Life Insurance Vs Term Insurance

Navigating the world of insurance can be a complex journey, especially when it comes to making informed decisions about life and term insurance policies. Understanding the nuances between these two types of coverage is crucial for anyone seeking financial protection for themselves and their loved ones. In this comprehensive guide, we will delve into the details of life insurance and term insurance, exploring their unique features, benefits, and considerations to help you make an educated choice tailored to your specific needs.

Unraveling the Concept: Life Insurance

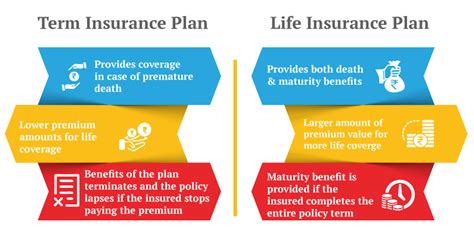

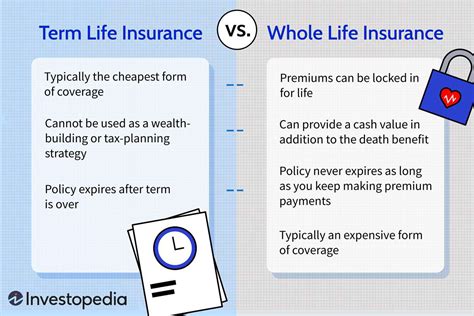

Life insurance, often referred to as whole life insurance, is a long-term financial protection strategy designed to provide coverage for the entirety of one’s life. It is a contract between the policyholder and the insurance company, wherein the latter agrees to pay a specified sum of money (known as the death benefit) to the designated beneficiaries upon the insured individual’s passing. This type of insurance serves as a safety net, ensuring that your loved ones are financially secure even in your absence.

One of the key advantages of life insurance is its permanence. Unlike term insurance, which we will explore later, life insurance policies remain in force as long as the premiums are paid. This means that the coverage continues to build value over time, and the death benefit remains guaranteed throughout the insured's life. Additionally, many life insurance policies offer cash value accumulation, which can be borrowed against or withdrawn to meet various financial needs, such as funding retirement, paying for a child's education, or covering emergency expenses.

Key Features of Life Insurance

- Guaranteed Death Benefit: Life insurance policies guarantee a specified amount to be paid out upon the insured’s death, providing financial security to the beneficiaries.

- Cash Value Accumulation: Whole life insurance policies build cash value over time, which can be accessed through policy loans or withdrawals.

- Permanent Coverage: As long as premiums are paid, life insurance coverage remains in force, ensuring long-term protection.

- Flexibility: Policyholders can customize their coverage, choosing from various options such as riders for additional benefits like long-term care or critical illness coverage.

However, it is important to note that life insurance comes with higher premiums compared to term insurance, as it offers lifetime coverage and the potential for cash value growth. The cost of life insurance can vary significantly depending on factors such as the insured's age, health, and lifestyle. It is essential to carefully consider your financial situation and long-term goals when evaluating life insurance options.

| Metric | Life Insurance |

|---|---|

| Coverage Duration | Lifetime (until policy matures) |

| Premium Structure | Level or increasing premiums based on age |

| Benefits | Guaranteed death benefit, cash value accumulation, optional riders |

| Cost | Higher premiums compared to term insurance |

Understanding Term Insurance: A Temporal Solution

Term insurance, as the name suggests, is a type of coverage that provides protection for a specified period, known as the term. Unlike life insurance, term insurance does not accumulate cash value, and it offers coverage only for the duration of the policy term. It is a cost-effective option for individuals seeking temporary financial protection to cover specific needs or goals.

The term length of a term insurance policy can vary, typically ranging from 10 to 30 years. During this period, the insured pays a fixed premium, and if they pass away within the term, the beneficiaries receive the death benefit. However, if the insured outlives the term, the coverage expires, and no benefits are paid out. This makes term insurance an ideal choice for individuals who have specific financial obligations or dependencies that will expire over time, such as covering mortgage payments or providing for dependent children until they become financially independent.

Key Advantages of Term Insurance

- Affordability: Term insurance policies offer significantly lower premiums compared to life insurance, making it an accessible option for many individuals.

- Flexibility in Coverage Duration: Policyholders can choose the term length based on their specific needs and financial obligations.

- Simple and Transparent: Term insurance policies are straightforward, with no cash value or investment components, making them easy to understand and manage.

- Renewable or Convertible: Many term insurance policies offer the option to renew or convert to permanent life insurance, providing flexibility as life circumstances change.

It is worth noting that term insurance may not be the best choice for individuals who have long-term financial dependencies or those who wish to leave a legacy for their heirs. In such cases, life insurance may be a more suitable option. Additionally, term insurance premiums can increase as the insured ages, so it is important to carefully consider the long-term affordability of the policy.

| Metric | Term Insurance |

|---|---|

| Coverage Duration | Specific term length (e.g., 10, 20, or 30 years) |

| Premium Structure | Fixed premiums for the term, may increase with age |

| Benefits | Death benefit if insured passes away during the term |

| Cost | Lower premiums compared to life insurance |

Comparative Analysis: Life Insurance vs. Term Insurance

When deciding between life insurance and term insurance, it is essential to consider your unique financial situation, goals, and dependencies. Here’s a comparative analysis to help you make an informed decision:

Financial Considerations

Life insurance tends to be more expensive due to its permanent nature and potential for cash value accumulation. On the other hand, term insurance offers a more budget-friendly option, especially for those with short-term financial obligations. It is crucial to assess your financial capabilities and prioritize your coverage needs accordingly.

Coverage Duration

Life insurance provides lifelong coverage, ensuring protection for as long as the premiums are paid. In contrast, term insurance offers coverage for a specified period, typically ranging from 10 to 30 years. Consider the duration of your financial dependencies and choose a policy that aligns with your needs.

Benefits and Flexibility

Life insurance policies offer a range of benefits, including guaranteed death benefits and the potential for cash value accumulation. Additionally, they provide flexibility through optional riders, allowing you to customize your coverage. Term insurance, while simpler, may not offer the same level of customization. However, some term policies allow for renewal or conversion to permanent life insurance, providing future flexibility.

Renewability and Convertibility

Term insurance policies often come with the option to renew or convert to permanent life insurance, giving policyholders the flexibility to extend their coverage as their needs evolve. Life insurance, being permanent, does not typically require renewal, but it may have limited convertibility options.

Suitability for Different Life Stages

Life insurance is often recommended for individuals with long-term financial dependencies, such as those with young families or significant financial obligations. Term insurance, on the other hand, can be a suitable choice for younger individuals with fewer financial commitments or for those seeking temporary coverage during specific life stages, such as paying off a mortgage or funding a child’s education.

Conclusion: Making an Informed Choice

Choosing between life insurance and term insurance involves careful consideration of your financial goals, dependencies, and long-term plans. Life insurance offers permanent protection and the potential for cash value accumulation, making it ideal for those seeking lifelong financial security. Term insurance, with its affordability and simplicity, provides a suitable solution for temporary financial needs.

It is crucial to assess your individual circumstances and consult with insurance professionals to make an informed decision. By understanding the unique features and benefits of each type of insurance, you can select the coverage that best aligns with your needs and provides the peace of mind you deserve.

Can I switch from term insurance to life insurance later in life?

+

Yes, many term insurance policies offer the option to convert to permanent life insurance at specific points during the term or upon renewal. However, the convertibility options may vary between insurers, so it’s important to review your policy terms and consult with your insurance provider to understand your conversion rights.

What happens if I outlive my term insurance policy?

+

If you outlive your term insurance policy, the coverage expires, and no benefits are paid out. However, if you have the option to renew your policy, you can choose to continue coverage for an additional term, typically at a higher premium rate due to increased age.

Are there any tax benefits associated with life insurance?

+

Yes, life insurance policies often offer tax advantages. The death benefit received by the beneficiaries is typically tax-free, and the cash value growth within a whole life policy may have tax-deferred benefits. However, it’s important to consult with a tax professional to understand the specific tax implications in your jurisdiction.