Hazard Insurance Florida

When it comes to safeguarding your property in the sunshine state, understanding the nuances of hazard insurance, or homeowners insurance, is crucial. Florida, known for its vibrant culture, diverse landscapes, and unique climate, presents homeowners with specific challenges and considerations when it comes to protecting their investments. This comprehensive guide will delve into the world of hazard insurance in Florida, offering insights, tips, and strategies to ensure your home and belongings are adequately covered.

Understanding Hazard Insurance in Florida

In the context of Florida, hazard insurance serves as a vital component of homeowners insurance policies. It is designed to protect property owners from various perils and damages that could potentially affect their homes and personal belongings. Given Florida’s susceptibility to natural disasters, including hurricanes, floods, and wildfires, having robust hazard insurance coverage is not just a wise choice; it’s an essential one.

Hazard insurance policies typically cover a range of potential hazards, including fire, windstorms, hail, and even damage caused by falling objects. In Florida, where the threat of hurricanes is a reality, this coverage becomes even more critical. However, it's important to note that certain natural disasters, such as floods, may require separate insurance policies, as they are often excluded from standard hazard insurance plans.

The importance of hazard insurance in Florida extends beyond protecting your physical assets. It also provides financial security, ensuring that you can rebuild or repair your home and replace your belongings if they are damaged or destroyed. With the unpredictable nature of Florida's weather, having this peace of mind is invaluable.

Customizing Your Hazard Insurance Policy

When it comes to hazard insurance in Florida, one size does not fit all. The unique characteristics of your home, its location, and your personal belongings will influence the type and level of coverage you need. Here’s a closer look at some key considerations when customizing your hazard insurance policy:

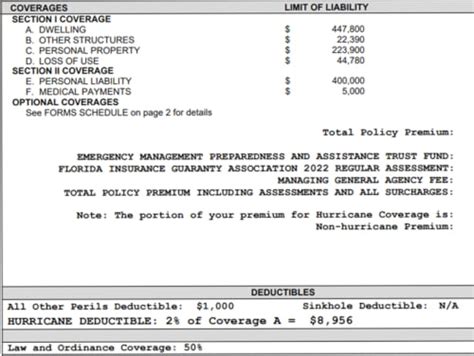

Dwelling Coverage

This aspect of your policy provides coverage for the physical structure of your home. It’s crucial to ensure that your dwelling coverage limit is sufficient to rebuild your home in the event of a total loss. Consider factors such as the cost of labor and materials in your area, as well as any unique features or upgrades in your home.

| Coverage Type | Description |

|---|---|

| Replacement Cost Coverage | Pays to rebuild your home at current costs, regardless of your home's original cost. |

| Actual Cash Value Coverage | Pays the cost to rebuild your home, minus depreciation. |

Personal Property Coverage

This coverage protects your personal belongings, such as furniture, clothing, and electronics. It’s important to assess the value of your possessions and choose a coverage limit that reflects their true worth. Keep in mind that certain high-value items, like jewelry or art, may require additional endorsements or separate policies.

Liability Coverage

Liability coverage is designed to protect you from financial loss if someone is injured on your property or if your actions off your property cause injury or damage to others. It can also cover legal costs if you are sued. Make sure your liability limits are sufficient to protect your assets in the event of a lawsuit.

Additional Living Expenses Coverage

In the event that your home becomes uninhabitable due to a covered peril, this coverage will reimburse you for additional living expenses, such as hotel stays or restaurant meals, until you can return to your home.

The Impact of Florida’s Climate on Hazard Insurance

Florida’s climate, characterized by its hot and humid summers and the threat of hurricanes and tropical storms, significantly influences the cost and availability of hazard insurance. Here’s a deeper look at how these factors come into play:

Hurricane Season and Windstorm Coverage

Florida’s hurricane season, which runs from June 1st to November 30th, is a period of heightened risk for homeowners. During this time, insurers may place restrictions on new policies or even stop writing new policies altogether. This is why it’s crucial to have your hazard insurance in place well before the season begins.

Windstorm coverage, which protects against damage caused by hurricanes and tropical storms, is typically included in standard hazard insurance policies in Florida. However, it's important to review your policy carefully to understand the specific coverage limits and any exclusions or deductibles that may apply.

Flood Insurance

While hazard insurance covers a range of perils, it typically does not include flood damage. In Florida, where flooding can occur due to heavy rainfall, storm surges, or rising water levels, having separate flood insurance is essential. The National Flood Insurance Program (NFIP) offers flood insurance policies, which can be purchased through private insurers or directly from the NFIP.

Wildfire Risk

Florida’s wildfire risk is relatively low compared to other states, but it’s still a consideration, particularly in certain regions. Hazard insurance policies may provide coverage for wildfire damage, but it’s important to review your policy to understand the specifics. In some cases, insurers may require additional measures, such as fire-resistant roofing, to maintain coverage.

Navigating the Insurance Process in Florida

Obtaining hazard insurance in Florida involves a series of steps and considerations. Here’s a guide to help you through the process:

Choosing an Insurance Provider

There are numerous insurance providers operating in Florida, offering a range of policies and coverage options. When selecting an insurer, consider factors such as their financial stability, customer service reputation, and the specific coverage options they provide. It’s also beneficial to seek recommendations from trusted sources, such as friends, family, or local real estate professionals.

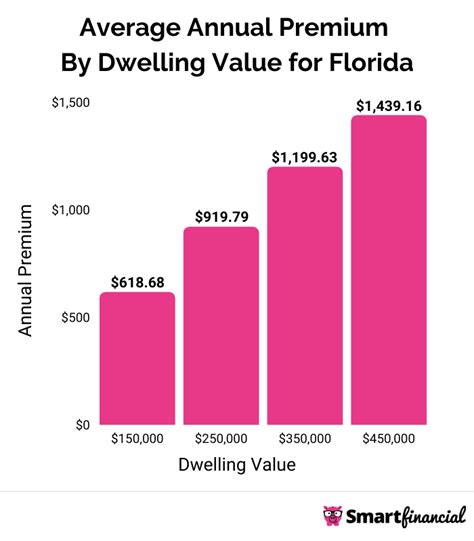

Obtaining a Quote

Once you’ve identified potential insurers, the next step is to obtain quotes. Most insurance providers offer online quote tools, allowing you to input information about your home and receive a personalized quote. Be sure to provide accurate and detailed information to ensure you receive an accurate quote. If you have any questions or need clarification, don’t hesitate to reach out to the insurer’s customer service team.

Reviewing Your Policy

When you receive your policy, it’s crucial to review it thoroughly. Pay close attention to the coverage limits, deductibles, and any exclusions or restrictions. Ensure that the policy aligns with your needs and expectations. If you have any concerns or questions, contact your insurer to discuss them.

Making Changes to Your Policy

As your circumstances change, your insurance needs may also evolve. Whether you’ve made significant upgrades to your home, acquired new possessions, or experienced changes in your personal situation, it’s important to review your hazard insurance policy regularly and make necessary adjustments. This ensures that you maintain adequate coverage at all times.

The Future of Hazard Insurance in Florida

The world of hazard insurance in Florida is constantly evolving, influenced by factors such as changing climate patterns, technological advancements, and shifts in the insurance industry. Here’s a glimpse into the future of hazard insurance in the sunshine state:

Climate Change and Its Impact

As climate change continues to affect weather patterns, the frequency and intensity of natural disasters in Florida may increase. This could lead to rising insurance costs and more stringent underwriting practices. Insurers may also introduce new products or coverage options to address these changing risks.

Technological Innovations

Advancements in technology are likely to play a significant role in the future of hazard insurance. For instance, the use of drones for risk assessment and claims adjustment could become more widespread, improving the accuracy and efficiency of the insurance process. Additionally, the integration of smart home technologies and sensors could provide insurers with real-time data, allowing for more precise risk assessment and potentially lowering insurance costs for policyholders.

Industry Trends and Regulatory Changes

The insurance industry in Florida is subject to ongoing regulatory changes and market trends. These can impact the availability and cost of hazard insurance. For example, the introduction of new laws or regulations related to natural disaster preparedness or building codes could influence the coverage options and requirements for homeowners.

Community Engagement and Risk Mitigation

As the importance of community engagement and risk mitigation becomes increasingly recognized, insurers may offer incentives or discounts to homeowners who actively contribute to disaster preparedness efforts. This could include participation in community flood mitigation projects, implementation of wildfire prevention measures, or adoption of energy-efficient home improvements.

What is the difference between hazard insurance and homeowners insurance in Florida?

+In Florida, hazard insurance is a key component of homeowners insurance. While homeowners insurance provides a comprehensive package of coverages, including liability protection and coverage for personal belongings, hazard insurance specifically covers damage to the physical structure of your home caused by various perils such as fire, windstorms, and hail.

Is flood insurance included in hazard insurance policies in Florida?

+No, flood insurance is typically not included in standard hazard insurance policies in Florida. Given the state’s susceptibility to flooding due to hurricanes, heavy rainfall, and storm surges, it’s important to have separate flood insurance coverage. You can obtain flood insurance through the National Flood Insurance Program (NFIP) or private insurers.

How can I ensure my hazard insurance coverage is sufficient for my home in Florida?

+To ensure your hazard insurance coverage is sufficient, consider the following: Assess the replacement cost of your home, including the cost of labor and materials in your area. Review your personal property coverage to ensure it reflects the true value of your belongings. Understand your liability limits and consider whether they are adequate to protect your assets. Review your policy annually and make adjustments as needed to reflect any changes in your home or personal situation.