Car Insurance Near Me

Are you searching for car insurance options near you? Finding the right car insurance coverage is crucial to protect your vehicle and yourself on the road. With numerous insurance providers offering a range of policies, it can be challenging to navigate the market and make an informed decision. This comprehensive guide will delve into the world of car insurance, providing you with valuable insights and expert advice to help you secure the best coverage tailored to your needs.

Understanding Car Insurance: The Basics

Car insurance is a contractual agreement between you and an insurance company. In exchange for your premium payments, the insurer promises to financially protect you in the event of an accident, theft, or other covered incidents. It’s essential to grasp the fundamental concepts to make an informed decision when choosing a policy.

Key Components of Car Insurance

Car insurance policies typically consist of several key components, each offering different types of coverage. These include:

- Liability Coverage: This is the most basic form of car insurance, covering damages you cause to others’ property or injuries to others in an accident.

- Collision Coverage: This coverage pays for repairs to your vehicle after an accident, regardless of who is at fault.

- Comprehensive Coverage: It protects your car against non-collision incidents such as theft, vandalism, natural disasters, and other unforeseen events.

- Personal Injury Protection (PIP): PIP covers medical expenses and lost wages for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient coverage.

Factors Influencing Car Insurance Rates

Insurance companies consider various factors when calculating your car insurance premium. Understanding these factors can help you negotiate better rates and choose the right coverage:

- Vehicle Type and Usage: The make, model, and age of your car, as well as how often you drive it, can impact your insurance rates.

- Driving History: Your past driving record, including accidents and violations, is a significant factor in determining your insurance premium.

- Location: The area where you live and park your car can affect your rates, as insurance companies consider local crime rates and accident statistics.

- Age and Gender: Statistics show that younger drivers and certain gender groups are more prone to accidents, which can influence insurance rates.

- Credit Score: In many states, insurance companies use credit-based insurance scores to assess risk, so maintaining a good credit score can lower your premiums.

Researching Car Insurance Providers Near You

Now that you understand the basics of car insurance, it’s time to explore the options available near you. Conducting thorough research is crucial to finding the best fit for your needs and budget.

Online Research and Reviews

Start your search by researching car insurance providers online. Look for reputable websites and insurance comparison platforms that offer insights into various providers’ coverage options, customer reviews, and financial stability ratings. Reading reviews can provide valuable insights into the customer service and claim-handling experiences of different insurance companies.

| Insurance Provider | Coverage Options | Customer Satisfaction Rating |

|---|---|---|

| Provider A | Comprehensive, Personalized Plans | 4.8/5 |

| Provider B | Customizable Policies, Discounts | 4.6/5 |

| Provider C | Specialized in High-Risk Drivers | 4.2/5 |

Local Insurance Brokers and Agents

Consider reaching out to local insurance brokers or agents who can provide personalized advice and help you navigate the complex world of car insurance. They can offer insights into the coverage options and pricing available in your area and assist you in comparing different policies.

Comparing Quotes and Coverage

Once you’ve identified a few potential providers, it’s time to request quotes and compare coverage options. Ensure you’re comparing apples to apples by obtaining quotes for similar coverage levels from each provider. Consider factors such as deductible amounts, policy limits, and any additional benefits or discounts offered.

Understanding Policy Terms and Conditions

When comparing policies, pay close attention to the fine print. Terms and conditions can vary significantly between providers, and understanding these nuances is crucial to ensure you’re getting the coverage you need. Look out for exclusions, limitations, and any clauses that could impact your coverage in the event of a claim.

Tailoring Your Car Insurance Coverage

Now that you’ve narrowed down your options, it’s time to tailor your car insurance coverage to your specific needs. Here’s how to make informed choices to get the best value for your money.

Assessing Your Coverage Needs

Evaluate your unique situation and determine the type of coverage you require. Consider factors such as the value of your vehicle, your financial ability to cover potential damages, and any specific risks you may face in your area. For example, if you live in an area prone to natural disasters, comprehensive coverage may be a priority.

Exploring Discounts and Bundling Options

Insurance providers often offer discounts to incentivize customers to choose their policies. Common discounts include safe driver discounts, multi-policy discounts (bundling your car insurance with other policies like home or life insurance), and loyalty discounts for long-term customers. Explore these options to potentially reduce your premium.

Considering Additional Coverage Options

While basic liability coverage is a legal requirement, you may want to explore additional coverage options to protect yourself further. For instance, gap insurance can cover the difference between your car’s value and what you owe on your loan if your vehicle is totaled. Rental car coverage can provide temporary transportation if your car is in the shop for repairs.

Securing Your Car Insurance Policy

Once you’ve made an informed decision and chosen the right car insurance provider and policy, it’s time to secure your coverage.

Completing the Application Process

The application process typically involves providing personal and vehicle information, as well as details about your driving history and any additional coverage options you’ve selected. Ensure you provide accurate information to avoid issues with your policy down the line.

Understanding Your Policy and Coverage

Once your policy is in place, take the time to thoroughly review the documents. Ensure you understand the coverage limits, deductibles, and any exclusions or limitations. If you have any questions or concerns, reach out to your insurance provider for clarification.

Managing Your Policy and Making Adjustments

Regularly review your car insurance policy to ensure it continues to meet your needs. Life circumstances and vehicle usage can change over time, so it’s essential to keep your coverage up-to-date. Consider adjusting your policy if you move to a new area, add a teen driver to your policy, or make significant upgrades to your vehicle.

FAQs

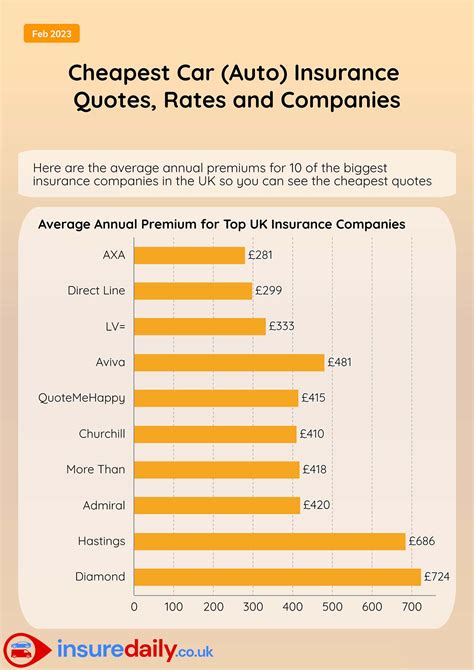

What is the average cost of car insurance near me?

+The average cost of car insurance can vary significantly depending on your location, driving history, and the type of coverage you choose. According to recent data, the average annual premium for minimum liability coverage in the United States is around 500, while full coverage can cost upwards of 1,500.

How can I get cheaper car insurance rates?

+To lower your car insurance rates, consider increasing your deductible, maintaining a clean driving record, and exploring discounts. Many providers offer discounts for safe driving, bundling multiple policies, or installing anti-theft devices in your vehicle.

What should I do if I’m involved in an accident?

+If you’re involved in an accident, remain calm and ensure everyone is safe. Exchange information with the other driver(s) involved, including their contact details and insurance information. Take photos of the accident scene and any damage to your vehicle. Report the accident to your insurance company as soon as possible and provide them with all the relevant details.

Remember, finding the right car insurance near you is an important decision that can provide peace of mind and financial protection. By understanding the basics, researching your options, and tailoring your coverage to your needs, you can secure the best policy for your vehicle and your budget.