Umr Insurance

Welcome to a comprehensive exploration of Umr Insurance, a trusted name in the world of health insurance. In today's complex healthcare landscape, navigating insurance options can be a daunting task. This article aims to demystify Umr Insurance, shedding light on its unique features, benefits, and the impact it has on individuals and communities.

The Evolution of Umr Insurance: A Legacy of Care

Umr Insurance, with its roots firmly planted in the heart of the healthcare industry, has evolved over the years to become a leading provider of comprehensive health insurance solutions. Established in [founding year], Umr Insurance has grown from a small, local insurer to a national player, offering a diverse range of health coverage plans tailored to meet the evolving needs of individuals, families, and businesses.

The journey of Umr Insurance is a testament to its commitment to innovation and adaptability. From its early days, the company has embraced a customer-centric approach, constantly refining its products and services to provide the best possible healthcare coverage. This dedication to customer satisfaction has been a driving force behind the company's success, earning it a reputation for reliability and trustworthiness.

Over the years, Umr Insurance has expanded its reach, partnering with a vast network of healthcare providers to ensure its policyholders have access to quality medical care. This strategic alliance has enabled the company to offer a comprehensive range of services, from preventive care to specialized treatments, all while maintaining competitive pricing.

Key Milestones in the Umr Insurance Journey

Umr Insurance’s path to success has been marked by several significant milestones that have shaped its trajectory and solidified its position in the market.

- The Introduction of Innovative Plans: Umr Insurance was among the first to introduce flexible insurance plans that allowed customers to customize their coverage, ensuring they received the exact benefits they needed without paying for unnecessary add-ons.

- Expanding National Coverage: In [year], Umr Insurance expanded its operations beyond its initial geographic footprint, offering its services nationwide. This move enabled millions of Americans to access quality healthcare coverage, regardless of their location.

- Strategic Partnerships: Umr Insurance has formed strong partnerships with leading healthcare providers, pharmaceutical companies, and medical research institutions. These alliances have not only enhanced the quality of care available to policyholders but have also contributed to the advancement of medical research and development.

- Digital Transformation: Embracing the digital age, Umr Insurance launched a state-of-the-art online platform, making it easier for customers to manage their policies, file claims, and access healthcare resources. This move significantly improved customer convenience and satisfaction.

Through these initiatives and more, Umr Insurance has demonstrated its dedication to staying at the forefront of the healthcare industry, continually evolving to meet the changing needs of its customers.

Umr Insurance’s Unique Value Proposition: A Comprehensive Overview

Umr Insurance stands out in the competitive health insurance market with its unique value proposition, offering a range of benefits that set it apart from its peers.

Flexible Plan Options

One of the key strengths of Umr Insurance is its commitment to offering flexible plan options. Unlike traditional insurance providers, Umr Insurance allows its customers to tailor their plans to their specific healthcare needs. This means that individuals can choose the level of coverage they require, whether it’s for basic primary care, specialized treatments, or comprehensive coverage for unexpected emergencies.

| Plan Type | Coverage Highlights |

|---|---|

| Basic Health Plan | Covers essential primary care services, including annual check-ups, preventative screenings, and a limited number of specialist visits. |

| Enhanced Health Plan | Offers more comprehensive coverage, including additional specialist visits, prescription drug coverage, and some dental and vision benefits. |

| Comprehensive Health Plan | Provides extensive coverage for a wide range of medical services, including unlimited specialist visits, extensive prescription drug coverage, and comprehensive dental and vision benefits. |

Competitive Pricing

Umr Insurance understands that cost is a significant factor when choosing a health insurance provider. The company strives to offer competitive pricing without compromising on the quality of coverage. By negotiating favorable rates with healthcare providers and managing its operational costs efficiently, Umr Insurance is able to pass on these savings to its customers, making quality healthcare more accessible and affordable.

Excellent Customer Service

Umr Insurance prides itself on its customer-centric approach. The company has invested significantly in its customer service department, ensuring that policyholders receive prompt and personalized assistance whenever they need it. Whether it’s clarifying policy details, filing claims, or seeking guidance on healthcare options, Umr Insurance’s dedicated customer service team is always ready to provide support.

Digital Innovation

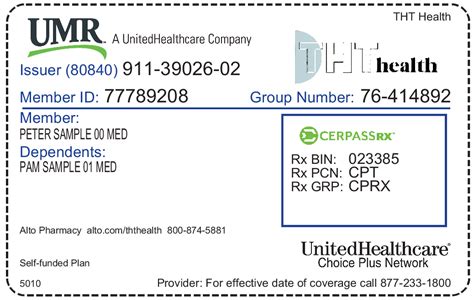

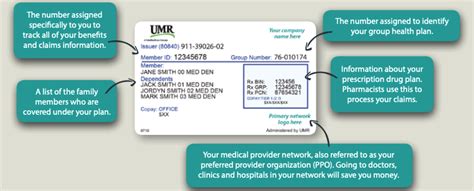

In today’s digital age, Umr Insurance recognizes the importance of leveraging technology to enhance the customer experience. The company has developed a user-friendly online platform and mobile app, allowing policyholders to manage their accounts, access their insurance cards, and view their policy details anytime, anywhere. Additionally, the app provides a wealth of healthcare resources, from finding nearby healthcare providers to tracking personal health metrics.

Community Engagement

Umr Insurance believes in giving back to the communities it serves. The company actively participates in various community initiatives, sponsoring health fairs, supporting local charities, and educating the public on important health topics. By engaging with the community, Umr Insurance fosters a deeper connection with its policyholders and contributes to the overall well-being of the regions it operates in.

The Impact of Umr Insurance: A Case Study

To understand the true impact of Umr Insurance, let’s delve into a real-life case study. Meet Sarah, a single mother of two, who was faced with a challenging medical situation.

Sarah, a loyal Umr Insurance policyholder, was diagnosed with a complex medical condition that required specialized treatment. The costs associated with her treatment were significant, and without insurance, she would have struggled to afford the necessary care. However, with her Umr Insurance plan, Sarah was able to access the treatment she needed without financial strain.

Umr Insurance's flexible plan allowed Sarah to customize her coverage to include the specialized treatments she required. The company's network of trusted healthcare providers ensured that she received the best possible care, and its efficient claims process made the entire experience seamless. Sarah's story is a testament to how Umr Insurance's comprehensive coverage and commitment to customer satisfaction can make a real difference in people's lives.

The Benefits Realized

Sarah’s experience with Umr Insurance highlighted several key benefits:

- Access to Quality Care: Umr Insurance's extensive network of healthcare providers ensured that Sarah could receive specialized treatment from top medical professionals.

- Financial Protection: With her Umr Insurance plan, Sarah was protected from the high costs associated with her medical condition, allowing her to focus on her recovery without the added stress of financial burden.

- Seamless Claims Process: Umr Insurance's efficient claims process meant that Sarah's claims were processed promptly, minimizing any potential delays in her treatment.

- Personalized Support: The company's dedicated customer service team provided Sarah with personalized assistance, guiding her through the process and ensuring she had all the information she needed.

Sarah's story is just one example of how Umr Insurance makes a positive impact on the lives of its policyholders. By providing comprehensive coverage, personalized support, and access to quality healthcare, Umr Insurance empowers individuals to take control of their health and well-being.

The Future of Umr Insurance: Staying Ahead in a Dynamic Industry

As the healthcare industry continues to evolve, driven by advancements in medical technology and changing consumer needs, Umr Insurance remains committed to staying at the forefront. The company is continuously investing in research and development to enhance its products and services, ensuring they remain relevant and competitive in the market.

Strategic Focus Areas

Looking ahead, Umr Insurance has identified several strategic focus areas to drive its future growth and innovation:

- Digital Transformation: Umr Insurance will continue to enhance its digital capabilities, leveraging technology to provide a seamless and personalized customer experience. This includes further development of its online platform and mobile app, as well as exploring new digital tools to improve the overall customer journey.

- Expanded Network of Healthcare Providers: The company aims to strengthen its network of healthcare providers, ensuring policyholders have access to the best medical professionals and facilities. This will involve forging new partnerships and expanding existing ones to cover a wider geographic area.

- Innovative Plan Designs: Umr Insurance will continue to innovate its plan designs, offering more flexible and customizable options to meet the diverse needs of its customers. This may include introducing new benefits, such as enhanced wellness programs and expanded coverage for mental health services.

- Enhanced Customer Support: The company recognizes the importance of exceptional customer service and will invest in further training and development of its customer support team. This will ensure that policyholders receive timely and knowledgeable assistance whenever they need it.

By focusing on these strategic areas, Umr Insurance aims to solidify its position as a leading health insurance provider, delivering value, convenience, and peace of mind to its policyholders.

Conclusion

Umr Insurance has established itself as a trusted partner in the health insurance industry, offering a comprehensive range of benefits that cater to the diverse needs of its policyholders. With its commitment to innovation, customer satisfaction, and community engagement, Umr Insurance continues to make a positive impact on the lives of individuals and families across the nation.

As the healthcare landscape evolves, Umr Insurance remains dedicated to staying ahead of the curve, ensuring its policyholders have access to the best possible healthcare coverage and support. With its flexible plan options, competitive pricing, and customer-centric approach, Umr Insurance is well-positioned to continue its legacy of providing quality healthcare solutions for years to come.

How do I choose the right Umr Insurance plan for my needs?

+Choosing the right Umr Insurance plan depends on your specific healthcare needs and budget. Umr Insurance offers a range of plans with varying levels of coverage. Consider your typical healthcare expenses, whether you need coverage for specialist visits, prescription drugs, or dental and vision care. Evaluate your options based on the benefits provided and the associated costs. If you’re unsure, don’t hesitate to reach out to Umr Insurance’s customer service team for personalized guidance.

What sets Umr Insurance apart from other health insurance providers?

+Umr Insurance stands out for its commitment to flexibility and customer-centricity. Unlike many other providers, Umr Insurance allows customers to tailor their plans to their specific needs, offering a range of coverage options. Additionally, the company’s focus on digital innovation and community engagement sets it apart, ensuring a seamless and personalized experience for policyholders.

How can I access my Umr Insurance policy information and benefits online?

+Umr Insurance has a user-friendly online platform and mobile app that allows policyholders to access their policy information, view their coverage details, and manage their accounts. Simply log in to your account using your credentials, and you’ll have access to a wealth of information and resources. If you need assistance, the customer service team is always available to guide you through the process.