How Do I Get Car Insurance

Securing car insurance is a crucial step for any vehicle owner, offering financial protection and peace of mind. This guide aims to provide an in-depth overview of the process, offering valuable insights and tips to ensure you're adequately covered.

Understanding Car Insurance: A Comprehensive Guide

Car insurance is a legal requirement in most countries and acts as a safeguard against potential financial losses arising from vehicle-related incidents. It provides coverage for a range of scenarios, including accidents, theft, and damage to your vehicle or others' property. With the right insurance policy, you can protect yourself, your vehicle, and others on the road.

The process of obtaining car insurance involves several key steps, each requiring careful consideration. From assessing your coverage needs to comparing providers and policies, understanding the factors that influence your premium, and ensuring you're aware of your rights and responsibilities, this guide will navigate you through the entire journey.

Assessing Your Coverage Needs

The first step in obtaining car insurance is to evaluate your specific coverage needs. This involves considering factors such as the value of your vehicle, your driving history, and the level of protection you desire. By understanding your unique circumstances, you can tailor your insurance policy to provide the most suitable coverage.

Determining Coverage Levels

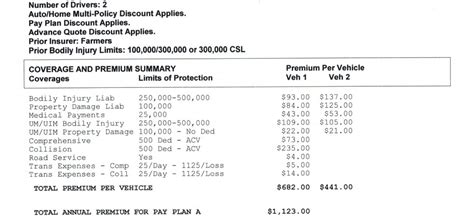

Car insurance policies typically offer a range of coverage options, including liability, collision, comprehensive, and additional add-ons. Liability coverage is a legal requirement and provides protection if you're at fault in an accident, covering damages to the other party's vehicle or property. Collision coverage, on the other hand, covers damages to your own vehicle, regardless of fault. Comprehensive coverage protects against non-collision incidents, such as theft, vandalism, or natural disasters.

Assessing your coverage needs involves weighing the cost of premiums against the level of protection desired. For instance, if you own an older vehicle with low resale value, you may opt for liability-only coverage to keep costs down. Conversely, if you own a newer, more expensive vehicle, comprehensive coverage may be a wiser choice to ensure adequate protection.

Understanding Policy Limits and Deductibles

When assessing your coverage needs, it's essential to understand the concept of policy limits and deductibles. Policy limits refer to the maximum amount your insurance provider will pay for a covered claim. Deductibles, meanwhile, are the portion of a claim you must pay out of pocket before your insurance coverage kicks in. Higher deductibles often result in lower premiums, but they also mean you'll need to pay more out of pocket in the event of a claim.

It's crucial to choose policy limits and deductibles that align with your financial situation and risk tolerance. Opting for higher limits and deductibles can provide significant savings on premiums, but it's important to ensure you have the financial means to cover the deductible in the event of a claim.

Comparing Insurance Providers and Policies

Once you've assessed your coverage needs, the next step is to research and compare different insurance providers and policies. This process involves evaluating factors such as coverage options, premiums, customer service, and claims handling.

Researching Insurance Companies

Begin by researching reputable insurance companies in your area. Look for providers with a solid financial standing, a good reputation, and a history of prompt claims processing. Online reviews and ratings can provide valuable insights into customer experiences, helping you gauge the reliability and service quality of different providers.

Consider seeking recommendations from friends, family, or colleagues who have had positive experiences with their insurance providers. Personal referrals can offer valuable insights into the reliability and customer-centric approach of insurance companies.

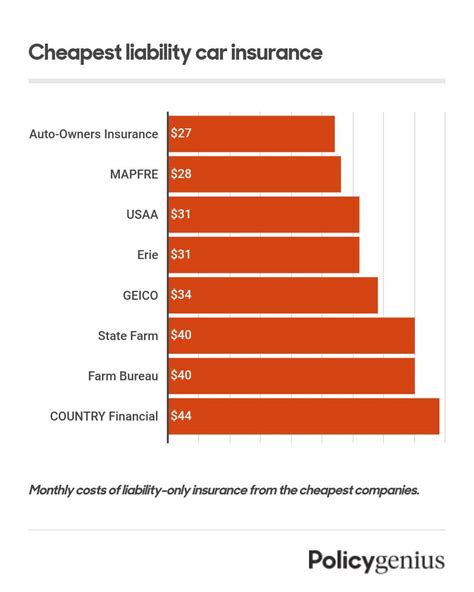

Evaluating Policy Coverage and Premiums

When comparing policies, pay close attention to the coverage options and premiums offered by each provider. Ensure that the policies you're considering align with your assessed coverage needs, providing the level of protection you desire. Compare premiums for similar coverage levels to identify the most cost-effective options.

It's crucial to read the fine print of each policy to understand the exclusions and limitations. Some policies may have specific restrictions or conditions that could impact your coverage, so it's essential to thoroughly review the terms and conditions before making a decision.

Assessing Customer Service and Claims Handling

The quality of customer service and claims handling can significantly impact your insurance experience. Look for providers with a track record of prompt and efficient claims processing, ensuring they offer 24/7 support and a dedicated claims team. Positive customer service experiences can provide peace of mind, knowing you'll receive assistance when you need it most.

Consider reaching out to the customer service teams of the providers you're considering to gauge their responsiveness and helpfulness. A prompt and friendly response can indicate a customer-centric approach, ensuring you'll receive the support you need throughout your insurance journey.

Factors Influencing Car Insurance Premiums

Car insurance premiums are influenced by a variety of factors, including your personal information, vehicle details, and driving history. Understanding these factors can help you anticipate and manage your insurance costs.

Personal Information and Driving History

Your age, gender, marital status, and driving record are key factors in determining your insurance premium. Younger drivers, especially those under 25, often face higher premiums due to their lack of driving experience. Similarly, a history of accidents or traffic violations can lead to increased premiums, as these factors indicate a higher risk of future claims.

Maintaining a clean driving record and taking defensive driving courses can help lower your insurance premiums. Many insurance providers offer discounts for safe driving practices, so it's beneficial to inquire about such incentives when comparing policies.

Vehicle Information and Usage

The make, model, and year of your vehicle, as well as its safety features and mileage, can influence your insurance premium. Sports cars and luxury vehicles, for instance, often carry higher premiums due to their increased risk of theft or damage. Similarly, vehicles with advanced safety features may be eligible for discounts, as they reduce the likelihood of accidents.

The primary use of your vehicle also impacts your premium. If you primarily use your car for commuting or personal travel, your insurance costs may be lower compared to those who use their vehicles for business or commercial purposes. Understanding how your vehicle usage affects your premium can help you manage your insurance expenses effectively.

Location and Mileage

Your geographic location and annual mileage can significantly impact your insurance premium. Areas with a higher incidence of accidents, theft, or vandalism may have higher insurance rates. Similarly, if you drive a significant number of miles each year, your premium may increase due to the higher risk associated with frequent driving.

Consider exploring options such as low-mileage or usage-based insurance policies if you drive infrequently or have a low annual mileage. These policies can provide significant savings, as they offer premiums that align more closely with your actual driving habits.

Understanding Your Rights and Responsibilities

As a car insurance policyholder, it's crucial to understand your rights and responsibilities. This includes knowing what your policy covers, how to make a claim, and what to do in the event of an accident or other covered incident.

Policy Coverage and Exclusions

Thoroughly review your insurance policy to understand the specific coverage and exclusions. This ensures you're aware of the scenarios your policy covers and those it doesn't. Understanding the exclusions can help you anticipate potential gaps in coverage and consider additional coverage options if necessary.

If you have questions or concerns about your policy coverage, don't hesitate to reach out to your insurance provider. Their customer service team can provide clarifications and ensure you have a clear understanding of your rights and protections.

Making a Claim: The Process and Tips

In the event of an accident or other covered incident, it's important to know the steps for making a claim. This typically involves notifying your insurance provider, providing relevant documentation, and working with their claims team to resolve the issue. Timely and accurate reporting of claims is essential to ensure a smooth process.

Keep detailed records of all interactions and communications with your insurance provider, including dates, times, and the names of individuals you speak with. This documentation can be invaluable if any disputes or issues arise during the claims process.

Consider consulting with an insurance professional or legal advisor if you have complex or high-value claims. They can provide expert guidance and ensure your rights are protected throughout the claims process.

Accident and Incident Response

In the event of an accident, remain calm and ensure the safety of all involved parties. Exchange information with the other driver(s) and, if necessary, call the police to file a report. Take photos of the accident scene, including any damage to vehicles or property, as these can provide valuable evidence for your insurance claim.

Notify your insurance provider as soon as possible after the accident. Provide them with a detailed account of the incident and any relevant documentation. Follow their instructions and cooperate fully with their claims process to ensure a timely resolution.

Future Implications and Tips for Managing Costs

As you navigate the car insurance landscape, it's essential to consider the future implications of your choices. Understanding how your insurance decisions can impact your long-term financial health and overall driving experience is crucial.

Long-Term Financial Considerations

When selecting a car insurance policy, consider the long-term financial implications. While it may be tempting to opt for the lowest premium, it's important to ensure the policy provides adequate coverage for your needs. Inadequate coverage can lead to significant out-of-pocket expenses in the event of a claim, potentially impacting your financial stability.

Assess your financial situation and determine how much you can afford to pay out of pocket in the event of a claim. Choose a deductible that aligns with your financial means, ensuring you have the resources to cover it without straining your finances.

Tips for Managing Insurance Costs

Managing your car insurance costs involves a combination of smart shopping, safe driving practices, and policy adjustments. Here are some tips to help you keep your insurance costs under control:

- Shop around for insurance providers and policies, comparing coverage and premiums to find the most cost-effective option.

- Consider bundling your car insurance with other policies, such as home or renters insurance, to potentially save on premiums.

- Maintain a clean driving record and take defensive driving courses to qualify for safe driver discounts.

- Explore usage-based insurance policies if you drive infrequently or have a low annual mileage.

- Review your policy annually and adjust coverage levels or deductibles to align with your changing needs and financial situation.

- Consider increasing your deductible to lower your premium, but ensure you can afford the out-of-pocket expense if a claim arises.

- Ask your insurance provider about discounts for multiple vehicles, safe driving practices, or loyalty programs.

Staying Informed and Engaged

Staying informed about changes in the car insurance landscape and your personal circumstances is essential for effective cost management. Regularly review your policy and assess whether your coverage and premium remain aligned with your needs and financial situation.

Keep up to date with changes in your personal information, such as address, marital status, or vehicle usage, as these can impact your insurance premium. Notify your insurance provider of any significant changes to ensure your policy remains accurate and up-to-date.

Seeking Professional Advice

If you have complex insurance needs or are unsure about the best coverage options for your situation, consider seeking advice from an insurance professional or financial advisor. They can provide expert guidance tailored to your specific circumstances, helping you make informed decisions about your car insurance.

An insurance professional can help you navigate the often complex world of car insurance, ensuring you have the coverage you need at a price you can afford. They can also provide valuable insights into potential savings and discounts, helping you maximize the value of your insurance policy.

FAQ

What factors determine my car insurance premium?

+Your car insurance premium is influenced by various factors, including your age, gender, driving record, vehicle make and model, location, and annual mileage. Younger drivers and those with a history of accidents or violations may face higher premiums. Additionally, the type of coverage you choose and your policy’s deductibles and limits can impact your premium.

How can I lower my car insurance costs?

+There are several strategies to reduce your car insurance costs. These include maintaining a clean driving record, taking defensive driving courses, exploring usage-based insurance policies, bundling multiple policies, and increasing your deductible. Regularly reviewing your policy and adjusting coverage levels or deductibles can also help manage costs.

What should I do if I’m involved in an accident?

+If you’re involved in an accident, remain calm and ensure the safety of all involved parties. Exchange information with the other driver(s) and, if necessary, call the police to file a report. Take photos of the accident scene and any damage. Notify your insurance provider as soon as possible and provide them with a detailed account of the incident. Follow their instructions and cooperate with their claims process.

Can I switch car insurance providers?

+Absolutely! Switching car insurance providers is a common practice, and it can be a great way to find more affordable coverage or better-suited policies. Shop around and compare policies to find the best fit for your needs. Ensure you understand the terms of your current policy and any cancellation fees or requirements before making the switch.

What happens if I don’t have car insurance?

+Driving without car insurance is illegal in most places and can result in severe penalties, including fines, license suspension, or even criminal charges. It’s essential to have adequate car insurance coverage to protect yourself, your vehicle, and others on the road. Check your local laws and regulations to understand the requirements and potential consequences of driving uninsured.