Insurance Sales Income

In the dynamic world of finance and sales, insurance agents play a crucial role, offering financial protection and peace of mind to individuals and businesses alike. The income of insurance sales professionals is a multifaceted topic, influenced by various factors such as commission structures, product types, geographic location, and individual performance. Understanding these aspects provides valuable insights into the financial potential and career trajectory of those in this industry.

Commission Structures: The Backbone of Insurance Sales Income

The foundation of an insurance agent’s income is typically built upon commission-based earnings. This means their income is directly proportional to the sales they make. Commission rates can vary significantly depending on the insurance company, the type of product sold, and the level of experience of the agent. For instance, an established agent selling complex, high-value policies may earn a higher commission percentage compared to a novice agent selling basic policies.

Commission structures often consist of two primary components: front-end commissions and renewal commissions. Front-end commissions are paid out when a new policy is sold, representing a significant portion of the total commission. Renewal commissions, on the other hand, are earned when an existing policy is renewed, offering a more consistent income stream over time.

To illustrate, consider an example where an agent sells a life insurance policy with a front-end commission rate of 50% of the first year's premium. If the policy has an annual premium of $1,000, the agent would earn a commission of $500 upon sale. If the policy is renewed for several years, the agent might earn a smaller renewal commission, let's say 5% of the annual premium, each year the policy remains active.

Understanding Commission Caps and Bonuses

Many insurance companies implement commission caps to limit the maximum commission an agent can earn on a single policy. These caps are designed to prevent agents from focusing solely on high-value policies, ensuring a balanced approach to sales. However, some companies also offer bonuses for achieving certain sales targets or for selling specialized products, which can significantly boost an agent’s income.

| Commission Type | Example Rate |

|---|---|

| Front-end Commission | 40% - 60% of First Year's Premium |

| Renewal Commission | 2% - 10% of Annual Premium |

| Bonus for Sales Target | Up to 20% of Total Commission |

Product Types and Their Impact on Income

The type of insurance products an agent specializes in can have a substantial impact on their income potential. Different insurance products, such as life insurance, health insurance, property and casualty insurance, and specialty products like disability or long-term care insurance, offer varying commission rates and earning opportunities.

Life Insurance: A High-Value, Long-Term Investment

Life insurance policies are often seen as a cornerstone of an agent’s portfolio. These policies can provide substantial front-end commissions, especially for whole life or universal life policies, which typically have higher premiums. Additionally, the long-term nature of life insurance policies ensures a steady stream of renewal commissions over many years.

Health Insurance: Navigating Complex Market Dynamics

Health insurance sales present a unique challenge due to the ever-changing regulatory landscape and the complex nature of health insurance products. Agents in this field often earn commissions based on a percentage of the monthly premium, with rates varying depending on the type of plan (e.g., individual, family, or group plans) and the insurer.

Property and Casualty Insurance: Breadth and Variety

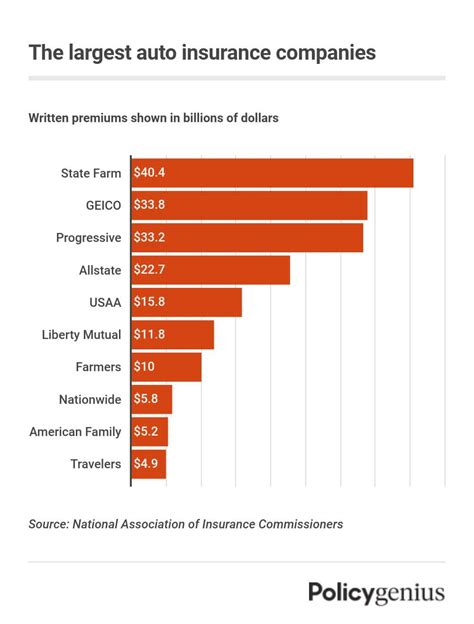

Property and casualty insurance encompasses a wide range of policies, including auto, home, renters, and business insurance. Agents in this field can expect to earn commissions based on a percentage of the policy premium, with rates often influenced by the risk profile of the insured and the insurer’s underwriting guidelines.

| Insurance Product | Average Commission Rate |

|---|---|

| Life Insurance | 40% - 60% of First Year's Premium |

| Health Insurance | 2% - 10% of Monthly Premium |

| Property and Casualty Insurance | 5% - 20% of Annual Premium |

Geographic Location: A Key Factor in Insurance Sales Income

The geographic location where an insurance agent operates can significantly influence their income potential. Factors such as the cost of living, the local economy, and the demand for insurance products can all impact an agent’s earnings.

Urban vs. Rural Markets

Insurance agents working in urban areas often have access to a larger, more diverse pool of potential clients. This can lead to higher sales volumes and, consequently, higher income. However, the competition in urban markets is typically more intense, which can impact an agent’s ability to secure new business.

In contrast, rural areas may have a smaller population and fewer potential clients, but the demand for insurance products can be high due to unique local needs. Agents in these areas may enjoy less competition, which can lead to stronger client relationships and higher renewal rates.

Regional Differences and Regulatory Factors

Regional differences in insurance regulations can also impact an agent’s income. Some states or regions may have more stringent regulations, which can influence the types of insurance products available and the associated commission rates. Additionally, the local economy and cost of living can affect an agent’s ability to attract and retain clients, as well as their overall earning potential.

Individual Performance and Career Trajectory

An insurance agent’s income is not solely dependent on external factors; individual performance and career development play a significant role as well. Agents who continuously develop their skills, stay up-to-date with industry trends, and build strong relationships with clients are more likely to experience sustained success and increased earnings over time.

Building a Successful Career in Insurance Sales

Success in insurance sales often hinges on an agent’s ability to develop a comprehensive understanding of their clients’ needs and tailor their product recommendations accordingly. This requires not only product knowledge but also strong communication and relationship-building skills.

Furthermore, ongoing professional development is crucial. This can include earning advanced certifications, such as the Certified Insurance Counselor (CIC) or Chartered Property Casualty Underwriter (CPCU) designations, which can enhance an agent's credibility and open doors to higher-paying opportunities.

Performance Incentives and Career Advancement

Many insurance companies offer performance incentives and career advancement opportunities for high-performing agents. These can include recognition programs, leadership roles within the company, or the opportunity to own and operate an agency. These avenues not only increase an agent’s income potential but also provide avenues for long-term career growth and satisfaction.

Conclusion: Navigating the Complexities of Insurance Sales Income

The income of insurance sales professionals is a complex interplay of commission structures, product types, geographic location, and individual performance. By understanding these factors and continually developing their skills and knowledge, insurance agents can navigate this complex landscape with confidence, maximizing their earning potential and building a successful, rewarding career.

What is the average income for an insurance agent?

+

The average income for insurance agents can vary widely depending on their specialty, location, and experience. According to recent data, the median annual wage for insurance sales agents in the United States is approximately $50,000. However, top earners in the industry can make significantly more, with some agents earning six-figure incomes.

Are there any additional earnings opportunities for insurance agents beyond commissions?

+

Yes, insurance agents may have opportunities for additional earnings through bonuses, incentives, and performance-based rewards. These can include quarterly or annual bonuses for meeting sales targets, referral bonuses for introducing new clients, or performance-based incentives for selling specific types of policies or reaching certain milestones.

How can insurance agents maximize their income potential?

+

Maximizing income potential in insurance sales requires a combination of strategies. This includes building a diverse client base, focusing on high-value policies with competitive commission rates, continuously developing product knowledge and sales skills, and leveraging technology to streamline the sales process. Additionally, building strong relationships with clients and offering exceptional service can lead to increased renewals and referrals.