Estimate House Insurance

Understanding the intricacies of home insurance is crucial for homeowners as it provides financial protection against various risks and unexpected events. This article aims to provide an in-depth guide on estimating house insurance, covering essential factors, common pitfalls, and expert tips to help homeowners make informed decisions when insuring their properties.

Assessing Your Property’s Value and Risks

The first step in estimating house insurance is to accurately assess the value of your property and identify potential risks. This involves understanding the replacement cost, which is the amount required to rebuild your home and replace its contents in the event of a total loss. Factors such as the age, size, and construction materials of your home play a significant role in determining its replacement cost.

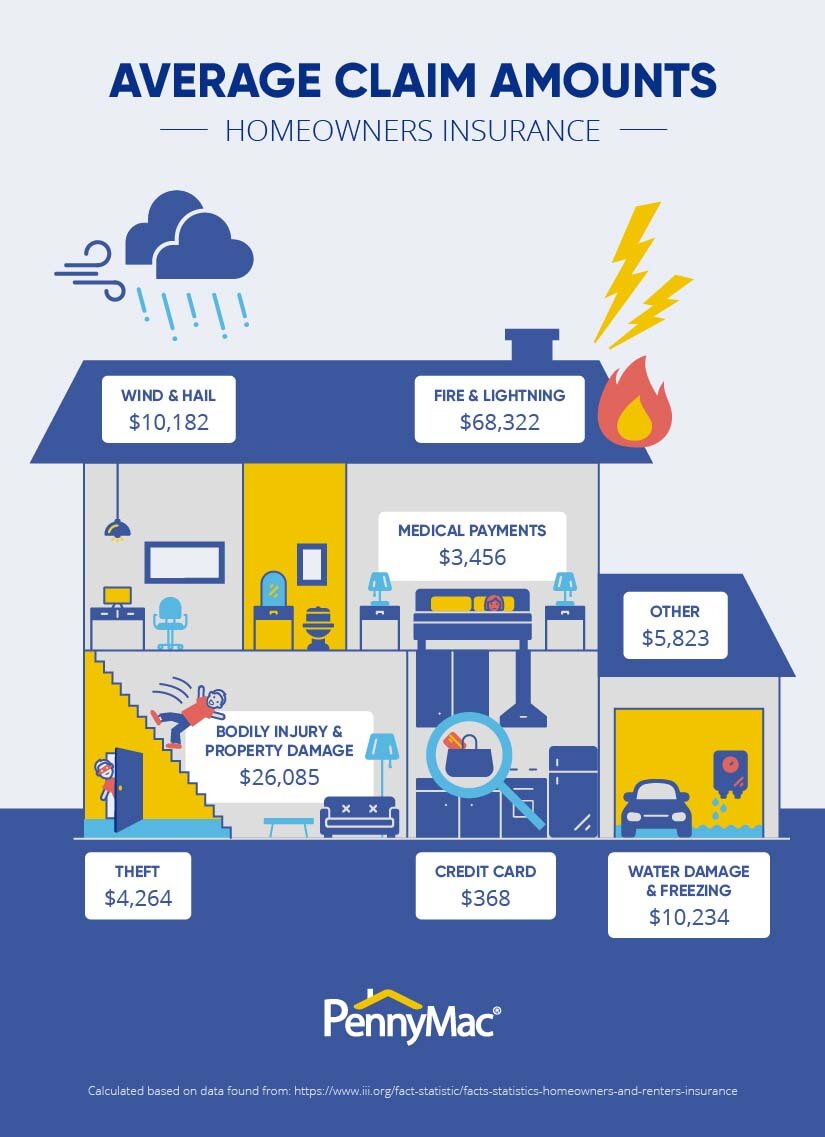

Additionally, identifying specific risks associated with your property is essential. These risks can include natural disasters like hurricanes, tornadoes, or earthquakes, as well as man-made hazards such as fire, theft, or vandalism. By evaluating these risks, you can tailor your insurance coverage to address the unique challenges your property may face.

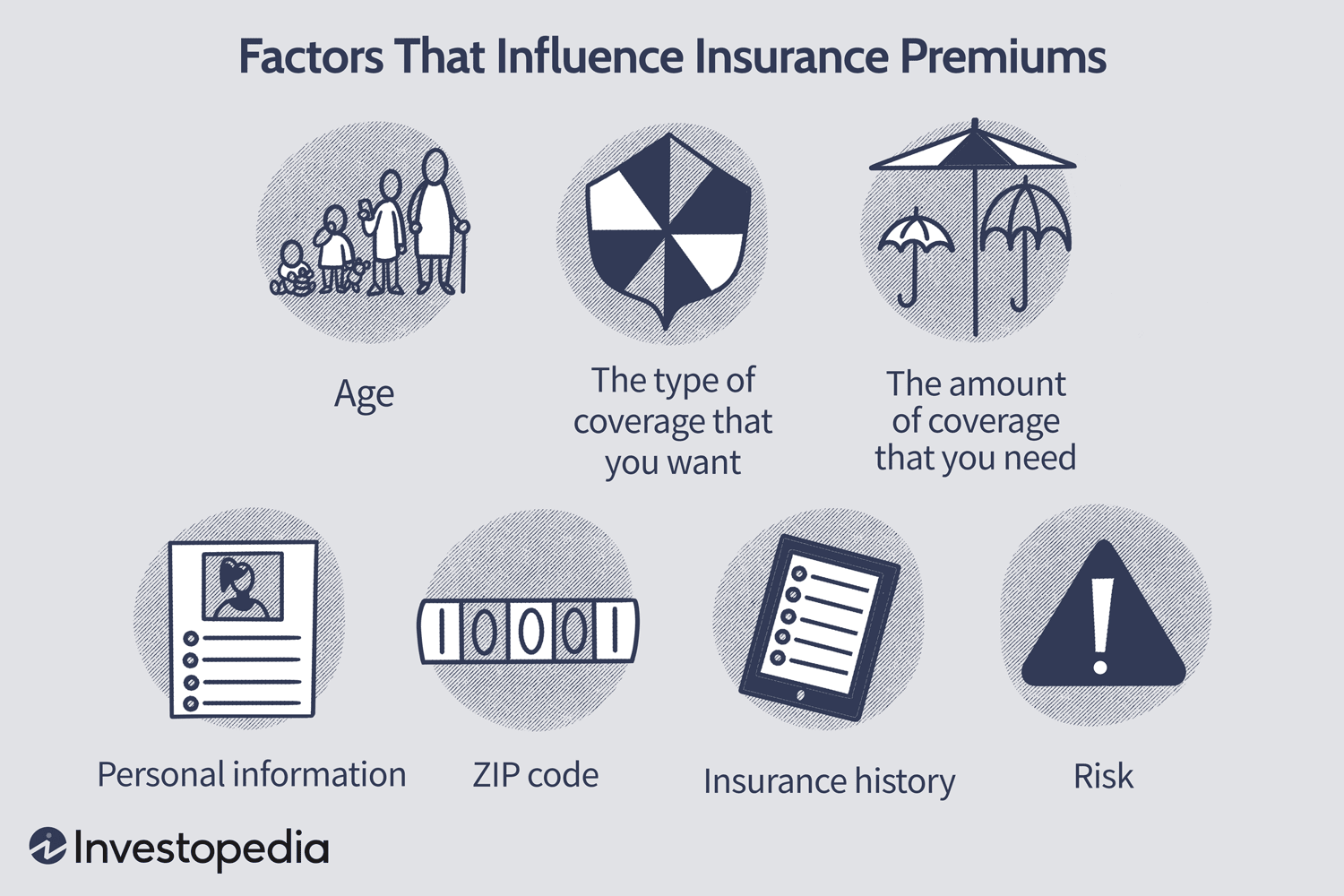

Factors Influencing Insurance Premiums

When estimating house insurance, it’s important to consider the various factors that influence insurance premiums. These factors can vary depending on your location, the type of property, and your personal circumstances. Here are some key elements to keep in mind:

- Location and Environment: The geographic location of your home plays a significant role in determining insurance rates. Areas prone to natural disasters or with a higher crime rate may result in higher premiums. It's essential to understand the specific risks associated with your locality.

- Property Age and Condition: Older homes may require more extensive coverage due to the increased likelihood of wear and tear. The condition of your property, including its maintenance and any recent renovations, can also impact insurance costs.

- Coverage Options: Different types of insurance coverage are available, including dwelling coverage, personal property coverage, liability coverage, and additional living expenses. The level of coverage you choose will directly influence your insurance premiums.

- Deductibles and Limits: Deductibles refer to the amount you agree to pay out of pocket before your insurance coverage kicks in. Higher deductibles can result in lower premiums, but it's important to strike a balance that suits your financial situation. Insurance limits, which specify the maximum amount your insurer will pay for a covered loss, also impact premiums.

| Coverage Type | Description |

|---|---|

| Dwelling Coverage | Protects the structure of your home against damages. |

| Personal Property Coverage | Covers the contents of your home, such as furniture and electronics. |

| Liability Coverage | Provides protection against legal claims and lawsuits arising from accidents or injuries on your property. |

| Additional Living Expenses | Covers the cost of temporary housing if your home becomes uninhabitable due to a covered loss. |

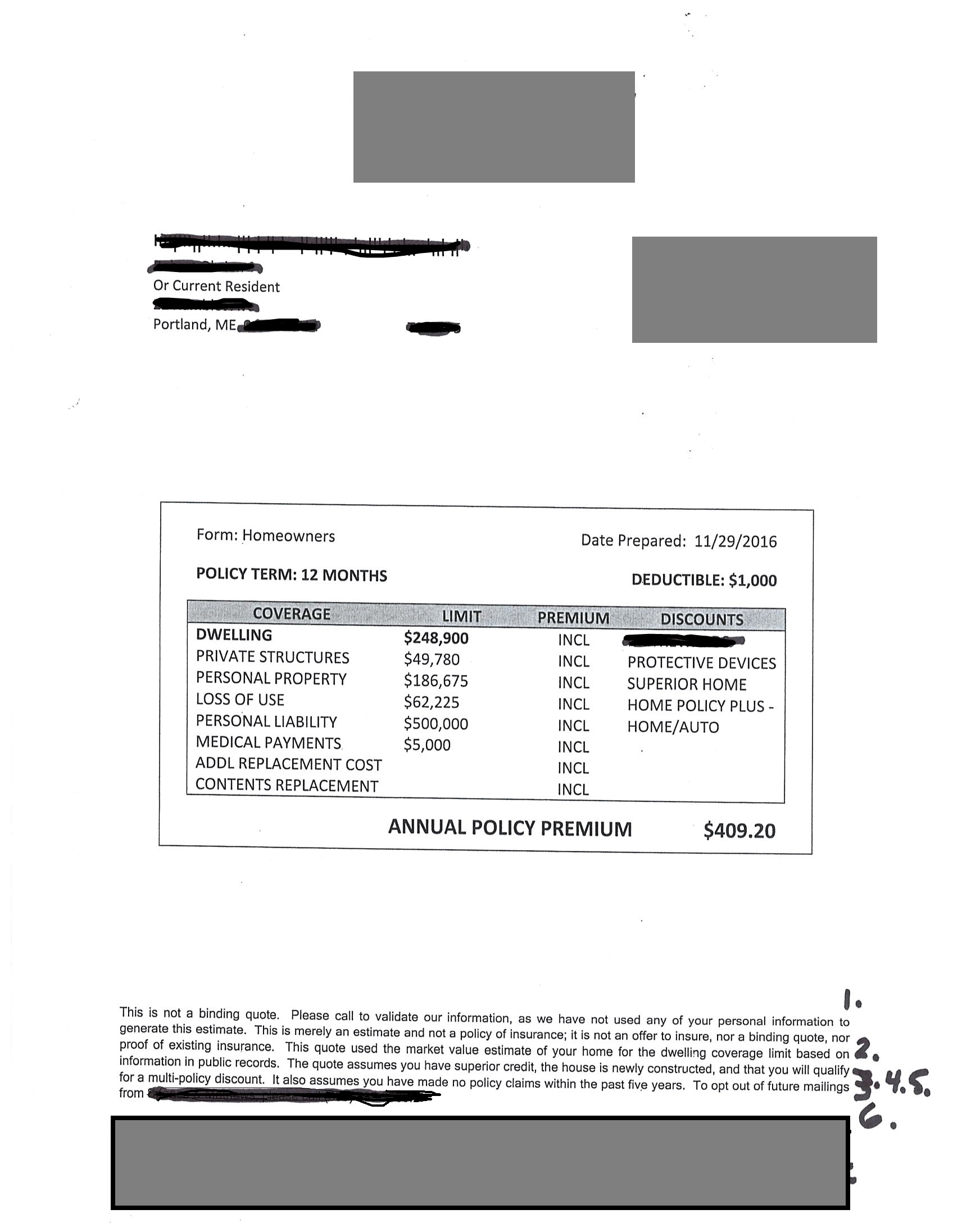

Comparing Insurance Providers and Quotes

To estimate house insurance accurately, it’s essential to compare quotes from multiple insurance providers. Each insurer may offer different coverage options, premium rates, and policy terms. By obtaining quotes from several providers, you can assess the market and make an informed decision about which insurer best suits your requirements.

When comparing quotes, pay attention to the coverage limits, deductibles, and any additional perks or discounts offered by each insurer. Some providers may offer bundle discounts if you combine your home and auto insurance policies, while others may provide discounts for installing security systems or making energy-efficient upgrades to your home.

Understanding Policy Exclusions and Limitations

Insurance policies often come with exclusions and limitations, which are situations or events that are not covered by the policy. It’s crucial to carefully review these exclusions to ensure you understand what is and isn’t covered by your insurance.

Common exclusions may include damage caused by floods, earthquakes, or other natural disasters, unless you have specific coverage for these events. Additionally, certain types of personal property, such as high-value jewelry or collectibles, may require separate coverage or endorsements to ensure adequate protection.

By understanding the exclusions and limitations of your policy, you can make informed decisions about any additional coverage you may need to protect your property and belongings fully.

Customizing Your Insurance Coverage

Every homeowner’s insurance needs are unique, and it’s important to tailor your coverage to your specific circumstances. Consider the following factors when customizing your insurance coverage:

- Personal Property Valuation: Assess the value of your personal belongings and choose a coverage limit that adequately protects your possessions. Consider factors like inflation and the cost of replacing items with new ones.

- Liability Protection: Evaluate your liability risks and choose a coverage limit that provides sufficient protection against potential lawsuits or claims arising from accidents on your property.

- Additional Coverage Options : Explore optional coverage endorsements, such as flood insurance, earthquake insurance, or personal liability coverage for specific activities. These additional coverages can provide peace of mind and protect against unique risks.

- Home Business Coverage: If you operate a home-based business, ensure you have adequate coverage for your business equipment, inventory, and potential liability risks associated with your business activities.

Expert Tips for Lowering Insurance Costs

While it’s essential to have adequate insurance coverage, homeowners can take steps to potentially lower their insurance costs. Here are some expert tips to consider:

- Home Security Systems: Installing a monitored security system or fire alarm system can often lead to discounts on your insurance premiums. These systems not only enhance your property's security but also provide an added layer of protection against potential losses.

- Maintenance and Upkeep: Regularly maintaining your home and addressing any necessary repairs can help prevent future issues and reduce the risk of insurance claims. Well-maintained properties are often viewed more favorably by insurers.

- Review and Update Coverage Regularly: Insurance needs can change over time, so it's important to review your coverage annually and make adjustments as necessary. This ensures that your insurance remains up-to-date and provides adequate protection for your evolving circumstances.

- Combine Policies: Consider bundling your home and auto insurance policies with the same insurer. Many providers offer discounts for customers who combine multiple policies, potentially saving you money on your overall insurance costs.

Finalizing Your Insurance Estimate

After assessing your property’s value and risks, comparing quotes, and customizing your coverage, it’s time to finalize your insurance estimate. Here’s a step-by-step guide to help you through this process:

- Choose the Right Insurer: Based on your research and comparisons, select an insurer that offers the coverage you need at a competitive rate. Consider factors like the insurer's financial stability, customer service reputation, and claims handling process.

- Review and Sign the Policy: Carefully review the policy documents provided by your chosen insurer. Ensure that all the coverage limits, deductibles, and exclusions align with your expectations and needs. Sign the policy and provide any necessary information to complete the insurance application.

- Pay Your Premium: Pay your initial insurance premium to activate your coverage. Most insurers offer flexible payment options, including monthly, quarterly, or annual payments. Choose the option that best suits your financial situation.

- Keep Records and Stay Informed: Maintain records of your insurance policy, including the policy number, coverage details, and contact information for your insurer. Stay informed about any changes to your policy or coverage limits, and regularly review your policy to ensure it continues to meet your needs.

Common Misconceptions and Pitfalls

When estimating house insurance, it’s important to be aware of common misconceptions and pitfalls that can lead to inadequate coverage or unexpected costs. Here are some key points to keep in mind:

- Overestimating or Underestimating Coverage: It's crucial to find the right balance when estimating coverage limits. Overestimating coverage can result in higher premiums, while underestimating coverage may leave you vulnerable to financial losses in the event of a claim. Take the time to accurately assess your needs and choose coverage limits that provide adequate protection.

- Assuming All Risks Are Covered: Insurance policies typically have standard exclusions, and it's important to understand what is and isn't covered. For example, flood damage is often not covered by standard home insurance policies and requires separate flood insurance coverage. Review your policy carefully to ensure you're aware of any potential gaps in coverage.

- Neglecting to Update Coverage: As your home and circumstances change, so do your insurance needs. Regularly review your coverage to ensure it aligns with your current situation. Factors like renovations, additions to your home, or changes in personal property value may require adjustments to your insurance policy.

Conclusion: Taking Control of Your Insurance Journey

Estimating house insurance is a crucial step in safeguarding your home and financial well-being. By understanding the factors that influence insurance premiums, comparing quotes, and customizing your coverage, you can make informed decisions and ensure you have adequate protection. Remember to regularly review and update your insurance policy to reflect any changes in your circumstances.

With the right knowledge and expertise, you can navigate the insurance landscape with confidence and peace of mind, knowing that your home and belongings are adequately protected.

What is the average cost of home insurance?

+The average cost of home insurance can vary widely depending on factors such as location, property value, and coverage limits. As of 2023, the average annual premium for homeowners insurance in the United States is around $1,300. However, it’s important to note that this is just an average, and your specific premium may be higher or lower based on your individual circumstances.

Can I get discounts on my home insurance premiums?

+Yes, many insurance providers offer discounts to their customers. Common discounts include bundle discounts for combining home and auto insurance policies, safety discounts for installing security systems or smoke detectors, and loyalty discounts for long-term customers. It’s worth exploring these options with your insurer to potentially lower your premiums.

What should I do if I need to make a claim on my home insurance policy?

+If you need to make a claim on your home insurance policy, the first step is to contact your insurance provider as soon as possible. They will guide you through the claims process, which typically involves providing details about the incident, assessing the damage, and submitting any necessary documentation. It’s important to follow the insurer’s instructions and cooperate fully during the claims process.

How often should I review and update my home insurance coverage?

+It’s recommended to review your home insurance coverage annually or whenever significant changes occur in your life or property. Changes such as renovations, additions to your home, or increases in personal property value may impact your insurance needs. Regularly reviewing your coverage ensures that you have adequate protection and helps identify any potential gaps in your policy.