Non Health Insurance Penalty

In the United States, the concept of the Non-Health Insurance Penalty is a crucial aspect of the healthcare system and the Affordable Care Act (ACA). This penalty, also known as the Individual Shared Responsibility Payment, was a provision of the ACA aimed at encouraging individuals to obtain health insurance coverage. While the penalty was a significant element of the healthcare landscape for several years, it was eliminated in 2019, leading to various implications for the American healthcare system. This article delves into the history, impact, and future prospects of the Non-Health Insurance Penalty, providing an in-depth analysis of its role in shaping healthcare accessibility and affordability.

Understanding the Non-Health Insurance Penalty

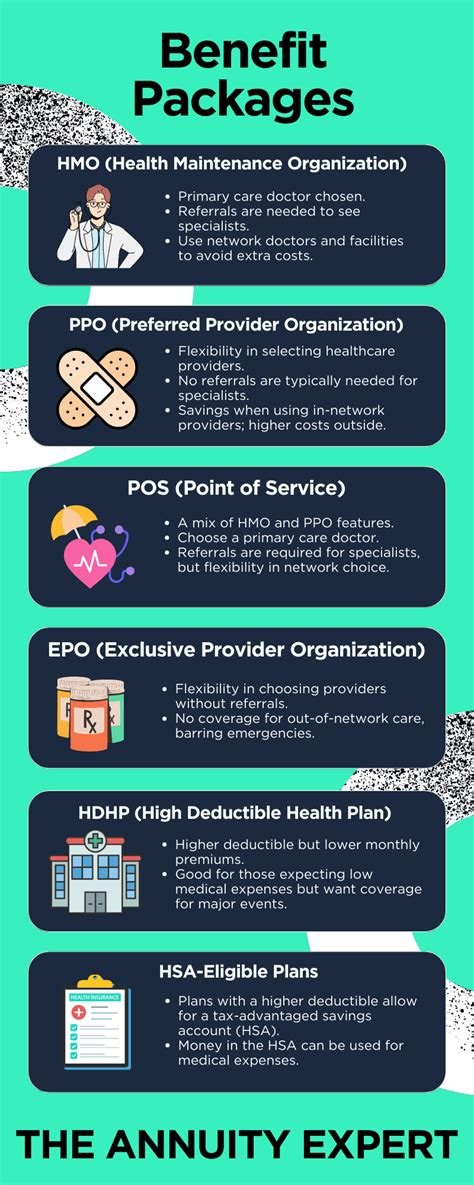

The Non-Health Insurance Penalty was introduced as part of the Affordable Care Act, a landmark healthcare reform legislation passed in 2010. The ACA aimed to expand healthcare coverage and reduce the number of uninsured Americans by implementing various measures, including the individual mandate, which required most individuals to have qualifying health insurance coverage or face a penalty.

The penalty served as an enforcement mechanism for the individual mandate. For tax years 2014 to 2018, individuals who did not maintain minimum essential coverage were subject to a tax penalty when filing their federal income tax returns. The penalty could be calculated in two ways: either as a percentage of household income or as a flat-rate amount per adult and child in the household.

The purpose of the penalty was to discourage individuals from remaining uninsured and to ensure that the risk pool for health insurance remained diverse and robust. By incentivizing people to obtain coverage, the ACA aimed to spread the financial risk across a larger population, thus stabilizing insurance premiums and making healthcare more accessible.

Evolution and Impact of the Penalty

The Non-Health Insurance Penalty has undergone several changes since its inception. Initially, the penalty was set at 95 per adult and 47.50 per child, or 1% of household income, whichever was higher. However, the penalty increased annually, reaching 695 per adult and 347.50 per child, or 2.5% of household income, in 2016.

During its implementation, the penalty played a significant role in increasing the number of insured Americans. According to the Kaiser Family Foundation, the uninsured rate dropped from 16.3% in 2010 to 8.8% in 2016, partly due to the individual mandate and the associated penalty. This reduction in the uninsured population led to improved access to healthcare services and contributed to better health outcomes for many Americans.

However, the penalty also faced criticism and legal challenges. Some argued that the individual mandate and its associated penalty were unconstitutional, as they imposed a financial burden on those who chose not to purchase health insurance. In 2012, the Supreme Court upheld the individual mandate as a valid exercise of Congress's taxing power, but the legal debate surrounding the penalty persisted.

Elimination of the Penalty

In 2017, a significant development occurred when the Tax Cuts and Jobs Act was signed into law. This legislation effectively eliminated the Non-Health Insurance Penalty by setting the penalty amount to $0, starting from the 2019 tax year. This move was a result of growing opposition to the individual mandate and the penalty, with some viewing it as a government overreach and an infringement on personal freedom.

The elimination of the penalty had immediate effects on the healthcare system. Without the penalty, the individual mandate became essentially unenforceable, leading to concerns about potential adverse selection and an unbalanced risk pool. Adverse selection refers to the situation where healthier individuals opt out of insurance coverage, leaving a sicker and more costly population insured. This could result in higher premiums for those who remain insured, potentially making coverage unaffordable for many.

Furthermore, the absence of the penalty may have discouraged some individuals from obtaining health insurance, particularly those who could afford coverage but chose not to due to the lack of a financial disincentive. This could lead to an increase in the uninsured population, reversing the progress made in reducing the number of uninsured Americans.

Implications and Future Prospects

The elimination of the Non-Health Insurance Penalty has left the healthcare system at a crossroads. While the individual mandate remains on the books, its effectiveness without the penalty is questionable. Some states, such as California and New Jersey, have implemented their own individual mandates and penalties to encourage insurance coverage, but the overall impact remains to be seen.

The future of the Non-Health Insurance Penalty and the individual mandate is uncertain. There have been calls for the reinstatement of the penalty, particularly from those concerned about the potential negative consequences of its elimination. However, political and ideological divides persist, making a unanimous decision on this matter challenging.

Moving forward, policymakers and healthcare experts must navigate a delicate balance between encouraging insurance coverage and respecting individual freedoms. Alternative approaches to promoting healthcare accessibility, such as expanding Medicaid coverage, improving insurance affordability, and addressing healthcare disparities, may become more prominent in the absence of a penalty-based individual mandate.

Conclusion

The Non-Health Insurance Penalty, a critical component of the Affordable Care Act, has had a significant impact on the American healthcare system. While the penalty played a role in reducing the uninsured rate, its elimination has raised concerns about the future of healthcare accessibility and affordability. As the healthcare landscape continues to evolve, finding innovative solutions to ensure coverage for all Americans remains a complex and ongoing challenge.

What is the current status of the Non-Health Insurance Penalty?

+The Non-Health Insurance Penalty, as part of the individual mandate, was eliminated in 2019 through the Tax Cuts and Jobs Act. Currently, there is no federal penalty for not having health insurance.

How did the penalty affect healthcare coverage rates?

+The penalty served as an incentive for individuals to obtain health insurance, leading to a significant decrease in the uninsured rate. Its elimination has the potential to reverse this progress.

Are there any states that have implemented their own individual mandates?

+Yes, states like California and New Jersey have implemented their own individual mandates and penalties to encourage health insurance coverage.