Average Cost Of Car Insurance Florida

Florida, known for its sunny beaches and vibrant lifestyle, is a popular state for both residents and tourists alike. However, the unique road and traffic conditions, coupled with a no-fault insurance system, make car insurance a complex and often expensive affair. Understanding the factors that influence insurance rates is crucial for Floridians to make informed decisions about their coverage.

The Landscape of Car Insurance in Florida

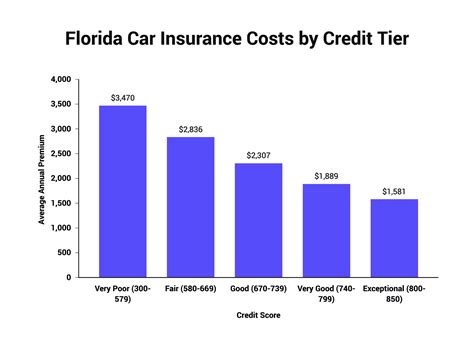

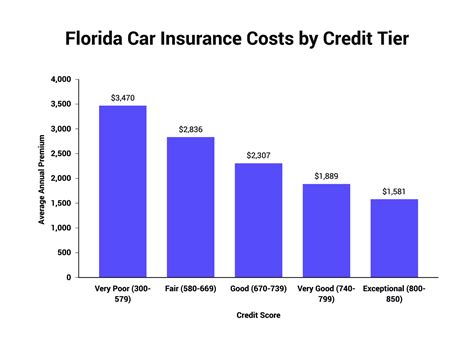

Florida’s car insurance market is diverse, offering a range of coverage options and providers. The average cost of car insurance in the state varies significantly depending on numerous factors, including the policyholder’s age, driving history, location, and the type of coverage chosen.

Personal Factors Influencing Premiums

Age and driving experience play a significant role in determining insurance rates. Young drivers, especially those under 25, often face the highest premiums due to their lack of experience on the road. Conversely, mature drivers with a clean driving record can enjoy more affordable rates. The type of vehicle and its usage also impact insurance costs. High-performance cars or those frequently driven for work or leisure may attract higher premiums.

The number of claims and traffic violations on a driver's record can significantly affect their insurance rates. A single accident or violation can lead to a substantial increase in premiums, while a clean record can result in significant discounts.

| Factor | Impact on Premiums |

|---|---|

| Age | Young drivers pay more; mature drivers with clean records pay less. |

| Driving Record | Clean records lead to discounts; accidents and violations increase premiums. |

| Vehicle Type | High-performance cars and frequent usage may result in higher costs. |

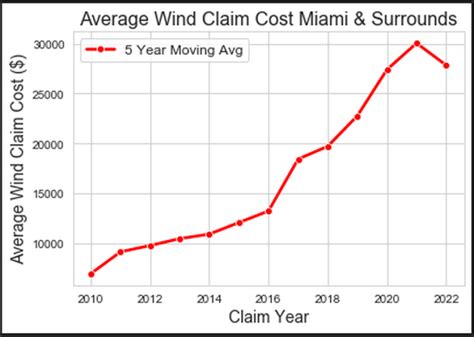

Geographical Considerations

Florida’s diverse landscape and urban areas present unique challenges. Coastal regions, especially those prone to hurricanes, often see higher insurance rates due to the risk of natural disasters. Urban areas with higher populations and traffic congestion may also have elevated insurance costs due to the increased likelihood of accidents.

The No-Fault Insurance System

Florida operates under a no-fault insurance system, which means that each driver’s insurance covers their own medical expenses and losses after an accident, regardless of fault. This system aims to streamline the claims process and reduce litigation. However, it also means that personal injury protection (PIP) and property damage liability (PDL) coverage are mandatory, adding to the overall cost of insurance.

Average Cost of Car Insurance in Florida

The average cost of car insurance in Florida varies significantly based on the factors mentioned above. According to recent data, the average annual premium for a minimum liability policy in Florida is approximately 900</strong>. However, this can range from <strong>500 to $2,000 or more depending on individual circumstances.

Minimum Liability Coverage

Florida requires all drivers to carry minimum liability coverage, which includes bodily injury liability and property damage liability. The state’s minimum liability limits are 10,000</strong> for property damage and <strong>10,000 per person or $20,000 per accident for bodily injury. While this basic coverage meets the legal requirements, it may not provide sufficient protection in the event of a serious accident.

Full Coverage Options

For more comprehensive protection, Floridians can opt for full coverage insurance, which includes collision and comprehensive coverage in addition to liability coverage. Full coverage policies can cost significantly more, with averages ranging from 1,500</strong> to <strong>3,000 annually. The cost of full coverage can be influenced by the vehicle’s make, model, and age, as well as the driver’s age, driving record, and location.

| Coverage Type | Average Annual Cost |

|---|---|

| Minimum Liability | $900 |

| Full Coverage | $1,500 - $3,000 |

Discounts and Savings

To mitigate the high cost of car insurance, Floridians can take advantage of various discounts offered by insurance providers. These may include safe driver discounts, multi-policy discounts (bundling home and auto insurance), and discounts for advanced safety features in vehicles. Additionally, maintaining a clean driving record and shopping around for the best rates can lead to significant savings.

Understanding Your Car Insurance Options

Navigating the complex world of car insurance in Florida requires a comprehensive understanding of the factors that influence rates and the types of coverage available. By considering personal circumstances, vehicle usage, and geographical factors, Floridians can make informed decisions about their insurance coverage and find the best value for their needs.

Frequently Asked Questions

How can I lower my car insurance costs in Florida?

+

There are several strategies to reduce car insurance costs in Florida. Firstly, maintain a clean driving record by avoiding accidents and traffic violations. Secondly, shop around and compare quotes from multiple insurers to find the best rates. Additionally, consider bundling your home and auto insurance policies for potential discounts. Lastly, opt for higher deductibles, which can lower your premium but increase your out-of-pocket expenses in the event of a claim.

What is the penalty for driving without insurance in Florida?

+

Driving without insurance in Florida can result in significant penalties. First-time offenders may face a fine of up to $500 and have their license and registration suspended for up to three years. Repeat offenders can face even steeper fines and longer periods of license suspension.

Are there any specific discounts available for Floridians?

+

Yes, Floridians can take advantage of several state-specific discounts. These include discounts for completing approved defensive driving courses, good student discounts for young drivers with high GPAs, and discounts for military personnel and their families. It’s worth checking with your insurance provider to see which discounts you may qualify for.