Geico Renters Insurance Number

In the realm of personal insurance, renters insurance stands out as a critical yet often overlooked component of financial protection. While homeowners insurance garners more attention, renters insurance is a necessity for individuals who lease their living spaces. This article delves into the world of GEICO's renters insurance, exploring its coverage, benefits, and the unique features that make it an attractive option for renters across the United States.

GEICO Renters Insurance: Comprehensive Coverage for Your Peace of Mind

GEICO, known for its excellent customer service and competitive rates, offers a robust renters insurance policy that caters to the diverse needs of its customers. Renters insurance from GEICO provides financial protection against a range of unforeseen events, ensuring that policyholders can recover from losses and continue their lives without significant disruption.

Coverage Options and Benefits

GEICO’s renters insurance policy offers a comprehensive suite of coverage options, including:

- Personal Property Coverage: Protects your belongings against damage or loss due to covered perils like fire, theft, or vandalism. GEICO allows you to customize your coverage limits to ensure you have adequate protection for your valuables.

- Liability Protection: Provides coverage in the event you're found legally responsible for another person's injury or property damage that occurs on your rented premises. This protection can safeguard you from costly legal expenses and settlements.

- Additional Living Expenses: If your rented home becomes uninhabitable due to a covered event, this coverage helps cover the additional costs of temporary housing and other necessary expenses until you can return home.

- Medical Payments Coverage: Offers coverage for medical expenses incurred by guests who are injured on your rented property, regardless of fault. This coverage can help you avoid potential legal issues and provides prompt assistance for injured individuals.

- Identity Restoration: In today's digital age, identity theft is a growing concern. GEICO's renters insurance includes identity restoration services to help you recover and restore your identity if it's stolen.

Additionally, GEICO renters insurance provides personal liability coverage, which can protect you if someone is injured on your property or if your actions cause property damage elsewhere. This coverage can provide essential financial protection in the event of a lawsuit.

Personalized Coverage for Your Unique Needs

One of the standout features of GEICO’s renters insurance is its adaptability. Policyholders can customize their coverage to fit their specific needs and budget. Whether you require higher limits for your valuable electronics or additional coverage for high-risk items like jewelry or fine art, GEICO offers flexible options to ensure you’re adequately protected.

| Coverage Category | Available Limits |

|---|---|

| Personal Property | Customizable, up to the value of your belongings |

| Liability | Up to $300,000 or $500,000 |

| Additional Living Expenses | Typically covers 20% of personal property limit |

| Medical Payments | Up to $1,000 or $5,000 |

Convenience and Customer Satisfaction

GEICO is renowned for its exceptional customer service and ease of use. Policyholders can easily manage their renters insurance policies online, making changes, adding endorsements, and even filing claims with just a few clicks. The GEICO mobile app further enhances convenience, providing policyholders with quick access to their policy details and claims information on the go.

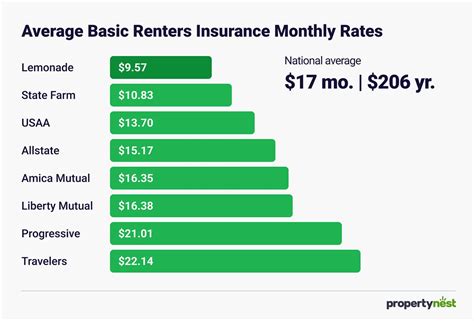

Competitive Rates and Discounts

GEICO is dedicated to offering competitive rates for its renters insurance policies. The company provides various discounts to help policyholders save, including:

- Multi-Policy Discount: Policyholders who bundle their renters insurance with other GEICO policies, such as auto insurance, can save significantly.

- Military Discount: GEICO offers a special discount to active-duty military personnel, veterans, and their families as a token of appreciation for their service.

- Advanced Quote Discount: Customers who obtain a quote for their renters insurance in advance may be eligible for a discount.

- Good Student Discount: Full-time students under 25 who maintain a good academic standing may qualify for this discount, encouraging academic excellence.

Real-World Examples and Success Stories

GEICO’s renters insurance has helped countless individuals recover from unexpected events. One policyholder, Sarah, had her apartment burglarized. GEICO’s renters insurance covered the cost of replacing her stolen electronics and jewelry, providing much-needed financial relief during a stressful time.

Another policyholder, David, experienced a water leak in his apartment that damaged his belongings. GEICO's personal property coverage helped him replace his damaged furniture and appliances, and the additional living expenses coverage provided the funds he needed to stay in a hotel while repairs were made.

Future Outlook and Innovations

As the insurance industry evolves, GEICO continues to innovate. The company is exploring ways to further enhance its renters insurance offerings, potentially including more specialized coverages for unique risks and incorporating emerging technologies to improve the claims process and overall customer experience.

FAQs

What is covered under GEICO’s renters insurance policy for personal property?

+GEICO’s renters insurance policy provides coverage for personal property against damage or loss due to covered perils such as fire, theft, or vandalism. Policyholders can customize their coverage limits to ensure adequate protection for their valuables.

Does GEICO offer liability protection with its renters insurance policy?

+Yes, GEICO’s renters insurance policy includes liability protection. This coverage provides financial protection in the event the policyholder is found legally responsible for another person’s injury or property damage that occurs on their rented premises.

What additional living expenses are covered under GEICO’s renters insurance policy?

+GEICO’s renters insurance policy includes coverage for additional living expenses if the rented home becomes uninhabitable due to a covered event. This coverage helps cover the costs of temporary housing and other necessary expenses until the policyholder can return home.

GEICO’s renters insurance policy is a testament to the company’s commitment to providing comprehensive and customizable coverage for its customers. With its range of coverage options, competitive rates, and excellent customer service, GEICO continues to be a leading choice for renters seeking financial protection and peace of mind.