Overnight Hospital Stay Cost With Insurance

Understanding the costs associated with an overnight hospital stay is crucial, especially when navigating the complexities of healthcare and insurance coverage. This comprehensive guide aims to provide a detailed breakdown of the expenses you may encounter during an overnight hospital stay, while also shedding light on the role of insurance in mitigating these costs.

Unraveling the Costs of an Overnight Hospital Stay

An overnight hospital stay typically involves a range of services and procedures, each with its own associated cost. While the exact figures can vary significantly depending on the hospital, the location, and the specific medical condition being treated, we can provide a general overview of the expenses involved.

Room and Board

The cost of a hospital room for an overnight stay is a significant component of the overall expense. This includes not only the physical space but also the nursing care and basic amenities provided. On average, a semi-private room in a standard hospital can cost anywhere from 1,500 to 3,000 per night. However, this cost can increase dramatically for specialized units like intensive care or neonatal care, where 24-hour monitoring is required.

For those seeking more privacy, a private room may be an option, although it comes at a premium. The additional cost for a private room can range from an extra $500 to $2,000 per night, depending on the hospital and the level of care required.

Medical Procedures and Treatments

The bulk of the costs during an overnight hospital stay often stem from the medical procedures and treatments rendered. These can include surgeries, diagnostic tests, medication, and specialized therapies. The expense of these procedures can vary widely based on the complexity of the treatment and the medical technology employed.

For instance, a simple outpatient surgery might cost a few thousand dollars, while a complex procedure like a heart transplant could easily exceed $1 million. Diagnostic tests, such as MRI scans or CT scans, can range from a few hundred to several thousand dollars, depending on the hospital and the urgency of the case.

Pharmaceutical Costs

Medication expenses can add up quickly during an overnight hospital stay. The cost of pharmaceutical drugs can vary based on the type of medication, its dosage, and the length of treatment. Some medications, particularly those used in specialized treatments or emergency care, can be extremely expensive.

Additionally, hospitals often charge a fee for administering medications, which can further increase the overall pharmaceutical cost. This fee covers the cost of having a trained healthcare professional, such as a nurse or pharmacist, oversee the medication administration process.

Ancillary Services and Supplies

Ancillary services and supplies, while often overlooked, can contribute significantly to the overall cost of an overnight hospital stay. These include services like laboratory tests, medical imaging, and the use of specialized equipment. For instance, a routine blood test may cost around 50 to 100, while more complex tests can exceed $1,000.

Other ancillary costs can include the use of medical devices like oxygen tanks or CPAP machines, which can range from $50 to $200 per day. Additionally, certain medical supplies like bandages, catheters, or intravenous solutions can also add up, with some hospitals charging a fee for each item used.

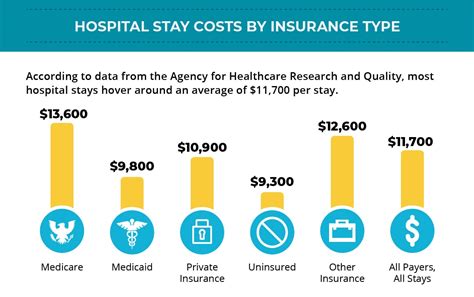

The Role of Insurance in Managing Hospital Costs

The good news is that insurance coverage can significantly reduce the out-of-pocket expenses associated with an overnight hospital stay. Depending on your insurance plan, you may be eligible for coverage that mitigates these costs to varying degrees.

Understanding Your Insurance Coverage

The first step in managing hospital costs is to thoroughly understand your insurance coverage. This includes knowing your plan’s deductible, co-insurance, and out-of-pocket maximum. Understanding these terms and how they apply to your specific plan can help you estimate your financial responsibility in the event of an overnight hospital stay.

For instance, if your plan has a high deductible, you'll need to pay a larger portion of the hospital costs upfront before your insurance starts covering a percentage of the expenses. On the other hand, a plan with low co-insurance means you'll pay a smaller percentage of the total costs, but you may have a higher monthly premium.

Utilizing Insurance Networks

Insurance companies typically have networks of preferred providers, which include hospitals and healthcare professionals. By utilizing these networks, you can often access lower rates for services and treatments. Out-of-network providers may charge significantly more, and these costs may not be fully covered by your insurance plan.

It's essential to check if your hospital of choice is within your insurance network before scheduling an overnight stay. If not, you may need to explore other options or consider the financial implications of using an out-of-network provider.

Pre-Authorization and Prior Approval

For certain medical procedures or treatments, insurance companies may require pre-authorization or prior approval. This means that the insurance company must approve the procedure in advance, ensuring that it’s medically necessary and covered by your plan. Failing to obtain pre-authorization can result in the procedure not being covered, leading to higher out-of-pocket costs.

It's crucial to work closely with your healthcare provider and insurance company to ensure that any necessary procedures or treatments are authorized in advance. This can help prevent unexpected costs and ensure a smoother financial experience during your hospital stay.

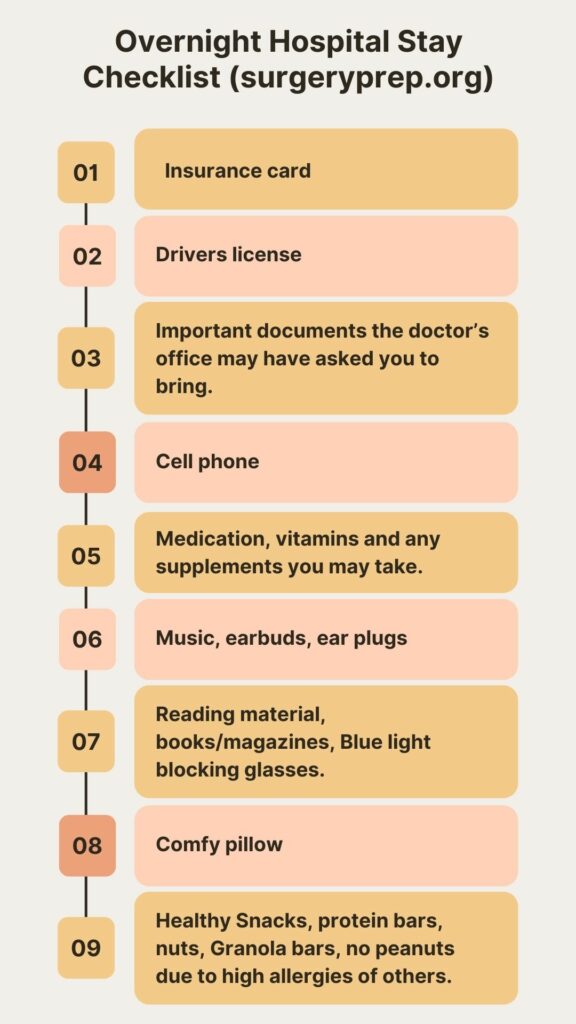

Understanding Your Bill and Insurance Claims

After your overnight hospital stay, you’ll receive a bill detailing the services and procedures provided, along with the associated costs. It’s essential to review this bill carefully to ensure accuracy and to identify any charges that may not be covered by your insurance.

Your insurance company will also provide you with an explanation of benefits (EOB), which outlines the services that were covered, the amount paid by the insurance company, and any remaining balance that you're responsible for. Understanding these documents can help you manage your financial obligations effectively.

Tips for Managing Hospital Costs

Navigating the financial aspects of an overnight hospital stay can be challenging, but there are strategies you can employ to manage these costs effectively.

Communicate with Your Healthcare Provider

Open and honest communication with your healthcare provider is crucial. Discuss your financial concerns and explore options that can help reduce the cost of your treatment. Your provider may be able to suggest less expensive alternatives or provide insights into cost-saving measures specific to your condition.

Shop Around for Prices

While you may not have much choice in selecting a hospital during an emergency, for planned procedures, it’s worth shopping around. Different hospitals can have significantly different price structures for the same procedure. Comparing prices and insurance networks can help you make an informed decision that balances quality of care with cost.

Explore Financial Assistance Programs

Many hospitals and healthcare organizations offer financial assistance programs for patients who cannot afford the full cost of their care. These programs can provide discounts, payment plans, or even complete forgiveness of the debt, depending on your financial situation and the hospital’s policies.

Negotiate Your Bill

Believe it or not, hospital bills are often negotiable. If you find that the charges on your bill are higher than expected or beyond your financial means, don’t hesitate to contact the hospital’s billing department. They may be willing to adjust the bill or set up a payment plan that suits your financial capabilities.

Consider High-Deductible Health Plans

If you’re generally healthy and don’t anticipate frequent hospital visits, a high-deductible health plan (HDHP) coupled with a health savings account (HSA) might be a financially prudent choice. HDHPs typically have lower monthly premiums, and you can use the HSA to save money on a pre-tax basis for medical expenses.

However, it's essential to have sufficient funds in your HSA to cover potential medical costs, especially if you're considering an overnight hospital stay.

Conclusion

An overnight hospital stay can be a significant financial burden, but with the right knowledge and strategies, you can navigate these costs effectively. Understanding your insurance coverage, communicating with your healthcare provider, and exploring cost-saving measures can help ensure that your financial health is as robust as your physical health.

How can I estimate the cost of an overnight hospital stay before it happens?

+Estimating the cost of an overnight hospital stay can be challenging due to the variability of medical conditions and procedures. However, you can contact the hospital’s billing department or your insurance company to get a rough estimate based on your specific situation and insurance coverage.

What happens if I can’t afford the costs associated with an overnight hospital stay?

+If you’re unable to afford the costs of an overnight hospital stay, there are several options you can explore. These include financial assistance programs offered by hospitals, payment plans, or negotiating the bill with the hospital’s billing department. Additionally, seeking support from community organizations or charities dedicated to healthcare assistance may be beneficial.

Are there any ways to reduce the cost of an overnight hospital stay?

+Yes, there are strategies to reduce the cost of an overnight hospital stay. These include communicating with your healthcare provider about cost-saving alternatives, shopping around for prices, and exploring financial assistance programs. Additionally, if you have a high-deductible health plan, you can use your health savings account to cover eligible expenses.