Most Affordable Auto Insurance

When it comes to finding the most affordable auto insurance, it's essential to understand the factors that influence insurance rates and the strategies you can employ to secure the best coverage at the lowest cost. The cost of auto insurance can vary significantly, and several factors come into play, including your driving history, location, vehicle type, and coverage preferences. This article will delve into the world of auto insurance, providing a comprehensive guide to help you navigate the process and make informed decisions to get the most affordable coverage.

Understanding Auto Insurance Premiums

Auto insurance premiums are the amounts you pay to your insurance provider to maintain your coverage. These premiums can be influenced by a variety of factors, and understanding these influences is crucial for finding the most affordable option.

Risk Assessment and Pricing

Insurance companies use sophisticated risk assessment models to determine the likelihood of an insured individual being involved in an accident or making a claim. These models take into account various factors such as age, gender, driving experience, and location. High-risk drivers, such as young adults or those with a history of accidents, tend to pay higher premiums as they are statistically more likely to be involved in accidents.

| Risk Factor | Impact on Premium |

|---|---|

| Age | Younger drivers (16-25) often pay higher premiums due to their lack of experience. |

| Gender | In some regions, males under 25 may face higher premiums due to statistical trends. |

| Driving Experience | New drivers with fewer than 3 years of experience may see higher rates. |

| Location | Urban areas with higher traffic and crime rates often result in higher premiums. |

Vehicle Type and Usage

The type of vehicle you drive and how you use it can significantly impact your insurance premiums. Generally, more expensive vehicles and those with higher performance capabilities tend to have higher insurance costs. Additionally, the primary purpose of the vehicle, such as personal use, business use, or pleasure driving, can affect your rates.

Coverage Preferences

The level of coverage you choose is a key factor in determining your insurance premium. Comprehensive and collision coverage, which protect against damage to your vehicle, typically come with higher premiums. Liability-only coverage, which covers damage to other vehicles and property, is often more affordable but provides less protection.

Strategies for Finding Affordable Auto Insurance

Now that we have a better understanding of the factors influencing insurance premiums, let’s explore some strategies to help you secure the most affordable auto insurance coverage.

Compare Quotes from Multiple Providers

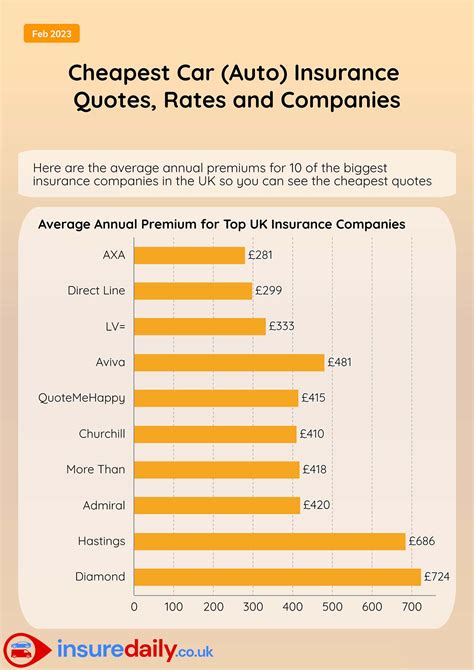

The auto insurance market is highly competitive, and rates can vary significantly between providers. By obtaining quotes from multiple insurance companies, you can easily compare prices and coverage options. Online comparison tools and insurance brokers can be valuable resources for this process.

Bundle Your Insurance Policies

Many insurance companies offer discounts when you bundle multiple policies with them. For instance, if you have both auto and home insurance, you may be eligible for a bundled discount. This strategy can save you money and provide the convenience of having all your insurance needs covered by a single provider.

Increase Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you can lower your monthly premiums. However, it’s important to ensure that you can afford the higher deductible in the event of an accident or claim.

Maintain a Clean Driving Record

Insurance companies reward safe driving habits. By maintaining a clean driving record free of accidents and traffic violations, you can qualify for lower insurance rates. Additionally, completing defensive driving courses can sometimes result in discounts.

Explore Discounts and Rewards

Insurance companies offer a variety of discounts and rewards to their customers. These can include safe driver discounts, good student discounts, loyalty discounts, and discounts for certain professions or affiliations. It’s worth inquiring with your insurance provider about the discounts they offer and ensuring you’re taking advantage of all applicable discounts.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is a relatively new concept where your insurance premium is based on your actual driving behavior. This type of insurance uses a device or an app to track your driving habits, such as miles driven, time of day, and driving style. If you’re a safe and cautious driver, usage-based insurance can result in significant savings.

The Impact of Location on Auto Insurance Costs

Your location plays a significant role in determining your auto insurance rates. Insurance companies consider factors such as traffic density, crime rates, and weather conditions when assessing risk in a particular area. Here’s a breakdown of how location can impact your insurance costs.

Urban vs. Rural Areas

In general, auto insurance premiums tend to be higher in urban areas compared to rural regions. This is primarily due to the increased risk of accidents and theft in urban settings. Additionally, the cost of repairs and the availability of repair services can be higher in urban areas, which can also impact insurance rates.

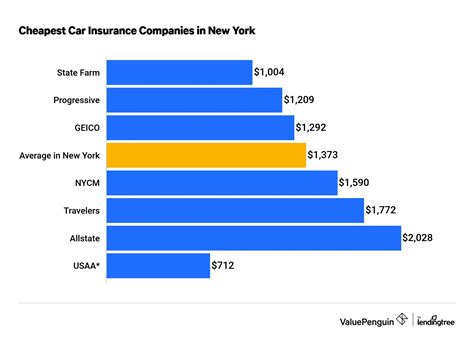

State-by-State Variations

Auto insurance rates can vary significantly from one state to another. This variation is influenced by state-specific laws and regulations, as well as the frequency and cost of insurance claims in each state. For example, states with higher populations and more congested traffic often have higher average insurance rates.

Local Crime Rates and Traffic Density

Areas with high crime rates, such as theft and vandalism, tend to have higher insurance premiums. Similarly, regions with dense traffic and a higher incidence of accidents will typically see higher insurance costs. Insurance companies factor in these local conditions when calculating premiums to ensure they can adequately cover potential claims.

Choosing the Right Coverage for Your Needs

When selecting auto insurance, it’s crucial to find the right balance between coverage and cost. While the most affordable option might be tempting, it’s important to ensure that you have adequate protection for your specific needs.

Understanding Coverage Types

Auto insurance typically consists of several types of coverage, each designed to protect against specific risks. These include liability coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), and uninsured/underinsured motorist coverage.

Assessing Your Risk Profile

Your personal risk profile should be a key consideration when choosing auto insurance coverage. Factors such as your driving history, the value of your vehicle, and your daily commute can influence the types of coverage you need. For instance, if you live in an area with a high risk of natural disasters, comprehensive coverage becomes more important.

Balancing Coverage and Cost

While it’s tempting to opt for the lowest-cost insurance option, it’s essential to ensure that you have sufficient coverage to protect yourself financially in the event of an accident or other insured event. Consider your financial situation and the potential costs you could incur if you were involved in an accident. Choosing the right coverage involves finding a balance between protecting your assets and keeping costs manageable.

Future Trends in Auto Insurance

The auto insurance industry is continuously evolving, and several emerging trends are likely to shape the future of auto insurance. Understanding these trends can provide valuable insights into how the industry might change and how you can adapt your insurance strategies accordingly.

Telematics and Connected Cars

The integration of telematics and connected car technologies is expected to have a significant impact on auto insurance. These technologies allow insurance companies to gather real-time data on driving behavior, which can be used to offer more personalized and accurate insurance rates. This shift towards usage-based insurance is likely to become more prevalent in the coming years.

Artificial Intelligence and Machine Learning

AI and machine learning are being increasingly used in the insurance industry to enhance risk assessment and claims processing. These technologies can analyze vast amounts of data to identify patterns and trends, helping insurance companies make more accurate predictions and decisions. This could lead to more efficient and effective insurance processes, potentially resulting in cost savings for consumers.

Automated Vehicles and Their Impact

The rise of autonomous vehicles is expected to have a transformative effect on the auto insurance industry. As self-driving cars become more prevalent, the number of accidents caused by human error is likely to decrease, potentially leading to lower insurance premiums. However, new risks and challenges associated with autonomous vehicles may also arise, such as cyber security concerns and liability issues, which could impact insurance costs and coverage.

Conclusion

Finding the most affordable auto insurance requires a combination of understanding the factors that influence insurance rates, employing strategic approaches to lower your premiums, and making informed decisions about coverage. By staying informed about the latest trends and innovations in the auto insurance industry, you can ensure that you’re always getting the best value for your insurance dollar.

How often should I compare auto insurance quotes to find the best rates?

+It’s a good practice to compare auto insurance quotes annually, especially when your policy is up for renewal. However, if you’ve recently moved, purchased a new vehicle, or made significant changes to your driving habits, it’s worth comparing quotes more frequently to ensure you’re still getting the best deal.

Can I get auto insurance if I have a poor credit score?

+Yes, you can still obtain auto insurance with a poor credit score, but it may result in higher premiums. Some insurance companies offer programs or discounts to help individuals with lower credit scores, so it’s worth exploring your options with different providers.

What are some common mistakes to avoid when shopping for auto insurance?

+Some common mistakes to avoid include not comparing enough quotes, assuming your current provider offers the best rates, and choosing coverage solely based on price without considering the quality of coverage. It’s important to thoroughly research and compare multiple options to find the best balance between cost and coverage.

Can I get auto insurance if I have a DUI on my record?

+Yes, you can still obtain auto insurance with a DUI on your record, but it may result in higher premiums and require you to purchase specific types of coverage, such as SR-22 insurance. It’s important to be transparent with your insurance provider about your driving history to ensure you’re getting accurate quotes and the necessary coverage.

How can I lower my auto insurance premiums if I’m a young driver?

+As a young driver, you can explore options such as bundling your insurance policies (e.g., auto and renter’s insurance), maintaining a clean driving record, and completing a defensive driving course. Additionally, consider increasing your deductible to lower your monthly premiums, but ensure you can afford the higher deductible in the event of a claim.