Car Insurance Quotes Texas

Car insurance quotes in Texas can be a complex and often confusing process, especially with the state's unique set of regulations and a wide range of options. As one of the largest states in the US, Texas has a diverse landscape, from bustling cities to vast rural areas, which can impact insurance rates. Understanding the factors that influence these quotes is crucial for residents seeking affordable and comprehensive coverage.

The Landscape of Car Insurance in Texas

Texas is known for its competitive insurance market, with numerous providers offering a variety of policies. This competition can be advantageous for consumers, often resulting in more affordable rates. However, with so many options, it’s essential to know the key factors that can influence your insurance quote.

Understanding Liability Coverage

Liability coverage is a critical component of any car insurance policy. In Texas, the minimum liability coverage required by law is 30/60/25. This means your policy must provide a minimum of 30,000 for bodily injury liability per person, 60,000 for bodily injury liability for all persons involved in an accident, and $25,000 for property damage liability.

While this is the legal minimum, many experts recommend carrying higher limits, especially in a state like Texas with a high number of uninsured drivers. Increasing your liability coverage can provide added protection in the event of an accident, and it might not significantly impact your premium.

| Liability Coverage Type | Minimum Requirement | Recommended |

|---|---|---|

| Bodily Injury Liability (per person) | $30,000 | $100,000 or more |

| Bodily Injury Liability (per accident) | $60,000 | $300,000 or more |

| Property Damage Liability | $25,000 | $50,000 or more |

Factors Affecting Car Insurance Quotes

Several factors can influence the cost of your car insurance in Texas. These include your age, gender, driving history, the type of vehicle you drive, and where you live. For instance, younger drivers, especially males, typically pay higher premiums due to their perceived higher risk on the road.

The type of vehicle you drive also matters. Sports cars and high-performance vehicles often cost more to insure due to their higher likelihood of being involved in accidents and their expensive repair costs. On the other hand, safer and more economical cars can result in lower insurance quotes.

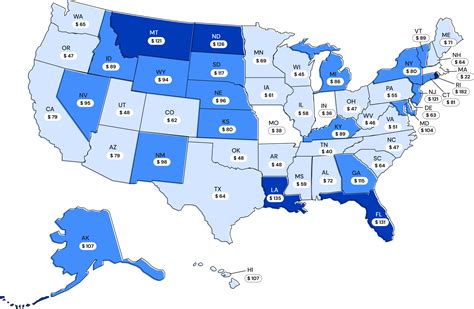

Your location is another significant factor. Urban areas like Dallas and Houston tend to have higher insurance rates due to factors like increased traffic, higher crime rates, and a higher likelihood of accidents. Conversely, rural areas might offer more affordable rates, but they could also have fewer coverage options.

Comparing Quotes and Finding the Best Deal

Given the diverse range of insurance providers and policies in Texas, it’s crucial to compare quotes from multiple companies. This allows you to find the best coverage at the most competitive price.

Online comparison tools can be a great starting point. These platforms allow you to input your details once and receive multiple quotes, making it easier to see the differences between providers. However, it's important to note that not all companies offer their best rates through these tools, so it can be beneficial to also get quotes directly from insurers.

When comparing quotes, pay attention to the coverage details. Ensure that the policies you're considering offer the right balance of coverage and affordability for your needs. Don't just focus on the lowest premium; make sure the policy provides adequate protection.

Additionally, consider the reputation and financial stability of the insurance company. A low-cost policy is useless if the company is unable to pay out claims. Check customer reviews and financial ratings to ensure you're dealing with a reputable insurer.

Tips for Lowering Your Car Insurance Costs

While the cost of car insurance in Texas can vary significantly, there are several strategies you can employ to potentially lower your premiums.

Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies with them. For instance, if you have home insurance, consider getting your car insurance from the same provider. This can lead to significant savings.

Increase Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you can often lower your premium. However, it’s important to choose a deductible amount that you’re comfortable paying if you need to make a claim.

Take Advantage of Discounts

Insurance companies offer a variety of discounts. These can include safe driver discounts, good student discounts, loyalty discounts, and even discounts for taking defensive driving courses. Ask your insurer about the discounts they offer and ensure you’re taking advantage of all the ones you’re eligible for.

Maintain a Good Driving Record

Your driving history is a significant factor in determining your insurance rates. A clean driving record can lead to lower premiums. Conversely, a history of accidents or traffic violations can result in higher rates. Focus on safe driving practices to keep your record clean and your insurance costs down.

The Future of Car Insurance in Texas

The car insurance landscape in Texas is evolving, with new technologies and trends shaping the industry. One notable development is the increasing popularity of usage-based insurance (UBI) programs. These programs use telematics devices or smartphone apps to monitor driving behavior and offer customized insurance rates based on actual driving habits.

UBI programs can be beneficial for safe drivers, as they offer the potential for significant premium reductions. However, they also raise privacy concerns, as they involve collecting detailed data on driving behavior. As these programs become more prevalent, it will be important for consumers to understand the trade-offs between personalized rates and privacy.

Another trend is the increasing focus on environmental sustainability in the insurance industry. Some insurers are offering incentives for drivers who choose electric or hybrid vehicles, reflecting the growing importance of green technologies in the automotive sector.

Finally, the rise of autonomous vehicles is likely to have a significant impact on car insurance in the coming years. While fully autonomous cars are not yet widespread, the technology is rapidly advancing. As these vehicles become more common, it's expected that insurance premiums will adjust to reflect the reduced risk of accidents associated with self-driving technology.

Conclusion

Obtaining car insurance quotes in Texas involves considering a range of factors, from your personal circumstances to the specific details of the policy. By understanding these factors and taking advantage of strategies to lower your costs, you can find a policy that provides the right balance of coverage and affordability. As the insurance landscape continues to evolve, staying informed about new trends and technologies can help you make the best decisions for your insurance needs.

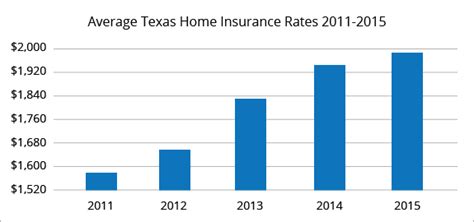

What is the average cost of car insurance in Texas?

+The average cost of car insurance in Texas varies depending on several factors, including your age, gender, driving history, and the type of vehicle you drive. However, according to recent data, the average annual premium in Texas is around $1,400.

How can I get a more accurate car insurance quote in Texas?

+To get a more accurate quote, provide as much detailed information as possible to your insurance provider. This includes your complete driving history, the make and model of your vehicle, and your intended usage (e.g., personal use, commuting, business use). Being thorough in your details can help ensure you receive a quote that’s tailored to your specific circumstances.

Are there any unique laws or regulations regarding car insurance in Texas that I should be aware of?

+Yes, Texas has a unique law known as the “choice law.” This law gives drivers the option to choose a lower personal injury protection (PIP) limit or reject it altogether. PIP coverage is designed to cover medical expenses after an accident, regardless of fault. However, in Texas, drivers have the freedom to decide the level of PIP coverage they want, which can impact their insurance quotes.