How Much Car Insurance

When it comes to car insurance, one of the most common questions that arises is, "How much car insurance do I need?" Understanding the costs and factors influencing car insurance premiums is crucial for making informed decisions about your coverage. In this comprehensive guide, we will delve into the world of car insurance, exploring the various aspects that determine the price and ensuring you get the right coverage for your needs.

The Cost of Car Insurance: A Comprehensive Breakdown

Car insurance premiums can vary significantly, influenced by a multitude of factors. Let’s break down the key elements that contribute to the overall cost of your policy.

1. Coverage Levels

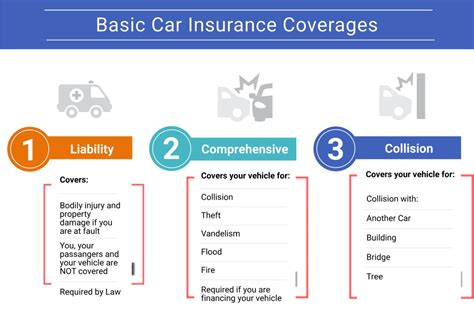

The type and extent of coverage you choose play a vital role in determining your insurance costs. Different coverage options include:

- Liability Coverage: This is the basic level, covering damages and injuries you cause to others. It is mandatory in most states but offers limited protection.

- Collision Coverage: This optional coverage pays for repairs to your vehicle after an accident, regardless of fault.

- Comprehensive Coverage: Covers damages caused by events other than collisions, such as theft, vandalism, weather, or animal collisions.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects you in case of an accident with a driver who has inadequate or no insurance.

Each coverage type comes with its own premium, and the more extensive your coverage, the higher the overall cost.

2. Vehicle Factors

The make, model, and year of your vehicle impact insurance rates. Factors such as safety features, repair costs, and theft frequency are considered. For instance, a luxury sports car may have higher insurance costs due to its expensive parts and higher risk of theft.

| Vehicle Type | Average Annual Premium |

|---|---|

| Sedan | $1,200 - $1,500 |

| SUV | $1,300 - $1,800 |

| Sports Car | $1,800 - $2,500 |

| Electric Vehicle | $1,400 - $2,000 |

3. Driver Profile

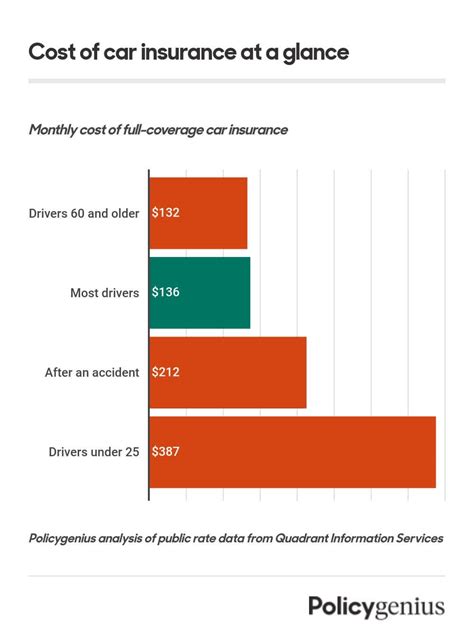

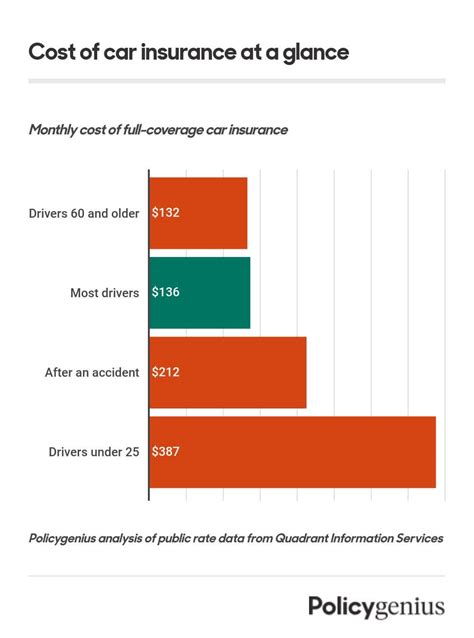

Your personal characteristics as a driver significantly influence insurance rates. Age, gender, driving history, and location are key factors:

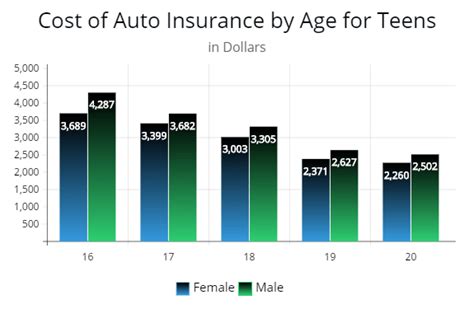

- Age: Younger drivers (especially teens) often face higher premiums due to their lack of experience. Premiums tend to decrease with age, reaching a lower rate for mature drivers.

- Gender: In some states, gender is a consideration, with male drivers often facing slightly higher rates due to statistical risk factors.

- Driving History: A clean driving record with no accidents or traffic violations can lead to lower premiums. Conversely, a history of accidents or citations may result in higher rates.

- Location: Insurance rates vary based on your state and city. Urban areas with higher traffic and crime rates often result in higher premiums.

4. Additional Factors

Several other considerations can impact insurance costs:

- Credit Score: In many states, insurance companies use credit-based insurance scores to assess risk. A higher credit score may lead to lower premiums.

- Discounts: Taking advantage of available discounts can reduce your insurance costs. Common discounts include multi-policy, good student, safe driver, and loyalty discounts.

- Usage-Based Insurance: Some insurers offer programs that track your driving habits, rewarding safe driving with lower premiums.

Tips for Finding the Right Coverage and Saving on Costs

Now that we’ve explored the factors influencing car insurance costs, here are some tips to help you find the right coverage and save money:

1. Compare Quotes

Obtain quotes from multiple insurance providers to compare rates and coverage options. Online comparison tools can streamline this process.

2. Review Coverage Needs

Assess your specific needs and risks. Consider your vehicle’s value, your driving habits, and potential financial liabilities. Tailor your coverage accordingly.

3. Raise Deductibles

Increasing your deductible (the amount you pay out of pocket before insurance kicks in) can significantly reduce your premium. Ensure you choose a deductible you can afford in case of an accident.

4. Bundle Policies

Insuring multiple vehicles or combining auto insurance with other policies, such as home or renters insurance, can lead to substantial discounts.

5. Maintain a Clean Record

A clean driving record is crucial for keeping insurance costs down. Avoid accidents and traffic violations to maintain a favorable insurance profile.

6. Explore Discounts

Inquire about available discounts and ensure you meet the criteria. Discounts can include safe driver, good student, multi-policy, and loyalty discounts.

7. Consider Usage-Based Insurance

If you have a safe driving record and drive infrequently, usage-based insurance programs may offer substantial savings by tracking and rewarding your safe driving habits.

Understanding the Future of Car Insurance

The car insurance industry is evolving, with technological advancements and changing consumer needs shaping its future. Here are some key trends and implications to consider:

1. Telematics and Usage-Based Insurance

Telematics devices and usage-based insurance programs are becoming increasingly popular. These technologies track driving behavior, offering personalized premiums based on real-time data. This trend empowers consumers to take control of their insurance costs by driving safely and efficiently.

2. Digital Transformation

The insurance industry is embracing digital innovation, with online platforms and mobile apps offering convenient ways to manage policies, file claims, and obtain quotes. This digital transformation enhances customer experience and simplifies the insurance process.

3. Autonomous Vehicles

The rise of autonomous vehicles is set to revolutionize car insurance. As self-driving cars become more prevalent, insurance models will need to adapt, potentially shifting liability and coverage needs. Insurance providers are already exploring new coverage options to accommodate this emerging technology.

4. Data-Driven Insights

Advanced analytics and big data are transforming the insurance industry. Insurers are leveraging data to make more accurate risk assessments and offer personalized coverage options. This data-driven approach enables insurers to provide tailored policies and improve overall customer satisfaction.

5. Regulatory Changes

Insurance regulations are subject to change, impacting the industry’s landscape. Stay informed about any legislative updates that may affect your coverage and premiums. Understanding these changes can help you make informed decisions about your insurance choices.

Conclusion

Understanding the factors that influence car insurance costs is essential for making informed decisions about your coverage. By considering coverage levels, vehicle factors, driver profile, and additional considerations, you can find the right balance between protection and affordability. Stay abreast of industry trends and regulatory changes to ensure your insurance needs are met in the evolving landscape of car insurance.

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the U.S. varies based on several factors, including the state you reside in, your driving record, and the type of coverage you choose. According to recent data, the average annual premium is around 1,600, but this can range from as low as 1,000 to over $2,000, depending on individual circumstances.

Are there ways to lower my car insurance costs without compromising coverage?

+Absolutely! You can explore various options to reduce your insurance premiums without sacrificing adequate coverage. These include raising your deductible, taking advantage of available discounts, bundling policies, and maintaining a clean driving record. Additionally, considering usage-based insurance programs can offer personalized rates based on your driving behavior.

How do insurance companies determine my premium rate?

+Insurance companies use a combination of factors to assess risk and determine premium rates. These include your driving history, credit score (in some states), the type of vehicle you drive, your age and gender, and the coverage options you choose. They also consider the statistical risk associated with your location and any discounts for which you may be eligible.