Income Requirements For Marketplace Insurance

Understanding the income requirements for Marketplace insurance is crucial for individuals and families seeking affordable healthcare coverage. This article will delve into the specifics of income eligibility, providing an in-depth analysis to help you navigate the process and make informed decisions.

Income Eligibility for Marketplace Insurance

The Health Insurance Marketplace, often simply referred to as the Marketplace, offers a range of insurance plans to help individuals and families obtain comprehensive healthcare coverage. Income plays a significant role in determining the type of plan and financial assistance one qualifies for.

Income Levels and Eligibility

The Marketplace takes into account your household income to determine your eligibility for premium tax credits and cost-sharing reductions. These financial aids can significantly reduce the cost of your monthly premiums and out-of-pocket expenses, making healthcare more accessible.

Here's a breakdown of income levels and the corresponding eligibility:

| Income Level | Eligibility |

|---|---|

| Up to 138% of the Federal Poverty Level (FPL) | May qualify for Medicaid or the Children's Health Insurance Program (CHIP) in most states. |

| 138% to 400% of FPL | Eligible for premium tax credits and cost-sharing reductions. The amount of savings depends on income and family size. |

| Above 400% of FPL | Still eligible for Marketplace insurance plans but may not qualify for financial assistance. |

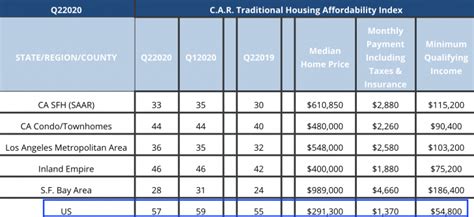

The Federal Poverty Level varies annually and is adjusted based on factors like family size and geographic location. For instance, in 2023, the FPL for a single individual is set at $13,590, while for a family of four, it's $27,750. These thresholds are used as a reference to calculate the income levels mentioned above.

Premium Tax Credits and Cost-Sharing Reductions

Premium tax credits and cost-sharing reductions are two key financial aids offered by the Marketplace. They are designed to make insurance more affordable, especially for those with lower incomes.

- Premium Tax Credits: These are available to individuals and families with incomes between 100% and 400% of the FPL. The credit amount depends on your income and family size, and it's applied directly to your monthly premium, reducing the cost of your insurance plan.

- Cost-Sharing Reductions: These are available to those with incomes up to 250% of the FPL. They reduce your out-of-pocket costs, such as deductibles, copayments, and coinsurance. With cost-sharing reductions, you pay less when you need medical care.

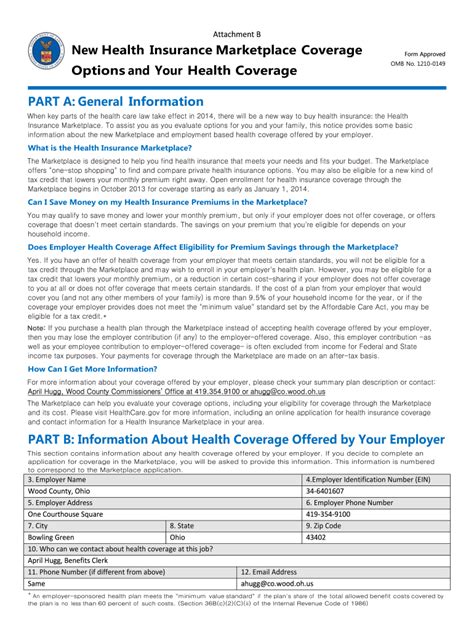

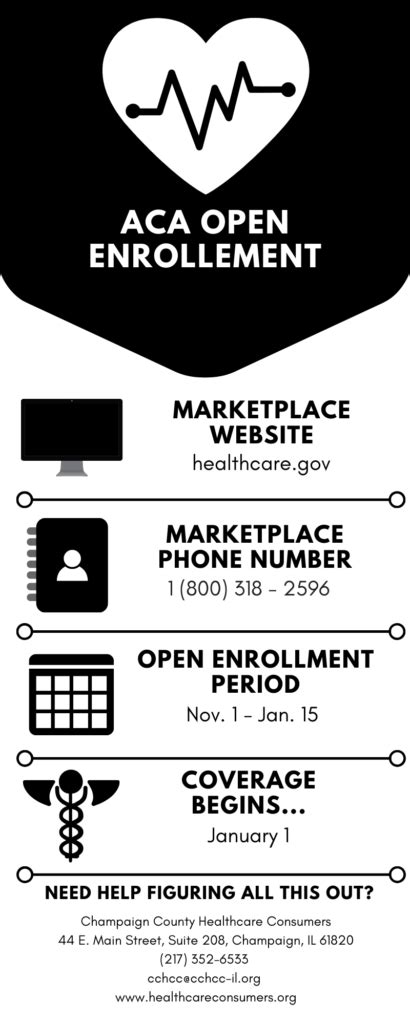

Applying for Marketplace Insurance

To apply for Marketplace insurance, you can visit the official website, Healthcare.gov. Here, you'll find a straightforward application process that guides you through the steps to enroll in a plan that suits your needs and income.

During the application, you'll be asked to provide details about your household income, family size, and other relevant information. This data is used to determine your eligibility for financial assistance and the most suitable insurance plan for your situation.

It's important to note that income verification is a crucial step in the process. You may be required to provide documentation, such as tax returns or pay stubs, to support the income information you provide. This ensures the accuracy of your application and eligibility for the right level of financial aid.

Income Thresholds and Plan Options

Understanding the income thresholds is essential to navigate the Marketplace effectively. Here's a deeper look at how income affects your plan options:

Income and Plan Premiums

The cost of your insurance plan premium is directly influenced by your income. Generally, individuals and families with lower incomes pay a smaller percentage of their income towards their premium, thanks to the premium tax credits.

For instance, if you earn 200% of the FPL, you might pay only a small fraction of the standard premium for your chosen plan. This ensures that healthcare remains affordable, even for those with limited financial means.

Plan Choices and Benefits

The Marketplace offers a range of insurance plans, from Bronze to Platinum, each with varying levels of coverage and costs. Your income, along with other factors like family size and age, will influence the plan that's most suitable for you.

- Bronze Plans: These plans typically have lower premiums but higher deductibles and out-of-pocket costs. They're ideal for those who are healthy and don't anticipate frequent medical needs.

- Silver Plans: Silver plans are the most popular and offer a good balance between premiums and out-of-pocket costs. They're often a great choice for those who want comprehensive coverage without paying too much in premiums.

- Gold and Platinum Plans: These plans offer the most comprehensive coverage but come with higher premiums. They're suitable for individuals and families with complex medical needs or those who prefer maximum coverage.

Income and Plan Availability

While income is a significant factor in plan eligibility, it's not the sole determinant. The Marketplace offers a wide range of plans, and availability can vary based on your location and the insurance providers operating in your area.

It's essential to explore the plans available to you during the open enrollment period or if you qualify for a special enrollment period due to a life event, such as a change in employment or family status.

Maximizing Savings and Financial Assistance

To make the most of your Marketplace insurance, it's crucial to understand how to maximize your savings and take advantage of all available financial assistance.

Income-Based Savings Strategies

If your income falls within the range for premium tax credits, you can strategically choose a plan that aligns with your needs and budget. Here are some tips:

- Consider plans with slightly higher premiums but lower deductibles if you anticipate frequent medical needs. This can save you money in the long run.

- If you're generally healthy, a plan with a lower premium and higher deductible might be more cost-effective, especially if you rarely need medical services.

- Review your income and plan choices annually during the open enrollment period. Your income and circumstances may change, and it's essential to adjust your plan accordingly to maximize savings.

Utilizing Cost-Sharing Reductions

Cost-sharing reductions are an excellent way to reduce your out-of-pocket expenses. These reductions can significantly lower your deductibles, copayments, and coinsurance, making medical care more affordable when you need it.

For instance, if you have a Silver plan with cost-sharing reductions, you might pay a lower percentage of your income towards out-of-pocket costs. This can provide significant savings, especially for those with chronic conditions or regular medical needs.

Exploring Other Financial Aids

In addition to premium tax credits and cost-sharing reductions, the Marketplace offers other financial aids that can further reduce your healthcare costs.

- Medicaid and CHIP: If your income is below 138% of the FPL, you may qualify for Medicaid or CHIP, which provide comprehensive coverage with little to no out-of-pocket costs.

- Special Enrollment Periods: Certain life events, such as losing job-based coverage or having a baby, can qualify you for a special enrollment period outside the regular open enrollment. This allows you to enroll in a Marketplace plan and potentially access financial assistance you may not have qualified for previously.

Frequently Asked Questions

How is income verified for Marketplace insurance eligibility?

+Income verification is typically done by providing tax returns, pay stubs, or other official income documentation. The Marketplace may also request additional information to confirm your eligibility for financial assistance.

<div class="faq-item">

<div class="faq-question">

<h3>Can my income change during the year, and how does it affect my insurance coverage?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, your income can change during the year due to various reasons, such as job changes or family circumstances. If your income changes, you should report it to the Marketplace. Depending on the change, you may qualify for different levels of financial assistance or need to adjust your insurance plan.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any penalties for not having Marketplace insurance if I don't qualify for financial assistance?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>As of 2019, there is no individual mandate penalty for not having health insurance. However, it's important to have coverage to protect yourself from unexpected medical costs. The Marketplace offers affordable options for various income levels.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I switch Marketplace insurance plans during the year if my income changes?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, you can switch plans during a special enrollment period if you experience a qualifying life event, such as a significant change in income. This allows you to adjust your coverage to align with your new income level and financial needs.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I don't report a change in income to the Marketplace?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Failing to report a change in income can lead to inaccuracies in your financial assistance and plan eligibility. It's important to report any income changes promptly to ensure you receive the correct level of financial aid and avoid potential issues with your coverage.</p>

</div>

</div>

</div>

Understanding the income requirements and financial aids available through the Marketplace is crucial for accessing affordable healthcare coverage. By knowing your income eligibility and exploring the various plan options, you can make informed decisions to protect your health and financial well-being.