can meet their obligations even during times of high claim volumes. Financial stability ratings and reports provide insights into the financial health and solvency of insurance providers, helping policyholders assess the long-term viability of their chosen insurer.

Customer Service Ratings

The quality of customer service provided by insurance companies is often a critical factor in the success and performance of comprehensive insurance policies. High customer service ratings indicate that policyholders receive prompt, efficient, and courteous assistance when they need it most. Positive customer service experiences can lead to higher satisfaction and retention rates, contributing to the overall success of the insurance provider.

Future Implications and Trends

The insurance industry is constantly evolving, and comprehensive insurance policies are no exception. As technology advances and consumer needs change, the future of comprehensive insurance is likely to be shaped by several key trends and developments.

Technological Integration

The integration of technology into the insurance industry is a significant trend that is set to impact comprehensive insurance policies. Insurtech, or insurance technology, is revolutionizing the way policies are designed, underwritten, and managed. From digital underwriting and risk assessment to the use of artificial intelligence and machine learning for claims processing, technology is enhancing the efficiency and accuracy of comprehensive insurance.

Personalization and Customization

One of the key advantages of comprehensive insurance is its ability to be tailored to the unique needs and circumstances of policyholders. As consumer expectations evolve, the trend towards personalization and customization is likely to continue. Insurance providers will increasingly offer more flexible and customizable policies, allowing individuals and businesses to choose the specific coverage they need while keeping costs manageable.

Risk Assessment and Mitigation

Advancements in data analytics and risk assessment tools are enabling insurance providers to better understand and mitigate risks. By leveraging data-driven insights, comprehensive insurance policies can be designed to address emerging risks and provide more targeted coverage. This trend towards more precise risk assessment and mitigation is expected to continue, enhancing the effectiveness and value of comprehensive insurance.

Collaborative Models

The insurance industry is witnessing a shift towards more collaborative models, with insurers partnering with other organizations to enhance their services and reach. For example, insurance providers may collaborate with technology companies to offer innovative solutions or with healthcare providers to improve the management of health-related risks. These collaborative models are likely to become more prevalent, leading to more integrated and holistic insurance offerings.

Sustainability and Environmental Concerns

As environmental concerns and sustainability become increasingly important, the insurance industry is likely to respond with new products and initiatives. Comprehensive insurance policies may incorporate sustainability factors, such as coverage for environmental risks or incentives for policyholders to adopt more sustainable practices. The insurance industry has a role to play in promoting sustainability and addressing environmental challenges, and comprehensive insurance is expected to be a key tool in this effort.

Conclusion

Comprehensive insurance is a vital tool for individuals and businesses seeking to protect their assets and financial well-being against a wide range of risks. By offering broad coverage and customizable options, these policies provide peace of mind and financial stability. As the insurance industry continues to evolve, comprehensive insurance policies will adapt to meet the changing needs and expectations of policyholders, leveraging technology, personalization, and sustainability to deliver even more value.

What is the difference between comprehensive insurance and other types of insurance policies?

+

Comprehensive insurance is distinct from other types of insurance policies in its breadth of coverage. While other policies may focus on specific risks or perils, comprehensive insurance aims to provide protection against a wide range of potential risks, offering a more all-encompassing level of financial protection.

How can I determine if I need comprehensive insurance?

+

Assessing your individual or business needs is crucial in determining whether comprehensive insurance is right for you. Consider the potential risks you may face, such as property damage, liability, or natural disasters, and evaluate how a comprehensive policy could provide coverage and peace of mind. Consult with an insurance professional to understand the specific risks you face and the coverage options available.

Are there any disadvantages to comprehensive insurance policies?

+

One potential disadvantage of comprehensive insurance policies is their cost. Due to the broad coverage they provide, these policies may be more expensive than more limited insurance options. Additionally, the specific terms and conditions of a comprehensive policy may be more complex, requiring careful review and understanding to ensure the coverage meets your needs.

![Erie Insurance Group] Erie Insurance Group]](https://media.pecb.com/assets/img/erie-insurance-group.jpeg)