Auto Insurance Companies Nj

When it comes to auto insurance, New Jersey residents have a unique set of considerations and requirements to navigate. The Garden State, known for its diverse population and busy roads, presents a distinct insurance landscape. Understanding the intricacies of auto insurance in New Jersey is essential for drivers to make informed decisions and secure the best coverage for their needs. This comprehensive guide delves into the specifics of auto insurance companies in New Jersey, offering an in-depth analysis of policies, providers, and key considerations to ensure drivers are well-informed and protected.

The Landscape of Auto Insurance in New Jersey

New Jersey operates under a no-fault insurance system, which means that each driver’s insurance company is responsible for covering their medical expenses and lost wages after an accident, regardless of who caused the crash. This system aims to streamline the claims process and ensure timely compensation for injured parties. However, it also means that drivers in New Jersey must carry specific types of insurance coverage to comply with state laws and protect themselves financially.

The state requires all drivers to carry minimum liability insurance, which includes bodily injury liability and property damage liability coverage. These requirements ensure that drivers can cover the costs of injuries and property damage they cause to others in an accident. Additionally, New Jersey has a unique law known as the Verifiable Proof of Insurance Law, which mandates that drivers always carry physical proof of insurance in their vehicles. This law aims to reduce the number of uninsured drivers on the roads and ensure that all drivers are financially responsible for their actions behind the wheel.

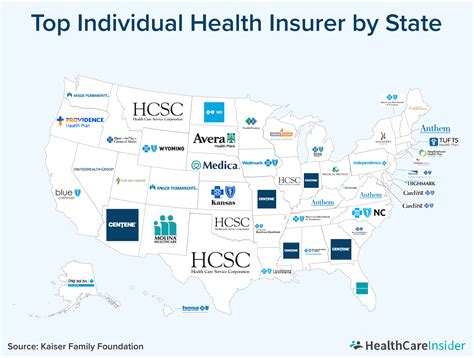

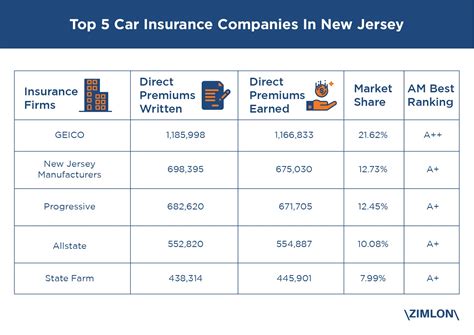

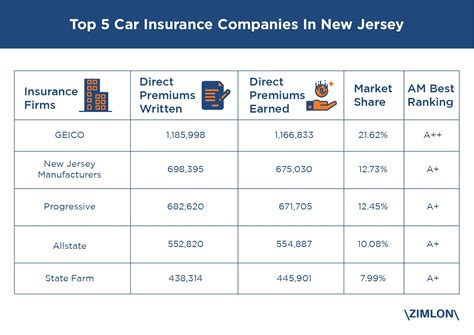

Top Auto Insurance Companies in New Jersey

New Jersey boasts a competitive auto insurance market, with numerous providers offering a range of coverage options and pricing structures. Here’s an overview of some of the top auto insurance companies operating in the state:

State Farm

State Farm is a prominent player in the New Jersey auto insurance market. Known for its comprehensive coverage options and personalized service, State Farm offers policies tailored to the specific needs of New Jersey drivers. Their policies include standard liability coverage, as well as optional add-ons like collision and comprehensive insurance, rental car coverage, and roadside assistance.

State Farm also provides usage-based insurance programs, such as their Drive Safe & Save program, which rewards safe driving habits with potential discounts. This innovative approach to insurance can help New Jersey drivers save money while promoting safer driving practices on the state's roads.

Progressive

Progressive is another leading auto insurance provider in New Jersey. They are renowned for their competitive pricing and extensive range of coverage options. Progressive offers standard liability insurance, as well as specialized coverage for high-risk drivers, classic car owners, and those seeking additional protection for their vehicles.

One of Progressive's standout features is their Name Your Price tool, which allows New Jersey drivers to set their desired insurance premium and then receive tailored policy options to match their budget. This customizable approach empowers drivers to find the right balance between coverage and cost.

Geico

Geico has established itself as a popular choice for auto insurance in New Jersey, known for its efficient claims process and competitive rates. Geico offers a wide range of coverage options, including standard liability insurance, personal injury protection (PIP), and uninsured/underinsured motorist coverage.

Additionally, Geico provides specialized coverage for specific needs, such as gap insurance, which covers the difference between a vehicle's actual cash value and the remaining loan balance in case of a total loss. This extra protection can be invaluable for New Jersey drivers with loans or leases on their vehicles.

Allstate

Allstate is a trusted auto insurance provider in New Jersey, offering a comprehensive suite of coverage options. Their policies include standard liability insurance, as well as optional add-ons like collision, comprehensive, and rental car coverage. Allstate also provides specialized coverage for unique situations, such as new car replacement and sound system coverage, which can be particularly appealing to drivers with specific needs.

Allstate's Drivewise program is another notable feature, offering discounts to New Jersey drivers who opt into a usage-based insurance plan. This program rewards safe driving habits with potential savings, encouraging safer roads and responsible driving practices.

Esurance

Esurance is a modern auto insurance provider that has gained popularity in New Jersey for its convenient online platform and competitive rates. They offer a range of coverage options, including standard liability insurance, collision, comprehensive, and personal injury protection (PIP) coverage. Esurance also provides specialized coverage for unique situations, such as pet injury coverage, which can be crucial for pet owners who frequently travel with their furry friends.

One of Esurance's standout features is their DriveSense program, a usage-based insurance plan that rewards safe driving habits with potential discounts. This program is particularly appealing to New Jersey drivers who are confident in their safe driving records and wish to save on their insurance premiums.

Comparing Coverage and Costs: A Comprehensive Guide

When it comes to choosing the right auto insurance company in New Jersey, it’s essential to compare coverage options and costs to find the best fit for your specific needs and budget. Here’s a breakdown of some key considerations:

Coverage Options

Each auto insurance company in New Jersey offers a range of coverage options, including standard liability insurance, collision, comprehensive, and additional add-ons. It’s crucial to assess your specific needs and select a provider that offers the coverage you require. For instance, if you own a classic car, you’ll want to ensure that your insurance company provides specialized coverage for such vehicles.

Additionally, consider any unique situations or items you want to protect. For example, if you have a high-end sound system in your vehicle, you may want to opt for insurance that covers this specific asset. New Jersey's diverse population and varied driving needs mean that customized coverage is often essential.

Pricing and Discounts

Pricing is a significant factor when choosing an auto insurance provider. New Jersey drivers should compare rates across multiple companies to find the most competitive options. Many providers offer discounts for various factors, such as safe driving records, multiple policy bundles, or usage-based insurance programs. Taking advantage of these discounts can significantly reduce your insurance premiums.

Some insurance companies in New Jersey also provide discounts for specific professions, educational achievements, or vehicle safety features. Exploring these options can help you secure additional savings on your auto insurance policy.

Claims Process and Customer Service

The efficiency and quality of an insurance company’s claims process and customer service can significantly impact your overall experience. Researching and reading reviews from other New Jersey drivers can provide valuable insights into an insurer’s responsiveness, transparency, and overall customer satisfaction.

Consider factors such as the ease of filing a claim, the speed of claim processing, and the availability of customer support. A seamless claims process and responsive customer service can provide peace of mind, especially in the event of an accident or other unexpected circumstances.

Understanding the Impact of New Jersey’s Unique Laws

New Jersey’s auto insurance landscape is influenced by several unique state laws and regulations. Understanding these laws is essential for drivers to ensure compliance and make informed decisions about their insurance coverage.

No-Fault Insurance System

As mentioned earlier, New Jersey operates under a no-fault insurance system. This means that drivers’ insurance companies are responsible for covering their medical expenses and lost wages after an accident, regardless of fault. While this system aims to streamline the claims process, it also means that drivers must carry specific types of insurance coverage to comply with state laws.

New Jersey's no-fault system requires drivers to carry personal injury protection (PIP) coverage, which provides compensation for medical expenses and lost wages after an accident. PIP coverage is a crucial component of auto insurance policies in the state, ensuring that drivers and their passengers are financially protected in the event of an injury.

Uninsured Motorist Coverage

New Jersey has a relatively high percentage of uninsured drivers on its roads. To protect insured drivers from financial loss in accidents caused by uninsured motorists, the state requires all auto insurance policies to include uninsured motorist coverage. This coverage ensures that drivers are compensated for damages and injuries caused by uninsured or underinsured motorists.

Uninsured motorist coverage is a vital aspect of auto insurance in New Jersey, providing an extra layer of protection for drivers who may encounter uninsured motorists on the state's roads.

Verifiable Proof of Insurance Law

New Jersey’s Verifiable Proof of Insurance Law is a unique regulation that mandates drivers to carry physical proof of insurance in their vehicles at all times. This law aims to reduce the number of uninsured drivers on the roads and ensure that all drivers are financially responsible for their actions behind the wheel.

Compliance with this law is essential, as failure to provide proof of insurance can result in significant fines and penalties. New Jersey drivers should ensure that they always have their insurance cards or other acceptable forms of proof readily available in their vehicles.

Tips for Securing the Best Auto Insurance in New Jersey

Navigating the auto insurance landscape in New Jersey can be complex, but with the right approach, drivers can secure comprehensive coverage at competitive rates. Here are some expert tips to help you find the best auto insurance in the Garden State:

Shop Around and Compare

Don’t settle for the first insurance quote you receive. Shopping around and comparing quotes from multiple providers is essential to finding the best coverage and rates. Online comparison tools and insurance brokers can be valuable resources for gathering multiple quotes and assessing your options.

Consider factors such as coverage limits, deductibles, and any additional perks or discounts offered by each provider. By comparing these details, you can make an informed decision about which insurance company best suits your needs and budget.

Bundle Policies for Savings

If you own multiple vehicles or have other insurance needs, such as homeowners or renters insurance, consider bundling your policies with the same insurance company. Many providers offer significant discounts when you bundle multiple policies, potentially saving you a substantial amount on your overall insurance premiums.

Bundling policies can also streamline your insurance management, providing a more convenient and cohesive insurance experience.

Explore Usage-Based Insurance Programs

Usage-based insurance programs, also known as telematics or pay-as-you-drive insurance, are becoming increasingly popular in New Jersey. These programs use devices or smartphone apps to track your driving habits, rewarding safe driving with potential discounts on your insurance premiums.

While usage-based insurance may not be suitable for everyone, it can be a great option for safe drivers who are confident in their abilities and wish to save on their insurance costs. Explore the availability and potential savings of these programs with different insurance providers to determine if they align with your driving habits and preferences.

Understand Your Coverage Needs

Before selecting an auto insurance policy, take the time to understand your specific coverage needs. Consider factors such as the value of your vehicle, your daily commute, and any unique situations or items you want to protect. For instance, if you frequently drive in busy urban areas, you may want to consider higher liability limits to protect yourself financially in the event of an accident.

Assessing your coverage needs and selecting a policy that provides adequate protection is crucial to ensure you're not underinsured or overpaying for coverage you don't require.

Frequently Asked Questions (FAQ)

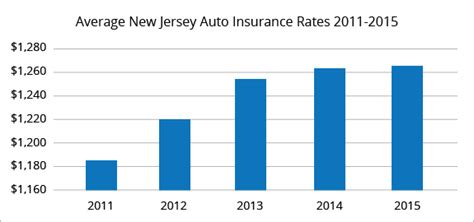

What is the average cost of auto insurance in New Jersey?

+The average cost of auto insurance in New Jersey varies based on factors such as the driver’s age, driving record, and the type of vehicle insured. According to recent data, the average annual premium for a standard policy in New Jersey is around $1,500. However, this can range significantly depending on individual circumstances.

Are there any discounts available for New Jersey drivers?

+Yes, many auto insurance companies in New Jersey offer a range of discounts to their policyholders. These discounts can include safe driver discounts, multi-policy discounts, good student discounts, and discounts for vehicle safety features. It’s worth exploring these options with your insurance provider to see if you’re eligible for any savings.

How can I save money on my auto insurance in New Jersey?

+There are several strategies you can employ to save money on your auto insurance in New Jersey. These include shopping around for quotes from multiple providers, bundling your policies with the same insurer, maintaining a clean driving record, and exploring usage-based insurance programs. Additionally, understanding your coverage needs and selecting the right policy limits can help you avoid overpaying for unnecessary coverage.

What happens if I’m involved in an accident with an uninsured driver in New Jersey?

+If you’re involved in an accident with an uninsured driver in New Jersey, your insurance company will provide coverage under your uninsured motorist coverage. This coverage ensures that you’re financially protected and can receive compensation for damages and injuries caused by the uninsured driver. It’s crucial to have uninsured motorist coverage as part of your auto insurance policy to protect yourself in such situations.

Can I cancel my auto insurance policy in New Jersey?

+Yes, you have the right to cancel your auto insurance policy in New Jersey at any time. However, it’s important to note that canceling your policy may have financial implications, such as losing any paid premiums or facing a short-rate cancellation fee. It’s recommended to review your policy terms and conditions and discuss the cancellation process with your insurance provider to ensure a smooth transition.