Gig Insurance

Gig insurance, also known as short-term or per-event insurance, has emerged as a vital aspect of the modern gig economy, providing essential coverage for professionals across diverse sectors. As the gig economy continues to evolve and expand, offering flexible and independent work opportunities, the need for adequate insurance protection has become increasingly critical. This article aims to delve into the world of gig insurance, exploring its importance, how it works, and the various options available to gig workers and businesses alike.

Understanding the Need for Gig Insurance

The gig economy encompasses a wide range of professions, from ride-sharing drivers and freelance writers to event planners and independent contractors. While these professionals enjoy the freedom and flexibility that gig work provides, they also face unique challenges and risks. Gig insurance is designed to address these challenges, offering tailored coverage to protect individuals and businesses engaged in temporary or project-based work.

One of the primary concerns for gig workers is liability. Whether it's a personal injury claim, property damage, or a contractual dispute, liability issues can arise unexpectedly and have significant financial implications. Without proper insurance, gig workers may find themselves facing costly legal battles and potential financial ruin. Gig insurance steps in to provide the necessary liability coverage, ensuring that professionals can operate with confidence and peace of mind.

Additionally, gig insurance can cover a range of other risks, including property damage, personal injury, and even business interruption. For instance, a freelance photographer might need insurance to protect their equipment during a shoot, while a ride-sharing driver may require coverage for any accidents that occur while transporting passengers. By tailoring insurance policies to the specific needs of gig workers, these professionals can focus on their work without constant worry about unforeseen events.

How Gig Insurance Works

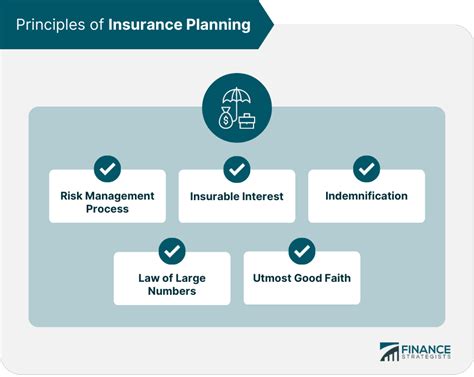

Gig insurance operates on a similar principle to traditional insurance policies, but with a more flexible and tailored approach. Insurance providers offer a range of coverage options, allowing gig workers to choose the level of protection that suits their needs and budget. These policies can be purchased on a per-event or per-project basis, providing coverage for a specific period or event.

For example, a musician performing at a local festival might purchase gig insurance to cover their equipment and liability for the duration of the event. Similarly, a freelance web developer working on a short-term project could opt for insurance to protect their business and intellectual property during the project's lifespan. This flexibility ensures that gig workers can secure the necessary coverage without committing to long-term policies that may not align with their unpredictable work schedules.

When purchasing gig insurance, professionals typically have the option to customize their coverage. This allows them to select the specific risks they want to insure against, such as public liability, professional indemnity, or equipment cover. By tailoring their policies, gig workers can ensure that their insurance adequately addresses the unique challenges and risks associated with their line of work.

Types of Gig Insurance

The gig insurance market offers a diverse range of coverage options, catering to the varied needs of professionals in the gig economy. Some of the most common types of gig insurance include:

Liability Insurance

Liability insurance is a cornerstone of gig insurance, providing protection against claims arising from bodily injury, property damage, or contractual disputes. This type of insurance is particularly crucial for gig workers who interact with the public or work on-site at client locations, as it safeguards them against potential lawsuits and legal expenses.

Professional Indemnity Insurance

Professional indemnity insurance, often referred to as errors and omissions insurance, is designed for professionals who provide advice or services to clients. It covers legal costs and compensation claims arising from alleged negligence, errors, or omissions in the course of their work. This type of insurance is vital for consultants, freelancers, and other professionals who rely on their expertise and advice.

Equipment Insurance

Equipment insurance is tailored for gig workers who rely on specialized tools, equipment, or machinery to perform their jobs. This coverage protects against loss, damage, or theft of equipment, ensuring that professionals can continue their work without financial strain. Whether it’s a photographer’s camera gear or a caterer’s kitchen equipment, equipment insurance provides essential peace of mind.

Business Interruption Insurance

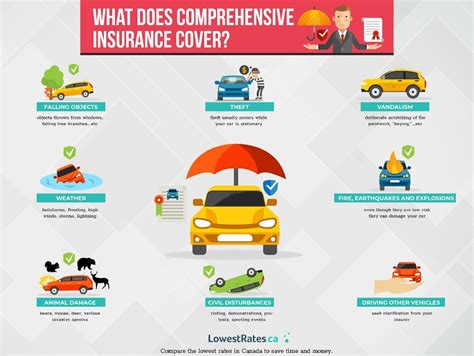

Business interruption insurance is a vital component of gig insurance, especially for professionals who derive their income from their business activities. This coverage provides financial support in the event of a business interruption due to unforeseen events like natural disasters, theft, or vandalism. By insuring against business interruption, gig workers can protect their income stream and ensure their business’s survival during challenging times.

Case Studies: Real-World Examples of Gig Insurance in Action

To illustrate the importance and effectiveness of gig insurance, let’s explore a few real-world case studies:

Case Study 1: Ride-Sharing Driver

John, a ride-sharing driver in a major city, faced a challenging situation when one of his passengers sustained an injury during a ride. The passenger claimed that John’s reckless driving caused the injury and sought compensation. Without gig insurance, John would have been personally liable for the passenger’s medical expenses and potential legal fees. However, with his comprehensive liability insurance coverage, John was able to resolve the claim quickly and without incurring significant financial losses.

Case Study 2: Freelance Graphic Designer

Sarah, a freelance graphic designer, was hired to create a logo for a small business. Unfortunately, the client accused Sarah of plagiarism, claiming that the logo design infringed on their intellectual property rights. Sarah’s professional indemnity insurance stepped in to cover the legal costs associated with defending the claim. Additionally, the insurance provider offered support and guidance throughout the legal process, ensuring that Sarah’s reputation and business remained intact.

Case Study 3: Event Planner

David, an event planner, organized a large-scale corporate event. Unfortunately, a severe storm caused significant damage to the event venue and equipment. David’s business interruption insurance covered the financial losses incurred due to the event’s cancellation, allowing him to reimburse clients and continue his business operations without interruption. The insurance also provided support in finding alternative venues and rescheduling the event, demonstrating the comprehensive protection offered by gig insurance.

Choosing the Right Gig Insurance Provider

When it comes to selecting a gig insurance provider, there are several key factors to consider. First and foremost, professionals should seek providers with a strong reputation and a track record of providing reliable coverage. It’s essential to choose an insurance company that specializes in the gig economy, as they will have a deeper understanding of the unique risks and challenges faced by gig workers.

Additionally, gig workers should assess the range of coverage options offered by different providers. While some insurance companies may offer standard policies, others provide more tailored and customizable options. By comparing policies and understanding the specific needs of their profession, gig workers can ensure they select the most suitable and comprehensive coverage.

Furthermore, it's crucial to consider the claims process and customer support offered by insurance providers. Gig workers should choose a provider with a straightforward and efficient claims process, ensuring that they receive prompt assistance and support when they need it most. Customer reviews and testimonials can provide valuable insights into the provider's reliability and responsiveness.

| Insurance Provider | Coverage Options | Claims Process |

|---|---|---|

| InsureTech | Comprehensive gig insurance policies with customizable options | Online claims submission with 24/7 customer support |

| ProCover | Specialized policies for specific gig professions, such as ride-sharing and freelance writing | Phone-based claims assistance with dedicated claims advisors |

| FlexProtect | Tailored insurance packages for short-term projects and events | Self-service claims portal with real-time updates |

Future Implications and Industry Insights

As the gig economy continues to grow and evolve, the demand for gig insurance is expected to rise. Insurance providers are increasingly recognizing the unique needs of gig workers and are developing innovative products to cater to this evolving market. One emerging trend is the integration of gig insurance with digital platforms and mobile apps, making it easier for gig workers to access and manage their insurance policies on-the-go.

Additionally, the gig insurance market is seeing a shift towards more collaborative and community-based models. Some insurance providers are exploring peer-to-peer insurance models, where gig workers can pool their resources and share risks collectively. This approach not only provides cost-effective coverage but also fosters a sense of community and support among gig workers.

Looking ahead, the gig insurance industry is poised to play a crucial role in shaping the future of the gig economy. By offering comprehensive and accessible insurance solutions, providers can help gig workers mitigate risks and focus on their passions and expertise. As the gig economy continues to redefine traditional work models, gig insurance will be an essential tool for professionals to navigate the challenges and opportunities of this dynamic and exciting sector.

What is the average cost of gig insurance?

+The cost of gig insurance can vary significantly depending on the type of coverage, the profession, and the provider. On average, gig workers can expect to pay anywhere from 50 to 200 per month for comprehensive liability insurance. However, the cost can be higher or lower depending on the specific risks and coverage needs.

Can gig workers get insurance for multiple gigs or side hustles?

+Absolutely! Many gig insurance providers offer policies that cover multiple gigs or side hustles under a single policy. This can be a cost-effective solution for gig workers who engage in various activities, as it allows them to streamline their insurance coverage and manage their finances more efficiently.

How long does it take to receive compensation for a claim under gig insurance?

+The time it takes to receive compensation for a claim can vary depending on the insurance provider and the complexity of the claim. Generally, gig insurance providers aim to process claims within a reasonable timeframe, often within a few weeks. However, more complex claims may require additional investigation and could take longer to resolve.