How Much Does A Life Insurance Policy Cost

Life insurance is a crucial financial tool that provides security and peace of mind to policyholders and their loved ones. The cost of a life insurance policy can vary significantly based on several factors, making it essential to understand the variables that influence the premium you pay. In this comprehensive guide, we will delve into the intricacies of life insurance costs, exploring the key factors, policy types, and strategies to help you navigate the insurance market with confidence.

Understanding the Factors that Influence Life Insurance Costs

The cost of a life insurance policy is not a one-size-fits-all proposition. Several factors come into play, each contributing to the overall premium. By understanding these factors, you can make more informed decisions when shopping for life insurance.

Age and Health

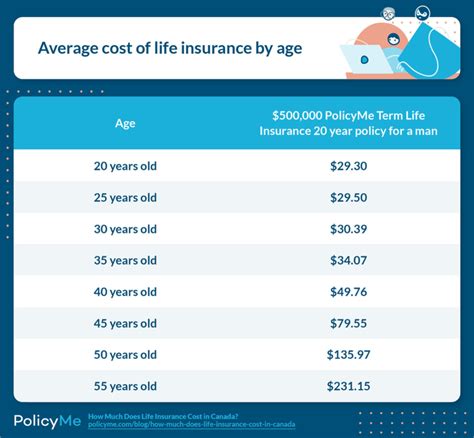

One of the primary determinants of life insurance cost is your age and health status. Generally, younger individuals are offered lower premiums because they are statistically less likely to pass away during the policy term. Additionally, good health and a low-risk lifestyle can lead to more affordable rates. Regular exercise, a healthy diet, and the absence of pre-existing medical conditions can significantly impact your insurance costs.

For instance, let's consider two individuals, John and Jane. John is a 30-year-old non-smoker with a healthy BMI and no history of medical issues. On the other hand, Jane is a 45-year-old smoker with a family history of heart disease. Insurance companies will likely offer John a more favorable premium due to his younger age and healthier profile. In contrast, Jane's premium might be higher to account for the increased risk associated with her age and health factors.

Policy Type and Coverage Amount

The type of life insurance policy you choose and the coverage amount you select also play a crucial role in determining your premium. Life insurance policies can be broadly categorized into two main types: term life insurance and permanent life insurance.

Term Life Insurance: Term life policies offer coverage for a specific period, typically ranging from 10 to 30 years. They are designed to provide financial protection during key life stages, such as raising a family or paying off a mortgage. Since term life insurance has a limited coverage period, the premiums are generally more affordable compared to permanent life insurance.

For example, imagine Sarah, a 35-year-old mother of two, purchases a 20-year term life insurance policy with a coverage amount of $500,000. Her premium might be relatively low because the policy covers a specific period and offers a fixed death benefit. Term life insurance is often chosen when individuals have temporary financial needs they want to protect against.

Permanent Life Insurance: Permanent life insurance, as the name suggests, provides coverage for the insured's entire life. It offers a death benefit and often includes a cash value component that grows over time. Permanent life insurance policies, such as whole life, universal life, and variable universal life, tend to have higher premiums because they offer lifelong coverage and additional benefits.

Consider David, a 40-year-old business owner. He opts for a whole life insurance policy with a coverage amount of $1 million. His premium will likely be higher compared to term life insurance because whole life insurance provides lifetime coverage and the potential for cash value growth. Permanent life insurance is often chosen for long-term financial planning and wealth accumulation.

Gender and Lifestyle Factors

Insurance companies may also consider gender and lifestyle factors when calculating premiums. Historically, men have been charged higher premiums than women due to statistical differences in life expectancy and mortality rates. However, this gender-based pricing has been a subject of debate and is undergoing changes in some regions.

Lifestyle factors, such as smoking, excessive alcohol consumption, dangerous hobbies, or high-risk occupations, can also impact your premium. Engaging in risky behaviors or having a hazardous occupation may result in higher insurance costs as these factors increase the likelihood of an early death.

Medical Underwriting and Rating Classes

Medical underwriting is a critical process during life insurance application. Insurance companies assess your medical history and current health status to determine your risk level and assign you to a rating class. The rating class you fall into will directly impact your premium.

Rating classes can include preferred, standard, or substandard (also known as table ratings). Preferred ratings are given to individuals with excellent health and low-risk profiles, resulting in lower premiums. Standard ratings are for average-risk individuals, while substandard ratings are assigned to those with higher-risk health conditions, leading to increased premiums.

Comparing Life Insurance Policy Types and Costs

Now that we’ve explored the key factors influencing life insurance costs, let’s compare the different policy types and their associated costs to help you make an informed decision.

Term Life Insurance

Overview: Term life insurance is a straightforward and affordable option, offering coverage for a specified period. It is ideal for individuals seeking financial protection during specific life stages.

Cost Factors:

- Age: Younger individuals enjoy lower premiums.

- Health: Good health and a low-risk lifestyle lead to more affordable rates.

- Coverage Amount: Higher coverage amounts typically result in higher premiums.

- Policy Term: Longer policy terms may have slightly higher premiums.

Example: Sarah, a 30-year-old non-smoker, purchases a 20-year term life insurance policy with a coverage amount of $400,000. Her annual premium might be around $250, providing excellent value for her financial protection needs.

Permanent Life Insurance

Overview: Permanent life insurance offers lifelong coverage and additional benefits, such as cash value accumulation.

Cost Factors:

- Age: Starting permanent life insurance at a younger age can result in lower premiums.

- Health: Good health and a low-risk lifestyle contribute to more affordable rates.

- Coverage Amount: Higher coverage amounts lead to higher premiums.

- Policy Type: Whole life insurance tends to have higher premiums compared to universal life or variable universal life.

Example: David, a 35-year-old business owner, opts for a whole life insurance policy with a coverage amount of $1 million. His annual premium might be around $1,500, providing lifelong coverage and the potential for cash value growth.

Comparative Analysis

| Policy Type | Cost Factors | Example Premium |

|---|---|---|

| Term Life Insurance | Age, Health, Coverage Amount, Policy Term | 250 (annual) for a 30-year-old with 400,000 coverage |

| Permanent Life Insurance | Age, Health, Coverage Amount, Policy Type | 1,500 (annual) for a 35-year-old with 1 million coverage |

The table above provides a comparative analysis of the costs associated with term and permanent life insurance policies. It's important to note that these examples are for illustrative purposes and actual premiums can vary based on individual circumstances and the insurance company.

Tips for Getting the Best Life Insurance Premium

Now that you have a better understanding of the factors influencing life insurance costs, here are some strategies to help you secure the best premium for your policy:

Shop Around and Compare Quotes

Don’t settle for the first quote you receive. Shopping around and comparing quotes from multiple insurance companies can reveal significant differences in premiums. Online quote comparison tools can be a great starting point, but it’s also beneficial to consult with independent insurance agents who can provide personalized recommendations.

Consider Different Policy Types

Explore the various life insurance policy types available, including term life, whole life, universal life, and variable universal life. Each type has its own advantages and costs. Assess your financial goals and needs to determine which policy best aligns with your objectives.

Improve Your Health and Lifestyle

Maintaining a healthy lifestyle and managing any health conditions can positively impact your insurance premiums. Regular exercise, a balanced diet, and quitting harmful habits like smoking can lead to lower rates. Additionally, managing stress and practicing good sleep hygiene can contribute to overall well-being and potentially reduce your insurance costs.

Opt for a Longer Policy Term (Term Life)

If you choose term life insurance, consider opting for a longer policy term. While the premiums may be slightly higher compared to shorter terms, a longer policy term provides peace of mind and financial protection for an extended period. It’s a strategic choice if you anticipate needing coverage beyond the typical 10-year term.

Consider Joint Life Insurance Policies

If you’re married or in a committed relationship, exploring joint life insurance policies can be a cost-effective option. These policies cover both partners under a single policy, often resulting in lower premiums compared to individual policies. However, it’s essential to carefully evaluate the coverage needs and financial goals of both partners to ensure the policy aligns with your requirements.

Work with an Independent Insurance Agent

Independent insurance agents can be invaluable resources when navigating the life insurance market. They are not tied to a specific insurance company and can provide unbiased advice and recommendations based on your unique circumstances. An independent agent can help you compare policies, negotiate rates, and ensure you obtain the best coverage at the most affordable premium.

Frequently Asked Questions

What is the average cost of life insurance per month?

+The average cost of life insurance per month varies based on several factors, including age, health, policy type, and coverage amount. As an example, a healthy 30-year-old non-smoker might pay around 20 to 30 per month for a term life insurance policy with a coverage amount of $500,000. However, premiums can range from a few dollars to several hundred dollars per month, depending on individual circumstances.

Are life insurance premiums tax-deductible?

+In most cases, life insurance premiums are not tax-deductible for individuals. However, there are certain exceptions, such as when life insurance is part of an employer-sponsored benefit plan or when it’s purchased as part of a business strategy. It’s advisable to consult with a tax professional to understand the specific tax implications in your situation.

Can I negotiate life insurance premiums?

+While life insurance premiums are primarily based on statistical data and underwriting guidelines, there may be some room for negotiation. Working with an independent insurance agent can be advantageous, as they may have relationships with various insurance companies and can advocate for the best rates on your behalf. Additionally, providing accurate and complete information during the application process can help ensure you receive a fair premium.

Do life insurance premiums increase over time?

+The increase in life insurance premiums over time depends on the type of policy you have. Term life insurance policies typically have level premiums for the duration of the policy term. However, when the term expires, you may need to renew the policy at a higher premium due to your increased age. Permanent life insurance policies, such as whole life or universal life, often have level premiums that remain constant throughout the policy’s lifetime.