Insurance Quote Travelers

When it comes to securing your travel plans, obtaining an insurance quote from a trusted provider like Travelers is an essential step. Travelers Insurance, a leading name in the industry, offers comprehensive travel insurance policies to protect you and your trip. This article will delve into the world of Travelers Insurance, exploring its services, benefits, and the process of acquiring an insurance quote tailored to your travel needs.

Understanding Travelers Insurance: A Trusted Companion for Your Journey

Travelers Insurance has established itself as a reliable partner for travelers worldwide. With a rich history spanning decades, the company has built a reputation for its commitment to customer satisfaction and comprehensive coverage. Travelers offers a wide range of insurance products, including travel insurance, designed to provide peace of mind and financial protection during your adventures.

The company's travel insurance policies are tailored to address various aspects of your journey, ensuring that you're covered for unexpected events such as trip cancellations, medical emergencies, lost luggage, and more. Travelers' expertise lies in understanding the unique needs of travelers and crafting policies that cater to these requirements.

Key Features of Travelers Insurance:

- Flexible Coverage Options: Travelers offers customizable plans, allowing you to choose the level of coverage that aligns with your travel style and budget. Whether you’re seeking basic protection or comprehensive coverage, they have a plan suited to your needs.

- Worldwide Assistance: With a global network of support, Travelers provides 24⁄7 assistance to policyholders, ensuring that help is always within reach, no matter where your travels take you.

- Comprehensive Benefits: Their travel insurance policies often include benefits such as trip cancellation or interruption coverage, emergency medical and dental care, baggage and personal effects protection, and even coverage for pre-existing medical conditions (subject to terms and conditions).

The Process of Obtaining a Travelers Insurance Quote:

- Identify Your Travel Needs: Begin by assessing your specific travel requirements. Consider factors like the duration of your trip, the destinations you’ll be visiting, and any activities you plan to engage in. This information will help tailor your insurance quote accurately.

- Visit the Travelers Website: Navigate to the official Travelers Insurance website. Here, you’ll find a user-friendly interface designed to guide you through the quote process. Look for the “Get a Quote” or “Travel Insurance” section to initiate your quote request.

- Provide Trip Details: Input the necessary information about your upcoming trip, including travel dates, destinations, and the number of travelers. Travelers may also request details about any pre-existing medical conditions or specific coverage needs.

- Select Coverage Options: Travelers offers a range of coverage levels and add-ons. Choose the options that best fit your requirements, ensuring you have the right level of protection for your journey. Consider factors like trip cost, potential risks, and personal preferences.

- Review and Personalize: After selecting your coverage options, review the quote provided by Travelers. This quote will outline the benefits, limits, and exclusions of your chosen plan. If needed, you can further customize your policy by adding or removing specific coverages.

- Obtain Your Quote: Once you’re satisfied with your selections, submit your request for a final quote. Travelers will provide you with a detailed breakdown of the costs and coverage associated with your chosen plan. This quote will serve as a valuable tool for making an informed decision.

By following these steps, you can obtain a precise and personalized insurance quote from Travelers, ensuring that your travel plans are adequately protected. Remember, travel insurance is an essential investment to safeguard your trip and provide peace of mind during your adventures.

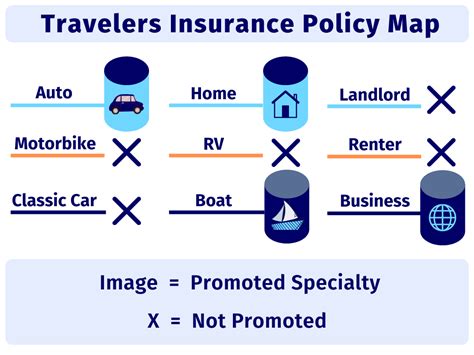

Comparative Analysis: Travelers Insurance vs. Competitors

To truly understand the value of Travelers Insurance, it’s beneficial to compare it with other leading travel insurance providers. Here’s a comparative analysis to highlight Travelers’ strengths and how it stacks up against the competition.

Coverage Options:

| Provider | Coverage Flexibility | Plan Customization |

|---|---|---|

| Travelers Insurance | Offers a wide range of coverage levels, catering to diverse travel needs. | Provides comprehensive plans with the option to add or remove specific coverages. |

| Competitor A | Limited coverage options, focusing on basic travel protection. | Less flexible, with fewer customization options. |

| Competitor B | Comprehensive coverage with a focus on medical emergencies. | Customizable, allowing for specific add-ons. |

Key Insight: Travelers Insurance stands out for its extensive coverage options and the ability to tailor plans to individual needs, offering a more personalized experience compared to some competitors.

Assistance and Support:

| Provider | 24⁄7 Assistance | Global Support Network |

|---|---|---|

| Travelers Insurance | Provides 24⁄7 assistance to policyholders worldwide. | Maintains a robust global support network, ensuring prompt assistance. |

| Competitor A | Offers assistance during limited hours. | Has a smaller support network, primarily focused on key travel destinations. |

| Competitor B | Provides 24⁄7 assistance but with longer response times. | Maintains a global presence but may have limited resources in certain regions. |

Expert Perspective: Travelers' commitment to 24/7 assistance and its extensive global support network sets it apart, ensuring travelers receive prompt and reliable support whenever and wherever they need it.

Benefits and Add-ons:

| Provider | Key Benefits | Add-on Options |

|---|---|---|

| Travelers Insurance |

|

|

| Competitor A |

|

|

| Competitor B |

|

|

Industry Takeaway: Travelers Insurance provides a well-rounded set of benefits and add-on options, ensuring travelers can customize their coverage to match their specific travel plans and activities.

Real-Life Case Studies: Travelers Insurance in Action

To illustrate the impact and value of Travelers Insurance, let’s explore a few real-life case studies showcasing how their travel insurance policies have made a difference for travelers in various situations.

Case Study 1: Unexpected Medical Emergency

Sarah, a solo traveler, embarked on a month-long adventure through Europe. During her trip, she experienced a sudden illness that required immediate medical attention. Thanks to her Travelers Insurance policy, she received prompt assistance and was able to access high-quality medical care without any financial strain. The policy’s coverage for emergency medical expenses ensured that Sarah could focus on her recovery without worrying about the cost.

Case Study 2: Trip Cancellation Due to Natural Disaster

John and his family had planned a dream vacation to the Caribbean. Unfortunately, a hurricane struck the region, forcing them to cancel their trip at the last minute. Travelers Insurance’s trip cancellation coverage came to their rescue. The policy reimbursed them for the non-refundable expenses they had already incurred, including flights and accommodations, allowing them to reschedule their trip without significant financial loss.

Case Study 3: Lost Luggage and Personal Effects

Emily, a business traveler, encountered a stressful situation when her luggage went missing during a conference trip. Travelers Insurance’s baggage and personal effects coverage provided her with immediate financial assistance to purchase essential items during her stay. Once her luggage was located, the insurance company facilitated its return, ensuring Emily’s belongings were safely reunited with her.

These real-life examples highlight the critical role that Travelers Insurance plays in protecting travelers from unforeseen circumstances. By offering comprehensive coverage and timely assistance, Travelers ensures that travelers can focus on enjoying their journeys, knowing they have a trusted partner by their side.

Future Trends and Innovations in Travel Insurance

As the travel industry evolves, so too does the world of travel insurance. Travelers Insurance is at the forefront of innovation, continually adapting to meet the changing needs of travelers. Here’s a glimpse into the future of travel insurance and how Travelers is leading the way.

Digital Transformation and Convenience

Travelers recognizes the importance of digital convenience in today’s fast-paced world. They are investing in innovative technologies to enhance the customer experience. This includes developing user-friendly mobile apps for policyholders, allowing them to access their policies, file claims, and receive assistance with just a few taps. Additionally, Travelers is exploring blockchain technology to streamline the claims process, ensuring faster and more secure transactions.

Personalized Coverage and Data Analytics

Travelers understands that every traveler has unique needs. They are leveraging advanced data analytics to tailor coverage options based on individual travel patterns and preferences. By analyzing data from past trips and customer behavior, Travelers can offer personalized recommendations, ensuring travelers receive the right coverage for their specific journeys. This level of personalization enhances the customer experience and ensures that policies are truly customized to each traveler’s needs.

Sustainable Travel and Eco-Friendly Initiatives

With a growing emphasis on sustainable travel practices, Travelers is committed to supporting eco-friendly initiatives. They are exploring partnerships with travel companies and destinations that prioritize sustainability. Travelers aims to encourage and reward travelers who choose environmentally conscious options, offering incentives and specialized coverage for sustainable travel experiences. By aligning with these initiatives, Travelers is not only supporting a greener planet but also providing travelers with peace of mind that their adventures align with their values.

Enhanced Customer Support and AI Integration

Travelers is committed to providing exceptional customer support, and they are integrating artificial intelligence (AI) to enhance this experience. AI-powered chatbots and virtual assistants are being developed to offer 24⁄7 assistance, answering common queries and providing real-time support to travelers. Additionally, Travelers is exploring the use of AI in claims processing, utilizing machine learning algorithms to streamline and expedite the claims journey, ensuring travelers receive prompt compensation when needed.

As Travelers Insurance continues to innovate and adapt, travelers can expect a future where travel insurance is not only comprehensive but also highly convenient, personalized, and aligned with their values. With a focus on digital transformation, data-driven insights, sustainability, and enhanced customer support, Travelers is shaping the future of travel insurance, ensuring that travelers have a trusted partner to rely on during their journeys.

How does Travelers Insurance compare to other travel insurance providers in terms of price and coverage?

+Travelers Insurance offers competitive pricing and a wide range of coverage options. While their plans may vary in cost based on factors like trip duration and coverage level, Travelers provides a comprehensive approach to travel insurance. They balance affordability with extensive coverage, ensuring travelers receive value for their investment. When comparing Travelers to other providers, it’s essential to consider not only the price but also the breadth of coverage and the level of customer support offered.

What are the key benefits of choosing Travelers Insurance for my travel needs?

+Travelers Insurance stands out for its commitment to customer satisfaction and comprehensive coverage. They offer a wide range of benefits, including 24⁄7 assistance, flexible coverage options, and customizable plans. Travelers’ global support network ensures prompt assistance whenever and wherever you need it. Additionally, their focus on data-driven insights allows them to provide personalized recommendations, ensuring your travel insurance aligns with your unique needs.

Can I customize my Travelers Insurance policy to include specific coverage for adventure sports or high-risk activities?

+Absolutely! Travelers Insurance understands the diverse nature of travel and offers add-on options to cater to specific activities. If you plan to engage in adventure sports or high-risk activities, Travelers provides the flexibility to enhance your coverage accordingly. This ensures that you’re protected for the unique challenges and risks associated with your chosen activities, giving you the confidence to explore and enjoy your travels to the fullest.

How does Travelers Insurance handle claims and what is the process for filing a claim?

+Travelers Insurance is committed to a streamlined and efficient claims process. They provide clear guidelines and support to policyholders, ensuring a smooth journey from claim submission to resolution. Travelers utilizes advanced technologies, including AI and blockchain, to expedite claims handling. Policyholders can expect timely assistance and compensation, allowing them to focus on their recovery or continue their travels without added stress.