How Do I Get Business Insurance

Securing business insurance is an essential step for any entrepreneur, as it provides protection and peace of mind for various aspects of your venture. From liability coverage to property insurance, the right policies can safeguard your business assets and ensure continuity in the face of unexpected events. In this comprehensive guide, we'll explore the ins and outs of obtaining business insurance, covering everything from the types of coverage available to the process of selecting the right provider.

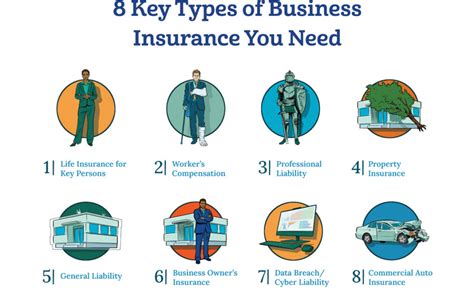

Understanding the Landscape of Business Insurance

Business insurance is a broad term encompassing a range of policies designed to protect commercial entities. These policies aim to mitigate risks and potential losses associated with running a business. Here’s an overview of the key types of business insurance and their purposes.

General Liability Insurance

General liability insurance is a cornerstone of business protection. It provides coverage for a wide array of common risks, including bodily injury, property damage, and personal and advertising injury. This policy is especially crucial for businesses that interact with the public, as it can cover claims arising from customer accidents or product defects.

| Coverage Areas | Description |

|---|---|

| Bodily Injury | Covers medical expenses and legal costs if a customer or visitor is injured on your premises. |

| Property Damage | Protects against claims resulting from damage to others' property caused by your business activities. |

| Personal and Advertising Injury | Offers coverage for defamation, copyright infringement, and other similar claims. |

Commercial Property Insurance

Commercial property insurance is vital for protecting the physical assets of your business. This policy covers your office space, equipment, inventory, and other physical assets against damage or loss due to perils like fire, theft, or natural disasters. It ensures that your business can recover and rebuild in the event of a covered loss.

Business Interruption Insurance

Business interruption insurance, often bundled with commercial property insurance, provides coverage for lost income and ongoing expenses if your business operations are disrupted by a covered event. This policy can help you maintain financial stability during temporary closures or operational setbacks.

Professional Liability Insurance (Errors and Omissions)

Professional liability insurance, also known as errors and omissions (E&O) insurance, is essential for businesses that provide professional services. It covers legal costs and potential damages if your business is sued for negligence, errors, or omissions in the services you provide. This policy is particularly critical for industries like consulting, healthcare, and finance.

Workers’ Compensation Insurance

Workers’ compensation insurance is mandated by law in most states and provides coverage for employees who suffer work-related injuries or illnesses. This policy ensures that injured workers receive medical treatment and wage replacement, while also protecting the business from potential lawsuits.

Cyber Liability Insurance

In an increasingly digital world, cyber liability insurance has become a necessity. This policy protects businesses from the financial consequences of cyberattacks, data breaches, and privacy violations. It can cover the cost of data recovery, legal fees, and even reputational damage resulting from a cyber incident.

Assessing Your Business’s Insurance Needs

The first step in obtaining business insurance is evaluating your specific needs. Every business is unique, and your insurance requirements will depend on factors such as your industry, the size and nature of your operations, and the potential risks you face. Here are some key considerations when assessing your insurance needs.

Industry-Specific Risks

Different industries carry unique risks. For instance, a construction business faces hazards related to heavy machinery and site safety, while a tech startup might face risks associated with data security and intellectual property. Understanding the specific risks of your industry is crucial for tailoring your insurance coverage.

Business Size and Growth

The size and growth trajectory of your business can impact your insurance needs. As your business expands, so do your potential liabilities. For instance, a growing e-commerce business may need to consider additional coverage for increased inventory and shipping risks. Regularly reviewing your insurance coverage is essential to ensure it aligns with your business’s evolving needs.

Client and Customer Base

The nature of your client or customer interactions can also influence your insurance requirements. If you serve a diverse client base or operate in multiple states, you may need to consider additional liability coverage to protect against potential claims from a wider range of sources.

Regulatory and Legal Requirements

Certain industries or businesses may be subject to specific insurance requirements. For example, businesses that handle hazardous materials or engage in high-risk activities may be required by law to carry specialized insurance coverage. Staying informed about regulatory requirements is essential to ensure compliance.

Researching and Selecting the Right Insurance Provider

With a clear understanding of your insurance needs, the next step is to research and select the right insurance provider. Here’s a step-by-step guide to help you make an informed decision.

Identify Reputable Providers

Start by identifying a list of reputable insurance providers. You can gather recommendations from industry peers, consult online reviews, or seek referrals from business associations or your accountant. Building a shortlist of providers will help streamline your decision-making process.

Compare Coverage and Premiums

Once you have a list of potential providers, compare the coverage they offer and the associated premiums. Ensure that the policies meet your specific needs and provide adequate protection. Consider not just the cost, but also the reputation and financial stability of the provider.

Review Policy Details and Exclusions

Pay close attention to the fine print of insurance policies. Understand the coverage limits, deductibles, and any exclusions or limitations. Exclusions can vary widely between providers, so it’s essential to thoroughly review the policy to avoid any surprises.

Assess Financial Stability

The financial stability of your insurance provider is crucial. A financially stable provider is more likely to be able to pay out claims when needed. You can assess a provider’s financial strength by checking ratings from independent agencies like AM Best or Standard & Poor’s.

Consider Bundling Policies

Bundling multiple insurance policies with the same provider can often result in cost savings. Many providers offer package deals or discounts for businesses that purchase multiple policies, so it’s worth exploring this option to optimize your insurance coverage.

The Application and Approval Process

Once you’ve selected an insurance provider, the next step is to navigate the application and approval process. Here’s a breakdown of what to expect.

Completing the Application

The insurance application will typically require detailed information about your business, including its legal structure, annual revenue, number of employees, and specific risk factors. It’s essential to provide accurate and honest information to ensure the policy is tailored to your needs.

Underwriting and Risk Assessment

After submitting your application, the insurance provider will conduct an underwriting process to assess the risk associated with insuring your business. This process may involve a review of your business’s financial records, claims history, and other relevant factors. The underwriter will determine the premium and any additional requirements based on this assessment.

Negotiating Coverage and Premiums

If you feel the initial premium or coverage offered does not align with your expectations, you may have the opportunity to negotiate. This is particularly true if you’re a low-risk business or have a strong track record of safe operations. Negotiating can help you secure the best value for your insurance coverage.

Finalizing the Policy

Once the underwriting process is complete and any negotiations are finalized, you’ll receive a policy document outlining the coverage, premiums, and other important details. Review this document carefully to ensure it meets your expectations and accurately reflects your business’s needs.

Maintaining and Adjusting Your Insurance Coverage

Obtaining business insurance is just the beginning. It’s essential to regularly review and adjust your coverage to ensure it remains up-to-date and adequate for your evolving business needs. Here are some key considerations for maintaining and adjusting your insurance coverage.

Annual Reviews

Schedule annual reviews of your insurance coverage to ensure it aligns with your business’s current situation. As your business grows or changes, your insurance needs may evolve. Regular reviews help you identify gaps in coverage and make necessary adjustments.

Keep Records Updated

Maintain accurate and up-to-date records of your business’s assets, revenue, and other relevant information. These records are essential for insurance purposes, especially when making claims or adjusting coverage.

Stay Informed About Industry Changes

Keep abreast of changes and developments in your industry that may impact your insurance needs. For instance, new technologies or regulatory changes can introduce new risks or alter existing ones. Being proactive about staying informed can help you anticipate and address these changes effectively.

Consider Additional Coverage as Needed

As your business expands or takes on new ventures, you may need to consider additional coverage. For example, if you launch a new product line or enter a new market, you may require specialized insurance to protect against unique risks associated with these new endeavors.

Conclusion: Navigating the Business Insurance Landscape with Confidence

Obtaining business insurance is a critical step in safeguarding your venture and ensuring its long-term success. By understanding the various types of coverage available, assessing your specific needs, and selecting the right insurance provider, you can navigate the complex world of business insurance with confidence. Remember, regular reviews and adjustments to your coverage are essential to keep pace with your business’s growth and changing landscape.

What is the average cost of business insurance?

+The cost of business insurance can vary widely depending on factors such as the type of business, its size, and the specific coverage needed. On average, small businesses can expect to pay between 500 and 900 per year for a basic general liability policy. However, costs can range from a few hundred dollars to several thousand dollars per year, depending on the risks and coverage required.

How do I choose the right insurance provider for my business?

+When selecting an insurance provider, consider factors such as their reputation, financial stability, and the range of coverage they offer. Look for providers with a track record of prompt claim handling and positive customer reviews. Additionally, compare premiums and coverage limits to ensure you’re getting the best value for your business’s needs.

Can I bundle multiple insurance policies with one provider to save money?

+Yes, bundling multiple insurance policies with a single provider is often a cost-effective strategy. Many providers offer discounts or package deals when you purchase multiple policies, such as general liability, property insurance, and professional liability coverage. This can result in significant savings while simplifying your insurance management.

What happens if I need to file an insurance claim?

+If you need to file an insurance claim, the first step is to notify your insurance provider as soon as possible. They will guide you through the claims process, which typically involves providing detailed information about the incident, including any supporting documentation. It’s important to cooperate fully with the insurer’s investigation to ensure a smooth claims process.

![Erie Insurance Group] Erie Insurance Group]](https://media.pecb.com/assets/img/erie-insurance-group.jpeg)