Cheapest Home Owner Insurance

Unveiling the Most Affordable Homeowner Insurance: A Comprehensive Guide

In the vast landscape of insurance options, finding the cheapest homeowner insurance that also provides comprehensive coverage can be a challenging yet rewarding endeavor. This comprehensive guide will delve into the world of homeowner insurance, offering expert insights and practical tips to help you secure the most cost-effective policy while ensuring your home and belongings are adequately protected.

With the right knowledge and strategy, you can navigate the insurance market confidently, making informed decisions that align with your budget and coverage needs. Let's embark on this journey to uncover the secrets of affordable homeowner insurance.

Understanding the Basics of Homeowner Insurance

Homeowner insurance is a vital investment for any property owner, offering financial protection against a range of potential risks and perils. This coverage extends beyond the physical structure of your home, encompassing your personal belongings, liability, and additional living expenses in the event of a covered loss.

The cost of homeowner insurance can vary significantly depending on various factors, including the location, size, and construction of your home, as well as your personal coverage preferences and deductibles. Understanding these variables is key to tailoring an insurance policy that suits your needs and budget.

Researching and Comparing Policies: A Step-by-Step Guide

To secure the cheapest homeowner insurance, a thorough research and comparison process is essential. Here's a step-by-step guide to help you navigate this journey:

Step 1: Assess Your Coverage Needs

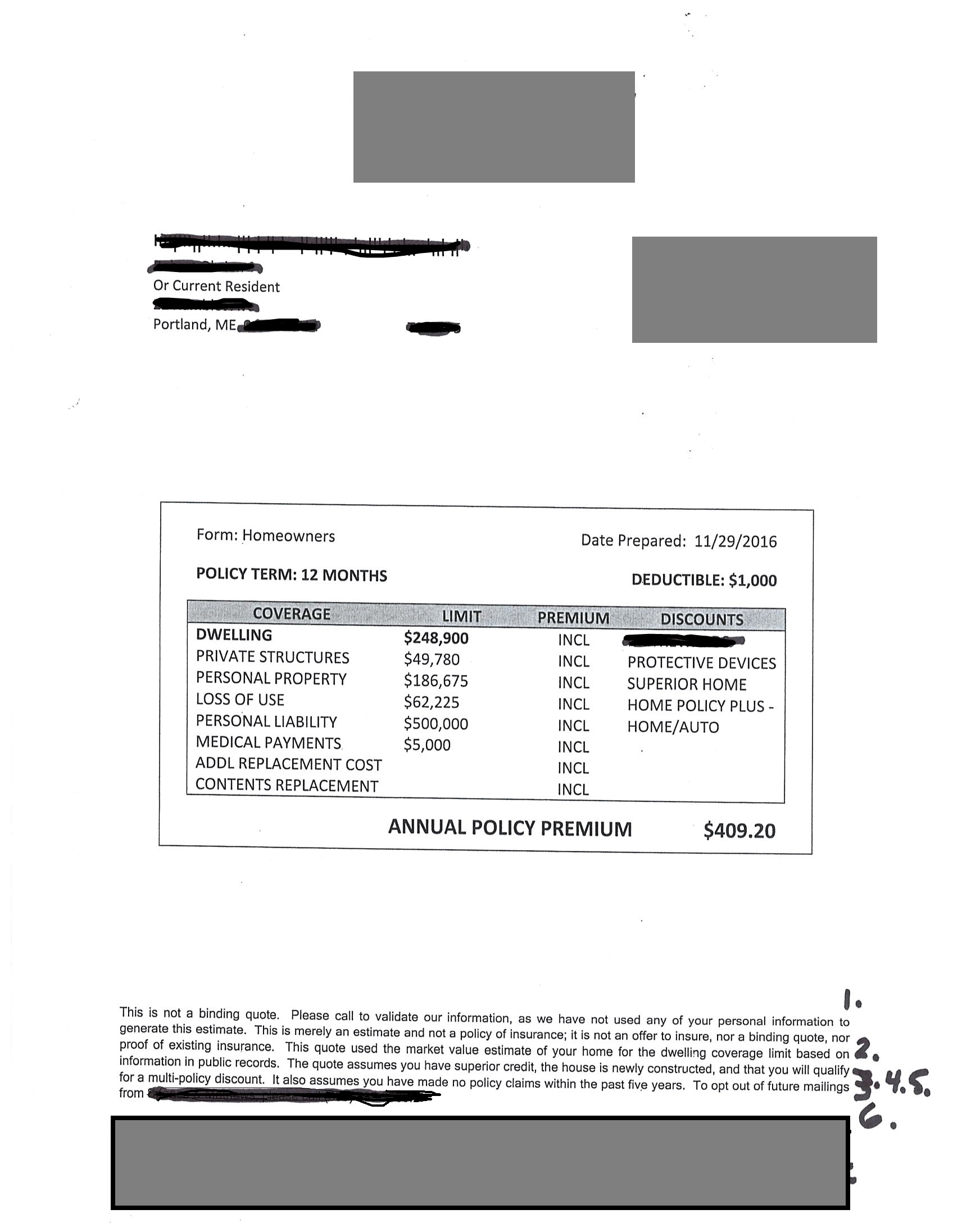

Start by evaluating the specific coverage requirements for your home and belongings. Consider factors such as the replacement cost of your home, the value of your personal possessions, and the potential liability risks associated with your property. This assessment will guide you in selecting the appropriate coverage limits and endorsements.

Step 2: Explore Insurance Companies and Policies

Familiarize yourself with the major insurance carriers in your area, including both national and local providers. Research their financial stability, customer satisfaction ratings, and the range of coverage options they offer. Compare policies side by side, paying attention to the specific coverage limits, deductibles, and any additional perks or discounts provided.

Step 3: Obtain Multiple Quotes

Request quotes from at least three insurance companies to get a clear understanding of the market rates. Ensure that each quote is tailored to your specific coverage needs and preferences. This process will help you identify the most competitive pricing options available.

Step 4: Analyze Policy Details

Beyond the cost, delve into the fine print of each policy. Compare the coverage limits, deductibles, and any exclusions or limitations. Look for policies that offer broad coverage without unnecessary restrictions. Consider additional endorsements or riders that can enhance your protection while staying within your budget.

Step 5: Evaluate Discounts and Savings Opportunities

Insurance companies often provide discounts to incentivize policyholders. Common discounts include multi-policy discounts (bundling homeowner insurance with other policies like auto insurance), loyalty discounts for long-term customers, and safety discounts for homes equipped with security systems or fire prevention measures. Explore these opportunities to further reduce your premium costs.

Optimizing Your Homeowner Insurance Premium

Apart from comparing policies, there are several strategies you can employ to optimize your homeowner insurance premium and make it more affordable:

Increase Your Deductible

Opting for a higher deductible can significantly reduce your insurance premium. However, it's essential to ensure that the deductible amount is manageable in the event of a claim. A higher deductible means you'll pay more out-of-pocket in the event of a loss, so choose a level that balances cost savings with your financial comfort.

Bundle Your Policies

Bundling multiple insurance policies, such as homeowner and auto insurance, with the same carrier can lead to substantial savings. Insurance companies often offer multi-policy discounts to encourage customers to consolidate their coverage needs.

Enhance Your Home's Safety

Investing in home safety measures can not only reduce the risk of losses but also qualify you for insurance discounts. Consider installing a monitored security system, fire alarms, and smoke detectors. Some insurance companies also offer discounts for homes equipped with smart home technology, such as water leak detection systems.

Review Your Coverage Regularly

Your insurance needs may change over time, so it's crucial to review your policy annually. Assess whether your coverage limits are still adequate and make adjustments as necessary. Regular policy reviews also provide an opportunity to explore new discounts or coverage options that may have become available.

Common Pitfalls to Avoid in Homeowner Insurance

While pursuing the cheapest homeowner insurance, it's important to be aware of potential pitfalls that could compromise your coverage or financial stability. Here are some common mistakes to avoid:

Underestimating Coverage Needs

Choosing a policy solely based on cost without considering your coverage needs can leave you underinsured. It's essential to ensure that your policy provides adequate coverage for your home's replacement cost, personal belongings, and liability risks.

Neglecting Policy Details

Failing to thoroughly review the policy details, including coverage limits, deductibles, and exclusions, can result in unexpected gaps in coverage. Always read the fine print and seek clarification from your insurance agent or broker if needed.

Overlooking Discounts

Many homeowners miss out on valuable discounts that could reduce their premium costs. Be proactive in exploring and taking advantage of available discounts, such as multi-policy, loyalty, or safety discounts.

Skipping Annual Reviews

Regularly reviewing your insurance policy is crucial to ensure it aligns with your changing needs and circumstances. Neglecting annual reviews can lead to outdated coverage and missed opportunities for cost savings.

Future Trends and Innovations in Homeowner Insurance

The homeowner insurance landscape is evolving, with emerging technologies and trends shaping the industry. Here's a glimpse into the future of homeowner insurance:

Digitalization and Data Analytics

Insurance companies are increasingly leveraging data analytics and artificial intelligence to improve risk assessment and pricing accuracy. This trend is expected to lead to more tailored and affordable insurance policies, as insurers gain a deeper understanding of individual risk profiles.

Telematics and Usage-Based Insurance

Telematics technology, which tracks and analyzes driving behavior, is gaining traction in the insurance industry. Similar technologies could be applied to homeowner insurance, where sensors and smart devices monitor and assess home usage patterns, potentially influencing premium costs based on actual risk exposure.

Parametric Insurance

Parametric insurance is an innovative approach that provides coverage based on specific parameters, such as weather events or natural disasters. This type of insurance offers quick and reliable payouts, making it an attractive option for homeowners seeking faster claims settlements.

Peer-to-Peer Insurance

Peer-to-peer insurance models, where policyholders contribute to a communal pool of funds and share risks, are gaining popularity. These models offer an alternative to traditional insurance, potentially providing more affordable coverage options and a sense of community.

Conclusion: Securing Affordable Protection for Your Home

Finding the cheapest homeowner insurance that provides comprehensive coverage is a worthwhile pursuit. By understanding the basics, conducting thorough research, and employing strategic optimization techniques, you can secure an affordable policy that protects your home and belongings without breaking the bank.

Stay informed about the evolving trends in the insurance industry, and don't hesitate to seek expert advice from insurance professionals. With the right approach and knowledge, you can navigate the homeowner insurance market confidently and make informed decisions that safeguard your assets and peace of mind.

What is the average cost of homeowner insurance in the United States?

+The average cost of homeowner insurance in the US varies by state and can range from 500 to 2,000 annually. Factors like location, home value, and coverage options significantly impact the premium.

Are there any government programs or subsidies available for homeowner insurance?

+Some states offer government-backed programs or subsidies for homeowner insurance, particularly for low-income households or properties in high-risk areas. Check with your state’s insurance department for more information.

Can I customize my homeowner insurance policy to suit my specific needs?

+Absolutely! Most insurance companies allow policyholders to customize their coverage by choosing specific limits, deductibles, and endorsements. This flexibility ensures you get the coverage that aligns with your unique circumstances.