Health Insurance For Traveling Abroad

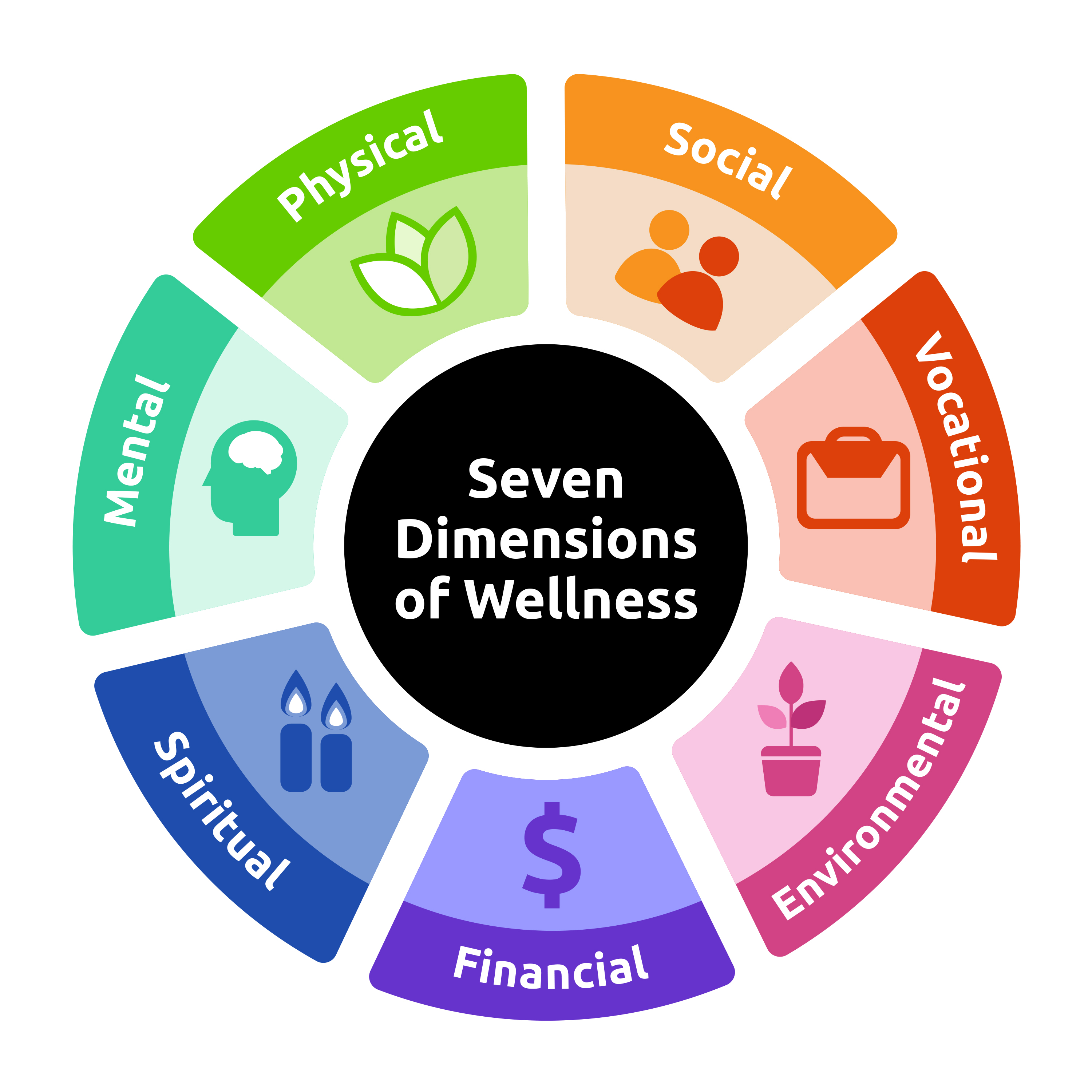

Traveling abroad is an exciting prospect, offering the opportunity to explore new cultures, landscapes, and experiences. However, it's essential to consider the potential risks and ensure you have adequate protection during your travels. Health insurance plays a crucial role in providing peace of mind and financial security while you're away. In this comprehensive guide, we'll delve into the world of health insurance for traveling abroad, covering everything you need to know to make informed decisions and travel with confidence.

Understanding Health Insurance for Travelers

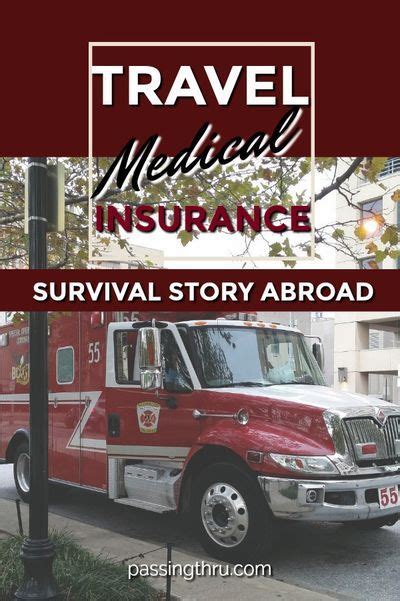

Health insurance for travelers, often referred to as travel medical insurance, is a specialized type of coverage designed to cater to the unique needs of individuals venturing outside their home country. It offers a safety net, ensuring you have access to medical care and financial protection should unexpected health issues arise during your travels.

Unlike regular health insurance plans, travel medical insurance is typically short-term and provides coverage for a specific period, often ranging from a few weeks to several months. It's designed to bridge the gap between your domestic health insurance and the healthcare systems of the countries you visit.

Key Benefits of Travel Health Insurance

- Worldwide Medical Coverage: Travel insurance provides access to medical facilities and professionals worldwide, ensuring you can receive the necessary care regardless of your location.

- Emergency Medical Evacuation: In severe cases, travel insurance may cover the cost of emergency medical transportation, including air ambulance services, to get you to the nearest appropriate medical facility.

- Repatriation: If you require extended medical care abroad, travel insurance can facilitate your return to your home country for treatment, reducing the financial burden.

- Prescription Medication: Many policies cover the cost of prescription medications, ensuring you can continue any necessary treatments during your travels.

- Emergency Dental Care: Unexpected dental issues can be costly, and travel insurance often includes coverage for emergency dental procedures.

Travel health insurance policies vary widely, and it's essential to carefully review the terms and conditions to ensure the coverage aligns with your specific needs and travel plans.

Factors to Consider When Choosing Travel Health Insurance

When selecting a travel health insurance plan, several factors come into play. Here’s a detailed breakdown to help you make an informed decision:

Destination and Duration

The country or countries you plan to visit and the duration of your trip are crucial considerations. Some destinations may have higher healthcare costs or specific health risks, such as tropical diseases. Ensure your insurance covers these potential issues.

For longer trips, you may need a policy that offers continuous coverage, whereas shorter trips might require a more flexible, short-term option.

Pre-Existing Medical Conditions

If you have any pre-existing medical conditions, such as diabetes, heart disease, or allergies, it’s vital to choose a policy that explicitly covers these conditions. Some insurers may exclude certain pre-existing conditions from coverage, so read the fine print carefully.

Adventure Activities

If your travel plans include adventure activities like skiing, hiking, or extreme sports, ensure your insurance policy covers these activities. Many standard travel insurance policies exclude high-risk activities, leaving you vulnerable to unexpected costs.

Policy Limits and Deductibles

Review the policy limits and deductibles to understand the maximum coverage amount and the out-of-pocket expenses you may incur. Higher limits and lower deductibles can provide greater financial protection but may result in a higher premium.

Repatriation and Evacuation Coverage

In the event of a serious medical emergency, repatriation and evacuation coverage can be a lifesaver. Ensure your policy covers these expenses, as they can be substantial.

Prescription Medication and Medical Devices

If you rely on prescription medications or medical devices, confirm that your insurance policy covers the cost of these items while abroad. This is especially important if you require ongoing medication or have specific medical needs.

Comparing Travel Health Insurance Providers

With numerous travel health insurance providers in the market, comparing policies can be overwhelming. Here’s a breakdown of key considerations to help you make an informed choice:

Coverage Options

Examine the range of coverage options offered by different providers. Look for policies that align with your specific needs, including adventure activities, pre-existing conditions, and destination-specific requirements.

Reputation and Customer Service

Research the reputation of the insurance provider. Check online reviews and ratings to gauge customer satisfaction. Excellent customer service can make a significant difference in resolving any issues that may arise during your travels.

Claim Process and Assistance

Understand the claim process and the assistance services offered by the insurer. Look for providers that offer 24⁄7 emergency assistance and have a streamlined claim process to ensure prompt resolution of any medical emergencies.

Cost and Premium Structure

Compare the premiums and understand the factors that influence the cost of the policy. Consider the coverage limits, deductibles, and any additional benefits or exclusions to ensure you’re getting the best value for your money.

| Provider | Premium (per day) | Coverage Limits | Adventure Activities |

|---|---|---|---|

| Insurer A | $5 | $1,000,000 | Included |

| Insurer B | $6 | $500,000 | Additional Coverage |

| Insurer C | $4 | $800,000 | Excludes High-Risk Sports |

Common Misconceptions About Travel Health Insurance

To ensure you make informed decisions, it’s important to separate fact from fiction when it comes to travel health insurance. Here are some common misconceptions clarified:

Misconception: “My Credit Card Provides Travel Insurance”

While some credit cards offer basic travel insurance benefits, they often have significant limitations and exclusions. These policies may not cover pre-existing conditions, adventure activities, or provide adequate medical coverage. Always review the fine print and consider purchasing a dedicated travel health insurance policy for comprehensive protection.

Misconception: “Travel Health Insurance is Expensive”

Travel health insurance premiums can vary based on your age, destination, and coverage limits. While some policies may seem costly, it’s essential to consider the potential financial risks of traveling without insurance. A single medical emergency can result in thousands of dollars in expenses, making insurance a worthwhile investment.

Misconception: “I Don’t Need Travel Health Insurance if I’m Healthy”

Even if you’re in excellent health, unexpected accidents or illnesses can occur while traveling. Travel health insurance provides peace of mind and financial protection, ensuring you can receive the necessary medical care without incurring substantial out-of-pocket expenses.

Tips for Using Travel Health Insurance Effectively

To maximize the benefits of your travel health insurance, here are some practical tips:

Keep Your Policy Details Handy

Store your insurance policy details, including the policy number and emergency contact information, in a readily accessible place. Share these details with your travel companions or family members back home.

Understand the Claim Process

Familiarize yourself with the claim process before you depart. Know what documentation you’ll need to submit and the steps to follow in the event of a medical emergency.

Choose a Reputable Provider

Select an insurance provider with a solid reputation and a history of prompt claim settlements. This ensures you receive the necessary support and financial coverage when you need it most.

Consider Travel Assistance Services

Some travel health insurance policies offer additional travel assistance services, such as lost luggage tracking or legal assistance. These services can provide added convenience and support during your travels.

Conclusion: Travel with Confidence

Travel health insurance is an essential component of any international travel plan. It provides a safety net, ensuring you can focus on creating unforgettable memories while knowing you’re protected against unexpected medical emergencies. By carefully reviewing your options, understanding the coverage, and selecting a reputable provider, you can travel with peace of mind, ready to embrace the adventures that await you.

Frequently Asked Questions

What happens if I need to make a claim while abroad?

+If you need to make a claim while abroad, follow the steps outlined in your insurance policy. Typically, you’ll need to contact the insurer’s emergency assistance hotline, provide the necessary details, and receive authorization for any medical treatment. Keep all receipts and documentation for your claim.

Can I extend my travel health insurance policy if my trip is longer than expected?

+Yes, most travel health insurance providers offer the option to extend your policy. Contact your insurer before your current policy expires to discuss the extension process and any additional costs involved. Extending your coverage ensures you remain protected throughout your travels.

Are there any exclusions or limitations I should be aware of in travel health insurance policies?

+Yes, travel health insurance policies often have exclusions and limitations. Common exclusions include pre-existing conditions, adventure activities like skydiving, and certain types of mental health treatment. It’s crucial to review the policy details carefully to understand what is and isn’t covered.

Can I purchase travel health insurance after I’ve already departed for my trip?

+In most cases, travel health insurance policies must be purchased before your departure date. Purchasing insurance after your trip has begun may not provide coverage for pre-existing conditions or other specific exclusions. It’s best to purchase insurance well in advance of your trip to ensure comprehensive protection.

What should I do if I lose my insurance policy documents while traveling?

+If you lose your insurance policy documents, contact your insurer immediately. They can provide you with a copy of your policy details, including the policy number and emergency contact information. It’s a good idea to keep digital copies of your policy in a secure location, such as a cloud storage service, to access them easily if needed.