Cost Renters Insurance

Renter's insurance, also known as tenant's insurance, is a vital yet often overlooked form of protection for individuals living in rented accommodations. It provides financial coverage for personal belongings, liability, and additional living expenses in the event of unforeseen circumstances. This article aims to delve into the intricacies of renter's insurance, exploring its costs, benefits, and the factors that influence pricing. By understanding the ins and outs of this coverage, renters can make informed decisions to safeguard their possessions and ensure peace of mind.

Understanding Renter’s Insurance

Renter’s insurance is a specialized type of policy designed to cater to the unique needs of tenants. Unlike homeowners insurance, which covers the structure of a home along with personal belongings, renter’s insurance focuses primarily on the contents within a rented property. This includes furniture, electronics, clothing, and other personal items. Additionally, it offers liability protection, covering medical expenses and legal costs if a guest is injured on the rental property or if the tenant accidentally causes damage to someone else’s property.

The primary purpose of renter's insurance is to provide financial assistance in the event of losses due to covered perils, such as fire, theft, or vandalism. It also offers protection against personal liability claims, which can be a significant financial burden if an accident occurs on the rental property. Furthermore, renter's insurance often includes additional living expenses coverage, ensuring that policyholders have temporary accommodation and other necessary expenses covered in the event that their rental home becomes uninhabitable due to a covered loss.

The Cost of Renter’s Insurance

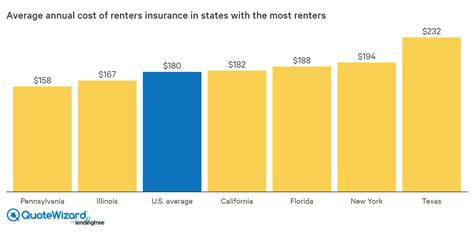

The cost of renter’s insurance varies based on several factors, including the location of the rental property, the value of personal belongings, and the level of coverage chosen. On average, renters can expect to pay anywhere between 15 to 30 per month for a basic policy. However, it’s essential to note that prices can fluctuate significantly depending on individual circumstances and the insurance provider.

One of the primary factors influencing the cost of renter's insurance is the location of the rental property. Areas with higher crime rates or a higher likelihood of natural disasters tend to have more expensive insurance premiums. Additionally, the value of personal belongings plays a crucial role in determining the cost of coverage. Policyholders with more valuable possessions will generally pay higher premiums to ensure adequate protection.

The level of coverage chosen is another significant factor in determining the cost of renter's insurance. Policyholders can opt for different coverage limits, deductibles, and additional endorsements to tailor their policy to their specific needs. Higher coverage limits and lower deductibles generally result in higher premiums, while choosing a higher deductible can reduce the cost of insurance.

Factors Affecting Cost

- Location: The cost of renter’s insurance is influenced by the location of the rental property. Areas with higher crime rates or a higher risk of natural disasters often have higher insurance premiums.

- Personal Belongings Value: The value of personal possessions is a significant factor in determining insurance costs. Policyholders with more valuable items may need to pay higher premiums to ensure adequate coverage.

- Coverage Level: The level of coverage chosen impacts the cost of renter’s insurance. Higher coverage limits and lower deductibles typically result in higher premiums, while opting for a higher deductible can reduce insurance costs.

- Claims History: Insurance companies consider the claims history of the rental property and the policyholder. A history of frequent claims may lead to higher premiums.

- Policy Add-ons: Additional endorsements or policy add-ons, such as coverage for high-value items or identity theft protection, can increase the overall cost of renter’s insurance.

Average Cost Breakdown

On average, the cost of renter’s insurance can be broken down as follows:

| Coverage Type | Average Monthly Cost |

|---|---|

| Basic Policy (Personal Belongings) | $15 to $30 |

| Liability Coverage | $5 to $10 (additional) |

| Additional Living Expenses | $5 to $15 (additional) |

It's important to note that these averages are estimates and actual costs may vary based on individual circumstances and insurance providers.

Benefits of Renter’s Insurance

Renter’s insurance offers a range of benefits that make it an essential consideration for anyone living in a rented property. Firstly, it provides financial protection for personal belongings, ensuring that policyholders can replace or repair their possessions if they are damaged or stolen. This peace of mind is invaluable, especially for renters who may have invested significant funds in furnishing their homes.

Additionally, renter's insurance offers liability protection, which is crucial in today's litigious society. It covers medical expenses and legal costs if a guest is injured on the rental property or if the tenant is held responsible for causing damage to someone else's property. This protection can provide significant financial relief and prevent policyholders from facing devastating financial consequences.

Furthermore, renter's insurance often includes additional living expenses coverage. In the event that a rental home becomes uninhabitable due to a covered loss, this coverage ensures that policyholders have the necessary funds to cover temporary accommodation and other essential expenses until they can return to their home. This added layer of protection provides stability and support during challenging times.

Factors Influencing Renter’s Insurance Premiums

Several factors come into play when insurance providers determine the premiums for renter’s insurance policies. Understanding these factors can help renters make informed decisions and potentially negotiate better rates.

Claims History

Insurance companies closely examine the claims history of both the rental property and the policyholder. A history of frequent claims, whether made by previous tenants or the current policyholder, can lead to higher premiums. It’s important for renters to maintain a good claims record to avoid unnecessary increases in insurance costs.

Credit Score

Insurance providers often consider an individual’s credit score when determining premiums. A higher credit score can indicate a lower risk profile, which may result in more favorable insurance rates. Renters with excellent credit scores may be eligible for discounts or more competitive pricing.

Policy Add-ons

Additional endorsements or policy add-ons can impact the overall cost of renter’s insurance. Renters who choose to add coverage for high-value items, such as jewelry or artwork, or opt for identity theft protection, may see an increase in their insurance premiums. It’s essential to carefully evaluate the need for these add-ons and weigh the benefits against the additional cost.

Discounts and Bundling

Many insurance providers offer discounts to renters who bundle their insurance policies. By combining renter’s insurance with other policies, such as auto insurance or homeowners insurance, renters can often save money. Additionally, insurance companies may provide discounts for policyholders who maintain a certain level of coverage or have a long-standing relationship with the provider.

Choosing the Right Renter’s Insurance

Selecting the right renter’s insurance policy involves careful consideration of individual needs and circumstances. Renters should start by assessing the value of their personal belongings and determining the level of coverage required. It’s crucial to ensure that the policy provides adequate protection for high-value items and covers the potential costs of additional living expenses in the event of a covered loss.

When comparing insurance providers, renters should pay attention to the reputation and financial stability of the company. Reading reviews and seeking recommendations from trusted sources can help identify reliable insurers. Additionally, it's beneficial to understand the claims process and the level of customer support offered by each provider.

Renters should also carefully review the policy's terms and conditions, including any exclusions or limitations. Understanding these details can prevent misunderstandings and ensure that the policy provides the desired coverage. It's advisable to discuss any concerns or questions with an insurance agent or broker to ensure a clear understanding of the policy.

Making the Most of Renter’s Insurance

Once a renter’s insurance policy is in place, there are several steps policyholders can take to maximize the benefits and ensure a smooth claims process.

Maintain an Inventory

Keeping an up-to-date inventory of personal belongings is essential for accurate coverage and efficient claims processing. Renters should regularly update their inventory, including photographs and receipts, to ensure that their possessions are adequately insured. This inventory can also assist in the event of a loss, providing a comprehensive list of items to be replaced or repaired.

Understand Coverage Limits

Policyholders should carefully review their policy’s coverage limits to ensure that they align with their needs. Understanding the maximum amount that the insurance provider will pay for specific types of losses is crucial. If the policyholder has high-value items or expects to incur significant additional living expenses in the event of a covered loss, they may need to increase their coverage limits to ensure adequate protection.

Know the Claims Process

Familiarizing oneself with the claims process is essential to ensure a timely and efficient resolution. Policyholders should understand the steps involved in filing a claim, including any necessary documentation and timelines. It’s beneficial to keep important contact information, such as the insurance provider’s claims hotline, readily available in case of an emergency.

Review and Update Regularly

Renters should review their insurance policies annually or whenever significant life changes occur. These changes may include acquiring new possessions, moving to a different rental property, or experiencing a change in financial circumstances. Regularly reviewing and updating the policy ensures that coverage remains appropriate and up-to-date, providing the necessary protection for personal belongings and liability concerns.

Conclusion

Renter’s insurance is a crucial investment for anyone living in a rented property. It provides financial protection for personal belongings, liability coverage, and support for additional living expenses in the event of a covered loss. By understanding the factors that influence the cost of renter’s insurance and carefully selecting the right policy, renters can enjoy peace of mind and ensure their possessions are adequately safeguarded.

Through regular inventory maintenance, a thorough understanding of coverage limits, and familiarity with the claims process, policyholders can make the most of their renter's insurance. By staying informed and proactive, renters can navigate the complexities of insurance coverage with confidence, knowing they have the necessary protection in place.

How much does renter’s insurance typically cost per month?

+On average, renter’s insurance costs between 15 to 30 per month. However, the cost can vary significantly based on factors such as location, personal belongings value, and coverage level.

What is covered under renter’s insurance?

+Renter’s insurance typically covers personal belongings, liability, and additional living expenses. It provides financial assistance for losses due to covered perils and protects against personal liability claims.

How can I reduce the cost of renter’s insurance?

+To reduce costs, renters can shop around for quotes from multiple insurance providers, bundle policies, maintain a good claims history, and consider increasing the deductible.

Is renter’s insurance required by law?

+Renter’s insurance is not typically required by law, but it is highly recommended to protect personal belongings and provide liability coverage. Landlords may require tenants to have renter’s insurance as a condition of the lease.

What happens if I file a claim with my renter’s insurance?

+When filing a claim, renters should contact their insurance provider and follow the specified claims process. The insurer will assess the claim, verify coverage, and provide financial assistance based on the policy’s terms and conditions.