Online Savings Account Is It Fdic Insured

Welcome to the comprehensive guide on online savings accounts and their FDIC insurance coverage. In today's digital age, managing your finances online has become increasingly convenient and efficient. As more people embrace the digital revolution, understanding the safety and security of online savings accounts is crucial. This article will delve into the world of online savings, exploring its benefits, how FDIC insurance works, and providing valuable insights to help you make informed decisions about your financial future.

The Rise of Online Savings Accounts: Convenience and Accessibility

Online savings accounts have gained popularity due to their numerous advantages. These accounts offer unparalleled convenience, allowing individuals to manage their finances from the comfort of their homes or on the go with a few clicks or taps. No more waiting in long lines at traditional banks; online savings accounts provide 24⁄7 accessibility, enabling you to check your balance, transfer funds, and make payments whenever it suits you.

Additionally, online savings accounts often come with higher interest rates compared to traditional brick-and-mortar banks. This is because online banks have lower overhead costs, which they pass on to their customers in the form of more competitive interest rates. Over time, these higher interest rates can significantly boost your savings, helping you reach your financial goals faster.

Furthermore, online savings accounts are known for their user-friendly interfaces. Many platforms offer intuitive dashboards, providing clear and concise overviews of your financial activities. This simplicity makes it easier to track your spending, set budgets, and monitor your savings progress, empowering you to take control of your financial well-being.

Understanding FDIC Insurance: Safeguarding Your Savings

FDIC insurance, or Federal Deposit Insurance Corporation insurance, is a crucial aspect of the US banking system. Established in 1933 during the Great Depression, FDIC insurance serves as a safety net for depositors, protecting their funds in the event of a bank failure.

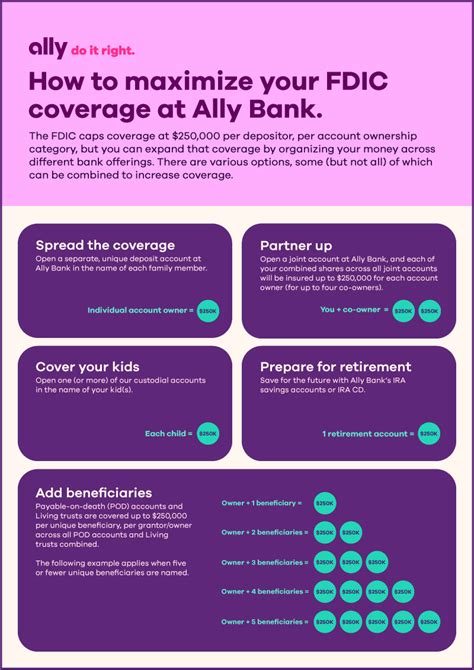

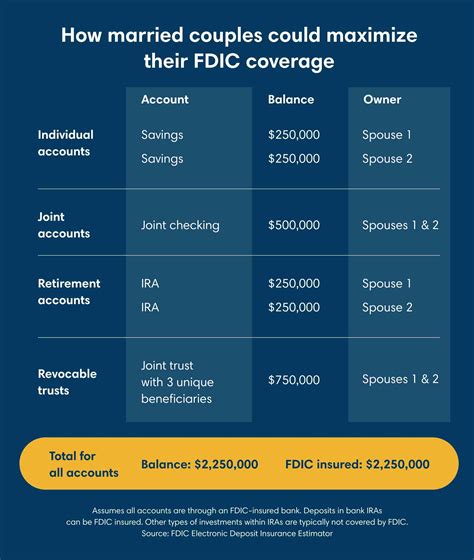

FDIC insurance covers a wide range of deposit accounts, including checking, savings, money market, and certificate of deposit (CD) accounts. The coverage limit is set at $250,000 per depositor, per insured bank, per ownership category. This means that even if a bank fails, your funds up to this limit are guaranteed by the FDIC.

For joint accounts, the coverage limit is $500,000, ensuring that couples or partners can have their savings protected. Additionally, certain retirement accounts, such as Individual Retirement Accounts (IRAs), also enjoy FDIC insurance protection, providing peace of mind for your retirement funds.

It's important to note that FDIC insurance only covers deposits held in FDIC-insured banks. Credit unions, on the other hand, are insured by the National Credit Union Administration (NCUA) through the National Credit Union Share Insurance Fund (NCUSIF). This insurance provides similar protection for credit union members, covering deposits up to $250,000 per account owner.

How Online Savings Accounts Work with FDIC Insurance

Online savings accounts operate similarly to traditional savings accounts but with the added convenience of digital access. When you open an online savings account, you’ll typically be required to provide personal information, such as your name, address, and Social Security number, to verify your identity.

Once your account is set up, you can make deposits and withdrawals using various methods. Most online savings accounts allow you to link your existing bank account for easy transfers. You can also fund your account using a mobile check deposit feature, where you can take a picture of your check and deposit it directly into your online savings account.

Withdrawal options include transferring funds back to your linked bank account or using a debit card associated with your online savings account. Some online savings accounts may also offer the option to write checks directly from your account.

When it comes to FDIC insurance, online savings accounts function just like traditional savings accounts. As long as your online savings account is with an FDIC-insured bank, your deposits are protected up to the $250,000 coverage limit. This protection applies even if the bank is solely operated online, ensuring your savings remain secure.

Example of FDIC-Insured Online Savings Accounts

Several reputable online banks offer FDIC-insured savings accounts, providing a safe and convenient way to manage your finances. Here are a few examples:

- Ally Bank: Offering competitive interest rates and a user-friendly mobile app, Ally Bank provides a seamless online savings experience. Your deposits are FDIC-insured, ensuring your funds are protected.

- Marcus by Goldman Sachs: Marcus offers a high-yield online savings account with no monthly fees and a straightforward account opening process. Your savings are FDIC-insured, giving you peace of mind.

- Discover Bank: With a focus on customer service and competitive rates, Discover Bank's online savings account is a popular choice. Your deposits are FDIC-insured, providing security for your savings.

Maximizing Your Online Savings Account: Tips and Strategies

Now that you understand the safety and convenience of online savings accounts, here are some tips to help you maximize your savings potential:

1. Compare Interest Rates

Online savings accounts often boast higher interest rates than traditional banks. Take the time to compare interest rates offered by different online banks. Look for accounts with compound interest, as this can significantly boost your savings over time.

2. Take Advantage of Promotions

Many online banks offer promotional interest rates or bonuses to attract new customers. Keep an eye out for these promotions and consider timing your account opening to take advantage of these limited-time offers.

3. Set Up Automatic Deposits

Automating your savings is a great way to build your wealth over time. Set up automatic transfers from your paycheck or existing bank account to your online savings account. This way, you can save effortlessly without having to remember to make manual deposits.

4. Explore Additional Features

Online savings accounts often come with additional features to enhance your financial management. These may include goal-setting tools, budgeting features, or even investment options. Explore these features to find the right fit for your financial goals and preferences.

5. Maintain Multiple Accounts

Consider maintaining multiple online savings accounts, each with a specific purpose. For example, you can have one account dedicated to your emergency fund, another for short-term savings goals, and a third for long-term savings. This segmentation can help you stay organized and on track with your financial plans.

The Future of Online Savings: Expanding Opportunities

The world of online savings is constantly evolving, offering new and innovative opportunities for savers. As technology advances, online banks are developing more sophisticated platforms to enhance the user experience.

One exciting development is the integration of artificial intelligence (AI) and machine learning into online savings accounts. These technologies can analyze your spending patterns, provide personalized financial insights, and even offer automated savings strategies tailored to your needs.

Additionally, online banks are expanding their services to include a wider range of financial products. From high-yield checking accounts to investment options, online banks are becoming one-stop shops for all your financial needs. This consolidation can simplify your financial management and provide a more holistic approach to building wealth.

Example of AI-Integrated Online Savings Platforms

Here’s a glimpse into the future of online savings with AI integration:

- SoFi Money: SoFi Money offers a unique combination of a high-yield savings account and a cash management account. With AI-powered features, SoFi Money provides personalized financial advice, budget tracking, and even investment recommendations.

- Vio Bank: Vio Bank's online savings account comes with a powerful AI-driven personal financial assistant. This assistant can help you set and achieve financial goals, track your spending, and provide real-time insights to optimize your savings.

Conclusion: Empowering Your Financial Journey

Online savings accounts have revolutionized the way we manage our finances, offering convenience, accessibility, and competitive interest rates. With FDIC insurance, you can rest assured that your savings are protected, even in the digital realm. By understanding how online savings accounts work and exploring the various options available, you can take control of your financial future and maximize your savings potential.

As the world of online savings continues to evolve, stay informed and embrace the opportunities that arise. Whether it's utilizing AI-powered features or expanding your financial horizons with additional products, the future of online savings is bright and full of possibilities. So, take the leap, open that online savings account, and watch your wealth grow!

Are all online savings accounts FDIC insured?

+No, not all online savings accounts are FDIC insured. It’s essential to verify the bank’s FDIC membership and ensure your deposits are protected. Check the bank’s website or contact their customer support to confirm FDIC insurance.

What happens if my online savings account exceeds the FDIC coverage limit?

+If your online savings account balance exceeds the FDIC coverage limit of $250,000, it’s advisable to spread your deposits across multiple accounts or ownership categories to ensure full protection. You can open additional accounts or consider other FDIC-insured banks to maximize coverage.

Can I open an online savings account if I don’t have a traditional bank account?

+Absolutely! Many online banks allow you to open an account without an existing traditional bank account. You can typically fund your online savings account through various methods, such as mobile check deposits or electronic transfers from another financial institution.

Are there any fees associated with online savings accounts?

+Online savings accounts often have low or no fees. However, it’s important to review the account terms and conditions to understand any potential fees, such as monthly maintenance fees or transaction fees. Many online banks waive these fees if certain conditions are met, such as maintaining a minimum balance.

How can I ensure my online savings account is secure?

+Online savings accounts prioritize security. Ensure you choose a reputable online bank and regularly monitor your account for any suspicious activity. Use strong passwords, enable two-factor authentication, and keep your personal information secure. Additionally, regularly review your account statements to detect any unauthorized transactions.